Should You Be Worried About Deflation?

Economics / Deflation Oct 24, 2010 - 03:55 AM GMTBy: Mike_Stathis

Last month, I followed up on a discussion I began in over a year ago as to why hyperinflation would be a very unlikely scenario in the U.S.

Last month, I followed up on a discussion I began in over a year ago as to why hyperinflation would be a very unlikely scenario in the U.S.

In summary, this devastating scenario is a virtual impossibility despite the printing frenzy by the Fed because the banks have held onto most of this newly printed currency, keeping it out of the hands of consumers. (1) I discussed this fact over a year ago when I first debunked the deflation myth. (2)

Before I discuss possibilities of deflation, I wanted to summarize my argument as to why hyperinflation isn’t going to happen in the U.S., as well as the underlying motives behind this myth. I also wanted to address the motive behind the NBER’s recent announcement that the recession ended in June 2009.

Since consumers account for about 70% of the U.S. economy, how can the U.S. experience hyperinflation if they aren’t receiving the dollars printed by the Fed?

This relates to basic economics underlying the tug-of-war between supply, demand and pricing. In order to have hyperinflation, you need a relentless demand for a small supply of goods and services. It is this enormous disparity between supply and demand that drives prices to the moon.

In order to keep up with this endless demand for goods and services, more currency is printed. Wages are raised serving to flood more money into the hands of consumers, who bid up the price of goods and services even more. Eventually, this cycle leads to a currency that’s nearly worthless. That scenario represents the basic consequences of hyperinflation.

Warnings of hyperinflation have come from agenda-ridden hacks, most of which have disseminated this myth throughout the Internet and financial networks. These are the gold bugs. Many of them are naïve followers. Many more are opportunists. They’ve been trying their hardest to pump up the price of gold after claiming it’s a hedge against inflation. (3)

As I have discussed on numerous occasions beginning with America’s Financial Apocalypse (2006) gold isn’t a hedge against inflation. My 3-part series “Fool’s Gold” pretty much drove that point into the ground. (4)

I myself forecast gold to soar in America’s Financial Apocalypse.

And I reiterated my buy on gold in several articles in 2008.

“Over the next decade, I expect gold, select foreign currencies, oil trusts, TIPS, Chinese and Latin American equities to significantly outperform the U.S. stock market. Watch out though, because if things get really bad, the entire world will be affected. But that will represent a buying opportunity in Chinese and Brazilian equities.” (5)

“No matter what you want to call it, the effects will be the same – more pain to the financial industry and the dollar. But it won’t send with Indy, Fannie, Freddie or the rest of the financial industry. Most likely the automotive and airlines industries will also need a bailout – that is, unless some firm is foolish enough to buy them… you would be advised to buy gold, oil, and foreign currencies.” (6)

However, since early 2009 I have not liked the fundamental drivers of gold appreciation. Specifically, the propaganda aired by hacks has scared many of the new gold investors into thinking that gold will offer them a “life-line” when all hell breaks loose.

While gold is headed higher, the important thing to focus on is risk. While I wouldn’t be selling gold just yet, I certainly wouldn’t be buying it. The higher an asset rises in price, the higher the risk becomes because valuation (or in gold’s case since it has no inherent value) is indirectly proportional to risk. Unfortunately, most of the hacks pumping up gold lack an adequate understanding of risk and valuation as well as suitability. So they are perfect pitch men for gold.

Several weeks ago, I also discussed the fact that the term “double-dip” recession has no validity for two reasons. (7)

First, it makes no sense if you adhere to the theory of recessions and expansions as they pertain to the economic cycle. Next, the term implies the recession ended, which I have shown is not the case. (8)

Since that time, the NBER concluded that the recession ended in June 2009. This is complete hogwash. It's clear to me that the NBER has given into pressures from the White House to make bogus claims that the recession ended in June 2009.

