Gold Continues to Outshine the Field

Commodities / Gold and Silver 2010 Oct 25, 2010 - 04:12 PM GMTBy: Pete_Grant

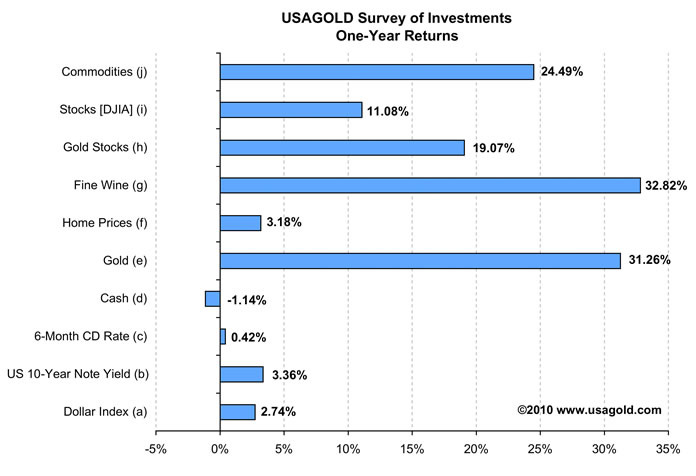

Peter Grant writes: It has been another stellar year for gold, which appreciated 31.26% in the 12-month period ended September 30, 2010. Only the Liv-ex 100 Fine Wine Index performed better, albeit nominally so. Nonetheless, let’s raise a glass to those two fine investments, gold and wine! No wait! Not the good stuff!

Peter Grant writes: It has been another stellar year for gold, which appreciated 31.26% in the 12-month period ended September 30, 2010. Only the Liv-ex 100 Fine Wine Index performed better, albeit nominally so. Nonetheless, let’s raise a glass to those two fine investments, gold and wine! No wait! Not the good stuff!

Once you’ve uncorked that heavenly bottle of Lafite Rothschild, the double-digit appreciation is meaningless, and after just four or five glasses your asset is gone completely. And worse yet, if the storage conditions were less than ideal, not only do you lose the return, but you won’t even enjoy the wine.

The first thing I notice about the one-year chart, unique to recent surveys, is that nearly everything is positive. Only the dollar bill in your pocket eroded in value as a result of the persistent weight of inflation.

On what tide are all these boats rising? Liquidity. Lots and lots of Fed-provided liquidity. With a zero interest rate policy to boot, the Fed is purposefully pushing investors out along the risk curve.

The Fed appears to be on the verge of turning the liquidity tap wide-open once again, which is likely to erase any lingering safe-haven up-ticks the dollar was clinging to at the end of September. That should continue to underpin gold.

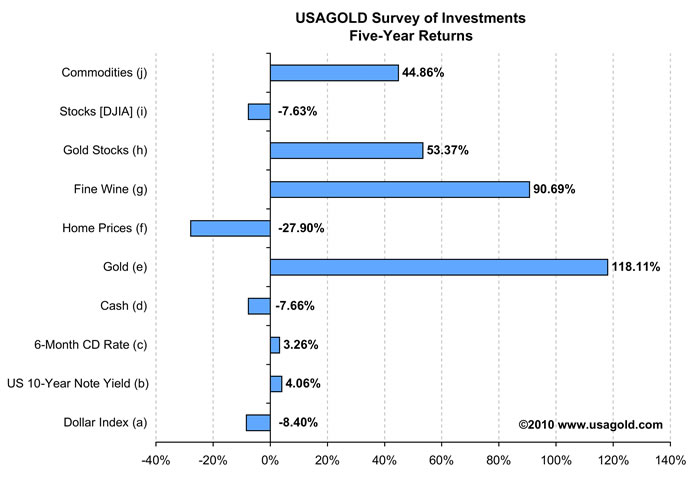

The five-year study - Gold outshines the field

In the five-year period ended September 30, 2010 gold was up 118.11%, outpacing high-flying gold stocks and the broader commodity complex as measured by the Reuters/Jefferies CRB index (which of course has a 6% allocation to gold).

The Dow Jones Industrial Average was down 7.63%, as the five-year period encompasses the 14,279.96 peak as well as the financial crisis inspired 6,440.08 low.

Residential real estate came under considerable pressure over the five-year period ended July 31, 2010 (the most recent S&P/Case-Shiller data available). While housing rebounded modestly in the past year, there remains cause for continued concern.

RealtyTrac recently reported that banks foreclosed on 102,134 properties in September. It was the first single month where foreclosures topped 100,000.

Additionally, the Foreclosure-Gate scandal is widening and nobody seems to have a firm grasp on the implications yet. While the pace of foreclosures is likely to slow in the months ahead as these paperwork issues get sorted out, the scandal is also likely to make buyers increasingly timid.

