Dr Ben "Kevorkian" Bernanke Helping U.S. Economy Commit Suicide

Economics / Great Depression II Nov 02, 2010 - 10:04 AM GMTBy: James_Quinn

Everyone has watched one of the best TV series of all-time - M*A*S*H. You also know the tune that played during the opening credits as helicopters delivered wounded soldiers to the 4077 Mobile Army Surgical Unit. Most people have never heard the lyrics that go with the music. The song is Suicide is Painless and the lyrics were sung during the M*A*S*H Movie. As I watched the movie a few weeks ago, the lyrics struck home. Our country has been slowly committing suicide for the last 40 years. The movie and TV series were set during the Korean War. It is fitting that military spending is one of the major causes of our suicide as a nation. On an inflation adjusted basis, the US has doubled spending on Defense since 1962. It is on course to rise another 20% in the next four years. Dwight D. Eisenhower warned us about the military industrial complex in 1961:

Everyone has watched one of the best TV series of all-time - M*A*S*H. You also know the tune that played during the opening credits as helicopters delivered wounded soldiers to the 4077 Mobile Army Surgical Unit. Most people have never heard the lyrics that go with the music. The song is Suicide is Painless and the lyrics were sung during the M*A*S*H Movie. As I watched the movie a few weeks ago, the lyrics struck home. Our country has been slowly committing suicide for the last 40 years. The movie and TV series were set during the Korean War. It is fitting that military spending is one of the major causes of our suicide as a nation. On an inflation adjusted basis, the US has doubled spending on Defense since 1962. It is on course to rise another 20% in the next four years. Dwight D. Eisenhower warned us about the military industrial complex in 1961:

"In the councils of government, we must guard against the acquisition of unwarranted influence, whether sought or unsought, by the military industrial complex. The potential for the disastrous rise of misplaced power exists and will persist."

The fact that the US currently spends 7 times as much on Defense as the next nearest country is proof that the military industrial complex has gained unwarranted influence and a disastrous rise of misplaced power has occurred.

U.S. DEFENSE SPENDING

When you critically analyze why we would need to spend 7 times as much as China on military when there is no country on earth that can challenge us, the answer can only be OIL. Our own military came to the following chilling conclusion in their Joint Operating Environment report, issued earlier this year:

By 2012, surplus oil production capacity could entirely disappear, and as early as 2015, the shortfall in output could reach nearly 10 MBD.

A severe energy crunch is inevitable without a massive expansion of production and refining capacity. While it is difficult to predict precisely what economic, political, and strategic effects such a shortfall might produce, it surely would reduce the prospects for growth in both the developing and developed worlds. Such an economic slowdown would exacerbate other unresolved tensions, push fragile and failing states further down the path toward collapse, and perhaps have serious economic impact on both China and India. At best, it would lead to periods of harsh economic adjustment. To what extent conservation measures, investments in alternative energy production, and efforts to expand petroleum production from tar sands and shale would mitigate such a period of adjustment is difficult to predict. One should not forget that the Great Depression spawned a number of totalitarian regimes that sought economic prosperity for their nations by ruthless conquest.

The U.S. military knows we are on the verge of an oil crisis. There are no new supplies ready to come on line before 2015. The President and his advisors know that an oil crisis is in our immediate future. We have military bases in Saudi Arabia, Iraq, and Kuwait. We have active fighting forces in Afghanistan and Pakistan. We have a naval armada of aircraft carriers in the Persian Gulf. Our forces completely encircle Iran. Is this a coincidence when the countries with the largest oil reserves in the world are noted?

- Saudi Arabia - 262 billion barrels

- Iran - 133 billion barrels

- Iraq - 112 billion barrels

- Kuwait – 97 billion barrels

The war on terror is a cover for access to the hundreds of billions of barrels of oil in the Middle East. A 10 million barrel per day shortfall by 2015 would be disastrous for a country that consumes 25% of all the oil in the world. Our hyper-consumer society is like a drug addict, dependent on its oil fix. If we are denied oil for even one day, the withdrawal symptoms would be traumatic and harrowing.

