After Reflation Comes Hyper-Deflation, a Different Kind of Deflation

Economics / Deflation Nov 22, 2010 - 04:41 PM GMTBy: Clif_Droke

There’s a wealth of wisdom to be found in ancient Chinese proverbs. Not uncommonly one can find answers to the most complex problems today by reading the simple yet elegant epigrams found in any collection of ancient sayings.

There’s a wealth of wisdom to be found in ancient Chinese proverbs. Not uncommonly one can find answers to the most complex problems today by reading the simple yet elegant epigrams found in any collection of ancient sayings.

One of the themes that runs like a thread in any book of Chinese proverbs is the honor the Chinese confer to the elderly. One such proverb advises anyone who is considering a new venture to “consult at least there older people before proceeding, then you will succeed.” Another one puts it much more succinctly: “The elderly: a national treasure.”

In the past few months I’ve been blessed to have encountered no less than four remarkable individuals who are past the age of 90. Each one of them is a rare specimen of physical health and mental acuity given their advanced age. Whenever I meet someone who is old enough to remember the Great Depression I can’t resist asking them how their recollection of the Depression days compares to today’s “Great Recession.” When I put the question to these four unique individuals I was surprised at the divergence of their answers. The answers were evenly divided into two categories: 1.) the Great Depression was far worse than anything we’re experiencing today; and 2.) today’s extended economic recession is actually worse than the Great Depression.

One gentleman I spoke to recently was a distinguished military veteran of 92 years of age. He had the distinction of being a Pearl Harbor survivor and can still vividly recall having to jump off his sinking ship and into the harbor on that fateful day of Dec. 8, 1941. Many of his comrades died in the attack and he can still remember their names. He also has a vivid recollection of the Great Depression as it affected his native southeastern North Carolina. When I asked this gentleman whether the current economic malaise compared to the severity of the 1930s Depression, he responded with an emphatic, “There’s no comparison – the Great Depression was far worse.”

When I asked him to relate some of his experiences of those days he replied, “Times were pretty bleak back then and a lot of men were out of work for a long time. My family lived on a farm, so we did okay since we raised our own food and sold the rest for cash.” I asked him if he saw any bread lines and he responded that the bread lines and soup kitchens started about the time the Depression bottomed out. He added that these services helped alleviate the suffering.

He went on to recount the famous Works Progress Administration scheme that gave work to the unemployed in the 1930s. “They called it the W.P.A. but we always joked that it stood for ‘We Poke Along.’ You’d see guys standing out there on the road side with their chin resting on a shovel handle, just collecting a paycheck when they should have been working. There were so many who should have been thankful to have a job but instead they didn’t really want to work. It was unbelievable considering how bad things were at the time.” He expressed his opinion that the Depression was much worse than the current recession “because there’s a lot more money available today than back then.” He also felt that in spite of the high unemployment rate, there are more opportunities for meaningful work today than there were in the Depression era.

The polar opposite of this opinion was held by a 92-year-old I spoke to in southeastern North Carolina. He is currently an active businessman and real estate investor and possesses and amazing mental acuity for his age. He still vividly remembers the Great Depression and he maintains the current recession is worse than the Depression “because of the inflation rate today.” As he put it, “Money was tight in the Depression and people struggled to get by, but at least prices were low. You could still scratch out a living and get the things you needed because of that fact.” He went on to say that the current rate of retail price inflation makes it much more difficult for those out of work to obtain necessities and pay bills.

These two viewpoints, while diametrically opposed, both contain elements of truth. For those who currently are employed or otherwise have a steady source of income, the present recession can’t be compared to the severity of the Great Depression. For the out of work, however, the recession might as well be the Great Depression. There’s also no denying that the retail price level of today is considerably higher than it was in the 1930s. With the highly touted “QE 2” monetary stimulus program widely expected to add further upside pressure to retail prices in the coming months, why should there be any talk of deflation at all? Shouldn’t we be more concerned by the possibility of inflation?