Remember, this is an election year. With just two months remaining before facing voters, democrats are shaking in their pants because there hasn't been a single bit of good news or positive developments since Obama has been in office. Americans should be accustomed to that. Bush didn't do a damn thing for the people as well. For Americans, it doesn't really matter who wins these elections because the Washington mafia always yields the same results; results focused on empowering corporate America at the expense of the people.

While I view the NBER as more credible than other economic organizations, the fact is that they still bow down to Washington and the Federal Reserve because the organization is made up of academic economists. Have a look at the list of researchers and see where they are from. If you have a good deal of time on your hands, you might want to research their ties more closely. http://www.nber.org/vitae.html

Never mind all the stimulus packages jettisoned into the economy in 2009. The fact is that even if this wasteful use of tax dollars did in fact end the recession, isn't this similar to cheating?

After all, this money has to be paid off eventually. You can never claim the economy has healed if it has not healed on its own or by instituting the types of fundamental changes that were responsible for the problems to begin with. So, ask yourself these questions...

Has free trade been restructured?

Will Wall Street reform be effective?

Does America have an affordable healthcare system?

By now, you should realize the answer to each of these three critical questions is NO.

Despite adding trillions to the national debt, the actions taken by Washington, the U.S. Treasury and Federal Reserve did not put an end to the recession by June 2009. The longest recession since the longest during the Great Depression is alive and well. In fact, it's possible this recession will eclipse the 43-month recession during the Great Depression.

Now that the housing subsidies have expired, the Federal Reserve has tripled its balance sheet to about $2.4 trillion through the purchase of toxic assets, now that much of the stimulus funds have been spent, the economy is poised to get worse.

Of course, many Americans will accept the claims made by the NBER without bothering to recall that these same economists missed much the collapse until after it occurred. Recently, I discussed how the declining housing market is going to impact GDP and ultimately the stock market. (9)

As I have discussed since the ARRA was passed in early 2009, I can guarantee you we will see many more stimulus packages over the next several years. And each time, as tax dollars are spent, Washington will claim that the recession ended.

This recession will end. But it hasn't yet. Even when it does end, you can expect a few more recessions over the next several years. In summation, this period will be remembered as America's Second Great Depression. As long as you keep the big picture in mind, you will be positioned to avoid excessive risk and seize spectacular opportunities while others crash and burn. (10)

For short-term traders, the news by the NBER has been a dream come true. Since the news was released, the U.S. stock market broke above a critical technical level. However, with Q3 earnings approaching, I would be surprised to see these levels hold. And by the time Q4 earnings and GDP data is released in early 2011, if the stock market has not adjusted downward to reflect the real economic picture, things could get ugly.

As economic stimulus funds and subsidies run dry, some experts are now expressing concerns over deflation. This offers yet more drama for the financial media to attract a large audience. The media only cares about drama because it attracts a large audience. A large audience brings in huge ad revenues. That’s all the media cares about. The quality of content is not a concern.

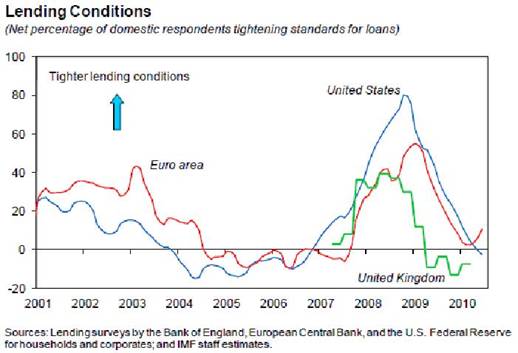

Certainly, it’s common sense to have concerns of deflation. After all, with the worst employment situation since the Great Depression, very tight credit markets, the need to deleverage and taxpayer-funded stimulus plans running dry, what else would you expect?

U.S. consumers simply don’t have much money. Others that do are paying off debt and saving for the storm. So of course we will see some relative deflation. But we are not seeing deflation now, nor will we through the remainder of 2010 in my opinion.

Keep in mind that the deflation hacks have been claiming the U.S. has been in deflation for over two years, so they’re jumping for joy now that some credible experts have issued these warnings. However, we should question whether even the most esteemed investment experts understand what’s going on. After all, they join the rest of the world in failing to predict the collapse.

