Trading Gold Options with Long-term Calendar Spreads

Commodities / Gold and Silver 2010 Nov 12, 2010 - 01:04 PM GMTBy: J_W_Jones

At this point anyone following financial markets realizes that current market conditions are directly impacted by the movement of the U.S. dollar. Recently the dollar has shown strength and could potentially be putting in an intermediate or potentially longer term bottom. At this point it is a fool’s game making predictions, but the current Dollar Index daily chart shows that the price is above the 20 day simple moving average which is generally a bullish signal. The daily chart of the Dollar Index (.DXY) can be seen below.

At this point anyone following financial markets realizes that current market conditions are directly impacted by the movement of the U.S. dollar. Recently the dollar has shown strength and could potentially be putting in an intermediate or potentially longer term bottom. At this point it is a fool’s game making predictions, but the current Dollar Index daily chart shows that the price is above the 20 day simple moving average which is generally a bullish signal. The daily chart of the Dollar Index (.DXY) can be seen below.

My most recent article discussed using a short term calendar spread to capture time premium of the gold ETF GLD’s weekly options. While I do not recommend that traders place trades based on my articles, I would like to point out that the most recent GLD calendar trade I posited would have produced a significant double digit gain as of the opening bell Friday. I do not mention this to boast, but simply to point out the power of calendar spreads using weekly options and their rapid time (Theta) decay.

The horizontal volatility skew of the weekly options places the short-term calendar strategy at the top of my list based on current market conditions. By this I mean that the implied volatility of the weekly options since their recent introduction has tended to be greater than that of the corresponding longer dated options. However, calendar spreads can be utilized in longer term trades as well as a cheaper surrogate for equity ownership.

Currently gold appears to be going through a pullback and possibly a major correction based on price action in the dollar and it could setup for a possible longer term entry in time. The weekly gold chart is listed below.

Traders that believe inflation will continue to rise dramatically over the next few years might consider the following long-term calendar spread versus outright equity ownership. The strategy is precisely the same as its proverbial cousin the short-term calendar spread, however the characteristics and risk profile is somewhat different due to volatility differences on longer dated option chains.

The strategy involves buying GLD leap (option that does not expire for 1-2 years or more) call contracts and regularly selling weekly call contracts against them. The process continues every week while the premium collected helps reduce the overall cost of longer dated GLD calls. The construction is fairly basic, however relatively deep in the money calls should be used for the long leap side of the construction. The weekly options to be sold against the long position will typically be at-the-money or even slightly out-of-the-money and the position will be classified as a diagonal calendar spread.

Since the longer dated calls are deep in the money and have a significant amount of time before they expire they are somewhat insulated against volatility and have a relatively low time decay risk. The sheer nature of option pricing enables the longer dated calls to withstand harsh volatility changes while providing the trader the ability to have similar price action as he/she would by owning GLD common stock outright. The primary advantage of utilizing options versus stock ownership is the reduced price of the option contract versus stock ownership.

As of the writing of this article, GLD in Friday’s pre-market action was trading around $136/share. An option trader could purchase a January 2012 125 Call contract based on Thursday’s close for $2,165 not including commissions. Purchasing 100 shares of GLD would cost an equity trader $13,600 or $6,800 if they were using a Reg T margin account. In either case, the long dated GLD leaps provide similar price action with reduced capital. For the price of 100 shares of GLD a trader could purchase 6 GLD January 2012 125 calls for 6x the exposure. However, as most astute traders will point out it is theoretically possible to lose the entire amount invested in the option contracts should gold have a major pullback in short order.

While this accusation is indeed correct, through the use of contingent stops based on GLD’s price this risk is mitigated to an equal amount of risk as an equity trader utilizing stops on GLD’s price. In the end, the risk is inherently the same setting aside time decay suffered by the long option, which early on in this trade will be next to nothing. Additionally, the trader will be selling weekly calls against the long dated GLD leaps to reduce the overall cost of the position allowing a trader the possibility of reaping additional upside.

The trade construction is as follows:

Buy 5 GLD Jan 2012 Leap Calls at the 120 strike for around $23.00

Sell 5 GLD November 2010 136 calls at the 135 strike for around $2.05

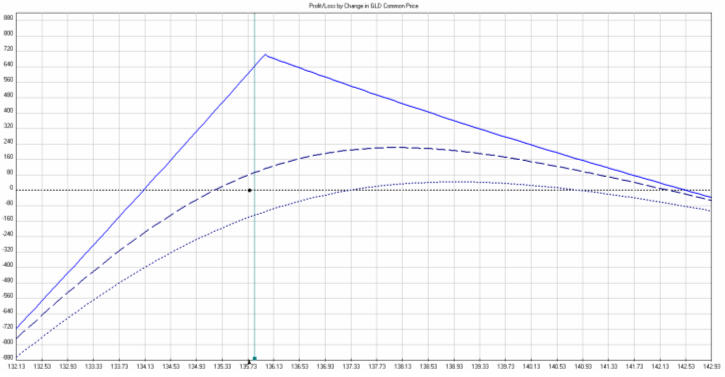

The profitability graph for the November expiration (Friday, November 19, 2010) is illustrated below:

It is important to recognize that the illustrated graph represents the first of 62 anticipated sales of weekly calls against these long options that will be available prior to the LEAP’s expiration.

The risk for this trade is twofold; the first risk occurs if price moves beyond the bounds of profitability. The second risk, volatility risk is not as obvious. One of the functional characteristics of LEAPS is that they are exquisitely sensitive to changes in volatility. It is for this reason we have chosen a deep in-the-money call to buy; remember that volatility changes only impact the time (extrinsic ) component of option premium and the deep in-the-money options have the least time premium embedded within their price.

Trade management includes exiting the trade if specific stop targets are hit, specific profit/loss targets on this trade are met, or violation of technical support or resistance. In order to understand this trade, the aspiring option trader needs to follow both price and volatility impacts that are respective of this trade’s construction. I suggest the trader journal not only the relevant prices of the underlying and its corresponding options, but also the implied volatility of each.

As with everything in life, there are no guarantees. However this trade harnesses the power of theta decay and capitalizes on one of the basic truths of life: tomorrow there is one less day for all of us - the same can be said for option contracts.

If you would like to continue learning about the hidden potential options trading can provide please join my FREE Newsletter: www.OptionsTradingSignals.com

J.W. Jones is an independent options trader using multiple forms of analysis to guide his option trading strategies. Jones has an extensive background in portfolio analysis and analytics as well as risk analysis. J.W. strives to reach traders that are missing opportunities trading options and commits to writing content which is not only educational, but entertaining as well. Regular readers will develop the knowledge and skills to trade options competently over time. Jones focuses on writing spreads in situations where risk is clearly defined and high potential returns can be realized.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.