Fed Fights to Hold Up Stocks into Election, The Accelerating Inflation Mega-Trend

News_Letter / Financial Markets 2010 Nov 08, 2010 - 12:35 AM GMTBy: NewsLetter

The Market Oracle Newsletter

The Market Oracle Newsletter

Oct 31st, 2010 Issue #58 Vol. 4

Fed Fights to Hold Up Stocks into Election, The Accelerating Inflation Mega-TrendInflation Mega-Trend Ebook Direct Download Link (PDF 3.2m/b) Dear Reader The stock market is holding up well into the U.S. mid-term elections, clearly the Fed is fighting to support stocks against a due technical correction from overbought levels after the strong bull run of the past 2 months. Market manipulation is nothing new, it has been around since the birth of the stock markets and their insurance precursors, current market manipulations have their roots in the 1987 crash when the Fed stepped in to Push the Dow UP from another pre-open 250 point crash (15%) (1987 Crash Trading). The U.S. Economy put in an annualised 2% GDP growth rate for Q3, which continues to confound a string of academic economists and the BlogosFear that have been patiently waiting all year for the double dip recession to make an appearance. My analysis conclusions remain unchanged dating back a year that there will be no double dip recession, in fact the UK economy continues to deliver a boom for 2010 by being on target to achieve the forecast growth rate of 2.8% (Inflation Mega-trend Ebook - Free Download) QE2 is all a buzz right across the media-sphere, as the Fed is expected to print money to inflate the U.S. Economy by means of monetizing government debt , and thereby driving asset prices such as stocks higher. Though this is nothing new, as the print money to inflate asset prices mechanism has been in place and implemented both overtly and covertly since March 2009 (15 Mar 2009 - Stealth Bull Market Follows Stocks Bear Market Bottom at Dow 6,470 ). Whether QE2 works or does not work, does not matter, what matters is as I have pointed out several times over the past year that once QE starts it does not stop whilst large government budget deficits exist, therefore we are looking at a decade of QE in the U.S. and much of the rest of the world. That is a decade of real-terms inflation expectations that is waiting to be priced into the asset markets! My last in depth analysis concluded in the following trend expectation for the stock market into January 2011 (18 Oct 2010 - Stocks Stealth Bull Market Dow Trend Forecast into Jan 2011 )

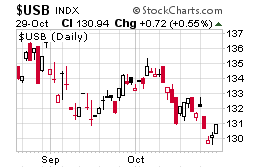

U.S. Treasury Bonds Double Top? My August analysis proved quite timely in concluding that US Treasury Bond Market Bubble top was imminent and a severe downtrend was expected for the next 9 months that would take USB$ all the way down to between $120-$115 as illustrated by the original graph below (26 Aug 2010 - Deflation Delusion Continues as Economies Trend Towards High Inflation)

Robert Prechter has produced a new 10 page report on the a developing disaster for Bond market Investors that is being made available for FREE (Download Here). Gold

