Fed Quantitative Easing 2, One of the Greatest Blunders in History

Currencies / US Dollar Nov 05, 2010 - 08:04 AM GMTBy: Toby_Connor

Many years from now when we look back at history I think yesterday will be seen as one of the greatest blunders ever made by a central banker.

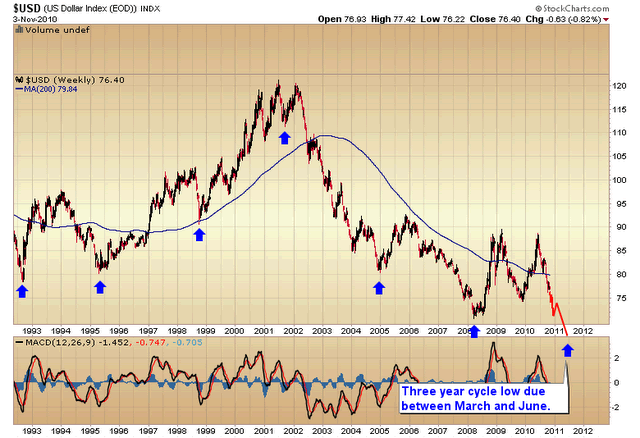

The dollar was already headed down into a major 3 year cycle low.

The first round of QE had already guaranteed that the dollar was going to be under severe duress by next spring. Bernanke just added insult to injury yesterday and virtually guaranteed we will have a major currency crisis by next spring.

I think history will come to view yesterday as the beginning of the end for the dollar as the worlds reserve currency and unless the Federal Reserve comes to their senses soon the dollar is doomed to follow every other fiat currency in history into an eventual hyperinflation and total devaluation.

One has to protect their purchasing power from the depredations of central bankers bent on destroying the dollar. That means one has to exchange their paper dollars for real assets. It's no longer safe to hold cash.

One can buy stocks but soaring inflation will destroy profit margins and the stock market is going struggle more and more to rise in the face of soaring input costs.

There is one and only one sector that is positioned to protect one's wealth from the Fed. That sector is of course precious metals. The more the Fed devalues the better the fundamentals become. Gold is now entering the parabolic phase of this particular leg of the ongoing C-wave advance.

I doubt we will ever see sub $1300 gold again for the duration of this secular bull. Now that the HUI and silver have broken to new all time highs we have a rare condition in that the entire precious metal sector is trading in a vacuum with no real overhead resistance. This is the only sector in the world in this position. That is the recipe for an incredible move higher in a short period of time as funds begin to chase the outperformance in the precious metal sector.

The key now is to spot the top and lock in profits, but not to exit too early, and believe me most traders and investors are going to exit too early because they will try to trade this based on oscillators and overbought levels. That will be a huge mistake during a parabolic surge.

I will reopen the 15 month subscription briefly for those that want to ride the bull and need a coach to keep them focused. And for those who want a voice of reason to get you out at the top when your emotions will urge you to stay at the party too long.

Toby Connor

Gold Scents

GoldScents is a financial blog focused on the analysis of the stock market and the secular gold bull market. Subscriptions to the premium service includes a daily and weekend market update emailed to subscribers. If you would like to be added to the email list that receives notice of new posts to GoldScents, or have questions,email Toby.

© 2010 Copyright Toby Connor - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.