Will the U.S. Treasury Defend the Dollar?

Currencies / US Dollar Oct 21, 2010 - 12:18 PM GMTBy: Gary_Dorsch

“Everything depends on proper listening. Of ten people who listen to the same speech or story, each person may well understand it differently. Perhaps, only one of them will understand it correctly.” How should traders interpret the latest remarks by US Treasury chief Timothy Geithner, who shocked the currency markets on October 18th, citing his determination to defend the value of the US-dollar?

“Everything depends on proper listening. Of ten people who listen to the same speech or story, each person may well understand it differently. Perhaps, only one of them will understand it correctly.” How should traders interpret the latest remarks by US Treasury chief Timothy Geithner, who shocked the currency markets on October 18th, citing his determination to defend the value of the US-dollar?

Geithner was asked in a question and answer forum, “Are you concerned with all of the money being printed over the last couple of years? Are we on our way to debasing the value of the dollar? Geithner surprised his audience with a passionate defense of the US-dollar. “Not going to happen in this country. It is very important for people to understand that the United States of America and no country around the world can devalue its way to prosperity and competitiveness,” he said.

“It is not a viable feasible strategy and we will not engage in it. It is very important that people have confidence in our capacity to meet our long-term fiscal obligations, to make sure the Federal Reserve does its job of keeping inflation low and safe over time. And we recognize that the US plays a particularly important special role in the international financial system, because the US-dollar serves as the principal reserve asset of the global financial system. So we’re going to work very hard to make sure that we preserve confidence in the strong dollar,” Geithner declared.

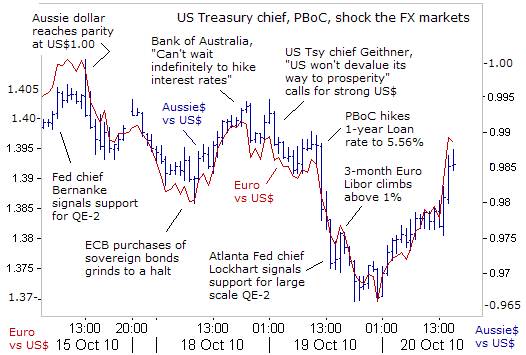

Yet just a few days earlier, during a much-anticipated speech on October 15th, Fed chief Ben “Bubbles” Bernanke broadly hinted that he favored an early resumption of “quantitative easing” (QE-2), knocking the US-dollar into a tailspin. “Inflation is running at rates that are too low relative to the levels that the Committee judges to be most consistent with the Fed’s dual mandate in the longer run. There would appear, all things being equal, to be a case for further action,” Bernanke declared.

Bernanke took the highly unusual step of making it clear that the Fed’s policy going forward would be to raise the rate of inflation to 2% by means of massive money printing. Bernanke tried to brainwash the American public into believing that QE-2 will significantly bring down the jobless rate. Bernanke’s support for QE-2 helped the Dow Jones Industrials index to soar above 11,100, despite further losses in US-payrolls, and a jump in the under-employment (U-6) jobless rate to 17.1%.

Bernanke knew that simply hinting at QE-2 would spark a further sell-off of US-dollars. After Bernanke spoke, the Australian dollar reached parity against the US-dollar for the first time since it was freely floated in 1983. The US$ also fell to parity with the Canadian dollar, and hit new all-time lows against the Swiss franc, and a 15-year low against Japan’s yen. Brazil’s real, Chile’s peso, the Korean won, and the Indian rupee rose versus the US-dollar. Gold hit a new record high, and commodities such as crude oil, copper, corn, cotton, cattle, soybeans, platinum, palladium, rubber, and silver all continued their upward spiral.

Bernanke knew that simply hinting at QE-2 would spark a further sell-off of US-dollars. After Bernanke spoke, the Australian dollar reached parity against the US-dollar for the first time since it was freely floated in 1983. The US$ also fell to parity with the Canadian dollar, and hit new all-time lows against the Swiss franc, and a 15-year low against Japan’s yen. Brazil’s real, Chile’s peso, the Korean won, and the Indian rupee rose versus the US-dollar. Gold hit a new record high, and commodities such as crude oil, copper, corn, cotton, cattle, soybeans, platinum, palladium, rubber, and silver all continued their upward spiral.

