As Stock and Commodity Markets Continue to Climb Pressure Builds to Revert to the Mean

Stock-Markets / Financial Crash Oct 08, 2007 - 10:09 PM GMTBy: Doug_Wakefield

TV Reruns or Real Manias : Last night my wife was watching an old “I Love Lucy” episode. I not only watched Lucy reruns as a kid in the 1960s; I watched those same reruns as my boys were growing up in the 1990s. Now it's 2007, and I'm still watching a group of individuals who haven't aged a day and are just as funny now as they were 40 years ago.

TV Reruns or Real Manias : Last night my wife was watching an old “I Love Lucy” episode. I not only watched Lucy reruns as a kid in the 1960s; I watched those same reruns as my boys were growing up in the 1990s. Now it's 2007, and I'm still watching a group of individuals who haven't aged a day and are just as funny now as they were 40 years ago.

With the continuous upward movements of our markets these days, regardless of negative economic and financial developments, many have come to believe that nothing really changes with this story either. It's as if investors are thinking, “Oh, I've seen this market a dozen times. This is the one where the markets are in trouble and the Fed steps in and saves the day. It's a rerun.” As much as I love to laugh and watch comedies, I understand the difference between a show and reality.

Those of us who've taken the time to change the channel and look for clues as to why the real world feels different from the movie land version of the markets are likely to realize that investors who refuse to differentiate between the two are about to be contestants on the, “Wheel of Misfortune” or “Who Wants to Lose a Million Here?”

Many investors fail to recognize that one asset has been destroyed in order to provide the firepower to drive another asset's price higher. They have not noticed the trade-off between the market's growth and the destruction of the US dollar.

While this game has gone on since the start of the 21 st century, we continue to see signs warning of the end of this period of worldwide credit. Since July the world has watched a severe credit contraction take place. This is impacting real estate, business, and banking relationships around the world, but especially in Europe and the US .

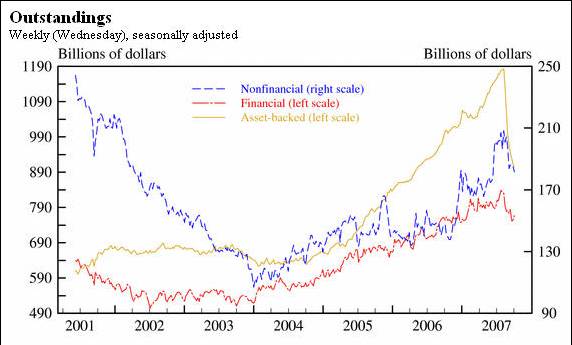

Consider the following: in the months following Katrina, the commercial paper market continued to rise. In the months after the equity markets sold off in May of 2006, the commercial paper market continued to rise. After the sharp sell off of the Shanghai and other world equity markets in February of 2007, the commercial paper market continued to rise. However, after equity markets around the world declined in late July and early August, the commercial paper disconnected.

On July 25, 2007 , the commercial paper market diverged from the trend line it had followed over the last several years. On that date, the Federal Reserve reported the commercial paper market stood at $2,224 billion in assets. On October 3, 2007 , this market stood at $1,859 billion. So this short-term debt instrument, stuffed in money market funds across the country and used for short-term liquidity needs by hundreds of highly leveraged hedge funds, has declined more than $364 billion dollars in ten weeks.

Trying to combat this, central bankers are pulling out all the stops. The trouble is that very few investors are factoring in what happens when crowd sentiment moves from greed, or complacency, to fear. If, as we all must, you've missed some of the real world events of late, let me share a few headlines with you:

“San Diego's Pension Crisis - City Must Answer the Biggest Question: Where to Find the Money?”

“While recommending a procedural path out of the city's financial chaos, the report leaves it to elected officials to answer the toughest question of all: Where do they find the money.”

“Merrill Lynch To Write Down Nearly $5.5 Billion Against Results”

“Merrill Lynch & Co. became the latest and biggest casualty of the credit crisis Friday, warning that it will write down nearly $ 5.5 billion and report a loss when it announces third-quarter financial results. Most of the write-down, $4.5 billion, comes as the firm marks to market the value of collateralized debt obligations, or CDOs, and subprime mortgages.”

“US Expert Warns of Fresh Shocks”

“Robert Shiller, a Yale university economist, told a US congressional panel that he feared ‘the collapse of home prices might turn out to be the most severe since the Great Depression.'”

“EU Business Lobby Say Euro Has Reached ‘Pain Threshold'”

“A leading Pan-European Business Lobby said Wednesday that the Euro had reached the ‘pain threshold for European companies' and urged the continent's politicians to press U.S. , Japan , and China to reevaluate their currencies at the upcoming meeting of the Group of Seven leading industrial nations.”

“Russian President Vladimir Putin has been likened to an imperialist tsar or Soviet dictator after unveiling his strategy to stay in power, perhaps permanently. Mr. Putin has announced he is planning to become Russia 's next prime minister. The Kremlin leader is barred by the constitution from seeking a third term as president when his eight years in office end early next year. But he has no intention of giving up the reins and late Monday disclosed just how he intends to keep control.”

