Consumer Price Inflation Has Finally Arrived and Gold Will Have Its Day In the Sun Yet

Commodities / Inflation Oct 12, 2007 - 07:40 AM GMTBy: Greg_Silberman

Not a day goes by without another financial institution getting bailed out.

Not a day goes by without another financial institution getting bailed out.

Let's see, we have Countrywide Financial, German IKB and now the UK based Northern Rock.

And the rumours. Oh the rumours. Let's see, there has been rumours of liquidity problems at Barclays Bank, Alliance & Leicester and Australian Adelaide Bank and on and on…

Central Bankers the world over have predictably come to the aid of ailing financial institutions by providing loan guarantees and emergency funds and rate cuts in an attempt to keep credit markets operational

The message ofcourse has not been lost on Gold.

When central bankers open their check books for all to come and borrow, to borrow with abandon, the message the market receives is clear. Nobody will be left to fail and central banks will print as much money as it takes to ensure this. Predictably, Gold will continue to rise as the bailouts stack up.

Loose monetary policy is going to unleash devastating inflation and will further underpin the bull market in Gold.

Chart 1 - 10-yr Note Yield bouncing off 50 month moving average

Bonds are challenging their 50 month moving average and long-term uptrend. Probabilities favour higher yields going forward.

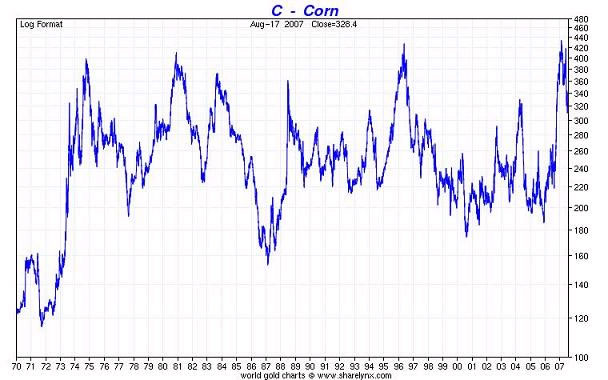

Talking about inflation, what better way to gauge Consumer Price inflation than by looking at food prices? Just take a look at this chart of Corn going back to 1972!

Chart 2 - 35 year Corn - 400c is tough resistance

400 – 420c has been incredibly strong resistance going back as far as 1973!

With the continued strength in Current Oil Prices it seems likely that Corn will finally breakout of this consolidation and unleash a fire storm of price inflation.

This will cause long-term rates sharply higher along with Gold as the safe haven investment of choice!

More commentary and stock picks follow for subscribers…

By Greg Silberman CFA, CA(SA)

Profession: Portfolio Manager and Research Analyst

Company: Ritterband Investment Management LLC

e-Mail: greg@goldandoilstocks.com

Website: blog.goldandoilstocks.com

I am an investor and newsletter writer specializing in Junior Mining and Energy Stocks.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Greg Silberman Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.