To answer this question we can go back to a similar point in our country’s history. The decade of the 1890s was in many ways similar to the present decade. It was a time when the U.S. was undergoing a major transition from a predominantly agrarian economy to an industrial one. It was also characterized by undertones of deflation counterbalanced by attempts at re-inflating the economy. The 1890s are also analogous to the present decade from the standpoint of the long-term Kress cycles: the last 20-year cycle bottom was in 1894 and the current 120-year cycle will bottom in 2014. In spite of the fact that the years 1890-94 were technically the hyper-deflationary part of the 120-year cycle, the inflationary efforts on the part of the government were sufficient to push the stock market as measured by the Axe-Houghton Index to a new all-time high. It wasn’t until the start of 1893 that stock prices collapsed and deflation ran rampant.

We all know that history tends to repeat and this time around is proving to be no exception. The Fed is doing its utmost to prop up a flagging economy by lowering rates and increasing liquidity. The problem they’re encountering is similar to the one the government encountered in the 1890s, namely a lack of confidence. Raising the price level of assets through re-inflation will only carry so far before the downward force of the hyper-deflationary 120-year cycle brings these efforts to naught.

There can be no denying, however, the temporal success these re-inflationary efforts are having in the interim. With the 4-year cycle having recently bottomed and the 6-year cycle still rising until next October, the coming year has the potential to show strong gains for both stock and commodity prices. This would also have the effect of pushing retail prices higher.

Another factor conspiring to push retail prices higher in the coming months is the monetary policy of the U.S. central bank. On November 3, the Federal Reserve announced that it would begin another round of Quantitative Easing (QE) by purchasing an additional $600 billion in bonds by April 2011. Real estate expert Robert Campbell made some worthwhile observations on the Fed’s “QE 2” program in the Nov. 15 edition of his “Campbell Real Estate Timing Letter” (www.SanDiegoRealEstateReport.com). He writes: “In simple terms, the idea behind QE is this: By buying bonds and injecting cash into the system, interest rates will fall and financial assets (namely stocks and bonds) will go up in value. These increased valuations will make people feel richer and more confident about the future, and thus spur consumers to spend more money – and even take on new debt. This increase spending, in turn, will help businesses, cause them to hire more people, and subsequently increase the rate of economic growth to a more vigorous and sustainable level. That’s the theory.”

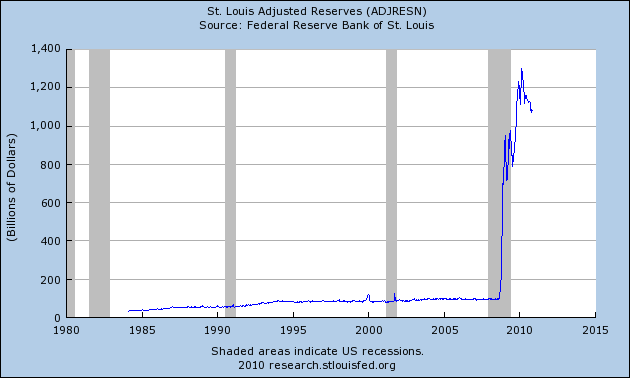

Campbell goes on to point out that even in today’s low interest rate environment, banks are now sitting on hoards of cash and over $1 trillion in excess reserves, as the following chart shows (courtesy of the St. Louis Fed).

Campbell observes, “After a post-bubble credit collapse, what Ben Bernanke and the Fed are up against is a secular shift in consumer attitudes toward spending and borrowing – whereby overly indebted consumers are now trying to de-lever and pay down another $3-$4 trillion of consumer debt in order to repair their balance sheets and bring their debt-to-income ratios back to pre-bubble historical norms. In other words, the new economic theme is frugality, where consumer spending is driven by need, not want. And that’s why the Fed is pushing on a string and is highly unlikely to be successful in it’s attempt to re-ignite a new credit-driven consumer spending cycle.”

Campbell concludes his assessment of the Fed’s QE 2 program by stating the monetary easing program could end up doing more harm than good to the economy by fueling expectations of higher inflation. He adds that the latest round of intervention will likely only “squeeze us all with higher food, energy and commodity prices (needs).”

With the 4-year and 6-year cycles in the ascent through most of 2011, the chances are high that we will witness additional inflation of asset prices. How then does this jibe with the fact that we’re in the final hyper-deflationary part of the Kress 120-year cycle? Going back to our earlier analogy of the deflationary 1890-1894 period of the previous 120-year cycle we saw that the attempts at artificially inflating asset prices succeeded up until the year 1892, just two years prior to the 120-year bottom.

