Gold Consolidates in Cautious Trade Ahead of the G20 Summit

Commodities / Gold and Silver 2010 Nov 10, 2010 - 12:28 PM GMTBy: GoldCore

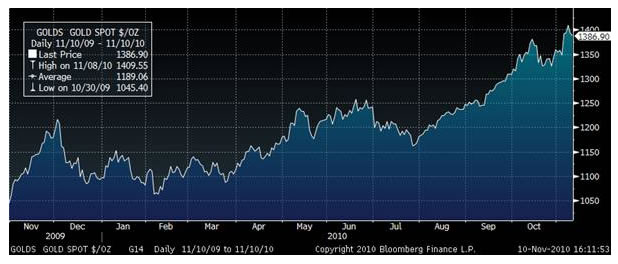

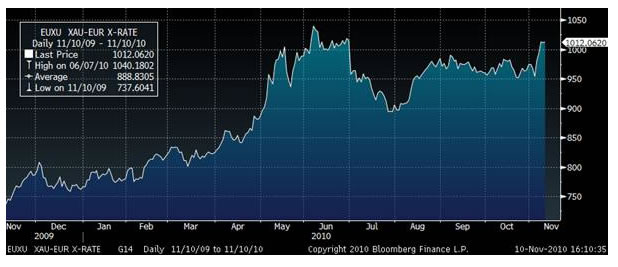

Caution has marked trading in most markets today at the start of the G20 summit in Seoul. Gold is marginally lower in dollar terms but is higher in euro terms due to sovereign debt issues in Ireland and other periphery eurozone states. Gold is also higher in yen which was have fallen sharply today prior to the G20 summit.

Gold is currently trading at $1,397.05/oz, €1,017.66/oz, £869.14/oz.

At the start of the G20 summit meeting, President Obama tried to calm fears of a currency war and other tensions. World Bank President, Robert Zoellick qualified his recent comments regarding a modified gold standard saying that gold's role in the international monetary system needs to be discussed as it is the "yellow elephant in the room" which is being used as an alternative monetary asset because of unease and a lack of confidence in western economic and monetary policies.

Peripheral sovereign risk and the possibility that some eurozone members will need to access the European bailout fund is supporting gold and may have contributed to slight falls in equity markets. The ECB has already resorted to printing euros to buy government bonds of countries such as Ireland. This is debt monetisation which is a form of quantitative easing which is leading to concerns about the euro along with the dollar.

India owns more than 18,000 metric tons of gold worth some $800 billion, the World Gold Council said today. That is equivalent to about half of ounce of gold owned per capita, "significantly below consumption in western markets" . India's gold holdings are at least 11 percent of the global above-ground gold stocks, it said. The savings rate in India is about 30 percent of total income, with 10 percent invested in gold, the council said. As India's economy grows and wealth increases their huge propensity to own gold could lead to even greater demand.

Silver surged yesterday and shorts panicked to close positions. Subsequently silver fell from the highest price in 30 years after CME Group Inc.'s Comex unit raised the margin requirements. This has given the shorts some breathing space but the possibility of a short squeeze leading to much higher prices remains.

Silver

Silver is currently trading at $27.31/oz, €19.90/oz and £16.99/oz.

Platinum Group Metals

Platinum is trading at $1,745.00/oz, palladium is at $710/oz and rhodium is at $2,300/oz.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.