How To Buy Stocks Ahead Of Corporate Earnings

Companies / Company Chart Analysis Oct 23, 2010 - 05:55 AM GMTBy: David_Grandey

NFLX reported earnings this week. There’s no secret that this stock is a leading stock and it was likely to move sharply one way or the other immediately following their earnings announcement.

NFLX reported earnings this week. There’s no secret that this stock is a leading stock and it was likely to move sharply one way or the other immediately following their earnings announcement.

So do we just blindly buy ahead of earnings and hope for the best? No. It’s all about what the chart is telling us to do and having a game plan where we prepare for the worst and expect the best. Here’s how we analyzed NFLX to make trading decisions prior to the release of their earnings announcement.

When evaluating any trade, you should get familiar with the phrase:

“Prepare For The Worst, Expect The Best”

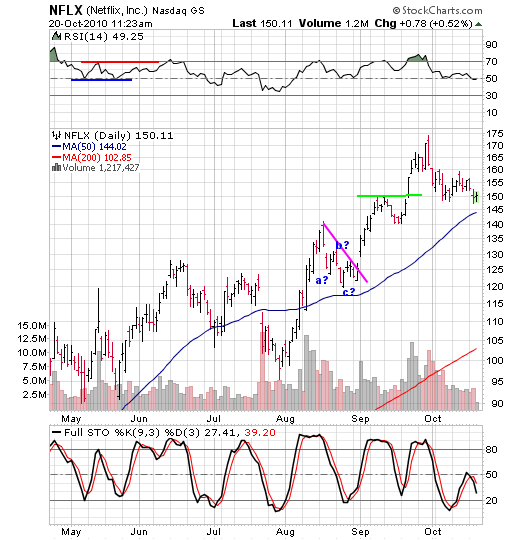

Prior to the earnings announcement, NFLX was Pulling Back Off Highs (POH) just like in August and down to the 50 day average. This is a bullish chart pattern. This is how the chart looked prior to their earnings announcement after the close on Wednesday:

So what do we do? So there are a few ways to look at it.

We could wait till after earnings and if they slam it we buy at the opening slam on the long side. If they pop it on earnings? We do nothing.

OR

We could buy a probing position to be there. Say 50 shares, or half our normal position . If they pop it? We are there and will ring the register on that pop. If they slam it? We buy a full position on the slam of 100 shares.

Options? If you buy calls and they slam it you get wiped out! If you buy puts and they pop it you get wiped out. Thanks anyway not for us.

We were prepared for the worst by having a game plan should the worst occur (slam on announcement) when we said:

“We could buy a probing position to be there. Say half our normal position of 50 shares . If they pop it? We are there and will ring the register on that pop. If they slam it? We buy a full position on the slam of 100 shares.”

So that all said — we took a flyer by buying 50 shares of NFLX at 150.13.

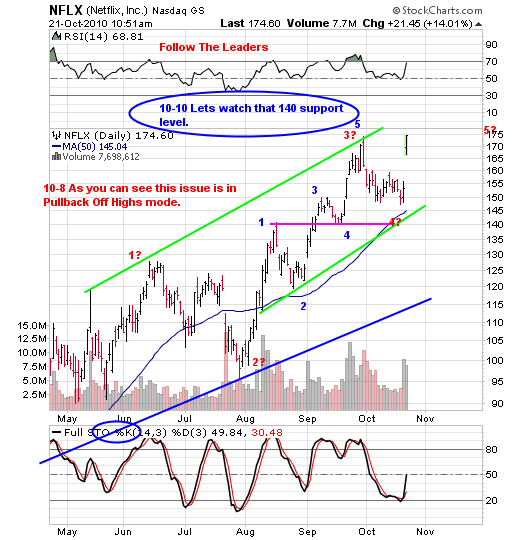

So how did NFLX do after the announcement?

Its Official! — A KOWABUNGA MOMENT.

Netflix pops in after hours and opened Thursday morning at 169.54.

That’s about 19.41 points to those who trade in tandem with us. On 50 shares it’s a gain of $970.50 dollars. Not bad.

And for smaller accounts at 25 share position was worth $485.25!

Bottom line is this — Always have a game plan in the event for when things go against you. That way if they happen? It won’t be such a shock mentally for you as you were prepared in advance, that is unless you are mentally attached.

The way we stay centered is through the mechanics of reality with regards to the stock market. And that is Gain, Wash, Loss.

By David Grandeywww.allabouttrends.net

To learn more, sign up for our free newsletter and receive our free report -- "How To Outperform 90% Of Wall Street With Just $500 A Week."

David Grandey is the founder of All About Trends, an email newsletter service revealing stocks in ideal set-ups offering potential significant short-term gains. A successful canslim-based stock market investor for the past 10 years, he has worked for Meriwest Credit Union Silicon Valley Bank, helping to establish brand awareness and credibility through feature editorial coverage in leading national and local news media.

© 2010 Copyright David Grandey- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.