Is the Fed Plunge Protection Team Manipulating the Stock Market?

Stock-Markets /

Market Manipulation

Oct 29, 2010 - 01:22 PM GMT

By: EWI

Rumors are, the U.S. government "is propping up the stock market."

Rumors are, the U.S. government "is propping up the stock market."

'By far, the most frequent question we've been asked recently at EWI's Message Board is this: "What is your take on the persistent internet chatter that the Federal Reserve is holding up the stock market via QE2, POMO, etc.? How can stocks ever decline again if the Fed is in control?" Here is an eye-opening chart that will help shed more light on this issue. Read more.

You will find many intriguing Q&As at EWI's Message Board. We offer it as a free way for our Club EWI members and subscribers to interact with EWI and the Socionomics Institute's experts. We strive to answer every Message Board reader, and publicly post the best Q&As. By far, the most frequent question we've been asked recently is:

"What is your take on the persistent internet chatter that the Federal Reserve is holding up the stock market via QE2, POMO, etc.? How can stocks ever decline again if the Fed is in control?"

We have several active Message Board posts that touch on "market manipulation." But here is an eye-opening chart that will help shed more light on this issue.

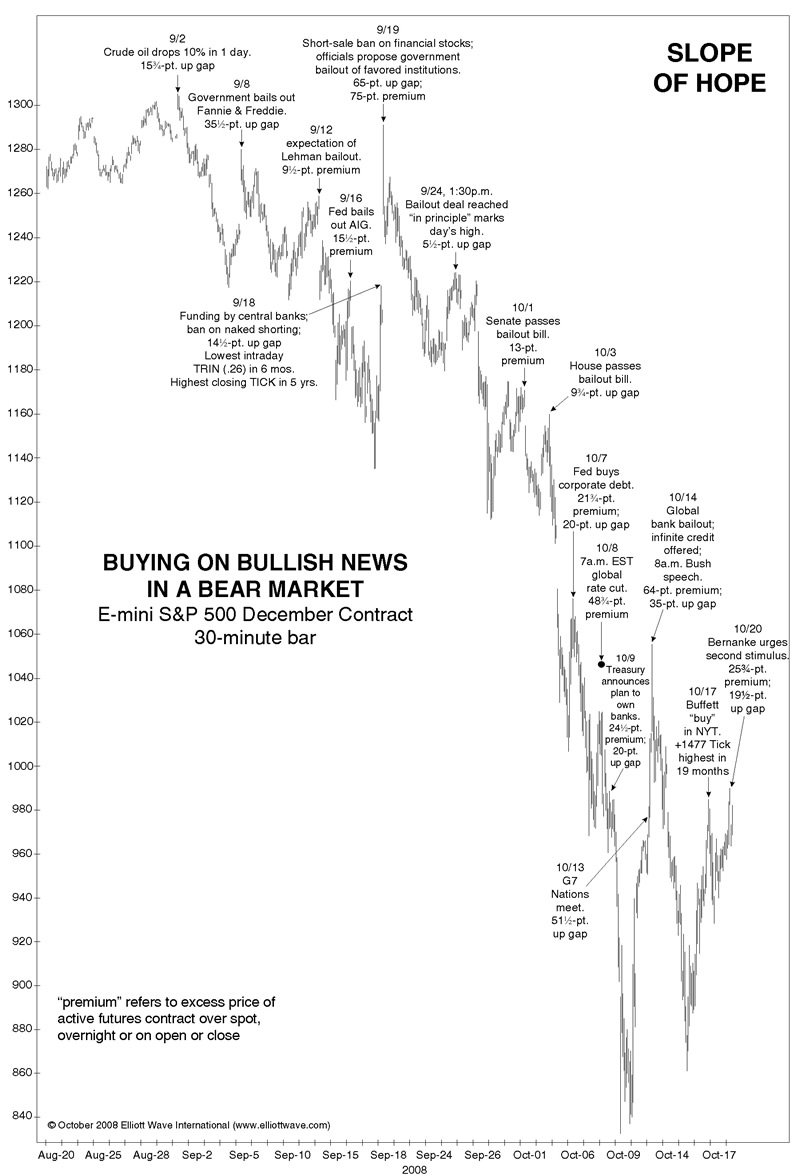

