The Effects of ObamaCare, Unintended Consequences of Health Care Reform

Politics / Healthcare Sector Nov 09, 2010 - 04:25 AM GMTBy: John_Mauldin

What will be the effects of ObamaCare? My friend Lisa Cummings, an expert on employee benefits (she was one of the first employees at Dell and was a senior exec at Wal-Mart), has analyzed the bill; and from what she tells me it appears to be one big pile of unintended consequences and costs. It will be far cheaper for an employer to simply pay the $2,000 fine and pay for the employee to enroll in the government health exchange program, which of course puts more cost on the taxpayer. Behind the curtain of wonderful and laudable objectives is a mountain of regulations and costs. But that is what is coming. I asked Lisa to give me a written report on just the more important changes and costs, and that is your Outside the Box reading today.

What will be the effects of ObamaCare? My friend Lisa Cummings, an expert on employee benefits (she was one of the first employees at Dell and was a senior exec at Wal-Mart), has analyzed the bill; and from what she tells me it appears to be one big pile of unintended consequences and costs. It will be far cheaper for an employer to simply pay the $2,000 fine and pay for the employee to enroll in the government health exchange program, which of course puts more cost on the taxpayer. Behind the curtain of wonderful and laudable objectives is a mountain of regulations and costs. But that is what is coming. I asked Lisa to give me a written report on just the more important changes and costs, and that is your Outside the Box reading today.

Lisa Cummings is an expert global benefits consultant with an emphasis on advising Fortune 500 companies of best practices regarding plan design and legal compliance. She is an ERISA attorney by training and has a rich experience with health and retirement plans in the US and around the world. For more information, you may contact her at lcummings@benefitsconnection.co. Many thanks, Lisa, for taking the time out of your busy schedule.

Lisa Cummings is an expert global benefits consultant with an emphasis on advising Fortune 500 companies of best practices regarding plan design and legal compliance. She is an ERISA attorney by training and has a rich experience with health and retirement plans in the US and around the world. For more information, you may contact her at lcummings@benefitsconnection.co. Many thanks, Lisa, for taking the time out of your busy schedule.

Your glad to be back in his own bed analyst,

John Mauldin, Editor

Outside the Box

The Effects of ObamaCare

By Lisa Cummings

It Does What?

Have you ever seen a television commercial touting diet pills, weight loss in a bottle, and bought them, thinking, "The ad seems reasonable, with a nice actor I've seen," and then get the bottle home and read the side effects? Although you were promised a return to the slim, beautiful you, the side effects on the bottle warn of "potential for heart attack, broken bones, upper respiratory infection, edema, loss of balance, and death." Talk about the cure being worse than the condition!

Health-care reform as signed into law is a prime example of the cure prescribed by Dr. Obama being worse than our current condition of rising health-care costs and uninsured Americans.

We all know that health care in America is on course to change significantly with the passage of the Patient Protection and Affordable Care Act ("the Act") on March 23, 2010. Most of you may think of this as "health-care reform," though some refer to it as "ObamaCare."

You may have heard about what ObamaCare was intended to do, but have you heard about the unintended outcomes of this massive restructuring of US health care? As of the date of this writing, over 55% of Americans would like to have ObamaCare repealed,[1] and that's based on what they know about it. Let's also consider the challenges that aren't commonly known.

Intended Outcomes of Health Care Reform: Just What Dr. Obama Ordered

Coverage for all with capped premiums

First, we'll begin with a recap of what the President and Congress intended to enact: ObamaCare's premise is that all Americans should have health insurance and shouldn't have to pay more than a set amount for their coverage. ObamaCare requires that an employee whose "household income" is less than "four times the Federal Poverty Level" (currently $73,240 for a family a four) pays no more 9.5% of his household income for employer-sponsored health insurance coverage. This is like car insurance being required by a state and then limiting the amount the driver has to pay for monthly premiums, basing the cost on an ability to pay.

General provisions of ObamaCare, generally starting in 2014

You can't be turned down for health insurance coverage.

You can cover your children on your health plan up to age 26 (starts in 2011).

If you can't afford health insurance, you will receive assistance from the government to purchase it.

You can purchase health insurance more easily.

Your personal health records will be digitized, resulting in cost savings.

