G20 Summit, Yet Another Global Cluster F*ck

Stock-Markets / Financial Markets 2010 Nov 12, 2010 - 12:27 PM GMTBy: PhilStockWorld

Why should we be surprised?

Why should we be surprised?

The last G20 meeting ended in chaos, the same nonsense that triggered a flight into commodities in Q3 as Global investors lost faith in ALL of the World leaders to be able to solve ANY of the many problems that face the Global Economy. Why should this time be different as the current conference broke up with NOTHING accomplished other than to promise to get right on these issues at next year's meeting. REALLY? Do we look like a planet that has another 6 months to wait for you to do something???

The delay by the Group of 20 industrial and developing powers in defining the external imbalances they had vowed to address represents a blurring of what at first had appeared to be clear goals designed to counter the growing threat of trade and currency wars, in which countries seek competitive advantage by weakening their currencies. The U.S. and G-20 host South Korea ran into strong opposition from such exporting powers as China and Germany to a proposal to quantify limits on current-account surpluses and deficits. Without cooperation, the IMF warns, not only will the G-20 fail to achieve a much-needed boost to growth, but it could tip the scales on the European sovereign-debt crisis and fuel capital flows into emerging countries that overheats their economies.

China is already overheating, with a 4.4% inflation rate but that's much worse when you consider that Food Inflation was 10.1% in October from the previous year. With average family incomes of less than $2,000 - food is pretty much all these poor people can afford! The other thing people MUST buy in China (because they can do without furniture, manufactured clothing and power) is housing, and that rose 4.9% in the past year despite the BOC's aggressive tightening measures. A lot of this is due to the Yuan's peg to the dollar as Bernanke's mad plan to devalue the Dollar is dropping China's currency as well and that's good for the manufacturers, who benefit from competitive export prices, but bad for their workers, who need to eat.

China is already overheating, with a 4.4% inflation rate but that's much worse when you consider that Food Inflation was 10.1% in October from the previous year. With average family incomes of less than $2,000 - food is pretty much all these poor people can afford! The other thing people MUST buy in China (because they can do without furniture, manufactured clothing and power) is housing, and that rose 4.9% in the past year despite the BOC's aggressive tightening measures. A lot of this is due to the Yuan's peg to the dollar as Bernanke's mad plan to devalue the Dollar is dropping China's currency as well and that's good for the manufacturers, who benefit from competitive export prices, but bad for their workers, who need to eat.

"Dollar issuance by the United States is out of control, leading to an inflation assault on China,"the Chinese commerce minister said in comments reported on Tuesday. Chen Deming, speaking at a trade fair in southern China, said that exporters had done a good job of preparing themselves for exchange rate changes as well as rising labour costs, but were suddenly confronted with new challenges. "Because the United States' issuance of dollars is out of control and international commodity prices are continuing to rise, China is being attacked by imported inflation. The uncertainties of this are causing firms big problems," Chen was quoted as saying by the Xinhua news agency.

Bank of China Chairman Xiao Gang called the Fed's move "dangerous," writing in the semiofficial China Daily newspaper that it had driven the dollar down in value, raised expectations of inflation and hurt other economies. That position was backed by former Federal Reserve Chairman Alan Greenspan, who said the U.S. was "pursuing a policy of currency weakening." U.S. officials declared they were doing no such thing. And, in fact, the U.S. dollar has been rising in value in recent days. "We will never seek to weaken our currency as a tool to gain competitive advantage or to grow the economy," Treasury Secretary Timothy F. Geithner told CNBC from Seoul. "It's not an effective strategy for any country, and it's not for the U.S. We'll never do that." To which the Chinese responded: "Liar, liar, pants on fire - your nose is longer than a telephone wire!" And the Chinese should know, as they make 98% of the World's telephone wires...

