Gold Breakout vs. Corporate Bonds

Commodities / Gold and Silver 2010 Oct 28, 2010 - 03:41 AM GMTBy: Jordan_Roy_Byrne

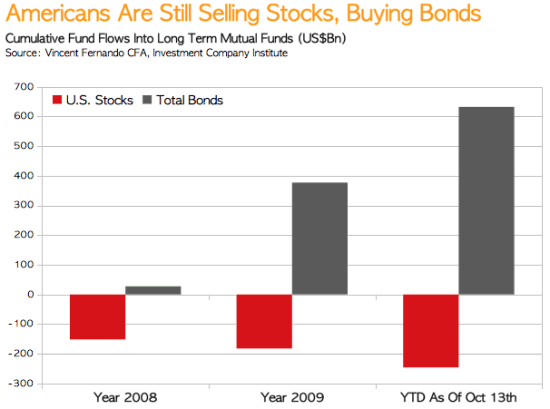

Since the financial crisis in 2008, it is undeniable that precious metals have been the best performer. One would assume that market participants have been piling into Precious Metals. Certainly some money has moved into the sector, smartly anticipating the continuance of a major bull market and looming severe inflation in the next several years. Yet, most funds have moved into fixed income (corporate bonds and treasuries) as the chart shows.

Since the financial crisis in 2008, it is undeniable that precious metals have been the best performer. One would assume that market participants have been piling into Precious Metals. Certainly some money has moved into the sector, smartly anticipating the continuance of a major bull market and looming severe inflation in the next several years. Yet, most funds have moved into fixed income (corporate bonds and treasuries) as the chart shows.

Corporate Bonds have been an even better performer than treasuries and rightly so. Not now, but a year or two years ago one could find great yield with the bonds of blue-chip companies, who will be in business for the years to come. Meanwhile, Uncle Sam has taken on the losses of the private sector amid a worsening economy. To begin with, Uncle Sam's balance sheet was a mess.

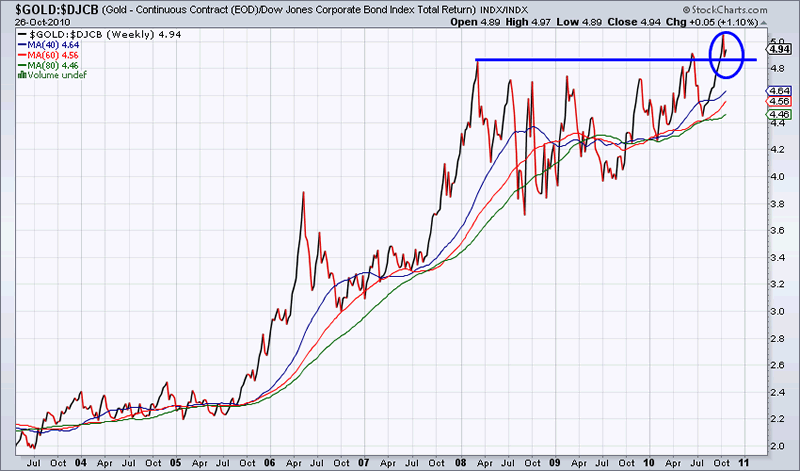

How does this all relate to Gold? Another way to track fund flows is to compare markets via intermarket analysis. Gold has performed very well but most money has moved into fixed-income. Gold will begin to accelerate when money starts moving out of bonds and into Gold. The chart below shows Gold vs. the total return of Corporate Bonds.

This ratio just brokeout from a 31-month base! Since the crisis, Gold and Corporate Bonds were performing about equally. Now Gold has gained the upper hand. This breakout could be the start of a new trend in fund flows over the next several years. Look for money to favor Gold and other Commodities, as inflation becomes a major concern. Ignore those who are promoting stocks as a way of beating inflation. Their interests are not aligned with yours.

How does this affect Gold right now? Gold is in a correction. We have upside targets of $1450-$1500 with a downside target of $1280-$1290. No one can predict the future but we can assess probabilities and manage risk. If this breakout holds then it means money in fixed-income is starting to worry about inflation. After all, the above chart is providing an early indication. This is what separates our work from the crowd. We analyze numerous charts to decipher and decode the message of the markets.

If you a precious metals investor seeking growth, you have to have some foothold in the juniors. Playing GDX or a basket of large-caps will likely leave you disappointed. In our service we seek to steer investors towards the stocks that offer not only value but also growth potential. Thus far, two of our first five junior gold picks have been taken-over. We invite you to consider a free 14-day trial as we seek to find the next takeover candidates.

Good luck ahead!

Jordan Roy-Byrne, CMT

Jordan@thedailygold.com

http://www.thedailygold.com/newsletter

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.