Buy Silver to Crash JP Morgan Due to its Giant Short Position

Commodities / Gold and Silver 2010 Nov 17, 2010 - 02:48 AM GMTBy: GoldSilver

Mike Maloney was recently in Europe working on his next top-secret project. While passing through France, Mike got the chance to visit with the one and only Max Keiser.

Mike Maloney was recently in Europe working on his next top-secret project. While passing through France, Mike got the chance to visit with the one and only Max Keiser.

Intelligent, witty, and never bashful, Max Keiser is pure financial entertainment. With over 25 years of experience with markets and finance, Max often draws from first hand experiences when providing his listeners explicit insights on how the financial markets truly operate.

He has been described as a film producer, a journalist, and as JP Morgan and friends are now finding out, an activist investor with powerful ideas on how the masses can help themselves in taking their financial power back.

Without further ado, let's check in with two of the most brilliant minds on the gold and silver scene, Max and Mike:

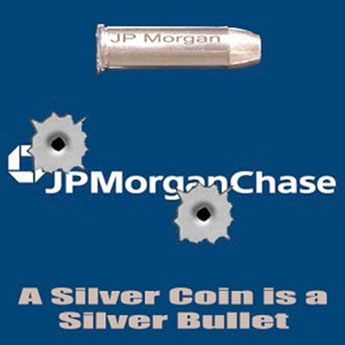

Late last week, Max Keiser was heard on The Alex Jones Show, brainstorming a brilliant idea which activist investors can aim at commercial banks who hold large concentrated short positions in silver commodity markets (JP Morgan currently has three class action lawsuits filed against them which allege the firm's manipulation of the silver market).

"Crash JP Morgan. Buy Silver. We can in fact crash JP Morgan. JP Morgan is one of the biggest financial terrorists in America today, probably even bigger than Goldman Sachs. If the American people can take this on and put that company under, take that stock price down to zero… that would be a major victory!" - Max Keiser

Max's Bulletproof Idea -> A Catchy Call To All

Yes you out there! Are you sick of too big to fail banks? Their endless black holes of debt, their enriching power ranks?

Mimic Max's cry out by taking offense in a silver delivery rout. How fitting it might be, silver the anti-corrupt banking-bacteria metal of our society!

We will never stop mining, using, and valuing silver. Since the dawn of civilization, silver has played part in mankind's modernization. Stockpiles now lost to our past two-century's ingenuities. Nearly all silver ever mined, completely vanished, offline.

Yet the world remains vastly unaware, physical investment grade silver is extremely rare. We majority invest in silver bullion even over gold. Really, it's about fifty times cheaper to hold!

Mirror, mirror on the wall, how you prove silver to be the greatest reflector of all. It too is the best conductor of heat and electricity, an essential precious metal commodity; super cheap and in short supply, such an investing abnormality!

Fiat currency lovers won't find this fact funny; silver is and always will be money. Silver is set to take its stand as today's myopic monetary system crash-lands. Silver is going to out endure, every bank whether or not it's FDIC insured!

How lucky are we?

Turning fiat paper currency decrees into real physical silver monies.

A keystroke or two, a wire transfer and a wait, walla! Silver coins and bars at your gate!

With physical silver bullion running roughly $30 an ounce, any and all can take part in this fraudulent bankster trounce!

Perhaps now's the hour to take back some power? It is time to join a peaceful revolution of silver coin!

We promise more content on this front no doubt.

Max's momentum building mantra, an incredible and bold call out: Crash JP Morgan! Buy Silver!

Mike Maloney is the owner and founder of GoldSilver.com, an online precious metals dealership that specializes in delivery of gold and silver to a customer's doorstep, arranges for special secured storage, or for placement in one's IRA account. Additionally, GoldSilver.com provides invaluable research and commentary for its clients, assisting them in their wealth building endeavors.

© 2010 Copyright GoldSilver - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.