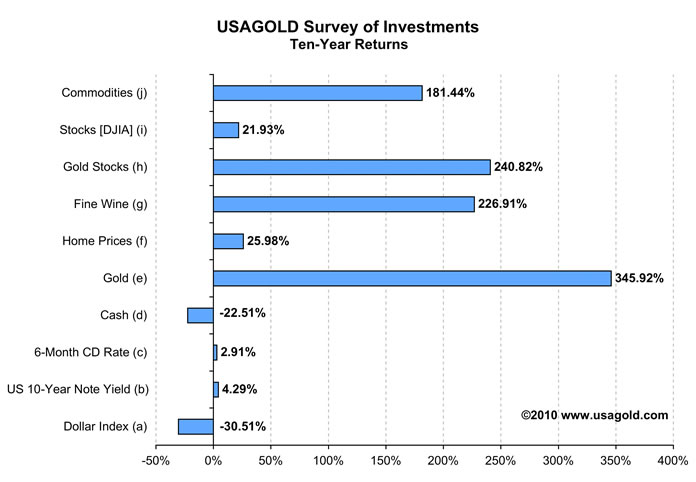

Ten-year study - Gold sets the long-term performance standard

Over the past ten years, gold has risen the most of all the assets we track. Gold stocks are a distant second, followed by fine wines and commodities.

The family home still proved to be a better investment than the Dow, but when inflation is taken into consideration, both are about a wash.

Pay particular attention to the collapse of yields and the dollar over the ten-year period, clear illustrations that your wealth is being inflated away. Stealthily.

The yield on a ten-year note fell from 4.73% in September 2001 to just 2.65% in September 2010. The yield on a six-month certificate of deposit tumbled from 2.84% to a measly 0.38% over the same period.

The dollar fell to a new all-time low against the euro in mid-2008 and was approaching its record low against the yen as the third quarter of 2010 wound down. Only aggressive intervention on the part of the Bank of Japan likely forestalled a new all-time low in the USD-JPY rate.

Concluding remarks

As a gold broker, it’s reassuring on some level to see the asset you sell at – or near – the top of our own and other investment surveys year-in and year-out. As an American, however, the policies that are driving this amazing performance are disheartening to say the least, and sadly unlikely to change any time soon.

After decades of a declining dollar and the inflation that results, the Fed is now suddenly worried that there isn’t enough inflation. They have made it abundantly clear that further accommodations are necessary to prevent deflation and reinvigorate the floundering US economy.

We are likely on the cusp of QE2 and in the midst of a currency war. We’re using up all of our ammo, while simultaneously eroding any goodwill we might have with our allies in the process.

Richard Fisher, the president of the Dallas Federal Reserve Bank, recently pointed out that the Fed is a monetary authority and is therefore limited in what it can do. Fed policy is not a substitute for fiscal policy and he suggested that regulatory and fiscal authorities "get their acts together."

However, I think Congress time and time again has made it abundantly clear that it fears sound fiscal policy. All too frequently nothing hastens to the un-invite back to Washington like talk of austerity measures and tax hikes. So Congress, in seeking political cover, foists the tough decisions on the Fed with its limited toolbox.

The Fed has neither the power to tax, nor the power to cut government spending, so it is liquidity we shall have. Lots and lots more liquidity. Mr. Fisher went on to recommend that any policy designed to stimulate our moribund economy -- whether it be monetary of fiscal – be done in a way that "doesn't scare people about the ultimate liabilities we're going to pile up over time."

Too late. Many are plenty scared already. It is only through proper portfolio diversification, including a physical gold component, that allows them to sleep at night.

For a free subscription to our newsletters, please click here.

By Pete Grant , Senior Metals Analyst, Account Executive

USAGOLD - Centennial Precious Metals, Denver

For more information on the role gold can play in your portfolio, please see The ABCs of Gold Investing : How to Protect and Build Your Wealth with Gold by Michael J. Kosares.

Pete Grant is the Senior Metals Analyst and an Account Executive with USAGOLD - Centennial Precious Metals. He has spent the majority of his career as a global markets analyst. He began trading IMM currency futures at the Chicago Mercantile Exchange in the mid-1980's. In 1988 Mr. Grant joined MMS International as a foreign exchange market analyst. MMS was acquired by Standard & Poor's a short time later. Pete spent twelve years with S&P - MMS, where he became the Senior Managing FX Strategist. As a manager of the award-winning Currency Market Insight product, he was responsible for the daily real-time forecasting of the world's major and emerging currency pairs, along with gold and precious metals, to a global institutional audience. Pete was consistently recognized for providing invaluable services to his clients in the areas of custom trading strategies and risk assessment. The financial press frequently reported his expert market insights, risk evaluations and forecasts. Prior to joining USAGOLD, Mr. Grant served as VP of Operations and Chief Metals Trader for a Denver based investment management firm.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.