Commodity Price Inflation, What is Likely Impact in the United States?

Commodities / Inflation Nov 23, 2010 - 03:52 AM GMTBy: Asha_Bangalore

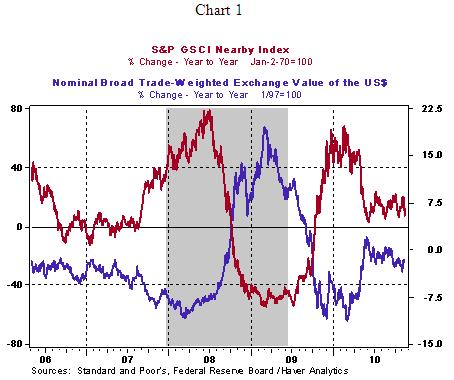

The S&P GSCI commodity index has moved up 11.3% from a year ago on November 19, 2010 (see Chart 1). The trade weighted dollar declined 1.2% from a year ago as of November 12, 2010. The immediate inference is that the extent of gains in the commodity price index is larger than the decline of the dollar. By implication, commodity price gains reflect more than the depreciation of the greenback.

The S&P GSCI commodity index has moved up 11.3% from a year ago on November 19, 2010 (see Chart 1). The trade weighted dollar declined 1.2% from a year ago as of November 12, 2010. The immediate inference is that the extent of gains in the commodity price index is larger than the decline of the dollar. By implication, commodity price gains reflect more than the depreciation of the greenback.

An increase in world demand for commodities is the other factor responsible for higher commodity prices. The world is operating on two different gears - advanced economies on first gear and emerging markets on a significantly higher gear. The two-speed world would entail that commodity prices have a differential impact in advanced economies compared with emerging markets.

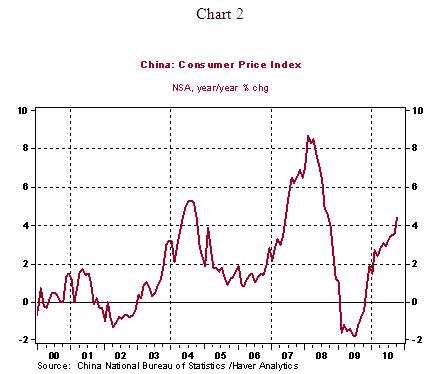

In the emerging markets, the sharp increase in overall inflation, partly due to higher commodity prices, should involve policymakers being concerned about higher inflation. China has already addressed the inflation issue with higher reserve requirements as inflation data show a troubling upward trend (see Chart 2). Price controls on food items in China are being considered and it should not be surprising if it is announced soon.

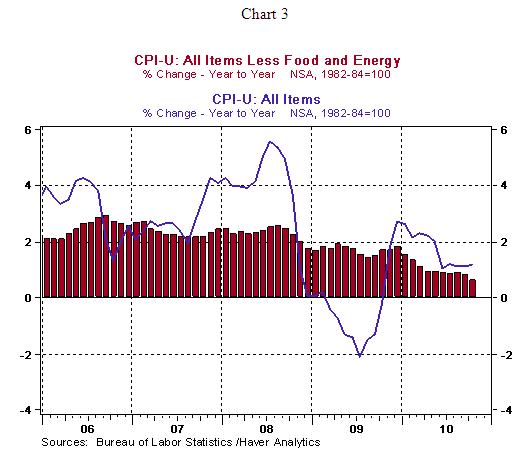

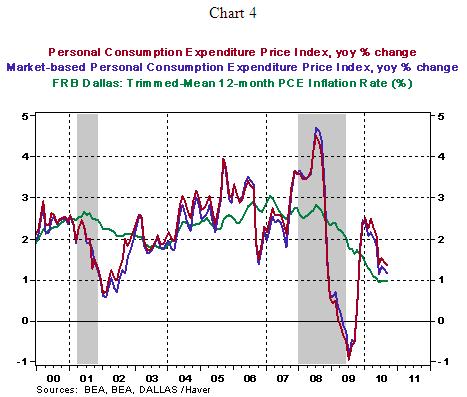

By contrast, in the United States, the Fed is concerned about a "low inflation" environment with vigorous discussions of how to prevent a deflationary situation. The Consumer Price Index (CPI) rose 0.2% in October, with the Labor Department indicating that higher gasoline prices accounted for 90% of the increase in the CPI. On a year-to-year basis, the CPI moved 1.2% in October. The core CPI, which excludes food and energy, held steady in October, matching the readings of the prior two months. The core CPI has advanced 0.6% from a year ago, the lowest mark for the entire history of the index. As shown in chart 3, both inflation measures show a contained inflation picture. Other measures of inflation also indicate a decelerating trend of inflation (see chart 4).