After Geithner’s remarks, the Euro quickly found resistance at $1.400, and began to sink to $1.3935 within a few minutes. The Aussie dollar dropped 0.80-cents to 98.50-cents, before getting blasted again, a few hours later, after China’s central bank shocked the markets, by lifting its one-year loan rate a quarter-point to 5.56%, its first rate hike in 3-years, knocking industrial commodities lower. The Aussie plummeted towards 96.50-cents a few hours later, before regaining its footing. The Euro’s slide came to a halt at $1.3700, where sidelined buyers emerged.

However, 24-hours later, the impact of Geithner’s remarks and China’s surprise rate hike, had already dissipated into thin air. The Aussie dollar, - a symbol of risk taking, - rebounded strongly to 98.75-cents, and the Euro recovered to $1.3950. The US-dollar skidded to 81-yen, despite threats by the Bank of Japan a few hours earlier to expand its own version of QE-3, beyond the 5-trillion yen of JGB buying pledged earlier. Once again, traders resumed their betting on “Bubbles” Bernanke, and a massive tidal wave of QE-2, starting after Nov 3rd, that would trump the efforts of other central banks to prevent the US-dollar’s downfall.

A few hours later, Geithner stepped-up his verbal rhetoric, by telling the Wall Street Journal, on October 20th, there’s no need for the US-dollar to sink further against the Euro and the yen, saying these currencies are “roughly in alignment” now. He emphasized that the US-Treasury isn’t trying to devalue the US-dollar, echoing comments he made in Palo Alto, California. Geithner appeared to offer a secret gentleman’s agreement with Beijing, to stop the currency war, if the pace of the Chinese yuan’s appreciation against the US-dollar since September is sustained, to correct its undervaluation. “If China knew that if it moved more rapidly, other emerging markets would move with them, it would be easier for them to move.”

Traders can expect greater volatility and turbulence in exchange rates, with the Group-of-20 nations moving towards the brink of a currency and trade war that is being driven by high unemployment in the United States. Faced with slumping domestic demand, the US-Treasury is trying to boost US-exports abroad, by cheapening the value of the US-dollar in relation to other currencies. President Barack Obama is under heavy pressure from leading Democrats, to declare China a currency manipulator, and to agree to stiff tariffs against Chinese imports.

Traders can expect greater volatility and turbulence in exchange rates, with the Group-of-20 nations moving towards the brink of a currency and trade war that is being driven by high unemployment in the United States. Faced with slumping domestic demand, the US-Treasury is trying to boost US-exports abroad, by cheapening the value of the US-dollar in relation to other currencies. President Barack Obama is under heavy pressure from leading Democrats, to declare China a currency manipulator, and to agree to stiff tariffs against Chinese imports.

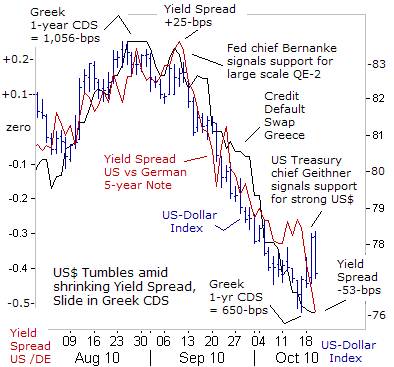

The Fed has engineered the devaluation of the US-dollar, by issuing a steady drumbeat of threats to unleash QE-2, upon the world money markets. Bond dealers reckon the Fed could print a minimum of $500-billion in the months ahead, or it might decide to monetize the entire US-budget deficit for this fiscal year, projected at $1.2-trillion. Also greasing the skids under the US-dollar has been the steady slide of US Treasury yields compared to German bund yields.

In early September, the US Treasury’s 5-year note yielded █basis points more than German 5-year yields. Today, the US-Treasury’s 5-year note yields -53-bps less. The US-dollar’s allure as a “safe haven” currency has also crumbled, as tensions surrounding the Greek bond market continue to subside. Credit default swap (CDS’s) rates, measuring the odds that Athens would default on its debts, have dropped in half over the past four-months, to around 650-basis points today.