There are 255 million passenger vehicles in the U.S. Our society will collapse within weeks without a sufficient supply of oil. The average American's only concern about oil is when they get a card in the mail from Jiffy Lube telling them it is time for their 5,000 mile oil change. They stick a hose in their gas tank and fluid pours out, allowing them to motor freely around mall dotted suburbia. Within five years they will be paying over $5 per gallon for this fluid or they will be waiting in lines for three hours to get 10 gallons of that precious fluid. Peak cheap oil has been predictable for decades. The Department of Energy was created 31 years ago. Preparing for peak cheap oil would have required some pain, sacrifice and forethought. But, suicide is painless, it brings on many changes.

Visions of Things To Be

Through early morning fog I see

visions of the things to be

the pains that are withheld for me

I realize and I can see...

That suicide is painless

It brings on many changes

and I can take or leave it if I please.

Suicide is Painless - M*A*S*H Movie

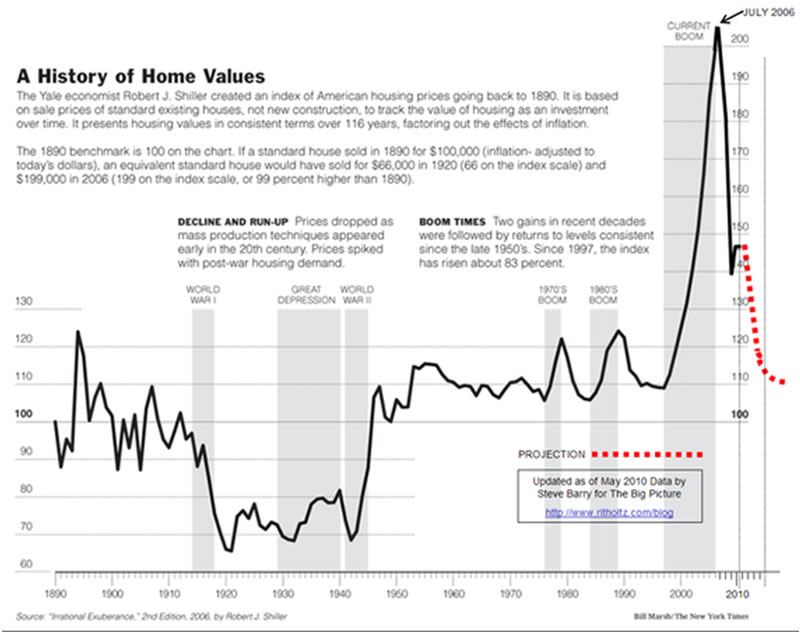

As I peer through the fog and attempt to see visions of things to be, I see nothing but pain ahead. Anyone who can look at the following chart and not conclude that there is much pain ahead for this country is either a Goldman Sachs banker, a Federal Reserve Governor, or a bought off politician in Washington DC. It is no coincidence that after Richard Nixon closed the gold window in 1971 and allowed the Federal Reserve to "manage" our economy that total debt outstanding in the US surged from $2 trillion to over $50 trillion. GDP has risen by 1,300% since 1971, while total US debt has risen by 2,600%. Now for the kicker. Real GDP has only gone up by 292% since 1971. This means that 1,000% of the increase in GDP was from Federal Reserve created inflation. Over this same time frame, real wages have declined by 6%, from $318 per week in 1971 to $299 per week today. Inflation has been the American drug of choice to commit suicide over the last 40 years. It is stealthy, seemingly painless, and deadly.

Inflation is the "painless" method through which the Federal Reserve has decided this country will commit suicide. It is like turning on the car in the garage and letting the carbon monoxide slowly put you to sleep. The ruling elite are content that the American public is dumbed down by the government run public schools. They count on the fact that 9 out of 10 Americans do not understand inflation. It is an insidious scheme of robbing the working middle class and funneling it to the Wall Street/K Street ruling class. The Federal Reserve has gotten bolder in the last few years as they realized the public doesn't understand or care what they do. Bernanke has relished in the mainstream media adulation that he saved the world with his printing press in 2008/2009. Even though critical thinkers know for a fact that it was Federal Reserve policies that created the worldwide financial conflagration in the first place, the corporate mainstream media and the Wall Street beneficiaries have been cheerleaders of Easy Al and Helicopter Ben. These men are traitors. They have purposefully impoverished senior citizens and the working middle class in order to enrich their ruling elite masters on Wall Street and in Washington DC.