When extremists want to make a case for deflation or inflation, they point to many things that don’t matter; anything they can come up with to strengthen their argument because they have agendas.

The best way to determine the level of deflation or inflation is to look at the relative price change within a basket of goods, preferably basic necessities. Ask yourself whether energy, healthcare, food, or education costs have declined over the past few years. These are basic living items that drain working class wages, leaving little for disposable income.

The only real price declines we have seen have been in housing. In part, the housing correction has masked high inflation in basic necessities. Housing cost declines have added a large deflationary component (up to 25%) to the inflation data. This has masked the official data. But ask yourself whether the collapse in housing costs has helped you pay for living expenses. Meanwhile, employee benefits continue to be slashed which adds to inflation.

Forget the money supply and everything else the deflation hacks have thrown at you. The only thing that matters is the price of goods and services because consumers control close to 70% of the economy. Thus, any other measures are essentially meaningless.

Deflation, as it applies to consumers means the cost of goods and services declines significantly. Inflation means just the opposite. In between we have disinflation, or the winding down of prices. Right now we are seeing some disinflation in my opinion. While the U.S. economy is likely to experience short periods of deflation over the next several years, it shouldn’t be much of a problem because Washington will continue with its attempt to consume its way out of this depression.

Deflation might bear its head at a later stage as it did in late 2008. But this depression will be characterized primarily by inflation. You might be thinking this doesn’t make sense. If so, then you aren’t familiar with inflation trends. Or perhaps you aren’t aware of how Washington understates inflation data. I devoted an entire chapter to the manipulation of economic data in America’s Financial Apocalypse. Thereafter, I discussed this topic in other publications. (11) (12) (13) (14)

We will continue to experience excessive inflation of basic goods and services, like oil, food and healthcare, much as we have for the past several years.

Combined with double-digit unemployment, very high underemployment, muted real wage growth will act in unison to squeeze consumers further over the next several years. Finally, some 76 million baby boomers will have little disposable income remaining to fuel the economy. For many, it will be a silent depression.

Why will the depression be silent? Because the daily events that have caused panic will come to an end in a few years. Meanwhile, the massive tax payer-funded bailout and stimulus funds will cause most Americans think that a recovery is in place. (15)

But there won’t be bread lines. Washington has food stamps and other subsidies. Already, more than 41 million Americans are on food stamps.

An economic recovery will be an illusion much like that created prior to 2007.It will be a much different depression than the previous one. And you should expect it to be different. After all, America is very different than it was decades ago, as is the rest of the world. (16)

I discussed this many times in the past. Let’s have a look at some excerpts from an article I published in October 2008.

“Instead of massive unemployment, we will see significant unemployment combined with massive underemployment. Already, my estimates are that the real unemployment rate is approaching 9% while the underemployment rate is 20 to 25%. Over the next few years, the underemployment rate will continue to increase and could top 50%. As well, we won’t see banks close their doors because we have the FDIC. Sure, it will run out of reserves most likely within the next 2 years, but that doesn’t matter because the Fed will just print more money, causing higher inflation. All of this will put further downward pressure on living standards. The devastation won’t be due to a crisis, it will be only heightened by a crisis. The real devastation will be due to the transfer of wealth and jobs overseas. It will be a silent depression.”

In a few years, the real estate and banking crisis will have cooled off and Washington will start reporting much improved numbers; numbers that will continue to be manipulated. In reality, things will only get worse. Real wages won’t budge, inflation for basic necessities will remain high and most likely be higher, and job quality will continue to decline. It will be a silent depression because there will be no crisis. You won’t feel the full effects on any given day. If you’re in the lucky majority, you will go to work and carry out your life as usual. But you just won’t be able to make ends meet like in the past. Each year things will get worse so you’ll spend more on credit.

It will be more difficult for your children to raise their income status because higher education is becoming an unaffordable luxury for the wealthy. Millions will be stuck in slave labor, working for low wages and no benefits. And they won’t be working in factories churning out goods for the global economy. They will be working in service jobs, tailoring to the needs of America’s wealthy.

