U.S. Inflation Remains Contained, In Contrast to Fed’s Preference

Economics / Inflation Nov 18, 2010 - 02:37 AM GMTBy: Asha_Bangalore

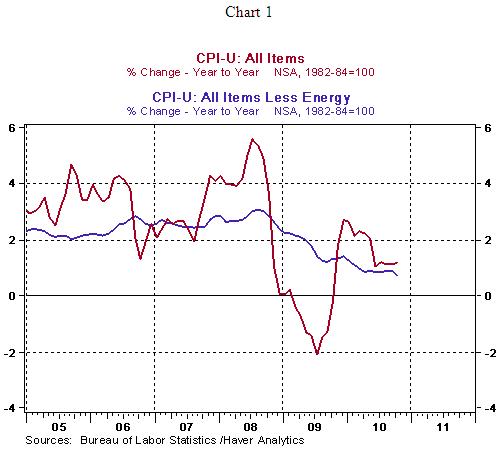

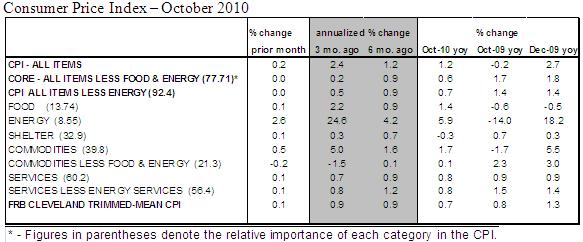

The Consumer Price Index (CPI) moved up 0.2% in October, after a 0.1% gain in the prior month. The year-to-year change is 1.2%, with the CPI trending down after a 2.7% increase in December. During the July-October period, energy prices have lifted the overall CPI. In October, higher gasoline prices (+4.6%) were responsible for nearly 90% of the increase in the CPI. The CPI excluding energy held steady in October after a similar reading in the prior month. Food prices inched up 0.1% in October, putting the year-to-year gain at 1.4%.

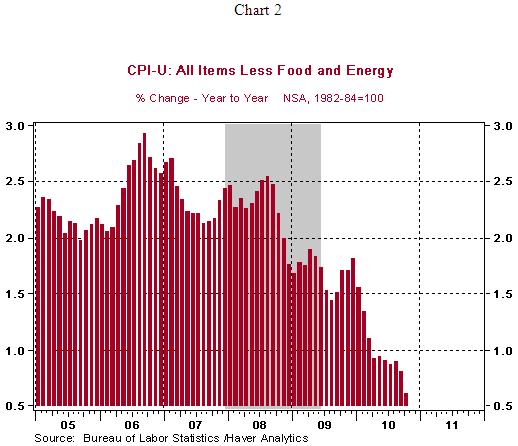

The core CPI, which excludes food and energy, held steady for the third month in a row. The 0.6% year-to-year increase in the CPI is the lowest since record keeping began for this series in 1957. The core CPI makes up nearly 78% of CPI. The underlying pace of inflation remains more contained than what the Fed would prefer.

In October, price measures of shelter (+0.1%) and medical care (+0.2%) advanced but these higher prices were offset by declines in prices of new cars and trucks, clothing, tobacco and recreation.

The probability of deflation is significant, given the decelerating trend of both overall and core consumer prices, if the economic fails to grow at a more rapid clip compared with the tepid pace of the sub-par growth seen in the second and third quarter of 2010. The October CPI report supports recent plans of the Fed to engage in $600 billion of purchases of Treasury securities.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2010 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.