The analogous period to 1892-94 is 2012 to 2014. Based on past precedent we can probably expect that the Fed’s re-inflationary attempts will temporarily succeed in pushing up asset prices until 2012, after the 6-year cycle peaks and just as the final hyper-deflationary leg of the 120-year cycle makes its irresistible presence known. History teaches that the Fed will find it all but impossible to counter the final two years of the deflation cycle in spite of their best efforts.

The price of gold is an excellent barometer of deflation. It is quite sensitive to the hyper-deflationary part of the economic long wave and tends to rise during the final years of the 120-year cycle. As investors continue reacting to the uncertainty surrounding the Fed’s attempts at countering the effects of long wave deflation, gold will continue to benefit and will establish itself as the safe haven du jour of investors around the globe.

During the interregnum between now and the fateful year 2012 when the final “hard down” of the 120-year cycle gets in full swing, we’ll likely experience what might be called a “different kind of deflation.” That is, while the deflationary undercurrents of the long cycle continues, periods of sometimes sharp “inflation” will be seen at time on the surface, only to dissipate once the government’s re-inflationary efforts cease. This curious mixture of inflation and deflation, which has been termed “retroflation,” there will be many marvelous opportunities for profiting from the Fed’s re-inflationary efforts, including in the precious metals and mining stock arena. If my reading of the economic tea leaves is correct, the year 2011 will be the last full year for individuals and corporations to shore up their balance sheets before the ugly effects of hyper deflation makes its appearance.

Gold & Gold Stock Trading Simplified

With the long-term bull market in gold and mining stocks in full swing, there exist several fantastic opportunities for capturing profits and maximizing gains in the precious metals arena. Yet a common complaint is that small-to-medium sized traders have a hard time knowing when to buy and when to take profits. It doesn’t matter when so many pundits dispense conflicting advice in the financial media. This amounts to “analysis into paralysis” and results in the typical investor being unable to “pull the trigger” on a trade when the right time comes to buy.

Not surprisingly, many traders and investors are looking for a reliable and easy-to-follow system for participating in the precious metals bull market. They want a system that allows them to enter without guesswork and one that gets them out at the appropriate time and without any undue risks. They also want a system that automatically takes profits at precise points along the way while adjusting the stop loss continuously so as to lock in gains and minimize potential losses from whipsaws.

In my latest book, “Gold & Gold Stock Trading Simplified,” I remove the mystique behind gold and gold stock trading and reveal a completely simple and reliable system that allows the small-to-mid-size trader to profit from both up and down moves in the mining stock market. It’s the same system that I use each day in the Gold & Silver Stock Report – the same system which has consistently generated profits for my subscribers and has kept them on the correct side of the gold and mining stock market for years. You won’t find a more straight forward and easy-to-follow system that actually works than the one explained in “Gold & Gold Stock Trading Simplified.”

The technical trading system revealed in “Gold & Gold Stock Trading Simplified” by itself is worth its weight in gold. Additionally, the book reveals several useful indicators that will increase your chances of scoring big profits in the mining stock sector. You’ll learn when to use reliable leading indicators for predicting when the mining stocks are about o break out. After all, nothing beats being on the right side of a market move before the move gets underway.

The methods revealed in “Gold & Gold Stock Trading Simplified” are the product of several year’s worth of writing, research and real time market trading/testing. It also contains the benefit of my 14 years worth of experience as a professional in the precious metals and PM mining share sector. The trading techniques discussed in the book have been carefully calibrated to match today’s fast moving and volatile market environment. You won’t find a more timely and useful book than this for capturing profits in today’s gold and gold stock market.

The book is now available for sale at: http://www.clifdroke.com/books/trading_simplified.html

Order today to receive your autographed copy and a FREE 1-month trial subscription to the Gold Strategies Review newsletter. Published each week, the newsletter uses the method described in this book for making profitable trades among the actively traded gold mining shares.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

even if it comes true you cant claim anything

24 Nov 10, 06:00 |

deflation

no logic given here apart from your cycles |