The US Treasury has sought to gain extra leverage from the dollar’s slide, by seeking to corral the support of other G-20 central bankers and finance ministers, behind its drive to strong-arm China into more rapidly and sharply rising yuan. With the dollar down 12% against the Japanese yen since mid-June, compared with less than 3% versus the Chinese yuan, sparks began fly. Tokyo denounced Beijing for bidding up the yen by increasing its purchases of Japanese government notes.

The US Treasury has sought to gain extra leverage from the dollar’s slide, by seeking to corral the support of other G-20 central bankers and finance ministers, behind its drive to strong-arm China into more rapidly and sharply rising yuan. With the dollar down 12% against the Japanese yen since mid-June, compared with less than 3% versus the Chinese yuan, sparks began fly. Tokyo denounced Beijing for bidding up the yen by increasing its purchases of Japanese government notes.

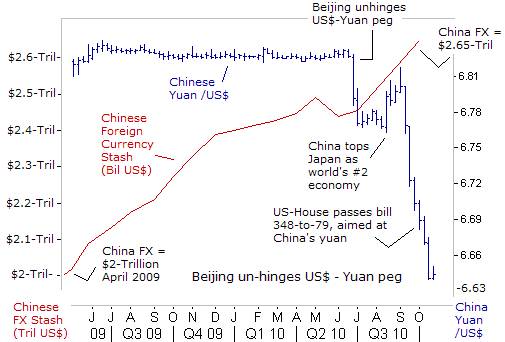

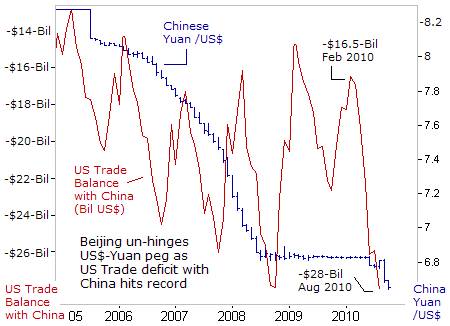

Since Beijing scrapped a 23-month-old peg to the dollar on June 19th, and said it would let the yuan resume a managed “dirty” float, the yuan has appreciated +2.8% against the US-dollar, but weakened 10% against the Euro. “It is much worse against the Euro than the US-dollar - this is not a good situation. It contributes to global imbalances. We want China to assume its responsibilities as a global player,” said Euro zone finance chief Jean-Claude Juncker.

US-lawmakers and President Obama have seized upon America’s widening trade deficit, which reached -$49.7-billion in June 2010, to take aim against the Chinese yuan. Over the last 12-months, the US-trade deficit with China reached $257-billion, and is running 21% above the pace from a year earlier. The deficit with China as a share of America’s balance of payments is now over 40%, compared to just 20% in 2001. Year-to-date imports from China are $229-billion, while exports are only $55.8-billion, leaving the ratio of imports to exports at 4.9. The average for all nations’ imports-to-exports with the United States is a ratio of 1.6.

Beijing intervenes regularly in its foreign exchange market to rig the value of the yuan, and it’s acquired a massive $2.65-trillion in FX reserves, while keeping the Chinese yuan undervalued by 40% against the US-dollar, on a trade weighted basis. Democrats and Republicans in the US-Congress aren’t willing to wait for Beijing to revalue the yuan at a snail’s pace over the next several years. In Hong Kong, the 12-month yuan forward contract is trading at 6.4425 /dollar indicating that traders figure that Beijing would only allow the yuan to rise by a paltry +3.2% rise against the dollar over the next 12-months.

Instead, US-lawmakers aim to level the playing filed in one fell swoop. On Sept 29th, the US-House passed legislation by an overwhelming margin, 348-79, to allow the Commerce department to apply tariffs on Chinese goods entering the United States. In the past, the Senate has pushed for tariffs of 25% on Chinese imports. “There is no question that China manipulates its currency in order to subsidize Chinese exports,” said Republican Senator Richard Shelby of Alabama. “The only question is: Why is the administration protecting China by refusing to designate it as a currency manipulator?” he asked.

