Six Million Benefit Paying Jobs Vanish in One Year!

Economics / Employment Nov 17, 2010 - 05:20 AM GMTBy: Mike_Shedlock

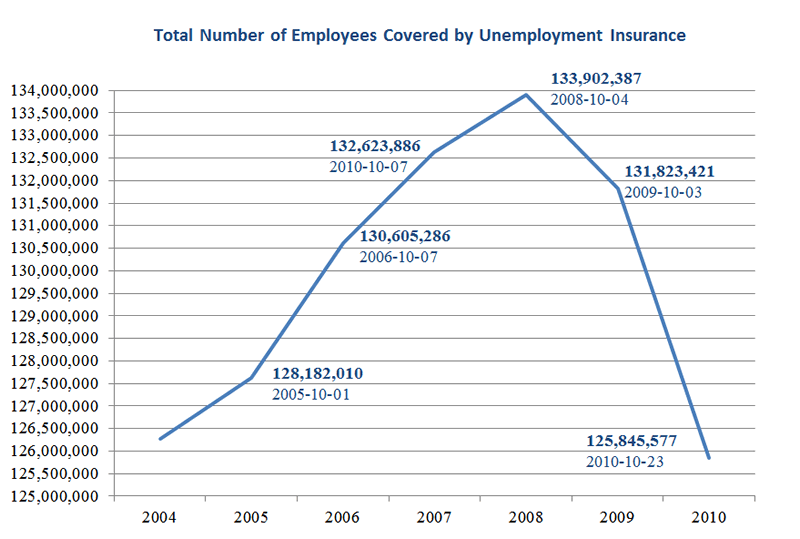

Analysis of weekly unemployment data and covered employees shows that 5,977,844 benefit paying jobs have been lost in the last year.

Analysis of weekly unemployment data and covered employees shows that 5,977,844 benefit paying jobs have been lost in the last year.

The above chart is from reader Tim Wallace. I added the date and numeric annotations. Thanks Tim!

Covered Employment Stats of Merit

- Covered employment is back to 2004 levels.

- Close to 6 million benefits paying jobs have vanished in a year.

- Over 8 million benefits paying jobs have vanished since the 2008 peak.

What is a Covered Employee?

The exact meaning of "covered employee" varies slightly state to state, but not by much. In simple terms it means one is eligible for unemployment insurance benefits.

Most states exclude the self-employed, commission based employment such as real estate agents, those in student training programs, academic and hospital internships, employment by churches or religious organizations, and rehabilitation programs.

Self-employed individuals must pay into unemployment insurance programs, however, the self-employed are not eligible for benefits anywhere.

Nearly 6 Million Jobs Vanish

By the above intrepretation, it is safe to conclude that 5,977,844 jobs totally vanished (not just benefit paying jobs).

The only way that cannot be true is if there was a sudden shocking increase in the number of real estate agents, church hiring, or close to 6 million people all of a sudden decided to go into business for themselves.

All of those possibilities are highly unlikely to say the least.

Tim Wallace writes ....

The ANNUAL ADDITIVE TREND from 2004 to 2008 of 1.9 million is now a net loss of 8 million the past two years

Year....Covered...........Number added from previous year

2004....126,276,670....Data from hard copy sheets

2005....127,622,590....1,345,920

2006....130,605,286....2,982,696

2007....132,623,886....2,018,600

2008....133,902,387....1,278,501 average added per yr = 1,906,429

2009....131,823,421....-2,078,966

2010....125,845,577....-5,977,844

Did the stimulus SAVE or CREATE any jobs, or did we lose over 8 million jobs in two years in spite of record amounts of stimulus?

Download data including the covered column is found on the US Department of Labor website, Weekly Claims Data.

