How the Government Lies About Low CPI Inflation, Krugman Deflation Propaganda

Economics / Inflation Nov 08, 2010 - 06:13 AM GMTBy: Submissions

Robert Wenzel writes: With commodity prices soaring, Paul Krugman is in a trap with his deflation call, so he has decided to turn to Richard "I am not a crook" Nixon to explain why price inflation is really not happening.

Robert Wenzel writes: With commodity prices soaring, Paul Krugman is in a trap with his deflation call, so he has decided to turn to Richard "I am not a crook" Nixon to explain why price inflation is really not happening.

Krugman tells us to forget about the prices that are going up. They are too volatile, he tells us. He says that what we should focus on are tricky sticky price indexes, specifically, core CPI.

The problem with this is that core CPI was designed at the request of Tricky Dick Nixon to hide real inflation. Here's the story of what went down:

Kevin Phillips, a political and economic commentator for more than three decades and onetime Nixon strategist, reports that President Richard Nixon asked his Federal Reserve chairman, Arthur Burns, to concoct a new inflation number that would be split off from traditional headline CPI, dubbed “core” inflation—and thus make inflation look less threatening.

Writes Phillips:

Richard Nixon, besides continuing the unified budget, developed his own taste for statistical improvement. He proposed albeit unsuccessfully—that the Labor Department, which prepared both seasonally adjusted and non-adjusted unemployment numbers, should just publish whichever number was lower. In a more consequential move, he asked his second Federal Reserve chairman, Arthur Burns,to develop what became an ultimately famous division between "core" inflation and headline inflation. It the Consumer Price Index was calculated by tracking a bundle of prices, so-called core inflation would simply exclude, because of "volatility," categories that happened to he troublesome: at that time, food and energy. Core inflation could he spotlighted when the headline number was embarrassing, as it was in 1973 and 1974. (The economic commentator Barry Ritholtz has joked that core inflation is better called "inflation ex-inflation"—i.e., inflation after the inflation has been excluded.)Phillips says in the 1990s, the CPI was subjected to three other adjustments, all delivering a downward bias and all dubious:

*Product substitution: If flank steak gets too expensive, people are assumed to shift to hamburger, but nobody is assumed to move up to filet mignon, he says;

*Geometric weighting: Goods and services in which costs are rising most rapidly get a lower weighting for a presumed reduction in consumption

*And, most strangely, hedonic adjustment: An unusual bit of monkeyshines by which the government says that product improvements in things like computers, cell phones or television actually amount to a reduction in price, so a $2000 laptop with a built in camera is less expensive than a $1500 laptop without one.This is the index that Krugman has decided to base his deflation case on. Yes, deflation! Even though the manipulated core index is up! I an not making this up. Here's Krugman:

There’s really nothing here to shake my view that deflation, not inflation, is the threat.

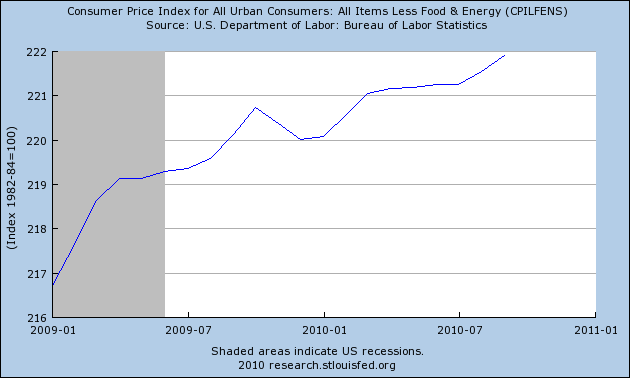

Here's the core CPI starting Jan 2009:

Using this sleazy core index, Krugman then divides the PPI by it. Which proves that Krugman once again doesn't understand the business cycle, since coming out of a recession, it will be capital goods prices and raw materials prices that climb first. Thus, he is trying to prove his deflation case by showing what any decent business cycle theorist would understand to be the way you would expect prices to move before you get inflation at the consumer level.

The key is really not to watch these mumbo jumbo equations designed by Tricky Paul with the help of Tricky Dick, but to keep an eye on money supply growth, in relation to productivity growth and the consumer desire to hold cash. If money growth is sufficient, it will cancel out any downward price pressures from productivity gains. As for the consumer desire to hold cash, we have been through a wretching financial crisis and business cycle down turn. The desire to hold cash has skyrocketed, it's not going to climb from here.

With Ben Bernanke launching the massive QE2, money supply growth will overpower downward price pressure from any productivity gains, but more important, the desire to hold cash is so high that it is unlikely to climb higher. Thus, the new QE2 money will, indeed, start working on pushing prices at the consumer level higher--there will be no further desire to hold cash to absorb the money. Thus, the coming consumer price inflation will be massive.

One other point, and Krugman is correct on this. There is additional demand for commodities from emerging markets, such as China, But this additional demand will do nothing but push prices even higher, than they are already are.

In short, Krugman has made a lot of dumb arguments, but his argument today may very well prove to be his dumbest, most inaccurate, embarrassing argument he has ever written. In time, I expect economists will be using it as an example of total confusion. It is likely to surpass the embarrassing calls of Irving Fisher, who said just weeks before the crash, "Stocks have reached what looks like a permanently high plateau," and the call of New York Fed economists McCarthy and Peach who wrote an entire paper in 2004 explaining why the housing market was not in a bubble.

Yes, write this down. In November 2010, when we are on the edge of huge price inflation at the consumer level, Krugman fears deflation.Source : http://www.economicpolicyjournal.com/...

Robert Wenzel

Editor & Publisherhttp://www.economicpolicyjournal.com

© 2010 Copyright Economic Policy Journal- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.