Investing Strategy for Switching from Bonds to High Dividend Paying Stocks

Stock-Markets / Investing 2010 Nov 22, 2010 - 07:35 AM GMTBy: Richard_Shaw

This is a follow-up to last week's letter suggesting that the best days for bonds are behind us for a while, and that reduction of bond positions is in order. We have been replacing bonds in managed accounts with high quality, above average dividend stocks with long histories of paying and growing dividends, and shortening duration among the substantially reduced bond positions we hold.

This is a follow-up to last week's letter suggesting that the best days for bonds are behind us for a while, and that reduction of bond positions is in order. We have been replacing bonds in managed accounts with high quality, above average dividend stocks with long histories of paying and growing dividends, and shortening duration among the substantially reduced bond positions we hold.

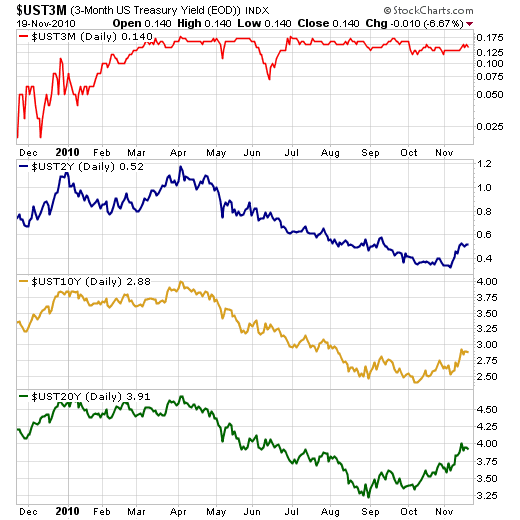

Rates have begun to rise, which means bond price have begun to decline. This daily chart of Treasury rates for 3-mo, 2-yr, 10-yr and 20-yr:

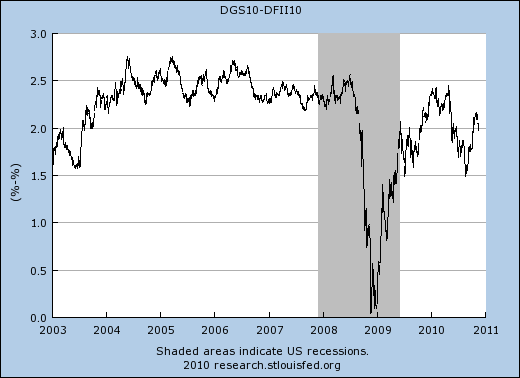

Inflation Protected Treasury bond investors expect the CPI for the next 10 years to be approximately 2%, as this Federal Reserve chart shows:

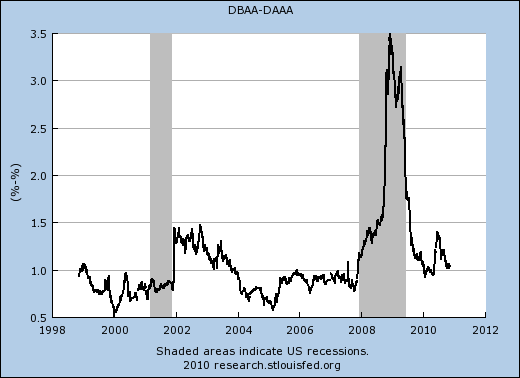

The historic opportunity for capturing a shrinking yield spread between higher and lower quality debt has mostly passed, as this Federal Reserve chart of the spread between AAA rated corporate bonds and BAA rated corporate bonds shows:

