What's Next for the U.S. Dollar, Stocks and Gold?

Stock-Markets / Financial Markets 2010 Oct 21, 2010 - 05:51 AM GMTBy: Chris_Vermeulen

The equities market reversed to the upside Wednesday posting a light volume broad based rally. Remember light volume tends to have a neutral to upward bias on stocks, But it was mainly the sharp drop in the dollar which spurred stocks and commodities higher.

The equities market reversed to the upside Wednesday posting a light volume broad based rally. Remember light volume tends to have a neutral to upward bias on stocks, But it was mainly the sharp drop in the dollar which spurred stocks and commodities higher.

Today’s bounce was not much of a surprise for several reasons…

- Overall trend is up, one day sell offs are generally profit taking

- Panic selling on the NYSE tipped us off that the market was oversold

- I don’t think they will let the market fall before the November election

- Intermediate cycle is turning up this week, 3 weeks of upward momentum…

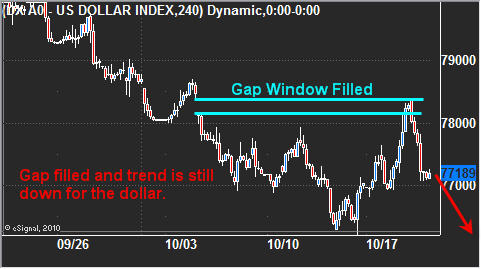

US Dollar Index – 4 Hour Chart

The dollar put in a big bounce this week filling its gap window… Remember most gaps get filled with virtually every investment vehicle so when you see them remember this chart….

SPY ETF – Daily Chart

SP500 has been riding the key moving average up and Tuesday’s sell off tagged the 14MA along with extreme market internal readings telling intraday traders that a bounce is about to take place.

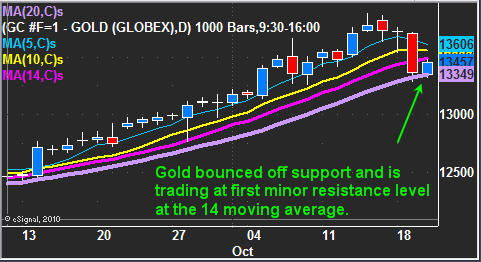

Gold Futures – Daily Chart

You can see gold has done much the same… A sharp profit/stop running sell off, which took the price back down to support. We took a long position to catch this bounce and hopefully a larger move going forward.

Market Sentiment Readings

Tuesday’s pullback was a great reminder of just how over extended the equities market was. These heavy volume sell offs are typical in a bull market. Without regular pauses in price, traders tend to place trailing stops moving them up each day. With traders chasing stocks higher bidding them up instead of waiting for a pullback we get a very large number to stop orders following the price up each day. Then, it’s only a matter of time before a key short term support level is broken at which point the flood gates open and everyone’s stops turn to market orders flooding the stock exchanges with sell orders causing a rapid decline and panic selling. This is exactly what happened on Tuesday which I show in the chart below.

Understanding how to read market internals provides great insight for short term traders looking to make quick high probability trades every week… Market internals are just part of the equation but very powerful on their own with proper money/position management. Both of these intraday extremes were bought on Tuesday in the advanced chatroom (FuturesTradingSignals.com).. We quickly booked profits and moved our stops up in order to protect our capital as the market surged higher.

Mid-Week Market Trend Analysis:

In short, the US Dollar is still in a down trend overall. The Fed’s I would think will continue to hold the market up into the election. It works well for them… they print money which devalues the dollar, and in return boosts stocks and commodities, plus they get trillions of dollars to spend… I’m sure its like kids in a candy store over there.

While everyone is trying to pick a top in this over extended market I think it is crucial to stick with the overall trend and to not fight the Fed. Using the key moving averages on the daily chart as shown in the charts above, continue to buy on dips until the market closes below the 20 day moving average at which point you should abandon ship.

I’d like you to have my ETF Trade Alerts for Low Risk Setups! Get them here: http://www.thegoldandoilguy.com/specialoffer/signup.html

Also Follow Me on Twitter in Real-Time: http://twitter.com/GoldAndOilGuy

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.