Gold Analyst Who Puts the Bull in Bullish

Commodities / Gold and Silver 2010 Nov 20, 2010 - 04:44 AM GMTBy: The_Gold_Report

Dundee Wealth Inc. Chief Economist Martin Murenbeeld is long on opinion and the gold market. "Gold bullion is in a long-term bull market. And that's going to go on for a number of years," he predicted during the recent Forbes & Manhattan Resource Summit in West Palm Beach, Fla. Analysts David Keating, Mackie Research Capital Corp., and Paolo Lostritto, Wellington West Capital Markets, also participated in this Gold Report exclusive, giving candid views of the global gold markets and plenty of reasons to be a gold bull.

Dundee Wealth Inc. Chief Economist Martin Murenbeeld is long on opinion and the gold market. "Gold bullion is in a long-term bull market. And that's going to go on for a number of years," he predicted during the recent Forbes & Manhattan Resource Summit in West Palm Beach, Fla. Analysts David Keating, Mackie Research Capital Corp., and Paolo Lostritto, Wellington West Capital Markets, also participated in this Gold Report exclusive, giving candid views of the global gold markets and plenty of reasons to be a gold bull.

"Gold bullion is in a long-term bull market. And that's going to go on for a number of years," Martin predicted during a recent presentation at the first annual Forbes & Manhattan Resource Summit in West Palm Beach, Florida. His remark was included as one of a handful of reasons to be bullish about gold and commodities.

Global Fiscal and Monetary Reflation

Martin noted that economists have known for some time that the retirement of baby boomers would create fiscal "stresses" unlike the world had ever seen. It would have been ideal, he said, if the world's developed economies had entered that period with budget surpluses but the onset of the global recession in 2008 made that notion impossible.

"Because of the 'Great Recession' we're going into the baby boom-retirement phase with some of the greatest deficits in peacetime history," Martin said.

Compounding that is something he called "convergence," a phenomenon whereby financial markets are giving poorer European Union countries like Greece and Ireland the same lending terms that such wealthy EU countries as Germany and France receive, sometimes as low as 3%.

He asked rhetorically, "What does a pathological borrower do when interest rates drop from 15% to 3%?"

But before you could dismiss those issues as faraway problems in faraway places, Martin took aim at North American fiscal policy.

He used two charts to aid his point. The first was from the U.S. Congressional Budget Office, the second from the Canadian Parliamentary Budget Officer Office. The message of both charts was identical—that, with current trends, the debt-to-GDP ratio would exceed 200% in both countries by the mid-21st century. A third chart outlining the debt-to-GDP ratio in Greece showed a similar growth curve.

"Debts blow up," he said.

The impact of the great recession was further illustrated by another slide that showed the U.S., Canada, Japan, Germany, France, Italy, UK, Greece, Portugal, Spain, OECD (Organization for Economic Cooperation and Development), China and India had all posted budget deficits in 2009.

Most of these deficits, Martin said, were related to stimulus measures designed to limit unemployment, as high unemployment is bad for "political health."

Yet another slide charted the growth in the U.S. monetary base from 1915 until now. The line was akin to a cobra slithering through the grass, and then rising sharply to strike on Sept. 15, 2008, the day Lehman Brothers went out of business.

According to Martin's chart, from that point until now—about two years—the U.S. monetary base has grown from about $900 billion to about $2 trillion, its steepest rise ever. But, he said, the U.S. Federal Reserve had little choice.

"I'm in full agreement with what the Fed did. The one thing that I have come to know after years of reading and writing about economics is that depressions really get going when you have a totally bankrupt banking system," Martin explained. "If all the banks had failed then, we would be having quite a different conference."

But these borrowing policies have left governments with few ways out. They can renege on promises, cut services, raise taxes or print more money, Martin said.

And what are the implications for gold?

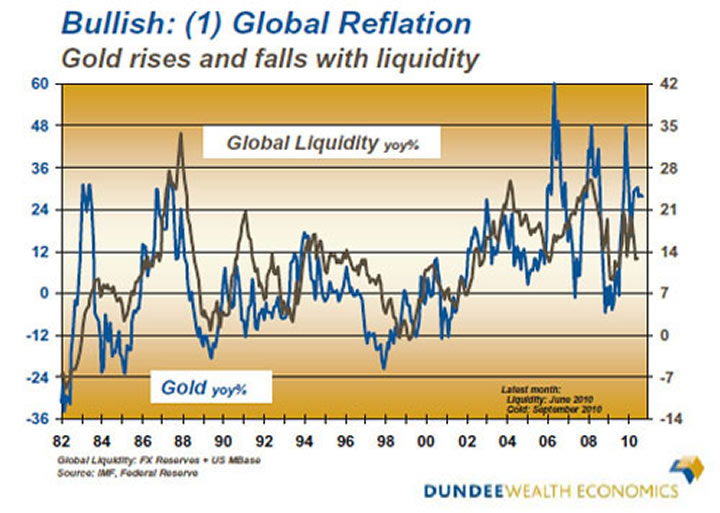

"Money is what drives gold," he said. "We print money and gold goes up."