Instead, US-lawmakers aim to level the playing filed in one fell swoop. On Sept 29th, the US-House passed legislation by an overwhelming margin, 348-79, to allow the Commerce department to apply tariffs on Chinese goods entering the United States. In the past, the Senate has pushed for tariffs of 25% on Chinese imports. “There is no question that China manipulates its currency in order to subsidize Chinese exports,” said Republican Senator Richard Shelby of Alabama. “The only question is: Why is the administration protecting China by refusing to designate it as a currency manipulator?” he asked.

On October 16th, Treasury chief Geithner backed away from a showdown with Beijing over the value of the yuan, by delaying a much-anticipated decision on whether to label China as a currency manipulator until after the Group-of-20 summit on November 11th. “Since September 2, 2010, the pace of the yuan’s appreciation has accelerated to a rate of more than 1% per month. If sustained over time, this would correct a significantly undervalued currency,” the Treasury said.

Geithner said on October 18th, the delay in the currency report was “an acknowledgment of the faster pace of the yuan’s appreciation and we’d like to see that sustained. What we know now is that it’s significantly undervalued, which I think they acknowledge and it’s better for them, and of course, very important for us, that it move. And I think it’s going to continue to move,” Geithner said.

Bank of England Mervyn King warned that the prospect of a trade war over global imbalances could spark a 1930’s-style economic collapse. “The need to act in the collective interest has yet to be recognized, and, unless it is, it will be only a matter of time before one or more countries resort to trade protectionism as the only domestic instrument to support a necessary rebalancing. That could, as it did in the 1930’s, lead to a disastrous collapse in activity around the world. Every country would suffer ruinous consequences -- including our own,” King warned.

Chinese – Indian Central banks fear Commodity Inflation

A stronger yuan is in China’s best interest, since it can be utilized to shield the world’s biggest buyer of commodities from the sting of sharply higher import prices. Since Beijing un-hinged the tightly pegged US$-yuan peg, and the Fed began sending signals about unleashing of QE-2, the Continuous Commodity Index (CCI) – an equally weighted index of 17 different commodity futures, has rallied by 23% to its highest level in two-years. Coffee, cotton, corn, cattle, gold, silver, platinum, soybeans, and wheat have been the stellar performers, with crude oil lagging behind. Other key industrial commodities not included in the index which have skyrocketed are tin, rubber, nickel, and palladium.

Efforts by Fed to weaken the US-dollar by threatening to unleash QE-2 have led to sharply higher commodity prices, and is pushing-up China’s inflation rate to +3.5%. There’s also bubbles brewing in Chinese property prices and renewed interest in Shanghai red-chips. Against this backdrop, the Fed and the US-Treasury have exerted considerable pressure on Beijing to allow the yuan to rise. The People’s Bank of China (PBoC) finds it difficult to lift interest rates to combat inflation, because a widening in the Chinese yield spread over US Treasuries would only suck in more “hot-money” into the Chinese yuan.

Efforts by Fed to weaken the US-dollar by threatening to unleash QE-2 have led to sharply higher commodity prices, and is pushing-up China’s inflation rate to +3.5%. There’s also bubbles brewing in Chinese property prices and renewed interest in Shanghai red-chips. Against this backdrop, the Fed and the US-Treasury have exerted considerable pressure on Beijing to allow the yuan to rise. The People’s Bank of China (PBoC) finds it difficult to lift interest rates to combat inflation, because a widening in the Chinese yield spread over US Treasuries would only suck in more “hot-money” into the Chinese yuan.

But on October 19th, the PBoC surprised the markets with its first interest rate hike in three years, taking one-year lending rates 0.25% higher to 5.56-percent. The rate hike follow on the heels of the PBoC’s decision to lift reserve requirements by half-point to 17.5% at six Chinese banks last week, draining 200-billion yuan out of the Shanghai money markets. Commodity traders are beginning to wonder if Beijing has just started to roll-out a longer-term tightening campaign.