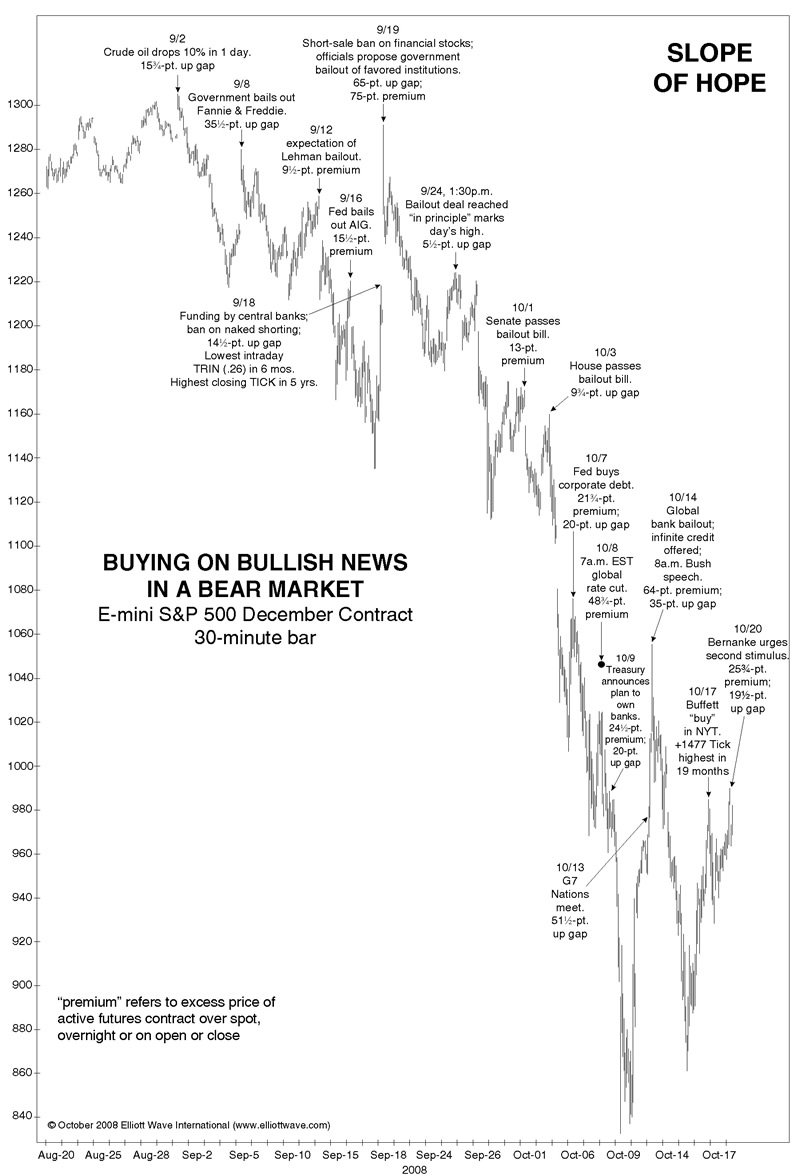

EWI President Robert Prechter published this chart in his October 2008 Elliott Wave Theorist. Review this chart carefully. For too many investors, the crash of 2007-2009 is becoming a hazy memory. And almost no one in the mainstream financial media talks about the utter panic in the markets in September-October 2008, the worst part of the crash.

If you think back to that time, you may remember that the Federal Reserve and U.S. government took many aggressive steps to help stop the collapse. Every time they would announce a new intervention, the market would cheer. Result? Prechter's chart gives an unequivocal answer:

As you can see, announcements of bailouts, unlimited credit, bans on short sales, etc., were powerless against the biggest stock market collapse in 76 years. The DJIA kept sliding. It didn't stop until March 6, 2009 -- after it had slipped below 6,500.

So: Is the Fed and the "Plunge Protection Team" engaged in market manipulation? You can browse EWI's Message Board for some answers, but one thing is clear: When stocks were crashing two years ago, few dared to suggest that the Fed was in the saddle. Bob Prechter puts it best:

"When markets go up, the Fed seems to be in control; when they go down, it seems out of control. But the control aspect is an illusion."