I know you could give me a laundry list of your own frightening headlines, and we would all like to jump into TV land and find solace in our favorite sitcom. But right now, learning and thinking are more critical than ever. Right now, we must read sources that come up with solutions very different from our own in order to challenge our thinking. None of us have ever been through a period like the one that is in front of us, but if we are willing to look at unpleasant realities, we can all gain increasing levels of insight.

Recently, Michael Panzer interviewed Satyajit Das, a gentleman with 30 years experience in developing and marketing derivatives who has written a 4,200-page reference work on these exotic instruments. Here, Panzer asks Das about the recent credit crisis and where we are in the process of things getting “back to normal:”

“I started by asking the Calcutta-born Australian whether the credit crisis was in what Americans would call the ‘third inning'. This is pretty amusing, it seemed, judging from the laughter. So I tried again. ‘Second inning?' More laughter. ‘First?'

Still too optimistic. Das, who knows as much about global money flows as anyone in the world, stopped chuckling long enough to suggest that we're actually still in the middle of the national anthem before the game destined to go into extra innings.”

As almost everyone looks to the Federal Reserve and central bankers around the world to continue this giant liquidity bubble forever, we would do well to look at the sentiment readings from Rich Ishida at www.marketvane.net .

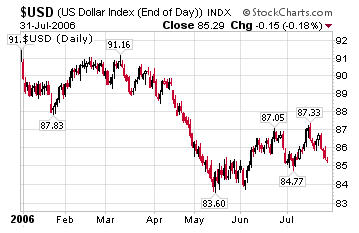

Gold recently hit a high of 90. On May 11, 2006 gold hit 92, right before it fell from $730 to $542 in four weeks. On May 12, 2006 the US dollar hit 35, and in four weeks, it had moved from 83.06 to 87.05. At the time, the Euro only hit a reading of 69 before turning down. As of last Friday, September 28 th , the dollar hit a low of 20, and the Euro hit a high of 93, both numbers that are the lowest and highest in the last 2 years. In addition to these markets, we notice that the NASDAQ hit a bullish level of 78, the highest level it has hit in the last 2 years.

If these sentiment levels back off from these extremes, October could be a tumultuous month. As to whether this is finally the top, I've seen some good arguments for another explosion higher after the next move down and good arguments for this being the top. In a probabilities game we can never know anything for certain until it has passed. What we do know is that rapid increases in confidence or fear, as shown in these readings, usually mean that the markets are poised for rapid price changes in the near future.

History shows that when everyone is on the same side of the trade, it may be time to rethink one's strategy. As the markets continue to climb, the pressure to revert to the mean only gets stronger.

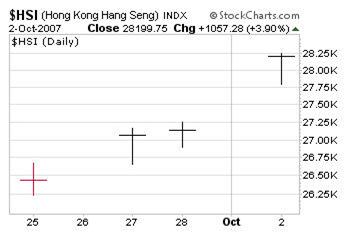

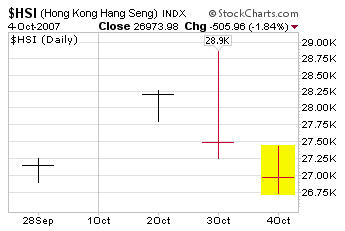

The recent volatility in the Hong Kong 's Hang Seng Index only demonstrates the speed in which trades are being executed. Were the investors, or traders who rode the Hang Seng up, on Monday, October 2 nd , thinking, “the next two days the markets are going to fall over 2,000 points?” Is this type of enormous volatility in the largest market in China a sign of stability and millions of investors carefully evaluating risk, or are they saying, “Forget the cookie –just give the Chinese Fortune”? In an environment like that which the Hang Seng has experienced in 2007, I venture to guess that not much thinking is taking place.

Right now, we are dealing with polar extremes. Similar to other critical junctures, millions are extrapolating the paper gains of the past as proof that this is the show that will never end. Our leaders and elected officials are trying to calm the crowd with comforting rhetoric.

We need to remember that “thinking positive,” while a necessity to keep our sanity at this time, will not make our mammoth financial issues disappear. We need to stop ourselves and question what the crowd is doing. We should look for solutions that are not popular and consider actually getting ahead of this credit contraction, which will most assuredly continue.

If you're interested in what various experts, from a variety of disciplines, have to say about finance, you should consider becoming a part of The Investor's Mind and benefiting from the research and views of some of the most experienced individuals in the world of money. To get a feel for the educational material we've presented to our readers since January of 2006, click here . We continue to gain recognition for our 154-page industry paper on short selling, Riders on the Storm: Short Selling in Contrary Winds , which can be obtained with a subscription to The Investor's Mind. To learn more about our mission, as well as our educational and advisory services, visit our website .

By Doug Wakefield with Ben Hill

President

Best Minds Inc. , A Registered Investment Advisor

Copyright © 2005-2007 Best Minds Inc.

Best Minds, Inc is a registered investment advisor that looks to the best minds in the world of finance and economics to seek a direction for our clients. To be a true advocate to our clients, we have found it necessary to go well beyond the norms in financial planning today. We are avid readers. In our study of the markets, we research general history, financial and economic history, fundamental and technical analysis, and mass and individual psychology.

Doug Wakefield Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.