The Reserve Bank of India (RBI) has also been forced to tighten its monetary policy to fend off commodity inspired inflation, by lifting its repo rate on five occasions this year to 6-percent. India’s wholesale inflation rate is +8.5% higher than a year ago, and is far above the RBI’s perceived tolerance level of around 5%, keeping the inflation adjusted interest rate stuck in negative territory. India’s economy is on track to grow at 8.5% this year, lagging only China, so the RBI could be forced to hike its repo rate several more times, if commodities continue to spiral higher under the magic carpet ride of the Bernanke’s QE-2.

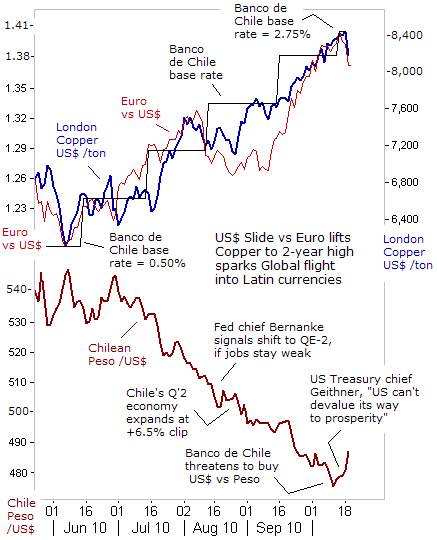

Soaring Copper, QE-2, Rising Interest rates Lift Chile’s Peso

Chile is among a number of emerging economies, including Brazil, India, Thailand, Korea, and South Africa, whose currencies have risen sharply against the Chinese yuan and US-dollar. They’re rising from an influx of foreign capital seeking higher returns than are available in the England, Japan, and the US, where interest rates are hovering near zero-percent. Capital is flooding into emerging markets and could lead to excessive exchange-rate moves, asset bubbles and financial instability, warned IMF chief Dominique Strauss-Kahn on October 18th.

Many of these emerging countries are intervening repeatedly in the currency markets to hold down the value of their currency against the US-dollar, and by default –the Chinese yuan. “Near-zero interest rates and rapid monetary expansion are geared at stimulating domestic demand but also tend to produce a weakening of their currencies,” warned Brazilian Finance Minister Guido Mantega on October 9th. “As a result, emerging countries will continue to build up reserves in foreign currency to avoid volatility and appreciation.”

Traders are pouring vast sums of capital into the emerging stock markets, forcing-up the exchange rate of emerging currencies and inflating asset bubbles. The MSCI Emerging Markets Index has soared +13% since the start of September. The US-dollar has tumbled -14% against the Chilean peso since the beginning of July, due to fears of QE-2. Chile’s peso is also gaining support from soaring copper prices, which reached a 2-year high of $8,400 /ton in London. Chile posted economic growth of +6.5% in the second quarter, helped by inflated copper prices, which are linked to a staggering 40% of the country’s total economic output.

Traders are pouring vast sums of capital into the emerging stock markets, forcing-up the exchange rate of emerging currencies and inflating asset bubbles. The MSCI Emerging Markets Index has soared +13% since the start of September. The US-dollar has tumbled -14% against the Chilean peso since the beginning of July, due to fears of QE-2. Chile’s peso is also gaining support from soaring copper prices, which reached a 2-year high of $8,400 /ton in London. Chile posted economic growth of +6.5% in the second quarter, helped by inflated copper prices, which are linked to a staggering 40% of the country’s total economic output.

Banco-de-Chile chief Jose De Gregorio is utilizing the direction of copper as a real-time indicator to gauge the forward momentum of the local economy. In sync with higher copper prices, Chile’s central bank has guided its overnight loan rate higher, by 225-basis points to 2.75% last week. In turn, the steady increase in Chile’s interest rates has widened the gap with US-Treasuries, and has attracted foreign capital, - putting upward pressure on the Chilean peso.

Chile’s finance chief Felipe Larrain says, “Both China and US are at fault in the currency war. Although the currency tension seems to be a dispute just between Washington and Beijing, its implications go well beyond the two countries. If exchange rate variability between the yuan and the US-dollar is very little, the US-currency will likely depreciate against currencies of emerging markets. Developed but fast-growing economies, like Korea and Australia, in turn, will also face great appreciation pressure on their currencies,” he predicted.