Bank of China Chairman Xiao Gang called the Fed's move "dangerous," writing in the semiofficial China Daily newspaper that it had driven the dollar down in value, raised expectations of inflation and hurt other economies. That position was backed by former Federal Reserve Chairman Alan Greenspan, who said the U.S. was "pursuing a policy of currency weakening." U.S. officials declared they were doing no such thing. And, in fact, the U.S. dollar has been rising in value in recent days. "We will never seek to weaken our currency as a tool to gain competitive advantage or to grow the economy," Treasury Secretary Timothy F. Geithner told CNBC from Seoul. "It's not an effective strategy for any country, and it's not for the U.S. We'll never do that." To which the Chinese responded: "Liar, liar, pants on fire - your nose is longer than a telephone wire!" And the Chinese should know, as they make 98% of the World's telephone wires...

Meanwhile, Obama has been called on the carpet for a more private meeting with our two biggest creditors, Japan and China as he attends the Asia-Pacific Economic Cooperation Forum. Angela Merkel, who has been very critical of US policy, was not invited to attend and it's just as well as she has her own major crisis to deal with as Ireland continues to come apart at the seams which is already forcing the EU's usually conservative Jean-Claude Trichet to "pull a Bernanke" as he becomes the buyer of ONLY resort in the EU's bond market as failures in Irish and Portuguese bond auctions threaten to spread to much larger Spain, where the Spanish 10-year bonds are already 229 points above German notes, up 15% this week and near the record 232-point spread, which was reached before the last Eurovention, just 6 months ago.

Spain is 3 times the size of Ireland and Portugal combined. Shoring up the finances of an economy that is 12 percent of the euro region and more than three times Portugal and Ireland combined would strain the 750 billion-euro ($1 trillion) lifeline set up to stop contagion from Greece’s near default in May. “There’s a perception that once you start down the path with one country, the others have to follow, at least the market will interpret it that way,” said Kleinwort's Phyllis Reed. Investors “won’t be able to help themselves, whether it’s right or not,” she said.

Spain is 3 times the size of Ireland and Portugal combined. Shoring up the finances of an economy that is 12 percent of the euro region and more than three times Portugal and Ireland combined would strain the 750 billion-euro ($1 trillion) lifeline set up to stop contagion from Greece’s near default in May. “There’s a perception that once you start down the path with one country, the others have to follow, at least the market will interpret it that way,” said Kleinwort's Phyllis Reed. Investors “won’t be able to help themselves, whether it’s right or not,” she said.

Portugal and Ireland requesting aid from the European Financial Stability Fund won’t stop the spread of the crisis, and the European Central Bank should take pre-emptive action to stem the fallout by buying Spanish bonds in secondary markets, Jacques Cailloux, chief European economist at Royal Bank of Scotland Group Plc in London, wrote in a note to investors. There are “growing signs that the contagion is spreading to the larger economies with Spain lining up next,” he said. “Now is the time to act.” Isn't there a Clash song about Spanish Bonds?

The Irish tomb was drenched in blood.

Spanish bonds shatter the hotels.

My señorita’s rose was nipped in the bud.

Spanish bonds; yo te quiero infinito.

Yo te quiero, oh mi corazón.

Have I mentioned how much I like cash lately? Somebody certainly wants our cash as TBT is rising like a Phoenix from the ashes of $36 this morning but the Dollar has been doing dipsy doodles all morning and has generally been driven down all the way from 78.64 to 78 at 9am and that is good enough to mask a 1.25% drop in the US indices, as well as the collapse of oil, which fell off a cliff last night, ripping trough our $87.50 line and falling all the way to 85.50 before the dollar got pounded into submission and saved it. Gold dropped $30 overnight and copper fell 2.5%.