And when you retire, only then will you realize that you’ve lived through a depression because you will run out of money. If you are lucky enough to have a home, you might have to end up selling it to pay for your medical bills, even if you have health insurance. The smaller minority will have a much worse fate.

What the ‘experts’ don’t get is that this will be a depression that will be much more difficult to reverse because it will be gradual. There will be no urgency. Many will wake up one day in a few years and realize that they just can’t make ends meet; they’ll have very little if any retirement assets. It will be a continuation of declining living standards to a point that could lead to some major societal problems.” (17)

One cannot compare the 1930s to the current time in order to determine if we are in the early stages of a depression because living standards were much lower back then. As I have stated on numerous occasions, one of the best ways to determine whether we are in a depression is to compare the decline in living standards between the roaring ‘20s and the 1930s to the decline between the roaring ‘90s and now.

If you do this you will see a similar decline. The next time some hack tells you we won’t enter a depression because there won’t be bread lines, you need to reply that there are bread lines. Washington has a different name for them. They are called food stamps and 41 million Americans are in this program.

The next time a hack tells you we won’t enter a depression because the Federal Reserve is printing money to create demand, remind them that it’s false demand; it’s short-term demand financed by long-term debt. And it’s serving to kick the can forward, ensuring a long duration of socioeconomic demise.

In conclusion, Washington and the Fed intend to create artificial demand as a solution to this depression. But this will only prolong the economic devastation, while adding to the nation’s long-term debt. While there will be brief deflationary periods, this will be largely an inflationary depression, as discussed in America’s Financial Apocalypse.

The scare tactics issued by Wall Street hacks have been designed to create panic, so as to keep you in a state of confusion. Others want to scare you into a doomsday scenario, offering gold as the solution.

The misguided views by some pundits and hacks have been designed to create optimism, as ordered by Washington. Denials and delusions by economists are designed to keep you in the dark, hoping you’ll gain confidence in the economy; hoping you’ll go out and spend more of what you don’t have. It’s a plan to create false demand through the illusion of an economic recovery. But these tactics aren’t going to work because this is no typical recession. (18)

This economic apocalypse is not one based on lack of confidence. It’s centered on fundamental economic problems neglected by politicians and economists for many years, as I detailed in America’s Financial Apocalypse.

It would be in the best interests of the nation for Washington to admit the full magnitude and scope of the problems now, so consumers can take the necessary steps to shield themselves from further devastation. But that’s not the way things are done in America. The people come last.

Because I expect to see short periods of deflation mixed in with a longer period of significant inflation (but not hyperinflation), I’m going to give you a general investment game plan so you can handle periods of inflation and deflation.

Investment Strategy for Inflation: oil, commodities, real estate and TIPS (if Washington finally decides to accurately report inflation)

In terms of inflation, oil is the best hedge you can get; specifically, oil securities that pay good dividends like oil trusts and MLPs. Dividend-bearing securities are the most important investment to own during bear markets. And oil is the best asset to own during inflation.

Commodities generally provide a good hedge against inflation. But oil is much better because it's more than a commodity. It’s got the dollar-oil link going for it that’s so critical to the U.S. economy. As I discussed in America’s Financial Apocalypse and many times since, this vital economic link enables the U.S. to export inflation throughout the globe.

But let’s assume a magical fantasy occurred; the U.S. experienced hyperinflation. Oil would eventually soar to millions or even billions of dollars per barrel.

So if anything, investors should want to own oil because it serves as the best hedge against inflation. The next best things to have if hyperinflation were to occur would be food, water, guns and bullets, but not gold.

Investment Strategy for Deflation: cash, CDs, and select stocks

While inflation and deflation are generally bad for stocks and bonds, most experts contend that inflation is worse for bonds than stocks. Meanwhile, they also claim that deflation is worse for stocks than bonds. These are generalizations that can actually cause you to lose a lot of money if you’re not careful to dissect precisely what’s going on.