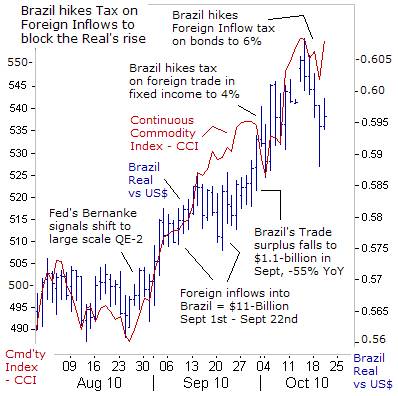

Brazil Locked in Tough fight with Currency traders

Brazil’s ministry of finance (MoF) is locked in a bitter struggle with traders over the value of its currency – the Real, - in a battle that requires unorthodox techniques. The MoF is desperately trying to halt the appreciation of the real, which has more than doubled in value against the US-dollar since President Lula da Silva took office in 2003. It’s now a darling of foreign investors. Yet what was once seen as a blessing has become a curse. From January until August, Brazil’s trade surplus was whittled down to $11.6-billion, or -41% less than in the same period a year earlier. Finance chief Guido Mantega warned he’ll take whatever measures are necessary to keep the real from further eroding Brazil’s trade surplus.

The Bank of Brazil has resorted to multiple interventions in the currency market to prevent the real from climbing higher. Brazil’s foreign exchange stash now exceeds $250-billion, with $165-billion parked in US-Treasuries. However, the combination of Brazil’s robust economy and the world’s highest interest rate at 10.75%, has made the real an irresistible target for foreign traders, at a time when Japanese and US bonds are saturated with excess liquidity and ultra-low yields.

Brazil has one of the most advanced industrial sectors in Latin America, accounting for roughly one-third of the GDP. It’s also a major supplier of commodities and natural resources, with significant operations in iron-ore, tin, sugarcane, coffee, tropical fruits, orange juice, corn, cotton, cocoa, tobacco, and forest products. Brazil has the world’s largest commercial cattle herd, and it’s the world’s #2 grower of soybeans and #1 exporter of ethanol, which are all soaring thanks to QE-2.

Brazil has one of the most advanced industrial sectors in Latin America, accounting for roughly one-third of the GDP. It’s also a major supplier of commodities and natural resources, with significant operations in iron-ore, tin, sugarcane, coffee, tropical fruits, orange juice, corn, cotton, cocoa, tobacco, and forest products. Brazil has the world’s largest commercial cattle herd, and it’s the world’s #2 grower of soybeans and #1 exporter of ethanol, which are all soaring thanks to QE-2.

Brazil should begin to reap bigger trade surpluses in the months ahead, as the latest upward thrust in global commodity prices filters into its economy. Currency dealers are tracking commodity prices, lifting the real briefly above 60-US-cents last week. Finance chief Mantega says Brazil is engaged in a “currency war” with Bernanke’s Fed, and has “a lot of ammunition” such as boosting taxes on foreign investment in Brazilian fixed income. Mantega criticized the Fed for “considering more quantitative easing. It won’t reactivate the US-economy, but it will weaken the US-dollar.”

On October 18th, Brazil hiked taxes on foreign investment in fixed-income bonds to 6%, and also closed a loophole that allows speculators to avoid the tax on margin deposits for transactions in futures markets. The higher taxes will only affect new flows of money into the bond market, not deposits already in Brazil. “This currency war needs to be deactivated,” Mantega said.

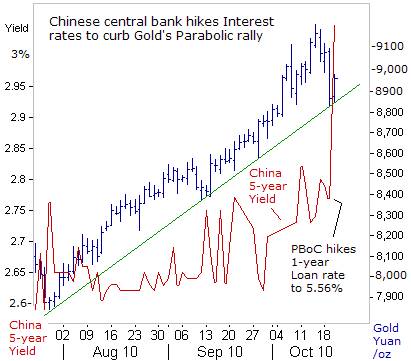

Beijing takes aim at Shanghai Gold

China’s central bank (PBoC) surprised traders on October 19th, with its first hike in bank deposit rates in three years, reflecting its concern about rising asset prices and stubbornly high inflation. The PBoC guided 1-year bank deposit rates higher by 25-basis points, to 2.50%, and triggered a 3% drop in the Shanghai gold market. Once a consensus has been forged in Beijing to raise or cut rates, past experience shows that the PBoC moves in a series of adjustments.

