Gold Higher as Risk of Competitive Currency Devaluation and Debasement Underestimated

Commodities / Gold and Silver 2010 Nov 04, 2010 - 08:05 AM GMTBy: GoldCore

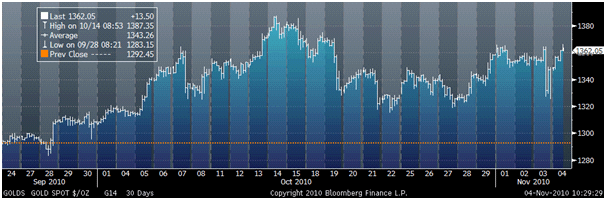

Gold fell initially after the QE2 announcement yesterday prior to recovering and it then rose steadily in after hours Asian and again in early European trading. Gold has risen to $1,362/oz due to the dollar falling and oil and commodities rising significantly in the aftermath of the announcement of the new $600 billion of quantitative easing.

Gold fell initially after the QE2 announcement yesterday prior to recovering and it then rose steadily in after hours Asian and again in early European trading. Gold has risen to $1,362/oz due to the dollar falling and oil and commodities rising significantly in the aftermath of the announcement of the new $600 billion of quantitative easing.

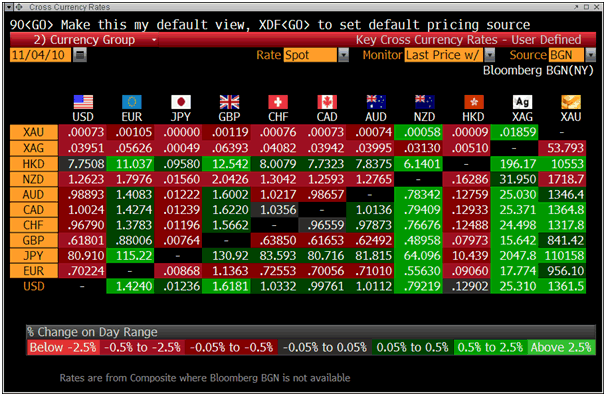

Gold is currently trading at $1,362.30/oz, €957.21/oz, £843.20/oz.

Gold is now only 2% below its recent nominal record high on October 14th ($1,387.35/oz) and after a period of consolidation the trend would suggest that $1,400/oz remains a near term target. Silver traded erratically yesterday with unusual price swings prior to reasserting its upward momentum and rising to new 30 year highs at $25.40/oz this morning.

Equities internationally have surged but it is hard to know if this is due to a belief that the US and global economic recovery might continue or is it due to some market participants using equities as an inflation hedge. Long dated US treasury bonds fell sharply yesterday and concerns about significant overvaluation in bond markets, particularly as commodity prices are back near the higher levels seen in mid 2008, are valid.

The assumption that commodities are in a bubble is wrong as many commodities are well below their recent highs in mid 2008 when the Thomson Reuters/Jefferies CRB Index was trading as high as 473 (see chart). Today the benchmark commodities index is trading 55% lower at just 305and is close to its average price in 2005, 2006 and 2007. More importantly, most commodities remain well below their inflation adjusted highs of more than 30 years ago. With currency debasement and currency wars in the form of quantitative easing and competitive currency devaluations set to continue, oil, commodities and other tangible, finite markets may continue to rise in price. This will likely leadto inflation - particularly in the food and energy sector.

Complacency about the these inflation risks and risks posed to the dollar and other fiat currencies remains widespread with incorrect assumptions made. Those warning of the risk of inflation are many of the same people who correctly warned about property bubbles and were ignored leading to some the problems that we are experiencing today.

Silver

Silver is currently trading at $25.33/oz, €17.80/oz and £15.67/oz.

Platinum Group Metals

Palladium for immediate delivery climbed as much as 2.5 percent to $671/oz this morning which is the highest price since May 2001.

Platinum is trading at $1,732.00/oz, palladium is at $666/oz and rhodium is at $2,175/oz.

News

(Bloomberg) - Germans own over twice as much gold as the country's central bank, Bild-Zeitung reported, citing a report by the Steinbeis University in Berlin. Germans own 7,500 metric tons of gold. The amount equals 5 percent of global holdings and is over twice the 3,500 tons held by the Bundesbank, the newspaper cites the report by the management school as saying.

(PRNewswire) - JP Morgan Chase & Co. (NYSE: JPM) and HSBC Securities Inc. (NYSE: HBC) face charges of manipulating the market for silver futures and options in violation of federal commodities and racketeering laws, according to a new lawsuit filed Tuesday in the U.S. District Court for the Southern District of New York.

(Bloomberg) - Demand for 1-ounce Krugerrand gold coins increased by 54 percent in the past month, the South African Gold Coin Exchange said in an e-mail received today, without giving further figures.

(Reuters) Turkish gold imports rise to 9.07 tonnes in October. Turkey's gold imports rose to 9.07 tonnes in October, compared with 2.45 tonnes the previous month, the Istanbul Gold Exchange said on Tuesday. Turkey is the world's third-biggest gold consumer.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.