Stock Market Trading, How to Be A Better Loser

InvestorEducation / Learn to Trade Oct 25, 2010 - 01:55 PM GMTBy: David_Grandey

As in being grounded in reality. The stock market is a two way street. Sometimes your the bat and sometimes the ball and much like life being a dance so is the stock market.

As in being grounded in reality. The stock market is a two way street. Sometimes your the bat and sometimes the ball and much like life being a dance so is the stock market.

We can’t tell you how many sites we’ve been to and subscribed to in the past but we can tell you most spend very little time if any talking about their losing trades. Let’s face it there is not a site or investor on this planet who has not gone under water on a trade.

So today let’s talk about being a loser and how to be a better one.

How to Be A Better Loser

Over the weekend one of our subscribers mentioned to us that we always talk about the ones we’ve made money on but what about the trades we’ve lost on. And he’s right so let’s take a look at a stock we lost money on in the recent past.

Losing To Win — RVBD

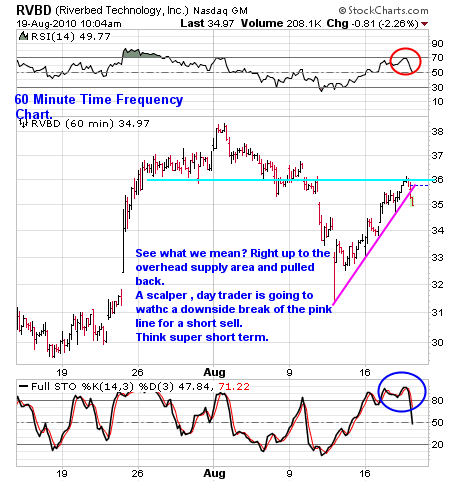

Back on August 19th we went short RVBD at 35.41 when it broke an uptrend to the downside off the August lows after testing some overhead supply as shown below.

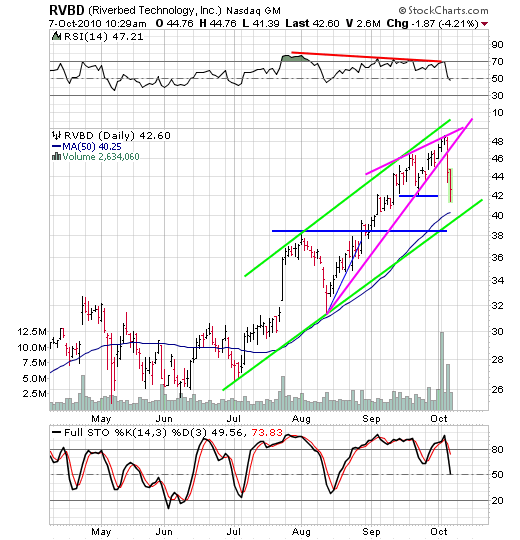

Since that time this issue was one that ended up being a thorn in our side and we fought with it for some time. Needless to say that issue walked its way up to 48 and change.

When the rest of the cloud stocks rolled over this issue really didn’t roll over to the degree that some of the others in that space did. To make a long story short in that pull back to the 42 level we walked away and took our loss on the issue.

Here is what it looks like now.

For us it was a successful trade, why you ask? How can losing be a successful trade?

Simple, we stress position size risk management and it is always for us of the utmost importance. That position made up 6.5% of our overall portfolio when we shorted it. In the end we lost 18.7% on the position on its own. While on its own that sounds like a lot, but the TOTAL IMPACT TO THE OVERALL PORTFOLIO was a whopping 1.2 percent loss.

Furthermore, since that time this issue has bounced off of that support level (where we walked away) and not only retested its highs, but on Friday it got an earnings pop and that took the issue to new highs with follow through today.

So where is the losing to win part? Simple, we waited for a pullback, took a loss, and walked away. Had we not used that pullback to walk away that loss we took would have been much much greater.

We lost 18.7 % on the position on its own, overall impact to the total value of the portfolio was 1.2% or -$1,995.00.

Had we not did that? The loss on the position would have been (at today’s highs of 56.80) -60% on the position alone or -$6,417 dollars, total impact to the overall portfolio would have been 3.9% for a difference of $4,422 dollars. This what we mean when we say lose to win.

The point we want to make with this exersise is that of the importance of Position Size Risk Management — it’s a lifesaver. No matter what you do, where you go, wherever you trade or however you trade this is the absolute best fail safe for when things go awry and over the next 100 years will continue to be no matter what you do. Use it — it’s a tool for you no matter who you are.

By David Grandeywww.allabouttrends.net

To learn more, sign up for our free newsletter and receive our free report -- "How To Outperform 90% Of Wall Street With Just $500 A Week."

David Grandey is the founder of All About Trends, an email newsletter service revealing stocks in ideal set-ups offering potential significant short-term gains. A successful canslim-based stock market investor for the past 10 years, he has worked for Meriwest Credit Union Silicon Valley Bank, helping to establish brand awareness and credibility through feature editorial coverage in leading national and local news media.

© 2010 Copyright David Grandey- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.