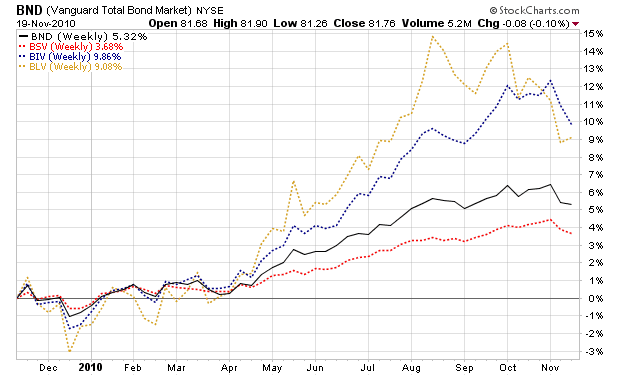

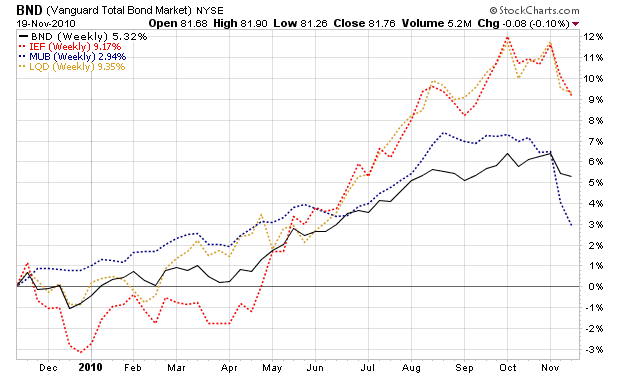

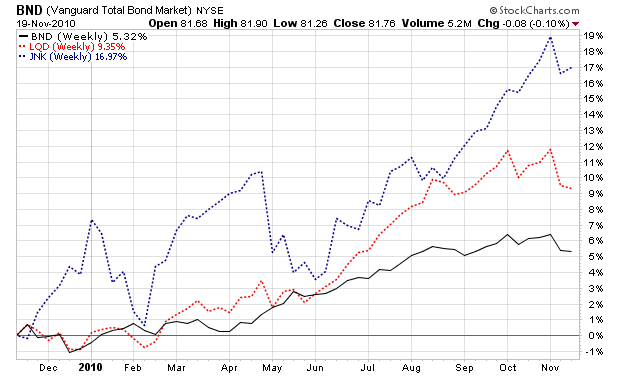

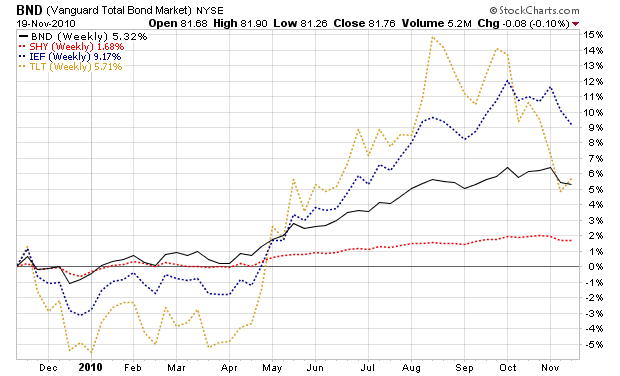

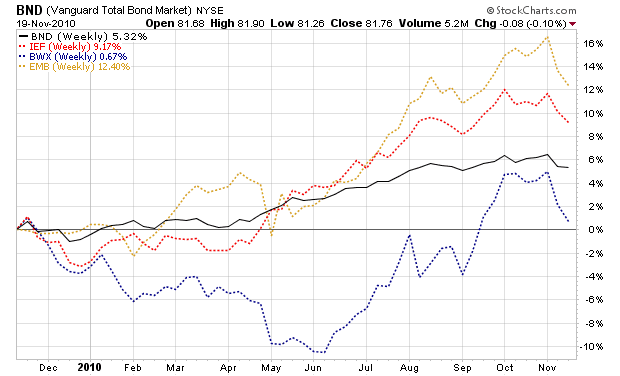

Here are weekly 1-year charts of percentage total return performance for several important bond groupings. In each case, they are compared to US aggregate bonds (BND):

Aggregate Bonds By Duration (BSV short-term, BIV intermediate-term, BLV long-term):

Bonds By Type (IEF intermediate Treasuries, MUB intermediate municipal bonds, LQD intermediate inv grade corporates)

Investment Grade Corporate Bonds versus Below Investment Grade Corporate Bonds (LQD inv grade, JNK below inv grade):

Treasuries By Duration (SHY 1-3 yr Treas, IEF 7-10 yr Treas, TLT 20+ yr Treas):

US versus Foreign Sovereign Debt (IEF US Treas, BWX Inv Grade Local Currency Developed Market Sovereigns, EMB Inv Grad USD Denominated Emerging Mkt Sovereigns):

Interest rates are beginning to rise, and have more room to rise than to fall. Bonds have gone from low risk to medium and high risk assets, as a result of what may be the bottom of the multi-decade decline in interest rates. We recommend substantially reducing bond exposures.

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2010 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.