Deflationists Continue to Exist in a Parallel Universe where Up is Down Deflationists continue to cling on to a busted flush that has little basis in fact and fly's in the face of commonsense. They fail to see the manifestation of the inflation mega-trend right across the world as illustrated by Chinese workers demanding pay hikes of 50% per annum in response to soaring food prices, if those are not a manifestation of the inflationary wage price spiral than what is ? Eventually these costs MUST appear in manufactured goods, especially as the U.S. Fed policy is to flood the world with dollars so as to INFLATE THE WHOLE WORLD! In the face of which countries such as China are mere rabbits caught in the Fed headlights, frozen by fear into trying to maintain their pegs to a U.S. Dollar which is in an inflationary free fall, as I covered at length 2 weeks ago (18 Oct 2010 - Stocks Stealth Bull Market Dow Trend Forecast into Jan 2011) Deflationists are even subverting the rise in the gold price to imply deflation, though if gold had fallen then that too would be manifestation of deflation (which it would be), whether prices are rising or falling its apparently always deflation, in reality the inflation or deflation equation is very simple: When prices are rising in the domestic currency, be they consumer, or asset or commodity, then they are INFLATING. When prices are falling in the domestic currency, be they consumer, or asset or commodity, then they are DEFLATING. The Gold price rising to nearly touch U.S. $1400 is NOT a manifestation of Deflation, it is an inflation warning bell ringing loud and clear. Deflationists state that when inflation was high in the past Gold did not rise i.e. 1980 to 2000. However the flaw here is that deflationists are always looking in the rear view at what happened in the past to imply the same will happen again as if things are so simple! Which is why deflationists constantly bring up changing charts from the 1930's to imply deflation and a return of the stocks bear market, but since this bear market refuses to manifest itself then they keep changing the chart year used. Similarly deflationists are ignoring the fact that virtually all commodities are soaring in price, one only needs to look at the agricultural commodities to see evidence for this. The general measure of inflation OR deflation in an economy as a whole is as measured by the consumer price index. What deflationists fail to comprehend is that the the REST of the ECONOMY is LEVERAGED to CPI, i.e. wage increases take CPI into account, and all financial markets react to the CPI right form the dollar downwards. The reason for this apparent leverage to CPI as also concluded by many others a long while ago is because the real inflation rate is far higher than official inflation statistics (CPI) state it to be, for instance Mr Shadowstats states that U.S. inflation is at 8% not 1.1%. Whilst in the UK the more recognised inflation measure RPI is at 4.6% against CPI of 3.1%, with real inflation at above 6%.

The reason why real inflation is significantly higher than official statistics is because successive governments have manipulated their statistics right across the globe so as to steadily increase the inflation stealth tax which forces people to work harder (greater productivity) for less pay in real terms, which the government uses to squander on the expansion of the size and scope of government, which is why regardless of what the politicians state in opposition, Left or Right, when they get into power all they are interested in is how to steal even more wealth to spend on usually worthless projects such as the Iraq war and ever expanding paper pushing bureaucracies. This trend for hiding real inflation continues to this very day, with the latest trick is to have hoodwinked the mainstream press into focusing on 'core CPI' i.e. to exclude food and energy prices as these have risen sharply, and therefore imply inflation is lower than where it actually is, even against phony CPI. Off course 'core CPI' will be lower because soaring food and energy prices mean people after warming and feeding themselves do not have much money left over to go shopping for luxuries such as new flat screen tv's! The UK government is in the process of accelerating the stealth inflation theft by forcing the UK to fully switch to using the consistently lower CPI inflation measure, which equates to an across the board theft of at least £20 billion per year, which has huge long-term implications for worker wages and pensions i.e. at least a 30% extra loss in purchasing power over 20 years as against RPI indexation, which means workers will increasingly be forced to work even harder just to stand still as real inflation eats away at the value of their earnings as governments use the low official inflation indices to politically mask the fact that they have bankrupted the country through unsustainable debt mountains and liabilities that they are seeking to default on by means of real (hidden) inflation, but the placid population does not appear to comprehend this blatant theft of their wealth and purchasing power of wages, why ? It is apparent from the observed writings of prominent deflationists that they ONLY tend to recognise the official inflation indices if monthly CPI is negative, otherwise they ignore it as they play pick and mix economics, and they definitely avoid sites such as Mr Shadowstats. Where the USA is concerned this is the Inflation trend for the past decade -