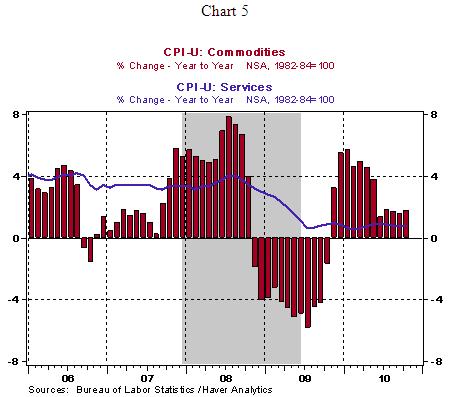

Commodities and services make up roughly 40% and 60% of the CPI, respectively. Both indexes show a decelerating trend (see Chart 5). The movements of the commodities price index is closely linked to the behavior of commodity prices.

Rising commodity prices, such as food and energy items, translate into higher prices for these items at the retail level but contained prices of services have provided a partial offset and held back overall inflation. In recent months, the commodity price index of the CPI shows a more moderate gain compared with readings earlier in the year. In recent weeks, the S&P GSCI index appears to have peaked on November 10 (see Chart 6)

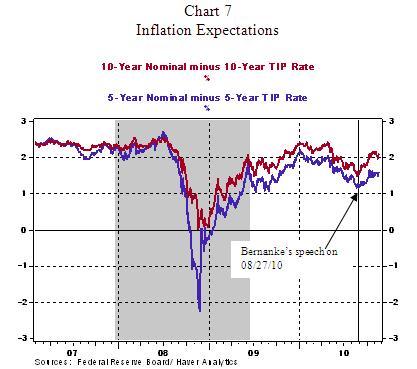

Speaking about overall inflation, the question is whether rising commodity prices will seep into the rest of the economy and result in higher overall inflation in the United States and call for tightening of monetary policy. In the United States, inflation expectations have risen since Chairman Bernanke spoke on August 27 indicating the possibility of the second round of quantitative easing. But the upward trend of inflation expectations remains non-threatening (see Chart 7).

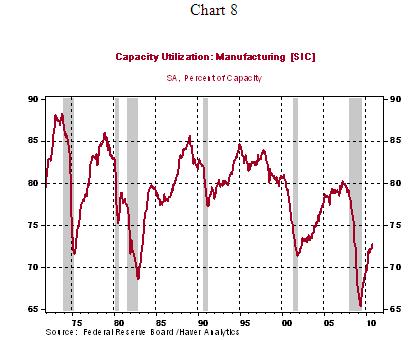

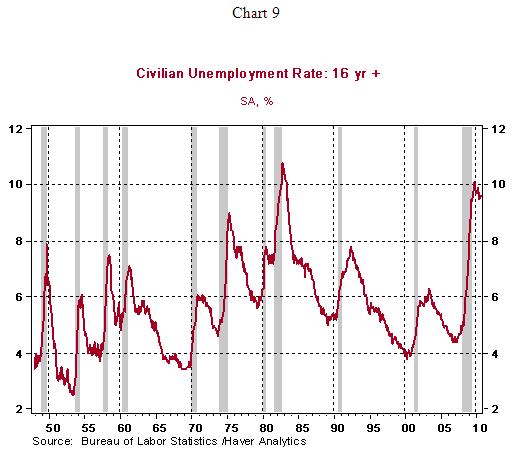

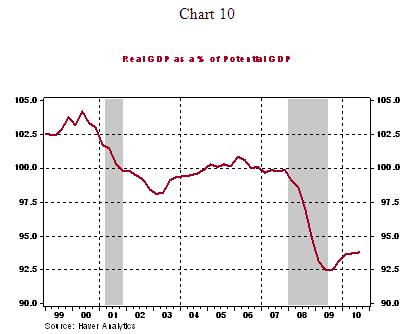

There is no immediate threat of inflation given the large excess capacity in the U.S. economy in terms of factory capacity and the high unemployment rate. Also, actual real GDP of the U.S. economy is far short of potential GDP. In addition, labor costs also show a downward trend. Charts 8, 9, 10 and 11 illustrate these aspects of the current situation in the U.S. economy. So, the upshot is that rising commodity prices are not a harbinger of higher inflation, for now.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2010 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.