On the surface, these items sound wholesome, kind of like motherhood and apple pie. However, some of the additional items required by ObamaCare include hundreds of requirements for individuals, for businesses, for insurance companies, for health care providers such as doctors and hospitals, and for government entities.

To get a visual idea of the complexity surrounding the new health-care requirements, you can peruse the following chart prepared by the Joint Economic Congressional Committee, which outlines the bureaucratic Frankenstein that is being created. I'm printing the chart in a size that is too small to read here, just to give you the idea. You can download the chart itself by clicking here.

Side Effects of Obamacare: Beware, the cure may be worse than the current condition.

The Health Reform Act and accompanying Reconciliation Act encompass over 1000 pages. Since their passage in March, dozens of additional interim final regulations, guidelines, and memos have been written, and in addition direct conversations from the HHS Secretary have now been made into law.

Here are some of the more audacious requirements of ObamaCare, along with the year they become effective:

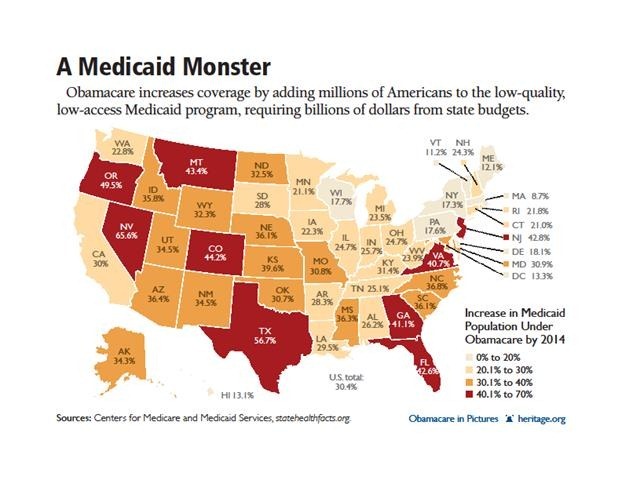

• Moves 18 million people onto Medicaid programs. Remainder of uninsured will go to state health exchanges (2014).[2]

To put ObamaCare in context, keep in mind nearly 60% of Americans receive their health care from their employer. 19% of Americans have no health coverage.

[3]

[3]

Once ObamaCare is in force in 2014, the uninsured will be redistributed: a third will go to Medicaid, 28% will go to Government health exchanges, and the remaining 41% will continue to be uninsured.

[4]

[4]

• Adds new taxation on capital gains, including a new 3.8% tax on the sale of your home (2013)

• Mandates auto-enrollment in long-term care at a cost of $123 per month for everyone (the CLASS Act), requiring an affirmative opt-out if you don't wish to be covered (as soon as HHS can determine how to implement).[5] This section is so outrageous, Sen. Kent Conrad (D-ND), Senate Budget Committee chairman, called it "a Ponzi scheme of the first order, the kind of thing that Bernie Madoff would have been proud of."[6] (Yes, Sen. Conrad voted for ObamaCare and the self-described Ponzi scheme.)

• Adds a medical device tax of 2.9% on everything from CT scanners to surgical scissors, to be passed along to health-care consumers (2013)[7]

• Enhances the Nanny State: restaurant chains will have to post caloric content next to prices on the menu, and nutritional information must be posted on the outside of all vending machines (2011).[8]

• Triggers loss of insurance coverage by large numbers of lower-paid employees, starting in 2011

A large number of "mini-med" plans, typically limited-coverage plans for employer groups in the retail and fast-food industries, and providing child-only coverage, will not be able to meet federal regulations on the minimum annual dollar limit. The minimum annual limit for benefits covered by the health plan is $750,000 in 2011. HHS has so far granted waivers for more than 30 employers, including such diverse employers as McDonalds, Jack in the Box, the United Federation of Teachers Welfare Fund, and a New York teacher's union, to allow coverage to continue for 2011.[9] What about the other 1,000,000 individuals who were previously covered under these plans? Does that mean they will no longer have coverage starting January 1, 2011?

