Inflationary Thursday - Benny Drops the Big One!

Stock-Markets / Financial Markets 2010 Nov 04, 2010 - 01:13 PM GMTBy: PhilStockWorld

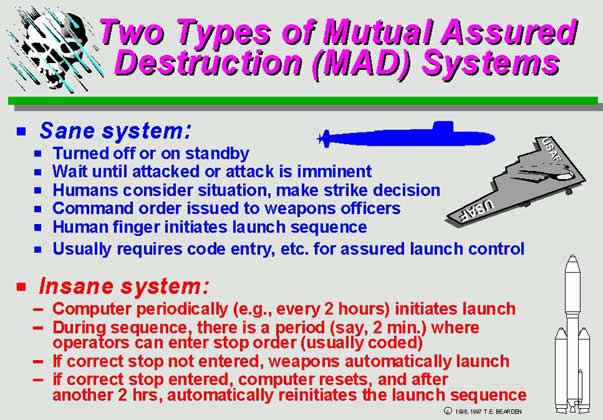

Mutually Assured Destruction (MAD).

Mutually Assured Destruction (MAD).

That was the actual military policy of the United States of America and the rest of the World for about 30 years. We had Presidents and Kings and thousands of bureaucrats - the top minds of 2 generations - all getting together on a regular basis and coming up with or buying into insanity like the system on the right. We look back at it now and say "Gee, what were we thinking" but the whole World went down this path for a while.

There is a scene from Doctor Strangelove where Major Kong, the bomb commander, is so focused on completing his mission that he loses sight of the bigger picture but he doesn't regret his actions - he goes down in a blaze of glory that ultimately dooms the World but his sense of personal triumph at achieving his wrong-headed goal is the punctuation for the film. Watch this scene and think of Bernanke, tinkering with this or that but so focused on "fixing" the economy with the one tool at his disposal that he ends up destroying it instead.

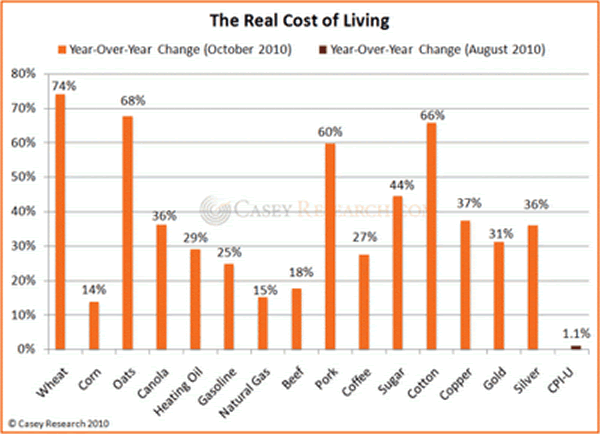

After putting over $2Tn into our Dead Parrot Economy since the crash and getting no response, Bernanke is upping the ante with another $600Bn round of Quantitative Easing ON TOP OF the ongoing $250-$300Bn round of POMO commitments for a total of about $110Bn per month dumped into the economy between now and the end of Q2. This represents a 10% increase in the money supply over 8 months and, therefore, a planned 10% decrease in the purchasing power of your dollar-denominated assets or, to put it bluntly - a 10% tax on everything you own.

That is the joke of this country. People sit there arguing about whether or not to extend a tax cut that will cost 3% of a year's salary while the Fed, with no electoral oversight, is simply taking 10% of your LIFETIME savings - AGAIN! They did it last year, they did it this year and now they promise to do it next year too. That's 30% folks!

You don't have to worry about the commodity pushers missing a signal - Oil, gold and copper jumped 2% yesterday and wheat, cotton and corn are on a similar path in the futures. Of course the speculators think this is just great and I told you on Monday that today was a POMO day and I even gave you a play yesterday that makes 1,300% off this inflationary BS so don't come crying to me that you can't keep up with inflation because we are the investor class and we LOVE this stuff.

I just feel a little bit bad for the bottom 95%, the suckers who have to pay for all this whenever they need to drive to work or buy a shirt or, dare we dream - eat! It sucks for them when the price of the things they HAVE to buy, the things that already eat up 60% of their disposable income, go up 2% in a day, doesn't it?

Those poor suckers can't choose what not to buy to survive but WE can choose what to invest in as we rip the money out of their wallets on an ever-accelerating basis through commodity inflation.

As I said, I feel a little bad but not so much now that the elections are over and the people now have exactly what they voted for: Back to a bank and commodity-driven, survival of the fittest, Big Business economy where their jobs will be shipped overseas to the lowest bidder as the rich people sit around trying to figure out how to begin charging them for water and air as well. Just another form of Mutually Assured Destruction? Hell no, we're (the investing class) going to make a fortune and the only people destroyed will be everyone else - it's a fine plan!

As I said, I feel a little bad but not so much now that the elections are over and the people now have exactly what they voted for: Back to a bank and commodity-driven, survival of the fittest, Big Business economy where their jobs will be shipped overseas to the lowest bidder as the rich people sit around trying to figure out how to begin charging them for water and air as well. Just another form of Mutually Assured Destruction? Hell no, we're (the investing class) going to make a fortune and the only people destroyed will be everyone else - it's a fine plan!

The Bernanke plan to rebuild banking by destroying the American Worker is in full force this week with Jobless Claims up 457,000 this morning while Big Business squeezes another 1.9% more productivity out of terrified workers who even took a 0.1% pay cut (Unit Labor Costs) for their troubles. That has sent the futures to even higher highs as nothing is better for the markets than cheap labor.

Small cap investors should be a bit concerned about mounting misses in October Same-Store Sales with BONT down 4.2%, AEO down 2%, ARO down 2%, HOTT down 8.5%, DDS down 1%, KSS down 2.5%, SSI down 3.5% along with disappointments (so far) from ANF (up 2% vs 4.5% expected) and M (2.5% vs 2.8%) as well. That's the worst performance we've seen all year but CNBC is accentuating the positive and eliminating the negative as GE's Jack Welch was the special guest, doing the happy dance as a good portion of that QE2 money ends up in his company.

The dollar is falling through support at 76 and touching 75.80 just ahead of the bell so that 0.1% pay cut taken by American workers is a 4% pay cut for the month of October if they are paid in dollars, which began the month at 79 and down 8% from Sept. 1st (83) and 12% from July 1st (86). Think of how fantastic this is for our Multi-Nationals - who collect international currencies as payments and get to pay their US labor force in (ROFL) American money! To foreign corporations, this is like paying their American workers in beads and trinkets...

In addition to our financial plays, we have our list of multi-national dividend payers to work to the upside but we're not going to be chasing this rally up - we'll more likely be shorting into the open as we test the breakout levels I set out for Members yesterday morning at Dow 11,500, S&P 1,200, Nasdaq 2,600, NYSE 7,750 and Russell 750. Since the Dow has the farthest to climb, they are the focus of our upside short-term plays but to play for the QE2 rally, our 3 leveraged financial plays give the most bang for the deflating buck.

Downside play of the day will be the QQQQ WEEKLY $53 puts for .10 - a gamble but a huge payoff if we turn down on tomorrow's Non-Farm Payroll and they were as high as .80 yesterday so hoping for .40 is not unrealistic but, keep in mind, they do expire tomorrow so just a craps-roll type of bet.

Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2010 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.