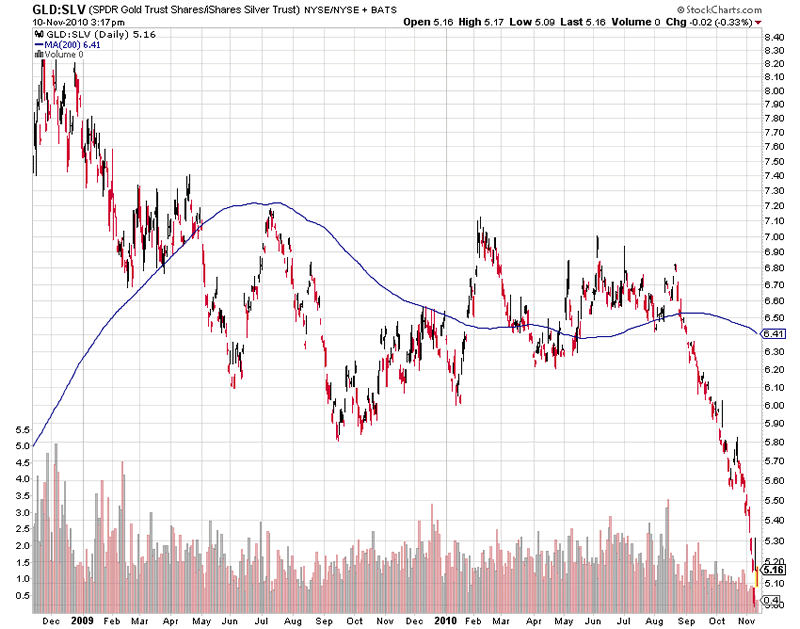

While we are all for gold plays as a hedge (see this weekend's "Spinning Straw Trades Into Gold") and while today is a great day to grab some inflation protection if you haven't already, we also like to make fun of our resident gold bugs in Member Chat as we don't take gold very seriously and neither does Barry Ritholtz, who points out:

Its obvious from the chart (valuing gold in terms of silver) that Gold has no intrinsic value. Forget QE, the Gold Miners are doing QM Quantitative Mining. These irresponsible Miners are “printing gold” by scraping it out of the ground as fast as they can. They are debasing it as a store of value, and are no better than central bankers with their fiat currencies and printing presses."

Last night's drop in commodities and the chaos at the G20 led to a 5% sell-off on the Shanghai composite, which is a lot as limit down is 10% there so 1/2 the stocks could have gone limit down in the session. What's most disturbing is how easily they gave up the 3,000 line - saved only by the closing bell at the 5% rule heading into the weekend. The Hang Seng followed down with a 2% drop and that was 477 points, also finishing at the day's lows and the Nikkei dropped 1.4% as the Yen could not stay below 82.50 to the dollar despite massive BOJ pumping. Even mighty India dropped 2% but, at 20,156, we're a long way from worrying about them. Europe opened way down, off 1% on the FTSE and DAX and off 2% on the CAC but they have bounced back almost a full point as EU Ministers run around making soothing noises for the bond market.

The EU economy slowed sharply with Greece's GDP falling 1.1% in Q3, Spain was flat, Italy up just 0.2% and Portugal up 0.4%. Germany, as usual, held things together with 0.7% growth rate and France was in-line with the EU average of 0.4%. "Entering 2011, momentum is bound to remain moderate with a bias to weaken further, as the export and inventory boost keeps softening, while domestic demand will be dampened by fiscal consolidation," said Marco Valli, an economist at UniCredit. "Financial-market tensions triggered by sovereign-debt concerns remain the main downside risk to our moderate recovery story."

We maintain our cash + bearish bias going into the weekend. I showed you how we play the dips yesterday and the example from the morning post was our very nice DIA $113 call play from Wednesday, which we played off the 11,250 line on the Dow. Yesterday, it was the QQQQ Weekly $52s that caught our attention in Member Chat at 10:06 and we were able to get those at $1 as the Qs bounced off the $53 line and those rose very quickly to $1.25 and topped out at $1.45 - pretty much the same path as the DIAs followed the previous day. Using day-trade covers like this let you ride out longer-term bearish positions, locking in the dips without having to cash out positions you hope will do better.

Our oil puts should be hot, hot, HOT today as we caught a huge break for our USO Nov $37 puts, that were as low at .30 yesterday and should open the day almost on the money. We also took a fun play on TZA Nov $19 calls at $1.10 at 2:52 in Member Chat and we should get a nice pop on those this morning too! Non-greedy exits are the key here - we don't know what is going to happen over the weekend but anyone watching the futures this morning, where the Dow touched 11,100, got a preview of what COULD happen if the dollar bounces back. Meanwhile, here's the best thing I found on YouTube this week, here.

Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2010 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.