Stock Market Trading Plan into Year End

Stock-Markets / Stock Markets 2010 Nov 15, 2010 - 02:48 PM GMTBy: David_Grandey

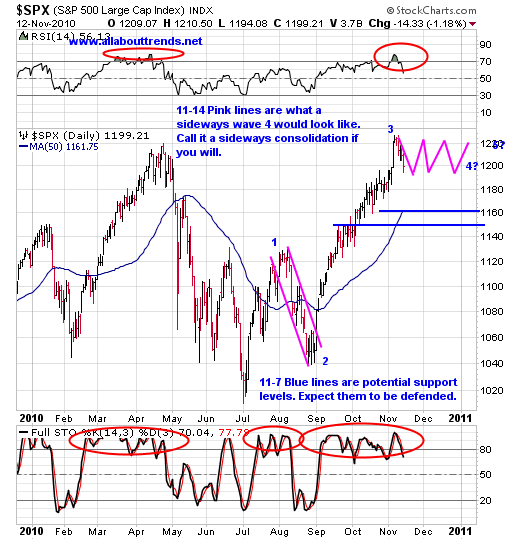

It sure looks like the markets are in a wave 4 which leads us to a fork in the road as in Sideways Or Down. BUT does it really matter? Not really as you’ll see.

It sure looks like the markets are in a wave 4 which leads us to a fork in the road as in Sideways Or Down. BUT does it really matter? Not really as you’ll see.

If Sideways?

Then the SPX would look like this in a daily frequency.

Note this could easily occur because the rule of thumb with Elliott Wave is that if two is a traditional pullback (and it was, Aug 2009) then 4 is sideways or vice versa. Upon completion then would come the wave 5 final upwards run into year end. Then? Don’t get caught long. But we’ll talk about that in late December.

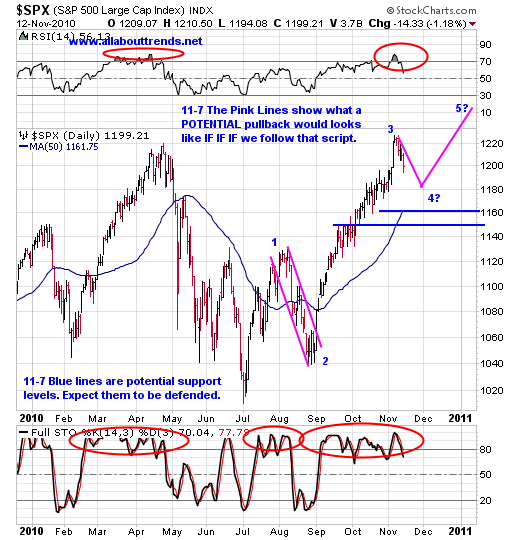

If down?

Where to? We can use technical analysis to give us a clue. See the 50 day average? It’s at 1160, which also happens to be near the 38.2% fib level at 1155, then there is some basing structure at the 1150 level so call it 1150-1160.

So you see it doesn’t really matter as both upon completion come to the same conclusion, that being a Wave 4 with the final upwards wave 5 yet to rear its head.

Note: See that wave 2 pullback in August? Notice it was 3-waves down? Be aware of that as when all said and done this pullback too could be a 3-waves down affair, that is if the scenario of down is occurring.

The bearish count has this recent peak as a 3-waves up affair off the July lows however we’ll have to see how that holds up over the next few weeks as true tops are a process.

As for the OTC Comp, Russell 2000 and Dow industrials? They all basically show similar patterns.

Next week is also options expiration week so heads up as volatility will reign and that means both directions folks. Listen to the charts not your emotions should things get dicey.

What would happen should either outcome occur to our holdings? To the follow the leaders?

If down:

It would bring them all down to major trend channel supports or moving averages as well and offer up some even better really nice entries where we can add to those issues where we took probing positions.

What it would also do is take some of the follow the leaders that you just weren’t able to pick off on the long side because of bus chasing and potentially set up grand slams to the 50 day averages or prior support/breakout levels.

If Sideways:

Then they base build right in here which gives names a platform to launch off of.

So you see? Again either way it doesn’t really matter when all is said and done.

So to the forward thinker with actual PATIENCE it all sets up a nice bunch of trades coming our way for the famous into the potential end of the push.

What about those who have to live in the moment and are highly emotional? It means they are going to get even higher emotionally speaking as their names are going to be pulling back and sure, they can deal with everything as long as life is giving them peaches and cream but we all know life is a two way street. It’s not just how you handle the good times, it’s also how you handle the bad times. That’s where trade size risk management comes in and classic use of support, resistance, trend channels, moving averages come in — all the stuff we talk about on a regular basis.

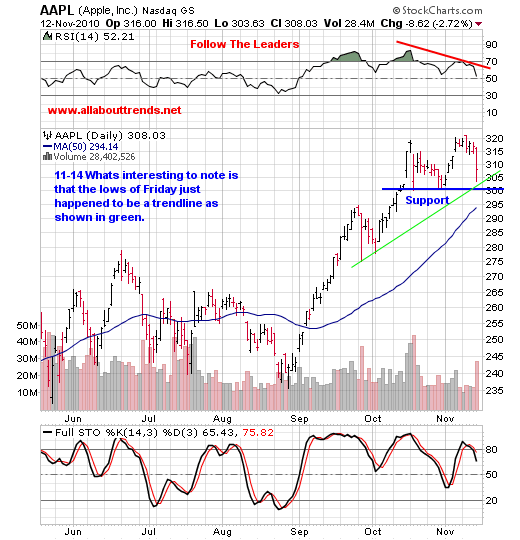

While on this subject yesterday Apple — AAPL went into a tizzy fit AFTER it was announced that some big holders according to 13F filings were sellers of AAPL in the quarter ended Sept. 30 of some serious size. A key point here is the stock sold off AFTER it was announced that these holders sold over a month ago! Now they sell off the stock? Sheesh talk about a delayed reaction to a reflexes check at the Dr.’s office.

We bring that up because we have said this in the past and that is that smart money gets out while the getting is good for whatever reason be it locking in gains or reducing position size or whatever. Think about it, if you are long 20 million shares of a stock what are you going to do? Sell it on a bad day? Know what you will do to yourself? You’ll blow the stock up on yourself.

Another point we want to make about this is that right after we bought the stock we went hunting around for a reason at that moment in time as to why if there was one. We found ourselves in the message boards and ran across a post that said to the effect of:

Help! Cramer told me to buy now I don’t know what to do, please help.

To us it’s obvious that this is a typical cramerican and a typical response to what we talked about above, that being life and the stock market are a two way street. Had this person been versed in technical analysis and managing his emotions, and employed proper position size risk management he probably wouldn’t have posted what he did. We bring this up as it’s an excellent example of how someone who doesn’t employ a “Knowledge is Power When Used Effectively” can get all flustered. For us? The chart below of AAPL sums up our thoughts.

You guessed it! A leading stock that has pulled back to support which is why we stepped up and bought 1/2 of a position Friday.

By David Grandeywww.allabouttrends.net

To learn more, sign up for our free newsletter and receive our free report -- "How To Outperform 90% Of Wall Street With Just $500 A Week."

David Grandey is the founder of All About Trends, an email newsletter service revealing stocks in ideal set-ups offering potential significant short-term gains. A successful canslim-based stock market investor for the past 10 years, he has worked for Meriwest Credit Union Silicon Valley Bank, helping to establish brand awareness and credibility through feature editorial coverage in leading national and local news media.

© 2010 Copyright David Grandey- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.