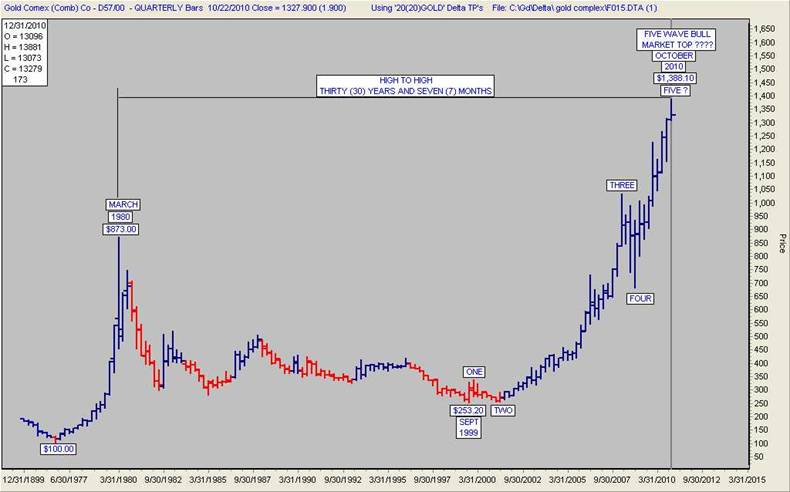

Gold Five Wave Bull Market Top?

Commodities / Gold and Silver 2010 Oct 24, 2010 - 10:26 AM GMTBy: Ronald_Rosen

“Time is the most important factor in determining market movements because the future is a repetition of the past and each market movement is working out time in relation to some previous Time Cycle.”

“Time is the most important factor in determining market movements because the future is a repetition of the past and each market movement is working out time in relation to some previous Time Cycle.”

“You should always figure the time from any top or high level to the next top or high point. Also figure the time from any low level to the next low level. Then figure the time from a low level to a high level and the time from the last high level down to the low level. By doing this, you will know when Time Periods balance or come out about the same as a previous move. This is balancing of time. By knowing these dates and prices, it will help you to determine the duration of the next move.”

“30 year cycle

This is the main cycle and the minor cycles are proportionate parts of the 30-year cycle or circle.”

GOLD QUARTERLY

GOLD

[---------------------------------------------------------]

APPROXIMATELY 30 YEARS BOTTOM TO BOTTOM

[…………………………..] [………………………..]

BOTTOM TO TOP BOTTOM TO TOP

APPROXIMATELY APPROXIMATELY

ELEVEN YEARS ELEVEN YEARS

DOLLAR INDEX - QUARTERLY SCENARIO # 1 - SYMMETRICAL TRIANGLE

Click here

v

The Impossible Dream

DOLLAR INDEX - QUARTERLY SCENARIO # 2 - NEW BULL MARKET

A Dollar Index bull market may be impossible but corrections are written in stone.

How far down will a correction go? Can gold correct to $954, $820, or $687? Emphatically no, never happen, or can it? Old man Gann seemed to think that the markets ran in cycles. He even thought that the 30 year cycle was the most important.

“Time is the most important factor in determining market movements because the future is a repetition of the past and each market movement is working out time in relation to some previous Time Cycle.” W. D. Gann

Stay tuned.

GOLD QUARTERLY

Subscriptions to the Rosen Market Timing Letter with the Delta Turning Points for gold, silver, stock indices, dollar index, crude oil and many other items are available at: www.wilder-concepts.com/rosenletter.aspx

By Ron Rosen

M I G H T Y I N S P I R I T

Ronald L. Rosen served in the U.S.Navy, with two combat tours Korean War. He later graduated from New York University and became a Registered Representative, stock and commodity broker with Carl M. Loeb, Rhodes & Co. and then Carter, Berlind and Weill. He retired to become private investor and is a director of the Delta Society International

Disclaimer: The contents of this letter represent the opinions of Ronald L. Rosen and Alistair Gilbert Nothing contained herein is intended as investment advice or recommendations for specific investment decisions, and you should not rely on it as such. Ronald L. Rosen and Alistair Gilbert are not registered investment advisors. Information and analysis above are derived from sources and using methods believed to be reliable, but Ronald L. Rosen and Alistair Gilbert cannot accept responsibility for any trading losses you may incur as a result of your reliance on this analysis and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities. Do your own due diligence regarding personal investment decisions.

Ronald Rosen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

David

29 Oct 10, 09:51 |

rosen

Very poor track record. |