• Subjects college student medical plans to possible elimination since they will not meet the "Medical Loss Ratio" requirements recently approved by the National Association of Insurance Commissioners.[10]

The Pork Included in ObamaCare

The Cornhusker kickback: the federal government picks up Nebraska's Medicaid expansion bill forever.[11] The Louisiana Purchase: Louisiana receives $300 million for increasing Medicare subsidies.[12] $100 million special funding for a hospital in Connecticut[13] Funding of asbestos clean-up in Montana[14] The Gator Aid, by which three counties in south Florida are exempted from Medicare Advantage cuts[15]

Unintended Consequences of Health Care Reform

"We have to pass the bill so that you can find out what is in it." - House Speaker Nancy Pelosi, March 9, 2010

Well, now we know. Here are some of the outcomes of legislation that was passed without having been read:

Employers may decide it is cheaper to drop health care plans altogether and instead pay the $2,000 penalty per employee. Large employers typically pay in excess of $9800 per employee for health plan coverage today.[16] After the new requirements for health-care reform are added to the already large costs, they may decide to split the cost savings with the employee and reinvest the difference in their businesses, whether in the US or in other countries where perhaps a higher return on investment can be achieved. Employers may decide to limit the number of full-time employees, favoring part-time employees instead. Employer penalties only apply to full-time employees working more than 30 hours a week. Would you try to move employees to less than 30 hours a week to save taxes?

Remember, employers today provide 59% of all Americans with their health insurance. The Congressional Budget Office estimates that today over 150 million Americans have their health insurance with their private employer. If employers decide to get out of the health insurance game, then the majority of Americans will have to look to the government health exchanges to purchase their health insurance.

When 2014 arrives, every employer with a health-care plan will need to make the same calculation: Determine the per-employee cost implications of providing a health-care plan and compare them to the benefit of dropping the plan, paying the penalty, and reimbursing the employee for his employee-mandate fee. The employer might also decide to share the cost savings with the employee to help reimburse the employee for his premium cost to purchase government-exchange health insurance.

Aside from the hard-dollar cost savings, the employer will also need to analyze whether providing a health-care plan can help the employer attract and retain highly prized employees. The logical conclusion is that employers who hire positions in great demand will be more likely to keep employer health-care plans, while employers who hire less unique skills will more likely terminate their health-care plans, pay the penalties, and redeploy the savings where there is a higher return on investment.

Healthy people will pay more for insurance coverage. Instead of individuals being able to choose the coverage they need, they will be required to purchase only government-approved benefit choices. Younger individuals will be required to subsidize older individuals, who will be required to have preventive-care screenings, with an expected increase of 17% in premiums, or up to $500.[17]

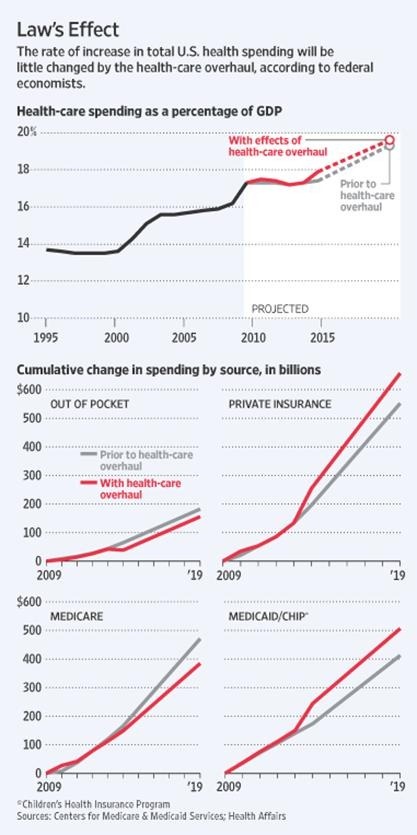

Health-care cost curve bends in the wrong direction by increasing overall health spending by $222 billion between now and 2019.

[18]

[18]

Neglects Medicare funding, which is already due to become insolvent in 2016

Retirees in Medicare Advantage plans may lose their coverage due to decreased government funding. Starting in 2011, the government reimbursement will be frozen at 2010 levels.

Health providers will be reimbursed less for Medicare patients, causing providers to reduce the number of Medicare patients they treat. This is an outcome of the reconciliation act that followed the passage of ObamaCare, migrating funding away from Medicare providers to pay for part of the ObamaCare provisions.

Consolidation of health markets: from small community hospitals, to doctors, regional hospitals, and insurance companies[19]. The consolidation of health-care providers will lead to increased costs for hospitals and doctors, simply because there is a reduced supply of providers.

If uninsured individuals choose to pay the tax instead of signing up for insurance through a government exchange, the government-exchange premiums will become so expensive, individuals won't be able to afford to buy insurance. Just look at the outcome of the Massachusetts mandated health-care coverage for an idea of how this will turn out.