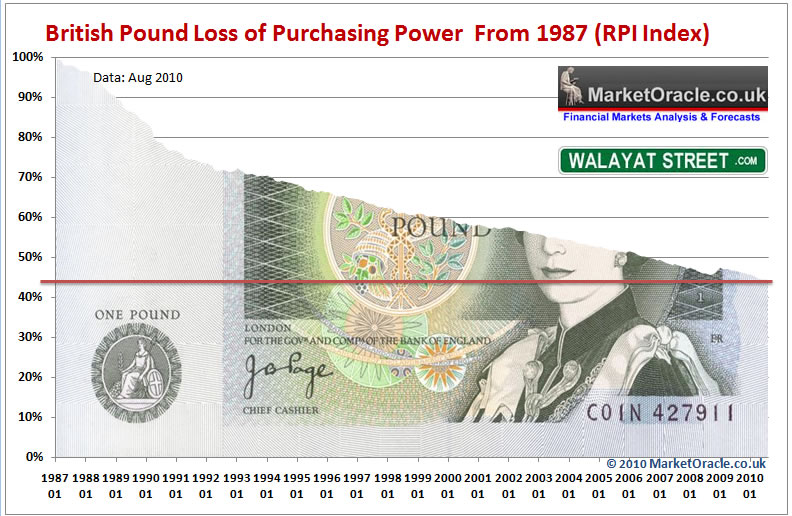

Where the UK is concerned this is the Inflation trend for the past decade -

The deflation of 2008-2009 as originally anticipated is turning out to be a mere blip along the long-term inflation mega-trend, instead deflationists are stuck in a time warp mindset that can only be concluded as being delusional. Worst still, some prominent deflationists have been rabbiting on about non existant deflation for over a decade by playing pick and mix as to what they choose to represent deflation. Back in November 2009, I started to warn that debt deleveraging deflation was a red herring (18 Nov 2009 - Deflationists Are WRONG, Prepare for the INFLATION Mega-Trend ), that debt would be defaulted on by means of Inflation rather than outright default, and that the delusional deflationists would eventually be forced to suffer amnesia and magically reinvent themselves into having been Inflationists all along. This trend is manifesting itself in stages where notably a shift in language has been taking place that now imply's that deflation and Inflation are the SAME Thing, or that there is no chance of hyperinflation, when hyperinflation was never on the table in the first place! The debate was supposed to have been between deflation vs inflation as the consequences for asset prices, wages and savings is immense on which outcome transpires, however now some prominent deflationists imply the debate has being low inflation against hyperinflation in an attempt to mask the fact that they do not have a clue. Yes, it would be great if investments and trading positions could be ABS (entry price - exit / current price) so that in a delusional sense inflation or deflation does not matter, unfortunately that is not how the real world works .... The facts are there is no deflation, neither is there a double dip recession (because official inflation statistics are bogus so nominal GDP will rise) which is another delusion that continues to this very day, and then there is the stocks bear market who's end has always been imminent for the past 19 months! The inflation mega-trend will continue for many years regardless of how much delusional deflationists pray for debt default deflation to manifest itself which is blind to the fact that the Fed has shown that it will print money (QE) to monetize ALL debt and INFLATE THE WHOLE WORLD, which means INFLATION NOT DEFLATION. Debt default that deflationists have been patiently waiting for is in fact taking place by means of high real INFLATION. The U.S. Treasury will not officially default on its debt, instead it will continue to stealth default by means of inflation, just as it has been doing for the past 100 years. At the end of the day the only thing that counts is converting price movements (trends) into monetary gains either banked or unrealised, everything else is just hot air, in this respect if deflationists had followed the sum of their own advice then they would have bankrupted themselves several times over as one cannot play pick and mix with portfolio's in hindsight! Protect Your Wealth from the ACCELERATING Inflation Mega-Trend Forget the ramblings of deflationists who never saw the inflation of 2010 coming, who instead postulate why inflation will always imminently turn negative. Instead, 2011 looks set to see yet higher inflation than 2010, and it WILL also come to the U.S. with a vengeance because the same deflation garbage that your hearing today in the U.S. is what we were hearing in the UK nearly a year ago. All you can do is to try and protect your wealth, so if you have not already started to do so, then The Inflation Megatrend ebook (FREE DOWNLOAD) contains over 50 pages of inflation wealth protection strategies - All of which are just as valid today because the global Inflation mega-trend is ACCELERATING, whilst at the same time governments such as the UK are making it harder to protect ones wealth such as withdrawal of RPI Index Linked Savings Certificates in June 2010 that effectively paid 6% tax free, with signs that Indexation of future Inflation proof Gilts being switched from RPI to CPI because CPI tends to be 1% to 3% below RPI. Euro and European Union Collapse Akin to deflation mantra has been equally delusional expectations for a collapse of the Euro currency block throughout the summer of 2010, which was most vocal just as the Euro bottomed. What these commentators continue to fail to realise is that the primary purpose for the creation of the European Union and the continuing trend towards integration is not financial or economic, the primary purpose for the creation of the European Union is to prevent Germany from starting world war 3, in this respect countries such as Britain, France and Germany pay an annual premium to ensure that such a condition never exists where war coming out of Germany would first consume the European continent and then much of the rest of the world amidst nuclear armageddon. In that respect £6 billion of annual contribution by the UK to the EU budget is a small price to pay. So no, the European Union will not collapse no matter how bad its economy becomes, the Euro will not collapse no matter how strained the pressures are within its borders. Even relatively mild talks of reform of the euro-zone to split into 2 currencies so as to allow competitive devaluations within the euro zone is not even being entertained. Instead the European governments are clearly willing to throw unlimited amounts of freshly printed Euros' (electronic) at whatever internal economic problem arises such as the bailout of Greece. A sample of the summers Euro collapse commentary - Euro Will Collapse Like Tower of Babel - CNBC Soros says Germany could cause euro collapse - Reuters

