US Economy’s Bubble: Casting the Recession Runes

Economics / US Economy Oct 08, 2007 - 07:25 PM GMTBy: Gerard_Jackson

That the US economy is running into problems is becoming clearer by the day. It is equally clear that America’s economic commentariat is still wedded to the fallacy that consumption drives economies. Time after time I keep reading that consumer spending is more than 70 per cent of GDP which means that if consumer spending falls the economy will slide into recession. What matters, however, is total spending, of which business spending is the most important component. The problem here is that the commentariat has unthinkingly swallowed the fallacy that including spending between stages of production would be a case of double-counting.

That the US economy is running into problems is becoming clearer by the day. It is equally clear that America’s economic commentariat is still wedded to the fallacy that consumption drives economies. Time after time I keep reading that consumer spending is more than 70 per cent of GDP which means that if consumer spending falls the economy will slide into recession. What matters, however, is total spending, of which business spending is the most important component. The problem here is that the commentariat has unthinkingly swallowed the fallacy that including spending between stages of production would be a case of double-counting.

If this were so then eliminating spending on intermediate goods would have no effect on production. Yet we know that if this were to occur the economy would collapse. Fortunately some government economists seem to have seen the light. The Bureau of Economic Analysis calculated that though GDP for 2000 was about $13 trillion actual spending came in at nearly $23 trillion. Although I think this is an underestimate it nevertheless reveals a fundamental and vitally important fact. And that is that business spending is what really drives the economy. We can therefore deduce that business spending is where we should first look for danger signs of an impending recession.

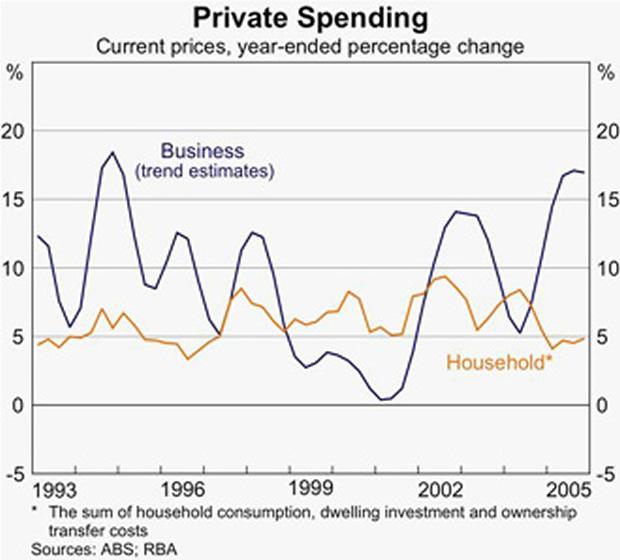

The following chart is a graphic example of our premise. Although it is for Australian spending it still applies equally to the US economy. The orange line represents consumer spending and the blue line is business spending. Now how any economist or finance writer could look at this chart and still categorically state that consumer spending is the most important component of total spending leaves me completely bewildered.

The chart clearly shows that business spending is the largest and most variable component of aggregate spending. The years 1998 to 2001 are particularly striking. As we can see, business spending plummeted, slowing the economy considerable, and yet consumer spending remained comparatively stable. In 2001 business spending rapidly expanded. The reason? It was then that the Reserve Bank of Australia let loose with the money supply, expanding M1 by 22 per cent and bank deposits by 25 per cent.

So how does this look today? The same as it did under Clinton. Back in 1999 I warned that the US economy was moving into recession. I emphasised the fact that manufacturing was contracting and shedding labour, a sure sign that recession had started. I also stressed that commentators would be deceived by the unemployment rate because it would continue to fall. This led to Steve Slifer, chief economist at Lehman Brothers, to say of the US economy in January 2001:

It’s really an odd-looking slowdown. The manufacturing sector is, in fact, in a recession but not the overall economy. At least not yet.

This is what happens when you have been infected with Keynesianitis: it forces its victims to focus on aggregates instead of relative prices. This is why the likes of Slifer were unable to see that the boom was nearing its final phase. Consumer spending was quickly rising at the same time as business spending was falling, creating an additional demand for labour at the lower stages of production. I pointed out in a number of articles that this consumer-led demand for labour would serve to conceal for a time what was really happening to the economy. Eventually a point would be reached where aggregate unemployment would begin to rise, even if consumer spending remained stable. And this is precisely what happened.

The same pattern appears to have re-emerged. The industries closest to the point of consumption hired 143,000 workers in September. But in the same month manufacturing shed 33,000 jobs. In January factory orders fell by fell 4.2 per cent and by 3.3 per cent in September. The Institute of Supply Management’s manufacturing index fell to 52.0 in September. It was 53.8 in July, dropping down 52.9 in August, a month that experienced a fall of 4.4 per cent in orders for capital goods. Yet employers hired an additional 110,000 workers in September. The pattern still holds. We also find that wages rose by about 4 per cent during the last 12 months. But this is usual for a boom that is drawing to a close.

New housing as well as manufacturing is also a good economic indicator, not just because housing is a durable good — so are my DVDs — but because it is an expensive good whose services are continuously consumed for decades. It therefore has the characteristics of a durable capital good.

So is the US economy on the skids? This is where the Fed comes in and the story becomes murky. Last September it cut the federal funds rate by 0.5 percent, bringing it down to 4.75 percent. Rates on 30-year mortgages quickly dropped to 6.37 per cent from 6.42 per cent. There are now reports that the housing markets in New York and San Diego are moving up again. If this is true then it’s possible that the Fed’s cut has given the housing market another gin and tonic. (This is like putting an alcoholic on a diet of whisky). If the cut is moving housing markets then it should also bolster shares. Well, this also appears to be the case, with the market turning bullish and commodity prices being driven up again.

At this stage it’s impossible to predict where interest rates will be within the next 6 months — even Bernanke doesn’t know that. What I do know is that back in 1927 Benjamin Strong gave the US economy a massive monetary injection that triggered a stock market frenzy. The rest, as they say, is history.

I’m not predicting another Great Depression, far from it. There existed at that time a concatenation of forces that do not exist today, or at least anywhere near the same scale. The real problem is not interest rates, exchange rates, unemployment, etc., it is bad economics. So long central banks and economists refuse to jettison Keynesian fallacies and the fallacy of the ‘stable price level’, and adopt sound money policies we will continue to suffer these economic crises.

By Gerard Jackson

BrookesNews.Com

Gerard Jackson is Brookes' economics editor.

Gerard Jackson Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.