"Deflation is very bad for gold," he said, adding, "the fact that we have low inflation is not good for gold. The fact that we're trying to pump economies up and put money into the system and avoid the problem is good for gold."

Global Imbalances

Martin pointed to America's trade deficit as a growing problem.

A chart showed that the U.S. trade deficit declined while the economy was in a recession in 2008 and 2009 and that the deficit is growing again as the country's economy posts modest growth numbers. That led Martin to a remarkable conclusion. . .

"The way for the U.S. to fix its current account deficit is to continue to have a recession," Martin said in jest. He noted two ways the U.S. could find its way out of a trade deficit: 1) Buy fewer goods from the foreign sector; and 2) Get the foreign sector to buy more from you.

Martin revealed that the U.S. trade deficit with China is pushing $300 billion. He then provided a brief history lesson on the relationship between the greenback and the renminbi (RMB). In 1986, it took a little more than RMB$3 to buy one U.S. dollar. Today, it takes about RMB$6.8 to buy a buck.

"In the 1980s and 1990s, China specifically devalued its currency to become the most competitively priced country," Martin said. "Now, it's time to give some of that back." He said the U.S. must pressure China to revalue the RMB.

The last time America took a stand on foreign currency values was in August 1971. At the time, President Richard Nixon established a 10% across-the-board tariff in an attempt to drive up Japan's yen and Germany's deutschemark (now the euro) after those two countries refused to revalue their currencies.

"It was messy, but it got done," Martin said.

Martin then took issue with China's stockpile of foreign reserves, which total almost US$2.7 trillion.

"In my humble opinion, this is criminal. This is so far beyond what a country needs as reserves that it has become a massively destabilizing force in the world economy," Martin explained.

He didn't let the U.S. off the hook, either. He pointed to America's roughly $300-billion energy deficit—basically, the amount of crude oil the U.S. imports versus what it exports—with the rest of the world and dubbed it a "disaster."

Martin called for changes to U.S. energy policy and recommended incremental increases in the price of oil until it reaches $200 per barrel. He said only then would America use less gas.

"That has to happen," Martin said. "Oil is far too important in chemical feed stocks to be burned up in a car." He used Japan to illustrate his point.

In 1975, OPEC demands sent oil prices through the roof and Japan, which imports virtually all its oil, was hit with a nearly tenfold increase in its energy costs. That, in turn, devalued the yen and forced Japan to become far more energy efficient. Today, Martin says, Japan is a leader in building hybrid cars and uses less energy per dollar of output than any other economy.

He says America's energy trade deficit ultimately pumps hundreds of millions into the foreign exchange market.

"I pay attention to that when I look at gold because dollars in the foreign exchange market can end up invested in gold," Martin said.

Excessive Global Reserves

Global foreign exchange reserves grew by $7.2 trillion between 2002 and 2009, according to Martin, and most of that money found its way into the international capital markets.

"This money has made a hell of a mess of housing markets around the world," he explained. "This was far too much money that got recycled. It should never have happened. And the IMF was asleep at the switch."

As of August 2010, China had foreign exchange reserves of $2.6 trillion; Japan, $1.01 trillion; Russia, $436 billion; Saudi Arabia, $422 billion; Taiwan, $372 billion; Korea, $281 billion; Hong Kong, $260 billion; India, $256 billion; and Brazil, $254 billion.

And what do central banks do with these reserves? Some are choosing mining investments.

"China has all these damn reserves and it has to get rid of them and, of course, it's decided that the best way to get rid of its reserves is to buy resources for the future," he said. "It can't go into the gold market. If China put $2.6 trillion into the gold market, I wouldn't be standing here. Gold would be what? $15,000–$20,000 an ounce? And I would be a very happy economist."

But some of China's reserves are finding their way into the gold market, albeit slowly. China has 1,054 tons of gold, up from 600 tons just a few years ago. India's central bank recently bought 200 tons of gold from the IMF, as did central banks in Bangladesh and Mauritius.

The central banks in the West, meanwhile, have largely liquidated their gold assets.

"The Indian subcontinent governments have made a statement that they are happy buying gold for anywhere from $1,050–$1,250 an ounce," Martin said. "The new guys on the block are very interested [in gold] for a simple reason: Gold is not the liability of another central bank. That is potentially earth shattering. It's certainly a structural change in the gold market."

Gold in a Bubble?

In real dollar terms, Martin argued, gold is nowhere near its 1980 high of $850, which translates to $2,385/oz. in inflation-adjusted terms today.

Martin went on to compare oil prices with gold. Gold has traditionally traded at 15 times the price of a barrel of oil, and it's close to that mark now. Oil also peaked in 1980 at about 34 barrels of oil to one ounce of gold. Murenbeeld basically dismissed any notion of gold being in a bubble with the yellow metal trading at around $1,350 an ounce.