To date, the PBoC has relied on slowing down bank lending and lifting banks’ reserve requirements to keep the growth of the M2 money supply from boiling over. Still, China’s Treasury yields rates are too low for an economy that’s growing at a +10% clip. The real rate of interest on China’s Treasury notes is buried in negative territory - yielding less than the official 3.6% rate of inflation. Negative interest rates are whetting the appetite of Chinese traders in gold, silver, and base metals. The Shanghai stock index, a laggard this year, has jumped +16% in the past nine trading days, led by banks and commodity related companies.

The PBoC’s rate hiked jolted the yield on China’s 5-year T-note out of its summer slumber, lifting it upwards by 30-basis points to as high as 3.05% on October 19th. In a knee-jerk reaction, Shanghai gold fell 3% to as low as 8,850-yuan /oz, where an upward sloping trend-line resides. Buyers emerged from the sidelines, on ideas that negative interest rates in China would continue to fuel gold’s historic rally.

The PBoC’s rate hiked jolted the yield on China’s 5-year T-note out of its summer slumber, lifting it upwards by 30-basis points to as high as 3.05% on October 19th. In a knee-jerk reaction, Shanghai gold fell 3% to as low as 8,850-yuan /oz, where an upward sloping trend-line resides. Buyers emerged from the sidelines, on ideas that negative interest rates in China would continue to fuel gold’s historic rally.

Li Daokui, an adviser to the People’s Bank of China, said on October 19th, “The interest rate rise will make people feel safe and prevent them from taking out their money from bank deposits to invest in stocks or property market.” However, gold traders and speculators in Shanghai red-chips disagree. The amount of cash sitting in China’s bank deposits increased by 1-trillion yuan ($156-billion) in September, to 30-trillion yuan, and could lend plenty of firepower for the Shanghai gold market.

However, on October 20th, China’s central bank continued to exert upward pressure on short-term Treasury yields, by draining 145-billion yuan ($21.8-billion) from the Shanghai money markets through 91-day reverse repos. The PBOC also mopped-up 50-billion yuan by selling one-year T-bills.

However, there’s other channels that can keep the gold market buoyant. The Value Gold ETF is expected to be launched on the Hong Kong Stock Exchange, in early November, with the underlying physical gold held at Hong Kong’s Precious Metals Depository. The Gold ETF could attract a whole new wave of wealthy investors to the yellow metal, since the Hong Kong Monetary Authority pegs its overnight loan rate at a miniscule 0.50%, in order to keep the HK-dollar fixed to the US$.

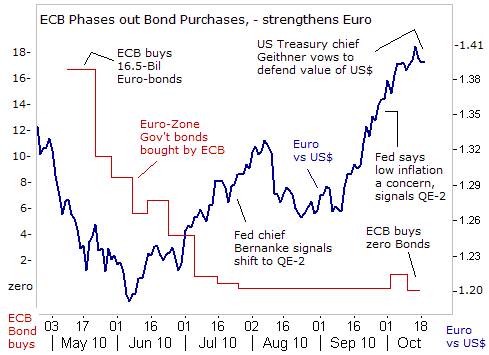

Is Mr Geithner going to make good on his vow to defend the US-dollar? He’ll need to convince the radical inflationists at the Bernanke Fed to mend their foolish ways, and follow the blueprints of the European Central Bank (ECB). Having bought 16.5-billion Euros of Greek, Irish, and Portuguese bonds in the second week of May, the ECB’s purchases of bonds slowed to a trickle by early August, winding down its sterilized QE scheme at 63.5-billion Euros. The three-month Euro Libor rate climbed above 1% this week, a signal that the ECB is slowly withdrawing liquidity.