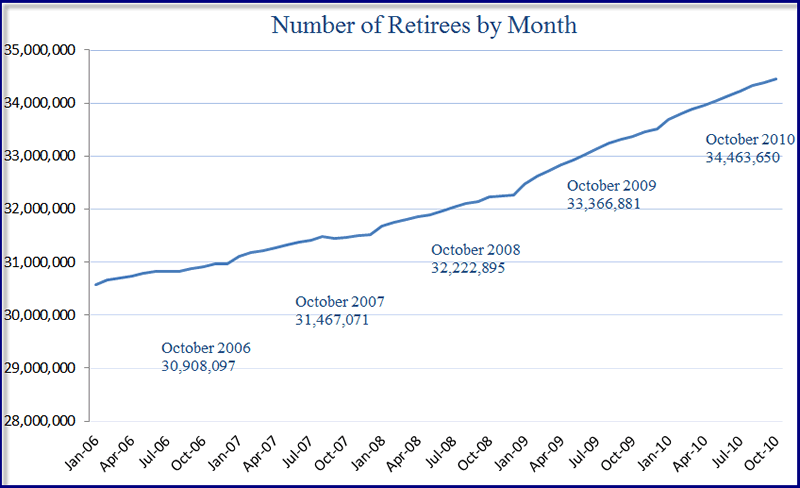

Was there a Massive Surge in Retirees?

There was no massive surge in retirees so that cannot account for the loss of benefits paying jobs.

Retiree Data

- In October of 2006 there were 30,908,097 retirees.

- In October of 2007 there were 31,467,071 retirees, an increase of 558,974.

- In October of 2008 there were 32,222,895 retirees, an increase of 755,824.

- In October of 2009 there were 33,366,881 retirees, an increase of 1,143,986.

- In October of 2010 there were 34,463,650 retirees, an increase of 1,096,769.

Information on retirees is from the Social Security Administration. It undercounts retirees not in the system so actual numbers would be somewhat higher.

The number of retirees is certainly increasing which suggests the number of jobs needed to keep the unemployment rate steady is dropping. It also helps explain a falling participation rate (although not at the rate that it is falling).

That aside, the growth in the number of retirees cannot begin to explain the massive loss of benefits paying jobs.

The increase in retirees from 2008 to 2010 is only 2,240,755 total. Civilian population growth was rose by 1,980,000 just last year.

Population Changes

I recently discussed population changes in my post In Search of 1.1 Million Jobs Claimed by Obama; Where the Hell are They?

Let's take another look at the BLS October Jobs Report.

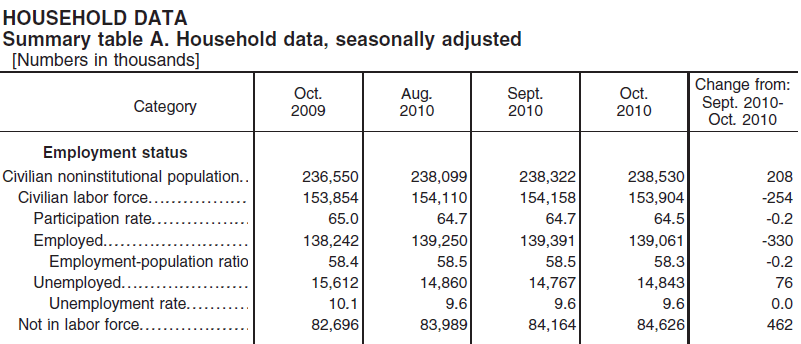

Scroll down to page 5: HOUSEHOLD DATA Summary table A. Household data, seasonally adjusted.

The first item of interest is the Civilian Noninstitutional Population (i.e the population aged 16 and up not in school, prison, or other institutions).

In the last year, the table shows Civilian Noninstitutional Population rose by 1,980,000 an average gain of 165,000 potential workers a month.Expected Increase In Workforce

In the last year the Civilian Noninstitutional Population rose by 1,980,000. There were 1,096,769 retirees. That mean the labor force should have increased by 883,231 workers. Instead the BLS reports the labor force increased by 50,000 workers (second line in table A above).

The rest supposedly dropped out of the workforce.

Hard Facts

Please remember the numbers in Table A are from phone surveys, seasonally adjusted, and arguably quite error prone.

On the other hand, the covered employees chart was produced from actual jobs data from the states.

Hard data says the US lost 5,977,844 benefits paying jobs in a year, and 8,056,810 benefits paying jobs in 2 years when we should have gained close to a million jobs a year or so based on population growth, even factoring in the number of retirees.

6 Million Benefits Paying Jobs Vanish and Unemployment Rate Drops!

In spite of losing nearly 6 million benefits paying jobs in the last year (and not gaining another 800,00 to a million more based on population growth minus retirees), the unemployment rate in October of 2009 was 10.1% and it is now supposedly a half-point lower at 9.6%.

Is this a crock or what?

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post ListMike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2010 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.