Investment Demand

"Think of gold today as actually going back to its roots. Central bankers are more interested in the metal. And you and I are wanting to hold at least some gold for precautionary reasons," Martin explained, adding, "hold some gold and hope it doesn't go up. That's my investment view."

Discussing gold's standard investment-demand arguments like currency debasement and "safe haven" status, Martin then took those ideas a step further and proclaimed that gold is "morphing" into an asset class in much the same way the real estate market did through real estate investment trusts (REITs) in the 1990s.

He said that in 2008 global financial assets totaled $117 trillion, with $33 trillion of that in equities (equities declined about 45% that year), $51 trillion in private debt and $32 trillion in government debt. Of that $117 trillion, some $40 trillion was vested in managed assets like hedge funds and mutual funds.

In mid-2010, managed commodities were only $300 billion.

"If you think like I do, that resources and gold are morphing into an asset class, then you say what portion of your portfolio should you invest in an asset class? And I say at least 3%. In fact, I would say 5% but I don't want to overstate my case," he added. "At under 5%, it's just an interesting investment. It doesn't really change the characteristics of a portfolio."

Martin did the math, though, and if 3% of the world's managed assets went into managed commodities, the value would quickly climb to $1.2 trillion.

He said there are new gold products out there to lure investors including Dundee subsidiary Dynamic Fund's Dynamic Strategic Gold Class (TSX:DYN2300).

David Keating, Mackie Research Capital Corp.'s managing director of equity markets, who was also at the conference, sees growing institutional demand for gold as well.

"Look at the rise of the gold ETFs. The market is definitely moving toward getting hard assets. You recently saw Sprott raise $550 million on its Sprott Physical Silver Trust (NYSE.A:PSLV). You've seen that being done on the gold side with all sorts of other structured product entities replicating owning physical gold. There are certainly dollars on the retail and institutional side being allocated to those kinds of funds," Keating said.

Keating says Mackie, too, is playing to the institutional audience.

"We play in this small- to mid-cap part of the market focusing on small-cap growth oriented stories. The institutional accounts and retail investors are looking to get access to the next gold story," Keating said. "One of the companies that we're involved with is Sandspring Resources Ltd. (TSX.V:SSP)," Keating said. "We got in early on that. We think that on an enterprise value to ounces-in-the-ground basis, it's very cheap."

He noted, "It just recently raised about $50 million. That money is going to be used for step-out drilling and expanding the resource to get a sense of how big the (Toroparu) deposit really is."

Mackie recently hosted a conference in Toronto where several junior companies pitched their stories to institutional and retail investors. Keating thought Geologix Explorations Inc. (TSX:GIX) made a case for its Tepal copper/gold porphyry deposit in Mexico.

"It recently put out a very positive feasibility study. And it's a story that based on enterprise value to ounces in the ground is still cheap," Keating said. "It's got dollars to continue to drill the resource and we believe the resource is going to expand."

Paolo Lostritto, an analyst with Toronto-based Wellington West Capital Markets, looks at companies a little higher in the food chain. His companies are generally producing or are near-term producers. He has a $1.20 target on Avion Gold Corp. (TSX.V:AVR; OTCQX:AVGCF), one of the companies in the F&M portfolio.

"It's a company that bought a suite of assets that were technically challenged, and has executed a plan to unlock that value," Lostritto explained. "The company has an excellent exploration team that has been adding ounces through the drill bit. But the reason people buy this story is because of cash flow."

Avion's operations in Mali produced slightly more than 51,000 ounces of gold in 2009. It will produce about 78,000 ounces this year, and the production guidance for 2011 is about 118,000 at cash costs of roughly $630 per ounce. The costs are higher than the industry average due to a high stripping ratio, which means a lot of superfluous material must be removed to extract the gold.

"There is quite a bit of strip associated with production (the ore), and the cash costs are elevated because of that. They've typically been around $650. You should see cash costs average around $550 for the next couple of quarters," Lostritto said. "My estimate is that the company has 12 months of open-pit mining and 7–10 years of underground. And if it can make the underground work, there is potential for the underground mine life to grow as Avion drills at depth."

Want to read more exclusive Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Expert Insights page.

DISCLOSURE:

1) Brian Sylvester of The Gold Report conducted this interview. He personally and/or his family own the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Gold Report: Timmins.

3) Ian Gordon: I personally and/or my family own shares of the following companies mentioned in this interview:Timmins Gold, Golden Goliath, Millrock and Lincoln. My company, Long Wave Analytics is receiving payment from the following companies mentioned in this interview, for receiving mention on my website, Golden Goliath, Millrock and Lincoln Gold.

The GOLD Report is Copyright © 2010 by Streetwise Inc. All rights are reserved. Streetwise Inc. hereby grants an unrestricted license to use or disseminate this copyrighted material only in whole (and always including this disclaimer), but never in part. The GOLD Report does not render investment advice and does not endorse or recommend the business, products, services or securities of any company mentioned in this report. From time to time, Streetwise Inc. directors, officers, employees or members of their families, as well as persons interviewed for articles on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.