Child-only policies will stop being issued due to the required annual benefit levels being increased along with the new requirements that at least 85% of all insurance premiums be used on health-care providers. This means that higher-cost child-only coverage plans will fail to meet the limits and must be discontinued. This will cause the children to lose their own cheap coverage and instead either have to move to their parents' employer plans or access care through the government exchanges.

Employer-sponsored retiree medical plans may be dropped due to repeal of the Medicare part D pharmacy subsidy. Although the subsidy isn't cancelled until 2013, the SEC requires accounting recognition of any changes as soon as they are known. This provision is what triggered the earnings impact announcements by Caterpillar, Deere, and AT&T within a week of ObamaCare being signed into law. Over 43% of employers with retiree plans indicated they would likely eliminate retiree medical programs due to the additional requirements under ObamaCare.[20]

Employers' Decision to Keep or End Retiree Medical Plans

It isn't going to be easy or cheap to be ObamaCare-compliant.

All of us will be affected in numerous ways by ObamaCare. Below is a listing of major groups that will be impacted. Overall Economy[21]

Some 670,000 jobs could be eliminated due to the additional $760 billion in taxes, penalties, and fees on investors and businesses.

The federal deficit will be increased up to an additional $115 billion over original projections.[22]

By 2020, ObamaCare will:

Increase the interest on the national debt by $23.1 billion per year

Raise the national debt by more than $753 billion

Increase annual budget deficits by an average of $75 billion.[23]

Employers

Short-term: Costs are increasing for employer-sponsored plans. Health-care premiums for 2011 are being increased by an average of 8.8%, and a 1-2% increase is due to the mandated 2011 changes of covering all dependents to age 26 and eliminating certain lifetime and annual limits.[24]

Starting in 2014: Employers who provide health-care plans for their employees will be required to ensure that the level of health-care benefits they provide their employees meet new government standards or face fines and penalties equal to $2,000 per year for each full-time employee. Even then, if their employees would have to pay more than 9.5% of their adjusted gross income for the health plan, or if the employee chooses to purchase from a government exchange, the employer will still have to pay a $2,000 penalty.[25]

Employers who provide health coverage will be required to provide an annual report to HHS that lists each individual eligible to enroll in "minimum essential coverage," the length of waiting period, number of months that coverage was available, monthly premium for lowest-cost option, plan's share of covered health-care expenses, number of full-time employees, number of months covered, and any other requirements that may be identified by HHS.[26]

If an employer doesn't provide a health-care plan for employees and has more than 50 full-time employees (who work more than 30 hours per week), the employer must pay a penalty equal to $2,000 per full-time employee per year. [27]

Individuals

Starting in 2014 you are required to have coverage, either from your employer or from a government-sponsored health-care exchange. If you don't purchase it, the IRS will assess you with tax of $695 per year per family member (capped at three) or 2.5% of your income, whichever is greater.[28]

Doctors[29]

With the increase of covered patients, there will be a shortage of 150,000 doctors.[30] Doctors are already overworked. Patients will have to wait longer to can get an appointment to see the doctor.

Starting in 2011, Medicare reimbursements will be reduced. Medicare already reimburses doctors at an amount equal to only 81% of private payments.

Between 18 to 20 million new Medicaid patients will flow to doctors. Medicaid coverage pays doctors 56% of the private payment amounts. Federal funding will pay for parity to Medicare for 2013 and 2014, and then it is up to the states to figure out how to pay the Medicaid doctors.

Doctors will face more federal agencies, boards, and commissions, including the Independent Payment Advisory Board in 2012, a nonprofit Outcomes Research Institute, and the Physician Quality Reporting Initiative.

59% of doctors think the quality of medicine will decline in the next five years and 79% are less optimistic about the future of medicine. 69% are thinking about dropping out of government health programs, 53% would consider opting out of treating insurance-covered patients, and 45% have considered leaving the profession altogether. [31]

States[32]

ObamaCare mandates the increase of Medicaid participation by 18-20 million more people, but provides states with limited support funding.

States are required to establish exchanges by 2013, and if they decline to establish exchanges, the Secretary of HHS runs the exchanges. Here's a question for you: if HHS runs a state's exchange, for whom do the state insurance commissioners work, the people who elected them or the federal government?

