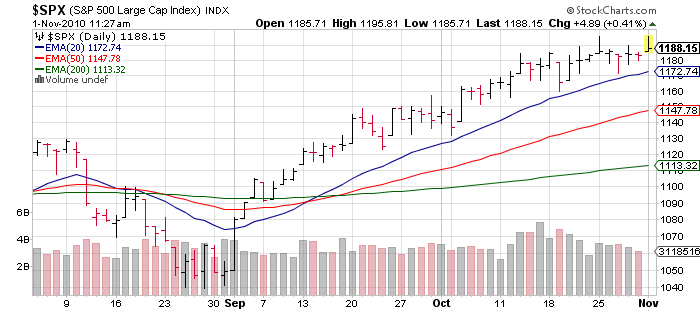

Mini Double Top on S&P 500 Stocks Index

Stock-Markets / Stock Markets 2010 Nov 01, 2010 - 11:37 AM GMTBy: Trader_Mark

The day's high is akin to what was seen the last time we had a gap up open / surge (wait for it.... last Monday). S&P 1196 on both days. Hence we have twin Monday highs and a mini double top. Traditionally (at some point) the market usually sells off, and a double top is a great formation for it to happen from. But I am not crossing my fingers. On the other hand, double top breakouts are usually quite bullish developments so if these intraday levels are cleared, off to the races we go ...although it feels like we've been in a marathon already.

p.s. notice how 3-4 weeks ago everyone was trying to time a selloff? (not the 1-2 day type - but a real one). Now, almost no one is doing that. Again, that *usually* means something but right now it seems like all the rules of a normal functioning market with human emotion and patterns has been tossed out the window.

By Trader Mark

http://www.fundmymutualfund.com

Mark is a self taught private investor who operates the website Fund My Mutual Fund (http://www.fundmymutualfund.com); a daily mix of market, economic, and stock specific commentary.

See our story as told in Barron's Magazine [A New Kind of Fund Manager] (July 28, 2008)

© 2010 Copyright Fund My Mutual Fund - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.