Is Mr Geithner going to make good on his vow to defend the US-dollar? He’ll need to convince the radical inflationists at the Bernanke Fed to mend their foolish ways, and follow the blueprints of the European Central Bank (ECB). Having bought 16.5-billion Euros of Greek, Irish, and Portuguese bonds in the second week of May, the ECB’s purchases of bonds slowed to a trickle by early August, winding down its sterilized QE scheme at 63.5-billion Euros. The three-month Euro Libor rate climbed above 1% this week, a signal that the ECB is slowly withdrawing liquidity.

By turning off the currency printing presses, the ECB laid the groundwork for the Euro’s recovery to $1.400 last week. Will Mr Geithner convince the Bernanke Fed to rescue the US-dollar by nixing QE-2? Philadelphia Fed chief Charles Plosser opposes the idea of launching QE-2. “Do we really think that creating another trillion dollars of excess reserves is going to solve our problems?” he asked. “We need to make the right decision for the longer horizon. And if the right decision means we disappoint markets, then that might be short-run painful, but is the right long-run decision,” Plosser said. However, Bernanke’s inflationists out-number the Fed hawks, and the world economy should brace itself for a round of hyper-inflation.

This article is just the Tip of the Iceberg of what’s available in the Global Money Trends newsletter. Subscribe to the Global Money Trends newsletter, for insightful analysis and predictions of (1) top stock markets around the world, (2) Commodities such as crude oil, copper, gold, silver, and grains, (3) Foreign currencies (4) Libor interest rates and global bond markets (5) Central banker "Jawboning" and Intervention techniques that move markets.

By Gary Dorsch,

Editor, Global Money Trends newsletter

http://www.sirchartsalot.com

GMT filters important news and information into (1) bullet-point, easy to understand analysis, (2) featuring "Inter-Market Technical Analysis" that visually displays the dynamic inter-relationships between foreign currencies, commodities, interest rates and the stock markets from a dozen key countries around the world. Also included are (3) charts of key economic statistics of foreign countries that move markets.

Subscribers can also listen to bi-weekly Audio Broadcasts, with the latest news on global markets, and view our updated model portfolio 2008. To order a subscription to Global Money Trends, click on the hyperlink below, http://www.sirchartsalot.com/newsletters.php or call toll free to order, Sunday thru Thursday, 8 am to 9 pm EST, and on Friday 8 am to 5 pm, at 866-553-1007. Outside the call 561-367-1007.

Mr Dorsch worked on the trading floor of the Chicago Mercantile Exchange for nine years as the chief Financial Futures Analyst for three clearing firms, Oppenheimer Rouse Futures Inc, GH Miller and Company, and a commodity fund at the LNS Financial Group.

As a transactional broker for Charles Schwab's Global Investment Services department, Mr Dorsch handled thousands of customer trades in 45 stock exchanges around the world, including Australia, Canada, Japan, Hong Kong, the Euro zone, London, Toronto, South Africa, Mexico, and New Zealand, and Canadian oil trusts, ADR's and Exchange Traded Funds.

He wrote a weekly newsletter from 2000 thru September 2005 called, "Foreign Currency Trends" for Charles Schwab's Global Investment department, featuring inter-market technical analysis, to understand the dynamic inter-relationships between the foreign exchange, global bond and stock markets, and key industrial commodities.

Copyright © 2005-2010 SirChartsAlot, Inc. All rights reserved.

Disclaimer: SirChartsAlot.com's analysis and insights are based upon data gathered by it from various sources believed to be reliable, complete and accurate. However, no guarantee is made by SirChartsAlot.com as to the reliability, completeness and accuracy of the data so analyzed. SirChartsAlot.com is in the business of gathering information, analyzing it and disseminating the analysis for informational and educational purposes only. SirChartsAlot.com attempts to analyze trends, not make recommendations. All statements and expressions are the opinion of SirChartsAlot.com and are not meant to be investment advice or solicitation or recommendation to establish market positions. Our opinions are subject to change without notice. SirChartsAlot.com strongly advises readers to conduct thorough research relevant to decisions and verify facts from various independent sources.

Gary Dorsch Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.