Iceland Inflation, Debt and New Mortgage Crisis, U.S. How Far Behind?

Economics / Global Debt Crisis Oct 24, 2010 - 04:37 AM GMTBy: Dian_L_Chu

The Icelandic financial crisis has been ongoing since 2008 when all three of the country's major commercial banks collapsed after they failed to refinancing their short-term debt and a run on deposits in the U.K.

The Icelandic financial crisis has been ongoing since 2008 when all three of the country's major commercial banks collapsed after they failed to refinancing their short-term debt and a run on deposits in the U.K.

In July, I talked about how Iceland is totally not a post-crisis miracle as Paul Krugman claims, but just how are things now with Land of Fire and Ice?

Scary Economic Numbers

Scary Economic Numbers Some of the scary economic figures, courtesy primarily of the plunging Icelandic króna:

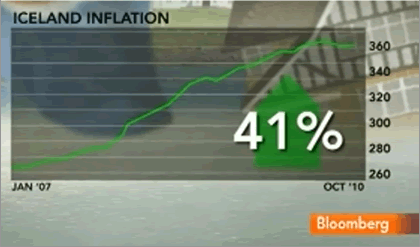

- Inflation has soared 41 percent from January 2007 through September this year (see screen print from Bloomberg)

- Real disposable incomes slumped 20.3 percent last year

- Real wages fell 10.1 percent from the beginning of 2007 through August this year

- 63 percent of the nation's mortgage is underwater

- 40 percent of homeowners are "technically insolvent"

$2 Billion Mortgage Write-off - Who Will Pay?

Bloomberg (clip below) reported that Iceland government last week proposed a debt relief bill to write off up to 220 billion króna ($1.99 billion) in mortgage loans. This is after about 8,000 protesters gathered outside parliament demonstrating their anger over rising homeowner insolvencies.

Most of Iceland’s mortgage debt is inflation-linked. So, what that means is that the principal has gone up 41% in three years, while everything from wage, income to real purchasing power has gone the opposite direction.

This debt relief sounds all nice and dandy, but the problem is a write-down of almost $2 billion is equivalent to about 8 percent of total assets at Iceland’s three biggest banks, their 2009 balance sheets show.

Moreover, Iceland’s pension funds, which hold most of the bonds behind the nation's mortgage debt, said they will try to block proposals. If the banks are forced to take a flat write-off, the government most likely will need to cover the loss of pension funds, i.e. taking on more debt.

Iceland, Ireland & Japan - Default Inevitable?

Separately, a WSJ article noted that during a speech at the Value Investing Congress in New York, Kyle Bass, head of $900 million hedge fund firm Hayman Advisors, says,

Iceland had sovereign debt of roughly 35% of its GDP. However, the country's three largest banks amassed roughly $200 billion of assets -- 10 times the country's GDP. When the financial crisis hit and Iceland had to bail out its banks, the country's sovereign debt ballooned.

According to Bass, right now, in terms of the size of banking systems relative to GDP. Iceland and Ireland are top of the list, thus post the highest sovereign debt risk. Ireland's on balance-sheet obligations are about 85% of GDP, but the country's bank bailout program is another 50% of GDP.

Meanwhile, Bass also warned that Japan may default in coming years. He said From 1989 to 2009, government debt grew 137%. But since Japan's interest rate is close to zero (so is the United States), it will be getting more difficult to pile on debt without incurring higher interest payments, and increasingly will need to go abroad for financing.

Bass estimated Japan is currently paying about 9.5 trillion yen in interest. Every one percentage point increase in the interest rate increases Japan's interest payments by 10.5 trillion yen.

Currency Debase - No Solution to Debt

Since this season is all about currency war to prop up economies, there's an increasing chorus from Washington to famed economists believing that the U.S. will become more competitive, thus creating more jobs, through massive dollar devaluation (50%) or wage deflation (the two are one of the same, in my opinion).

Well, we may take a look at Iceland to test that theory.

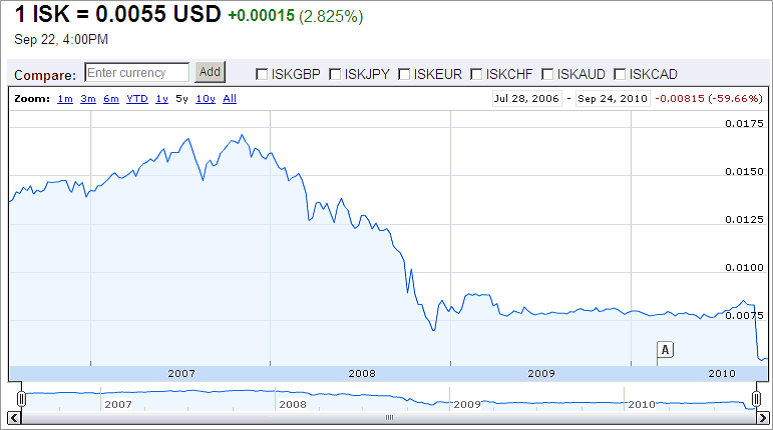

Iceland's currency has devalued almost 60% since July 2006 (see chart), wages also fell, and aside from IMF's loan, Iceland's been held together mostly by "technical defaults" and capital control.

While the currency devaluation might have helped the nation's export (while forcing debtors taking haircuts), the domestic inflation, and asset devaluation, most likely will wipe out the entire middle class (hence the "Angry Icelandic 8,000").

United States Not Far Behind?

Due to its size, massive resources and different macroeconomic makeup, the United States, although inching closer to Iceland, Ireland and Japan, in terms of debt levels, housing, mortgage and banking bust, has not quite fallen into the similar trap yet.

Nevertheless, US Federal debt is around 94.27% of GDP as of October, 2010, up from 57% just ten years ago. CBO projected U.S. debt would reach 100% of GDP within a decade (the next five years seems more likely the way it's going).

Meanwhile, by observing crisis unravel in countries with fiscal situations not that different from the U.S. hopefully would serve as a warning and prophecy of things to come. Whether the prophecy will be fulfilled is yet to be seen.

Dian L. Chu, M.B.A., C.P.M. and Chartered Economist, is a market analyst and financial writer regularly contributing to Seeking Alpha, Zero Hedge, and other major investment websites. Ms. Chu has been syndicated to Reuters, USA Today, NPR, and BusinessWeek. She blogs at Economic Forecasts & Opinions.

© 2010 Copyright Dian L. Chu - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.