The states will first have to figure out how much money is required to pay for this - and guess what, it won't be cheap. Texas' Medicaid costs would increase by $4.5 Billion for 2014-2019 alone.[33]

These new state mandates explain why over 21 states have filed suit in federal court to declare parts of ObamaCare unconstitutional, as infringing on the Tenth Amendment rights afforded to states.[34]

[35]

[35]

Retirees[36]

Medicare Advantage plans, which cover nearly 25% of Medicare seniors, will be cut in half over the next ten years due to ObamaCare freezing payment to the plans.

Some $416.5 billion in "savings" from Medicare (actually, cuts in Medicare payments to doctors and hospitals) is being shifted from shoring up Medicare funding to paying for ObamaCare.[37]

The donut hole in Medicare Part D is being reduced with a $250 payment in 2010 and drug companies being required to provide a 50% discount on brand-name prescriptions filled in the hole.

The Medicare program will be adding 77 million baby boomers starting in 2011. Finding a doctor will become even more difficult with the already existing doctor shortage and another 18-20 million individuals receiving Medicaid coverage in 2014.

Medicare Part A providers - hospitals • will receive reduced funding. By 2020 15% are slated to become unprofitable, according to the Center for Medicare and Medicaid Services Actuary.

Seniors will pay higher taxes as well.

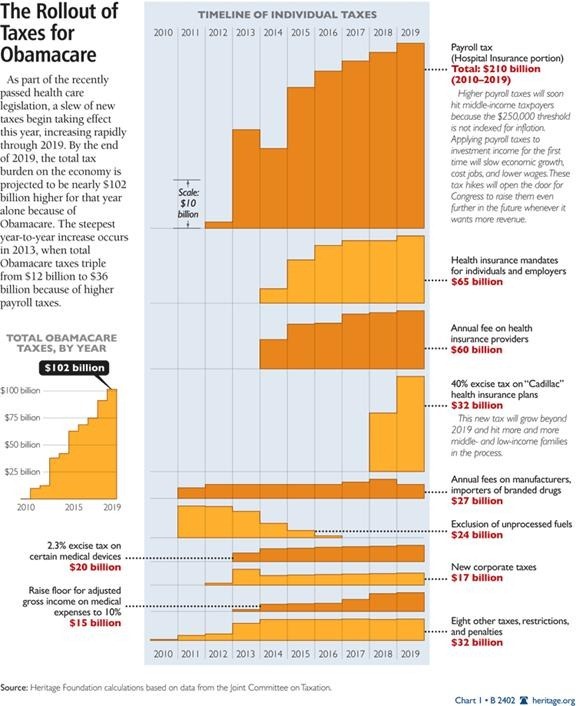

Taxpayers[38]

Three major tax increases:

• New 40% excise tax on health insurance plans, known as the "Cadillac Tax" if a health plan is valued in excess of $10,200 for employee-only coverage [Can someone show me where the hell I can get a policy for less than $10,200?? Seriously. - JM] and $27,500 for family coverage. 43% of all plans are expected to incur this tax by 2018, when it becomes effective.[39]

• Increase in hospital insurance portion of payroll tax: Medicare tax will be increased from 1.45% to 2.35% for families making more than $250,000. The new rate will be 3.8%, effective in 2013. Note: the health insurance rate increase is not being used to fund Social Security and Medicare, but rather a separate entitlement.[40]

• Payroll taxes on investment. A new 3.8% health insurance tax applies to investment income, including capital gains, dividends, rents, royalties, and yes, even the sale of your home.[41]

Numerous additional taxes:[42] • Limit on itemized deductions for health care • Increased taxes on prescription drugs • Increased medical device taxes • Additional taxes on insurers

[43]

[43]

What's Next?

Regulatory interpretations are piling up, along with regulatory burdens. Since ObamaCare and the Reconciliation Act were signed into law in March, there have been no fewer than twelve sets of additional regulations, guidelines, or notices that have been issued to lend clarification and at the same time add additional regulatory requirements. ObamaCare establishes more than 159 boards, panels, and programs, all of which will add to bureaucratic red tape.