For instance, if bonds are purchased during an inflationary period after interest rates have risen significantly (in response to inflation) they can provide excellent returns. If bonds are purchased prior to heightened inflation, the low dividend won’t be adequate to neutralize the effects of inflation.

Well-managed bond funds can dampen the effects of inflation on diminished returns through prudent management of the yield curve and other prognosticators of rising interest rates.

However, open-end bond funds have excessive fees. I prefer to invest in closed-end bond funds because they have lower fees and more transparency. However, they are not without their own unique risks.

While deflation typically crushes stock values due to diminished revenues, I would expect certain companies to be able to mitigate this effect.

Defensive industries such as consumer staples, healthcare, and others are likely to outperform the broad market during deflationary conditions because consumers must buy these items. Other companies are positioned in the sweet spot because they have established virtual monopolies and can raise prices leaving consumers with few alternatives.

The point is that you must understand precisely what’s going on in the economy. You must also understand how each company makes money and identify methods companies have to mitigate the effects of deflation. Finally, valuations matter because securities pricing is directly related to investment risk.

Finally, the most important skill investors can have to navigate this long period of economic turmoil and market volatility will be market forecasting. Granted, this is an extremely difficult task for even the most seasoned investors.

At AVA Investment Analytics, we advise financial institutions, financial advisers, corporations and venture capital firms. We do research full time for a living. We do not sell securities or gold, so we have no agendas.

If you want the unbiased truth, world-class research and guidance covering economic analysis of the U.S. economy and the global economy, U.S. stock market forecasts for the U.S., China, India, Brazil, securities analysis, foreign currency forecasts, top-notch investor education, you should subscribe to the AVA Investment Analytics newsletter today. We provide one of the most comprehensive and insightful investment newsletters in the world. More important, we get things right, ahead of time. www.avaresearch.com

By Mike Stathis

www.avaresearch.com

Copyright © 2010. All Rights Reserved. Mike Stathis.

Mike Stathis is the Managing Principal of Apex Venture Advisors , a business and investment intelligence firm serving the needs of venture firms, corporations and hedge funds on a variety of projects. Mike's work in the private markets includes valuation analysis, deal structuring, and business strategy. In the public markets he has assisted hedge funds with investment strategy, valuation analysis, market forecasting, risk management, and distressed securities analysis. Prior to Apex Advisors, Mike worked at UBS and Bear Stearns, focusing on asset management and merchant banking.

The accuracy of his predictions and insights detailed in the 2006 release of America's Financial Apocalypse and Cashing in on the Real Estate Bubble have positioned him as one of America's most insightful and creative financial minds. These books serve as proof that he remains well ahead of the curve, as he continues to position his clients with a unique competitive advantage. His first book, The Startup Company Bible for Entrepreneurs has become required reading for high-tech entrepreneurs, and is used in several business schools as a required text for completion of the MBA program.

Restrictions Against Reproduction: No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without the prior written permission of the copyright owner and the Publisher. These articles and commentaries cannot be reposted or used in any publications for which there is any revenue generated directly or indirectly. These articles cannot be used to enhance the viewer appeal of any website, including any ad revenue on the website, other than those sites for which specific written permission has been granted. Any such violations are unlawful and violators will be prosecuted in accordance with these laws.

Requests to the Publisher for permission or further information should be sent to info@apexva.com

Books Published

"America's Financial Apocalypse" (Condensed Version) http://www.amazon.com/...

"Cashing in on the Real Estate Bubble" http://www.amazon.com/...

"The Startup Company Bible for Entrepreneurs" http://www.amazon.com...

Disclaimer: All investment commentaries and recommendations herein have been presented for educational purposes, are generic and not meant to serve as individual investment advice, and should not be taken as such. Readers should consult their registered financial representative to determine the suitability of all investment strategies discussed. Without a consideration of each investor's financial profile. The investment strategies herein do not apply to 401(k), IRA or any other tax-deferred retirement accounts due to the limitations of these investment vehicles.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.