Get the 33-page Market Myths Exposed eBook for FREE Learn why you should think independently rather than relying on misleading investment commentary and advice that passes as common wisdom. Just like the myth that government intervention can stop a stock market crash, Market Myths Exposed uncovers other important myths about diversifying your portfolio, the safety of your bank deposits, earnings reports, inflation and deflation, and more! Protect your financial future and change the way you view your investments forever! Learn more, and get your free eBook here.

This article was syndicated by Elliott Wave International and was originally published under the headline The Fed and "Plunge Protection Team": Are They Manipulating Stocks?. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

chrisitian

29 Oct 10, 20:55

|

POMO'S

it's the POMO'S sorry your analysis is flawed in the face of 30 billion /month in pomo's levered up. now this doesn't mean it won't flop soon....but i can't determine this from you anaylsis.

|

Elizabeth Jane

01 Nov 10, 10:16

|

Is the Fed Plunge Protection Team Manipulating the Stock Market?"

The article: "Is the Fed Plunge Protection Team Manipulating the Stock Market?" says that the perception that the Federal Government is manipulating the stock market is an illusion. The reason given, supported by evidence, is that when stocks are going up the Fed appears to be in control, but when stocks are going down the Fed appears to be out of control. That doesn't mean that the Fed is not trying to control the Stock Market. It isn't a logical conclusion - if you try to recycle money so as to increase your bank's balances, and fail, that doesn't mean that you were not money laundering. Failing to achieve your objectives at control and manipulation does not mean that you were not engaging in manipulation and attempted control. There is also a matter of "influence" which is not total control, but which is still a form of manipulation. What i believe to be going on, is that investors do not themselves consider the propaganda and manipulative information put out by the Fed (i.e. figures that are poorer, but "not as bad as predicted", when the predictions referred to are plausibly intentionally skewed in order to create such "favourable" economic "news" - commonly called "political propaganda") as impartial and realistic, but that investors act by tacit agreement with other investors to behave as though the information is of high economic value. The information put out by the Fed is always highly visible to all investors, and acts as a signal, in my view, that investors can, or even "must", act upon as though the information were reliable, not because the information has intrinsic value, but because the response of other stock-market traders - and the 'subjective trader', who has constructed herself or himself in terms of "the other stockmarket investors" - is predictable, and so, 100 percent economically reliable. The manipulation, and attempts by the Fed to control the market, is of value to share traders in the market, because it enables them to "predict" when the market will rise. There is therefore a tacit conspiracy between share-traders and the Fed. The Fed doesn't get control, but it gets the response it is seeking, because it is profitable for traders to provide it with what it wants for their own purposes - not because they are so easily duped!: The traders don't care if it is propaganda - they only care that it is a clear signal from the Fed, which has been broadcast to all other investors! But look at it from the Fed's viewpoint! The Fed's attempts to manipulate the market always appear to be temporarily successful (and sometimes dramatically so for the weakest of "reasons") in stimulating the stockmarket. From the point of view of the Fed, their attempts to manipulate the market are successful - they do not themselves beleve that they have absolute control - at least by this methodology!* *i.e. A "known unknown": Who knows what deeper levels of economic power and control may secretly exist - or what "war-games" algorithms that may have been written by skilled programmers perhaps with inside information, and that may have been strategically deployed; and what battles, or global economic "nuclear" war, might be being played out - all completely covertly, of course?! ...Or what the "nature of [their] game" might be - which might not necessarily be personal financial gain - and which would, if run over time across diverse economic domains, appear invisible to outsiders! i.e Not even confined to "private interests" - there are black ops in Government, and it would not be difficult to imagine market manipulation for covert purposes, including covert military purposes. Such purposes would include cyber-warfare, but would obviously not be limited to this, which is one of the most commonly discussed of cyber-attack fears - the national defence decision taken by the British government to make cyber-warfare the highest priority is one recent example. Covert money laundering by black ops for both hostile and operational-funding purposes is one other alternative possibility that springs to mind! Manipulation of the Tokyo Stock Exchange has only just been discovered, and this has threatened confidence in the Tokyo Exchange world-wide. This could be only the tip of an invisible iceberg - cyber market-manipulation is happening, but to what extent and to what purposes is definitely a known unknown - and even, conceptually-speaking, a known unknowable!

|

Rumors are, the U.S. government "is propping up the stock market."

Rumors are, the U.S. government "is propping up the stock market."