Ben Bernanke on Wednesday afternoon will announce Quantitative Easing Part Deux. This is a fancy name for Ben printing $1 trillion out of thin air, buying US Treasuries and/or more toxic mortgage securities and artificially lowering interest rates to convince Americans to spend money they don't have. Jeremy Grantham, in his recent quarterly letter, issues a scathing indictment of Bernanke's methods:

"For all of us, unfortunately, there is still a further great disadvantage attached to the Fed Manipulated Prices. When rates are artificially low, income is moved away from savers, or holders of government and other debt, toward borrowers. Today, this means less income for retirees and near-retirees with conservative portfolios, and more profit opportunities for the financial industry; hedge funds can leverage cheaply and banks can borrow from the government and lend out at higher prices or even, perish the thought, pay out higher bonuses. This is the problem: there are more retirees and near retirees now than ever before, and they tend to consume all of their investment income. With artificially low rates, their consumption really drops. The offsetting benefits, mainly shown in dramatically recovered financial profits despite low levels of economic activity, flow to a considerable degree to rich individuals with much lower propensities to consume."

The ruling elite in Washington DC and Wall Street decided that fraud, misinformation and cooking the books was preferable to the pain of honesty, orderly bankruptcy, and assets valued at their true worth. Ben Bernanke "saved the world" by putting the taxpayer on the hook for $1.5 trillion of toxic mortgage garbage he bought from his masters on Wall Street. John Hussman describes the decision to choose painless suicide over choosing painful medicine to cure our disease:

"Over the short run, two policies have been primarily responsible for successfully kicking the can down the road following the recent financial crisis. The first was the suppression of fair and accurate financial disclosure - specifically FASB suspension of mark-to-market rules - which has allowed financial companies to present balance sheets that are detached from any need to reflect the actual liquidating value of their assets. The second was the de facto grant of the government's full faith and credit to Fannie Mae and Freddie Mac securities. Now, since standing behind insolvent debt in order to make it whole is strictly an act of fiscal policy, one would think that under the Constitution, it would have been subject to Congressional debate and democratic process. But the Bernanke Fed evidently views democracy as a clumsy extravagance, and so, the Fed accumulated $1.5 trillion in the debt obligations of these insolvent agencies, which effectively forces the public to make those obligations whole, without any actual need for public input on the matter."

The Only Way to Win is Cheat

The only way to win is cheat

And lay it down before I'm beat

and to another give my seat

for that's the only painless feat.

That suicide is painless

It brings on many changes

and I can take or leave it if I please.

Suicide is Painless - M*A*S*H Movie

The Federal Reserve has incessantly created new bubbles every time one of their old bubbles has burst, since the elevation of Alan Greenspan as Fed Chairman in 1987. The bailout of LTCM convinced Wall Street that uncle Al would come to the rescue if their gambles endangered the financial system. Greenspan cheered on the internet revolution and flooded the system for the fake Y2K crisis. When the internet bubble burst in 2000 and the 9/11 attack struck in 2001, Greenspan aided and abetted the greatest bubble in history. He dropped interest rates to historic lows, encouraged the use of adjustable rate mortgages, didn't enforce bank regulations, and pretended that he couldn't see the bubble forming. Jeremy Grantham explained the Federal Reserve, Wall Street and K Street conspiracy to avoid the pain of dealing with our long-term structural problems in his latest letter:

