World Bank Chief Calls For Return to Modified Gold Standard

Commodities / Gold and Silver 2010 Nov 08, 2010 - 07:32 AM GMTBy: GoldCore

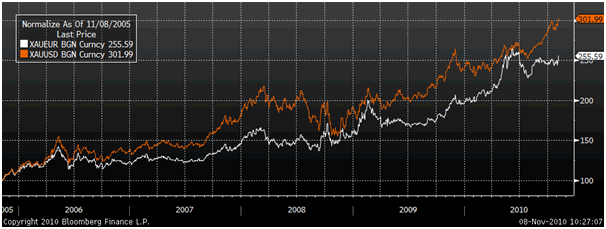

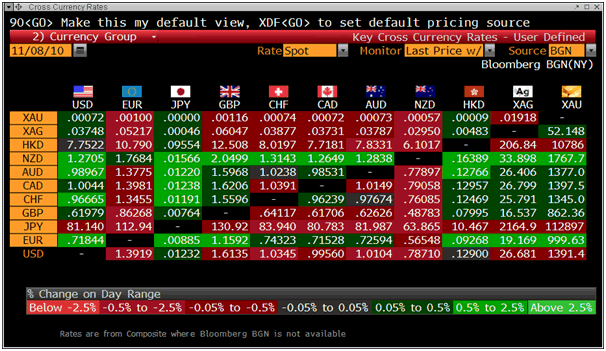

This morning, gold hit a new record nominal high in dollar terms at $1,398 an ounce and gold in euro terms surged to reach €1,000. A subsequent bounce in the dollar and profit taking saw gold fall from the record nominal high in dollar terms but it remains near €1,000/oz. There is increasing concern about Ireland and other periphery EU nations' worsening fiscal and economic situations and possible ramifications for the European Monetary Union and the euro. Silver has risen to over €19/oz (see Cross Currency Table below).

This morning, gold hit a new record nominal high in dollar terms at $1,398 an ounce and gold in euro terms surged to reach €1,000. A subsequent bounce in the dollar and profit taking saw gold fall from the record nominal high in dollar terms but it remains near €1,000/oz. There is increasing concern about Ireland and other periphery EU nations' worsening fiscal and economic situations and possible ramifications for the European Monetary Union and the euro. Silver has risen to over €19/oz (see Cross Currency Table below).

Gold is currently trading at $1391/oz, €999.85/oz, £862.84/oz.

Gold's safe haven credentials have been increased by World Bank president Robert Zoellick's suggestion that leading economies should consider readopting a modified global gold standard to guide currency movements. G20 economies should consider using gold as a reference point for market expectations of currency values, inflation and deflation as they reform the global monetary system, Zoellick wrote in an opinion article in the Financial Times. While textbooks may view gold as "old money," markets use it as an alternative monetary asset, Zoellick wrote. His comments come after the Federal Reserve's announced plans to buy $600 billion in Treasurys which has led to concerns about the dollar and the emergence of inflation and possibly stagflation.

Leaders from the G-20 gather in Seoul, South Korea, on Nov. 11-12 and tensions over currency wars look set to dominate. Beijing has again criticized US monetary policy and QE2 with Zhu Guangyao, the Chinese vice minister of finance, saying at a briefing on Monday "that the US as a major reserve currency issuer, launching a second round of quantitative easing at this time" ... "did not recognise its responsibility to stabilise global markets and did not think about the impact of excessive liquidity on emerging markets."

China's increasing importance to the gold market is also being seen in gold demand from China which remains robust and continues to rise. Many Chinese people, like their government, are concerned about growing inflation and are buying gold as a hedge.

Silver

Silver rose sharply to almost $27/oz at $26.9938/oz, the highest price since March 1980. Silver remains some 46% below its nominal record price of $50.35/oz reached in 1980. An ounce of gold now buys 51.7821 ounces of silver in the spot market, the smallest amount since August 2008, before the collapse of Lehman Brothers Holdings Inc. However the gold/silver ratio remains well above the long term historical average of gold to silver which is 15 to 1. Reversion to the mean is likely to continue in the long term. While silver is overvalued in the short term, it may remain overvalued as it did in the 1970s. Investors would be advised to gradually scale into a long positions rather than attempting to time the market - by waiting for a pullback which may not materialise until silver is at higher levels.

Silver is currently trading at $26.68/oz, €19.17/oz and £16.54/oz.

Platinum Group Metals

Platinum is trading at $1,753.50/oz, palladium is at $685.50/oz and rhodium is at $2,175/oz.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.