Fed QE2, Insanity Prevails Over Common Sense

Interest-Rates / Quantitative Easing Nov 04, 2010 - 02:54 PM GMTBy: Andy_Sutton

It certainly looks as though once again insanity has prevailed over common sense. In what has become a recurring theme in our world, particularly from a policy standpoint, the Federal Reserve announced another round of government bond purchases, dubbing the effort ‘QE2’. I wonder if QE2 is any relation to R2D2 from the popular Star Wars series? I think a rather strong argument could be made that the little guy has more common sense than the entire board of Fed governors. All jest aside, however, there are rather serious ramifications to this latest round of pumping; especially since there is no reason to believe the results will be any different than the last effort. Banks and the Government will maintain the status quo while Main Street languishes.

It certainly looks as though once again insanity has prevailed over common sense. In what has become a recurring theme in our world, particularly from a policy standpoint, the Federal Reserve announced another round of government bond purchases, dubbing the effort ‘QE2’. I wonder if QE2 is any relation to R2D2 from the popular Star Wars series? I think a rather strong argument could be made that the little guy has more common sense than the entire board of Fed governors. All jest aside, however, there are rather serious ramifications to this latest round of pumping; especially since there is no reason to believe the results will be any different than the last effort. Banks and the Government will maintain the status quo while Main Street languishes.

The Government’s Story

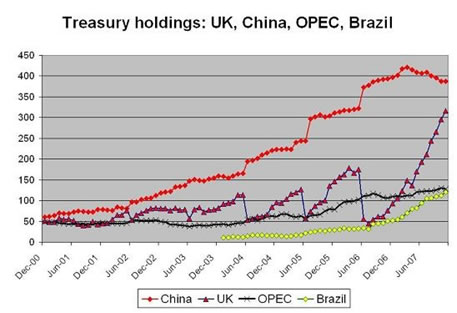

The massive borrowing by the US Government has certainly been no secret over the past 2 years. It has been the topic of nearly every political debate or dinner table discussion. Many, myself included, have wondered aloud how long it would be before the Chinese, Japanese, OPEC, and the rest of our creditors would be able to continue to justify buying all our debt, especially considering the awful rates at the long end of the yield curve. There has been a rotation into the shorter end for sure, and many bond players are now speculating on making money on bonds through higher bond prices as opposed to the normal practice of clipping bond coupons. This mentality was on full display recently when a group of geniuses bought roughly $10 Billion worth of 5-Year TIPS at a negative yield.

Let’s not split hairs here. The Fed has been backdoor monetizing for some time now. There are many different ways they’ve done this such as using currency swaps with the ECB, and other ‘facilities’ in foreign jurisdictions like the UK to make their purchases for them. Notice at around the same time China started cutting back on its exposure that Great Britain, broke as a stone, started ramping up bond purchases. It is a pretty safe bet that this is none other than Mr. Bernanke and Co. at work.

This has been going on and will continue. However, the shift towards overt monetization should tell us that the Fed is stuck and is beginning to panic. The stimulus didn’t work. The last round of asset purchases, totaling nearly $2 Trillion that we know of, only fattened bank balance sheets and did almost nothing to help Main Street. I am inclined to believe that was the whole idea though since the Fed has been incentivizing the banks NOT to expand lending.

In any case, our government requires massive amounts of cash to continue its wayward spending patterns. The Treasury estimates that borrowing this quarter will be in the $362 Billion ballpark. That is a $1.4 Trillion annual clip for those keeping score at home. And now with what appears to be political gridlock in Washington, it hopefully won’t get worse. But of course that also means that it is also rather likely that it will not get better either. Someone is going to need to buy all those fresh Treasury bonds, and the Fed has just openly positioned itself as the buyer of last resort. At least that part of the charade is ending.

The Consumer’s Retrenchment

Another battle going on is the need for retrenchment on the consumer level. This flies directly in the face of stimulating economic growth since much of our ‘growth’ the past few decades has been derived from a service oriented, consumption driven model. The fuel for that growth has been the expansion of consumer credit, so much that consumer credit outstanding and GDP have marched in near lock step since the turn of the century. This tells us that our ‘growth’ has been borrowed, and is in fact, not growth. Throw in the inflation of the early part of this decade and there has been negative growth across the board. The prosperity has been put on plastic and now hangs like a boat anchor around the necks of most Americans. Here are some frightening statistics:

In 2009, the average balance on credit cards held by undergraduates was $3,700, with the average rate being 17.86%.

Among households who have credit card debt, the average debt was $15,788 in 2009.

In 2009, 14% of disposable income went towards servicing credit card debt.

In 2008, 44% of small business owners identified business credit cards as a source of financing, more than any other source of financing including earnings.

On the flip side of the coin, there are certainly some bright spots:

Almost 45% of consumers who had a credit balance said that balance got ‘lower or much lower’ in 2009. This is a signal of at least a partial retrenchment.

Earlier this year, 29% of poll respondents said they did not have a credit card, which was a 10% jump over the same period in 2009.

In a somewhat dated study in July 2008, 37% of consumers said they were using their credit cards less.

Let’s take a look at some of the components of consumer credit. Due to the extremely close correlation with GDP, consumer credit is something I have written about many times. The past few years have seen the ONLY contraction in total credit outstanding since recordkeeping began in 1943.

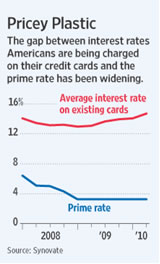

The only period in the past 67 years that rivaled what has happened since 2008 is the recession of the early 1990s, which saw a gentle stagnation in credit outstanding. Sadly, 1993 was the period in time when the growth in consumer debt began in earnest and marked a crossing of a Rubicon from wage financed consumption to credit financed consumption. The current contraction, which is showing signs of exhaustion, has only clipped 6.49% off the total consumer debt outstanding. While this is significant in that it is unprecedented, it is not enough to substantially decrease the costs of servicing the debt for consumers. Since being bailed out, banks have continued to raise rates on many forms of revolving debt to keep profits steady.

What might be somewhat surprising, however, is who actually HOLDS the consumer debt that remains. We’re able to do some breakdowns in this regard.

Commercial banks net on net are in a better position with regards to their holdings than they were before the recession started and the average rate on their cards has increased significantly as well. It is no wonder the banks are profitable again. When you figure the bailouts, higher interest rates, and steady holdings, even the losses from charge-offs and other bad debt procedures, there is still plenty of gravy.

The bottom line here is the impact of policy. It should be obvious now that there have been beneficiaries of the policies of the past decade (or more), and there have been those who have seen little or no benefit. What the above analysis should also tell us is that an economy-cleansing consumer retrenchment still has not taken place. It has also become very clear that the Fed and our government will not allow such a retrenchment to take place. Why do I say this? Because every time consumers refuse to spend more, the government does it for them and the Fed pumps more fiat cash into the banking system to fill the gap. All that said, there is still nothing wrong with cleaning up your own personal balance sheet; you may not be able to teach your government anything, but you’ll certainly sleep better at night.

By Andy Sutton

http://www.my2centsonline.com

Andy Sutton holds a MBA with Honors in Economics from Moravian College and is a member of Omicron Delta Epsilon International Honor Society in Economics. His firm, Sutton & Associates, LLC currently provides financial planning services to a growing book of clients using a conservative approach aimed at accumulating high quality, income producing assets while providing protection against a falling dollar. For more information visit www.suttonfinance.net

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.