Silver Robust as CFTC Commissioner Alleges Price Manipulation

Commodities / Gold and Silver 2010 Oct 27, 2010 - 07:25 AM GMTBy: GoldCore

While gold fell marginally yesterday (down 30 cents) on dollar strength, silver rose by over 1% (by 28 cents to $23.81/oz) after a senior CFTC Commissioner alleged that major silver market participants were involved in manipulation and suppressing the silver price. Overnight and this morning there has been weakness in equity markets internationally and in commodity markets with suggestions that risk aversion may have picked up ahead of the FOMC decision next Wednesday.

While gold fell marginally yesterday (down 30 cents) on dollar strength, silver rose by over 1% (by 28 cents to $23.81/oz) after a senior CFTC Commissioner alleged that major silver market participants were involved in manipulation and suppressing the silver price. Overnight and this morning there has been weakness in equity markets internationally and in commodity markets with suggestions that risk aversion may have picked up ahead of the FOMC decision next Wednesday.

Gold is currently trading at $1,333.74/oz, €963.96/oz, £841.80/oz.

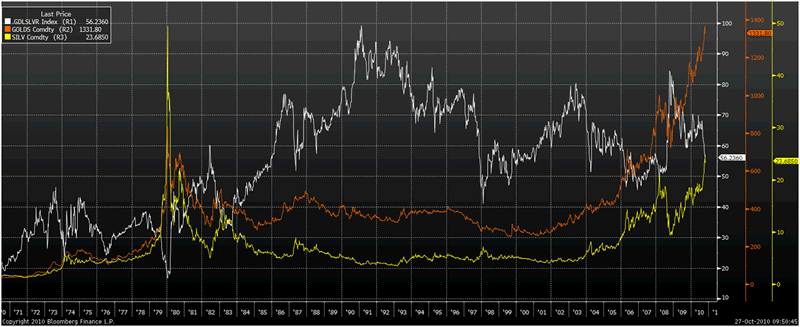

Gold (orange), Silver (yellow) and Gold/ Silver Ratio (white) - 40 Years.

Silver

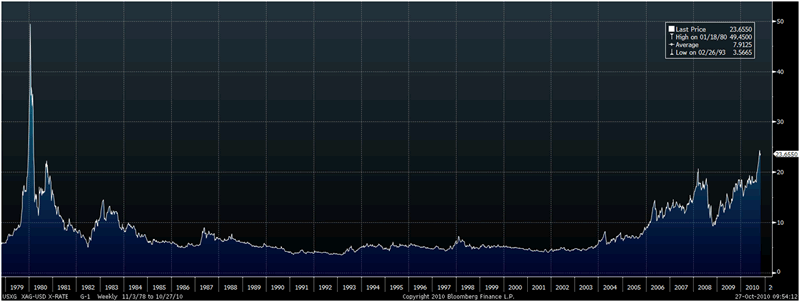

Silver looks very well technically and continues to play catch up with gold which has already risen by more than 50% over its 1980 nominal high of $850/oz (see chart above). The gold to silver ratio has fallen below 57 (56.3 - 1332/23.68) with 55 and 50 looking potential targets in the coming months. Throughout history the gold/silver ratio has been close to 15 and the average in the 20th century has been around 45. The relative undervaluation of silver to gold and the fact that it remains less than half of its (nominal) record price in 1980 is leading to strong demand for poor man's gold internationally and in Asia particularly.

Silver is currently trading at $23.73/oz, €17.16/oz and £14.98/oz.

Silver - 40 Years (Weekly).

The US commodity futures regulator is looking into claims by a former JP Morgan trader in London that JPMorgan Chase was involved in manipulative silver trading, The Wall Street Journal reports, citing a person close to the situation. Reuters reports that in recent months, Commodity Futures Trading Commission (CFTC) lawyers have interviewed employees of JPMorgan in its metals trading business, the newspaper said. Along with JPMorgan, CFTC lawyers have also interviewed industry traders, commodity executives, experts and employees of other metals trading firms, The Journal said. Ray Bashford, a spokesman for JPMorgan in Hong Kong, said the bank had no comment when contacted by Bloomberg News today.

It is hard to know how important Chilton's comments are with regard to the ongoing silver manipulation allegations.

They suggest that he himself agrees with the Gold Anti-Trust Action Committee (GATA) allegations that silver prices are manipulated. If the CFTC prosecutes those who may have manipulated gold and silver markets (as Chilton urged today) and violated commodities laws then it could lead to further volatility and higher prices. This would especially be the case if the large concentrated short positions on the COMEX, held by banks such as JP Morgan, were forced to cover their positions.

This may lead to a short squeeze that could propel silver above $30 and towards its nominal high of $50/oz in the coming months.

Platinum Group Metals

Platinum is trading at $1,693.75/oz, palladium is at $623/oz and rhodium is at $2,225/oz.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.