"House prices may often not be susceptible to manipulation. Low interest rates may not be enough: they may stimulate hedge fund managers to speculate in stocks, but most ordinary homeowners are not interested in speculating. To stir up enough speculators to move house prices, we needed a series of changes, starting with increasing the percentage of the population that could buy a house. This took ingenuity on two fronts: overstating income and reducing down payment requirements, ideally to nil. This took extremely sloppy loan standards and virtually no data verification. This, in turn, took a warped incentive program that offered great rewards for quantity rather than quality, and a corporation overeager, with aggressive accounting, to book profits immediately. It also needed a much larger, and therefore new, market in which to place these low-grade mortgages. This took ingenious new packages and tranches that made checking the details nearly impossible, even if one wanted to. It took, critically, the Fed Manipulated Prices to drive global rates down. Even more importantly, it needed the global risk premium for everything to hit world record low levels so that suddenly formerly staid European, and even Asian, institutions were reaching for risk to get a few basis points more interest. Such an environment is possible only if there exists an institution with a truly global reach and a commitment to drive asset prices up. In the U.S. Fed, under the Greenspan-Bernanke regime, just such an institution was ready and willing."

On Wednesday Ben Bernanke will inject more poison into the veins of a once great country. This country, at one time, dealt with its problems in a realistic manner and was willing to sacrifice, cooperate, and make hard choices. QE2 will not help our economy or solve any of our problems.

Is It To Be Or Not To Be?

A brave man once requested me

to answer questions that are key

'is it to be or not to be'

and I replied 'oh why ask me?'

'Cause suicide is painless

it brings on many changes

and I can take or leave it if I please.

...and you can do the same thing if you choose.

Suicide is Painless - M*A*S*H Movie

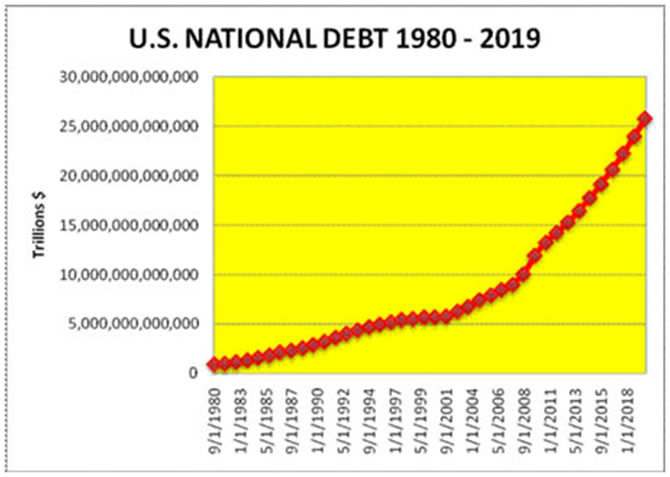

The leaders of this country, with the full support of a zombie like disinterested distracted electorate, have chosen to ignore and defer every tough decision regarding energy, spending, entitlements, deficits, and infrastructure. The Federal Reserve has allowed politicians to run the National Debt up to $13.6 Trillion by imposing no limits on the printing of fiat currency backed by nothing but promises. Based on Obama's 10 year budget projections, adjusted for the real impact of Obamacare and extension of Bush tax cuts, the National Debt will reach $20 trillion in 2015 and $25 trillion by 2019. This is truly a suicide mission. We will never reach these levels because the sweet relief of death will overtake our economic system as the final vestiges of QE2 painlessly bring about the end.

Grantham warns that Bernanke's actions on Wednesday are a desperate last ditch attempt to fend off the pain of reality. It will fail.

"Thus, our current policy of QE2 is merely the last desperate step of an ineffective plan to stimulate the economy through higher asset prices regardless of any future costs. Continuing QE2 may be an original way of redoing the damage done by the old Smoot-Hawley Tariff hikes of 1930, which helped accelerate a drastic global decline in trade. We may not even need the efforts of some of our dopier Senators to recreate a more traditional tariff war. And all of this stems from the Fed and the failed idea that it can or should interfere with employment levels by interfering with asset prices.

The only difference between Dr. Bernanke and Dr. Kevorkian is that Kevorkian helped the terminally ill commit suicide. Dr. Bernanke and his colleagues at the Federal Reserve have inflicted suicide on a patient that was healthy and capable of living many more years. The suicide concoction of fiat currency, debt, military empire, and delusion has been painless for those in power, but painful for the working middle class of this country. Dr. Bernanke fancies himself as an expert on the Great Depression. He is destined to be remembered as the man who killed America. Suicide is painless, it brings on many changes.

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2010 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.