Employers face immediate plan changes that must be implemented for the upcoming plan year. All plans (except retiree-only plans) have to allow children of covered employees to be added up to age 26. Additionally, the lifetime maximum benefit levels have to be eliminated. These costs alone will add 1-2% to 2011 health-care costs for employers.[44]

Longer-term, employers will need to consider whether they will cancel health-care plans in 2014, when exchanges become effective. Also, employers will need to determine whether they will eliminate retiree medical coverage due to elimination of the pharmacy subsidy in 2013.

[1] Rasmussen Poll, October 11, 2010

[2] Heritage Foundation, May 11, 2010,Webmemo #2895, Impact on Doctors

[3] Employee Benefits Research Institute No. 347, Sources of Health Insurance and Characteristics of the Uninsured, September 2010.

[4] http://www.heritage.org/research/projects/obamacare/obamacare-in-pictures

[5] Section sec. 8002(a)(1) of P.L. 11-148; Letter from Douglas Elmendorf, director, Congressional Budget Office, to House speaker Nancy Pelosi, March 20, 2010.

[6] Lori Montgomery, "Proposed Long-Term Insurance Program Raises Questions," Washington Post, October 27, 2009.

[7] Section 9009 of P.L. 111-148

[8] Section 4205(b) of P.L. 111-148

[9] http://www.hhs.gov/ociio/ regulations/patient/appapps.html.

[10] NAIC.org, October 21, 2010, "Regulation for Medical Loss Ratio per Section 2718(b)

[11] Section 10201(C)(3) of P.L. 111-148

[12] Section 2006 of P.L. 111-148

[13] Section 10502 of P.L. 111-148

[14] Section 10323 of P.L. 111-148

[15] Section 3201(c)(3)(B) of P.L. 111-148, as amended in P.L. 111-152

[16] Aon Hewitt, September 27, 2010

[17] Carla Johnson, "Health Premiums Could Rise 17 Percent for Young Adults," Associated Press, March 29, 2010.

[18] National Health Spending Projections: The Estimated Impact Of Reform Through 2019; Sisko et al. Health Affairs.2010; 29: 1933-1941

[19] Wall Street Journal, October 26, 2010, "Big Insurance, Big Medicine.

[20] Towers Watson Flash Survey, http://towerswatson.com/health-care-reform

[21] Heritage Foundation, September 22, 2010, Webmemo #3022, Impact on the Econ

[22] Ibid.

[23] HIS/Global Insights macroeconomic model, using HeritageFoundation.org assumptions

[24] Aon Hewitt "Rate of Increase Rises Significantly as Companies Struggle to Keep up with Rapidly Evolving Health Care Landscape" September 27, 2010

[25] Section 1513(a) as amended by Section 10106 (e-g) of P.L. 111-148 and Section 1003 of P.L. 111-152

[26] Section 1514 of P.L. 111-148

[27] Section 1513(a) as amended by Section 10106 (e-g) of P.L. 111-148 and Section 1003 of P.L. 111-152

[28] Section 1501(b) as amended by Section 10106(b) of P.L. 111-148 and by Section 1002 of P.L. 111-152

[29] Heritage Foundation, May 11, 2010,Webmemo #2895, Impact on Doctors

[30] Susan Sataline and Shirley Wang, "Medical Schools Can't Keep Up," Wall Street Journal, April 12, 2010.

[31] Terry Jones, Investors Business Daily, September 15, 2010

[32] Heritage Foundation, May 3, 2010, #2408, Impact on States

[33] Cato Institute, Michael Tanner, Bad Medicine, Page 8 and Table 1

[34] Heritage Foundation, June 21, 2010, #2424, Ongoing ObamaCare Concerns

[35] http://www.heritage.org/research/projects/obamacare/obamacare-in-pictures

[36] Heritage Foundation, May 20, 2010, #3022, Impact on Seniors

[37] Letter from Douglas Elmendorf, Director, Congressional Budget Office, to House speaker Nancy Pelosi, March 20, 2010.

[38] Heritage Foundation, April 14, 2010, #2402, Impact on Taxpayers

[39] "Cadillac Health Plan Tax to Penalize Majority of Employers by 2018," Towers Watson, press release, May 19, 2010.

[40] Section 9015, of P.L. 111-148

[41] Section 1411, of P.L. 111-152

[42] Cato Institute, Michael Tanner, Bad Medicine, Page 21

[43] Ibid.

[44] Aon Hewitt, September 27, 2010

John F. Mauldin

johnmauldin@investorsinsight.com

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2010 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.