Now the commentary has switched to a collapse of the Dollar, which as my earlier USD forecast concluded is not going to happen for the obvious reason that all currencies are in perpetual free fall as governments seek to stealth tax their populations and gain competitive advantage against other countries, therefore all that exchange rate trends represent is the volatility in the rate of decent between currencies, for instance today's GBP rate of £/$1.60 is virtually the same as where it was 20 years ago! However the below graph illustrates what successive British governments have achieved in eroding the real value of sterling by means of the inflation stealth tax, that's a drop of about 40%.

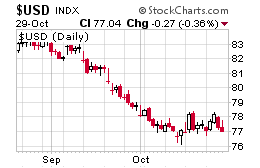

Therefore despite the U.S. dollar being in an a bear market, the current dollar collapse mantra 'should' resolve in a corrective rally that targets a trend towards USD 80 by early December as illustrated by the forecast trend below (12 Oct 2010 - USD Index Trend Forecast Into Mid 2011, U.S. Dollar Collapse (Again)? ). However longer-term, continuing (permanent) Fed money printing ensures the Dollar is going to trend all the way towards the mid 2011 target of 69-70 as the U.S. economy imports inflation to mask economic stagnation by means of illusory nominal growth i.e. stagflation as covered at length in the Inflation Mega-trend Ebook (FREE DOWNLOAD).

Ensure you are subscribed to my ALWAYS FREE Newsletter to receive my in-depth analysis in your email in box. Your inflation mega-trend monetizing analyst. Comments and Source : http://www.marketoracle.co.uk/Article23909.html By Nadeem Walayat Copyright © 2005-10 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

You're receiving this Email because you've registered with our website. How to Subscribe Click here to register and get our FREE Newsletter To access the Newsletter archive this link Forward a Message to Someone [FORWARD] To update your preferences [PREFERENCES] How to Unsubscribe - [UNSUBSCRIBE]

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication. |

||||||||||||||

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

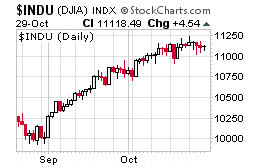

Quick Update- As mentioned above, the Dow is being held up quite successfully into the U.S. elections, this implies that the subsequent rate of decent could be more swift so as to converge inline with the mid November target of 10,500 and 10,700, another possibility is a later low.

Quick Update- As mentioned above, the Dow is being held up quite successfully into the U.S. elections, this implies that the subsequent rate of decent could be more swift so as to converge inline with the mid November target of 10,500 and 10,700, another possibility is a later low.

The subsequent price action is showing a double top price pattern with the neckline at the current level of $130, this also suggests that there should be a minor bounce at this support level over the next few days before the downtrend resumes. This trend will be very volatile as it has plenty of time left to run.

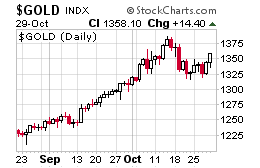

The subsequent price action is showing a double top price pattern with the neckline at the current level of $130, this also suggests that there should be a minor bounce at this support level over the next few days before the downtrend resumes. This trend will be very volatile as it has plenty of time left to run. Gold has achieved my forecast trend expectations for 2010 for a rally to at least $1333 and more probably $1400 (

Gold has achieved my forecast trend expectations for 2010 for a rally to at least $1333 and more probably $1400 (

(04 Oct 2010 -

(04 Oct 2010 -