Peter Schiff Wrong on Gold Stocks, Small Caps Leveraged to Gold Price

Commodities / Gold and Silver 2010 Oct 21, 2010 - 05:44 AM GMTBy: Jordan_Roy_Byrne

Days ago I was watching Peter Schiff on Yahoo Tech Ticker. Normally, I find myself in agreement with Schiff. This time, however I disagreed with his comments on the gold stocks. He was saying to buy GDX because the large-cap stocks were priced for a decline in Gold. He also said the speculative juniors were going nowhere. These things may be true and play out in his favor over the coming months and years.

Days ago I was watching Peter Schiff on Yahoo Tech Ticker. Normally, I find myself in agreement with Schiff. This time, however I disagreed with his comments on the gold stocks. He was saying to buy GDX because the large-cap stocks were priced for a decline in Gold. He also said the speculative juniors were going nowhere. These things may be true and play out in his favor over the coming months and years.

However, the reality is that over time, large-cap gold stocks do not outperform Gold. If you want leverage, the large caps are a terrible place to go. Steve Saville has a great commentary on this. Over time, large cap miners struggle to replace reserves and grow production. The larger you are, the more new resources you have to find and the more cash intensive the business (exploration, extraction, production) becomes. While it is likely that the large-caps will rise in the coming years, it is dangerous to assume they will outperform Gold. That would be going against history.

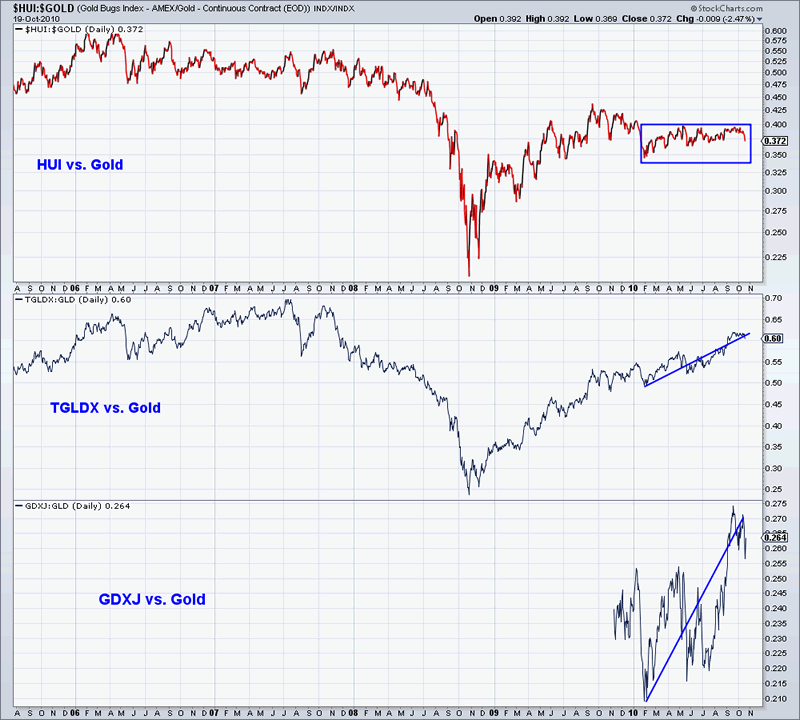

Even the unhedged large-caps can’t outperform Gold consistently, as the following chart shows. Aside from major bottoms in 2001 and late 2008, the HUI/Gold ratio has basically trended sideways or down.

However, note the recent leverage in both GDXJ and TGLDX (Tocqueville Gold Fund). If you want more consistent leverage, go with the juniors or John Hathaway’s Fund and avoid GDX altogether.

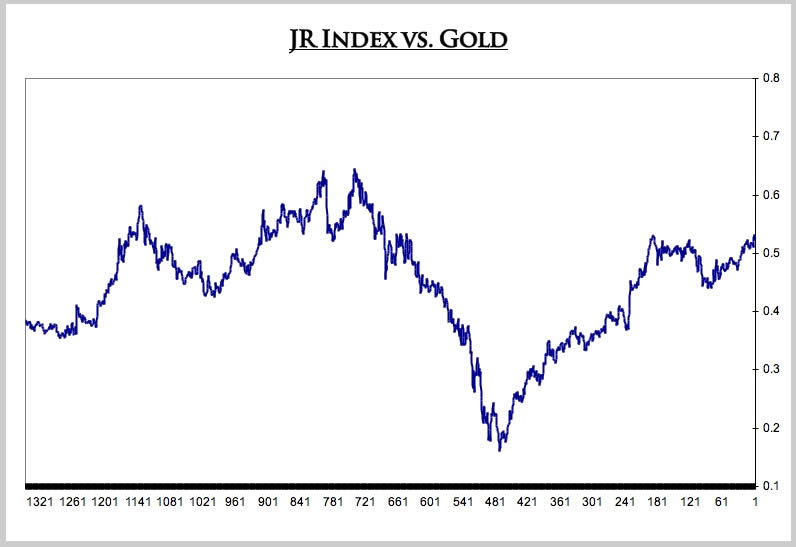

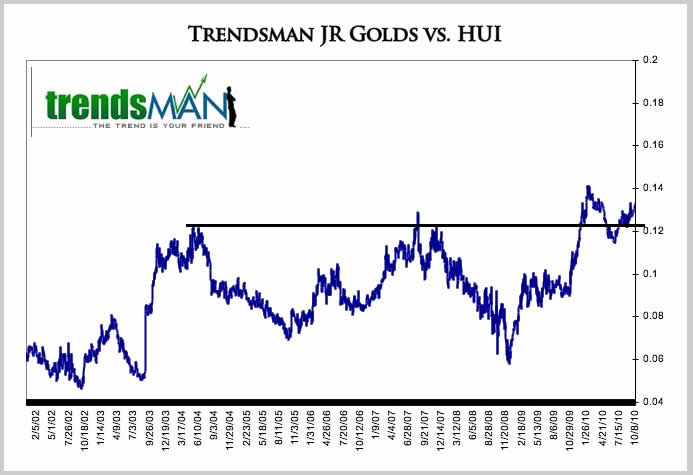

In regards to the juniors, our 25-stock index has performed quite well both nominally and in real terms. Next are two charts that show the performance in real terms.

I am not sure which juniors Peter Schiff is referring to but the juniors we follow have performed very well. It is clear that the juniors are the place to be if you want growth and leverage. The juniors, when measured against Gold have recovered significantly, while the HUI (GDX) has only recovered less than half of its losses against Gold. Also we can see the when measured against the HUI, the juniors have made a major breakout.

Part of the reason for junior outperformance is the increasing number of takeovers. This is no surprise as many analysts have expected this. Majors are taking over intermediates and large juniors while large juniors are taking over smaller juniors. It is happening across the spectrum. Simply put, in most cases it is easier and more cost effective for a company to grow via acquisition than via in house exploration and development. This makes many juniors a takeover candidate.

Recently, two of our five junior gold recommendations have been taken-over. We seek to find quality companies that offer value but have growth potential while exhibiting positive technicals. If they are taken-over, it becomes a huge bonus.

If you a precious metals investor seeking growth, you have to have some foothold in the juniors. Playing GDX or a basket of large-caps will likely leave you disappointed. In our service we seek to steer investors towards the stocks that offer not only value but also growth potential. Thus far, two of our first five junior gold picks have been taken-over. We invite you to consider a free 14-day trial as we seek to find the next takeover candidates.

Good luck ahead!

Jordan Roy-Byrne, CMT

Jordan@thedailygold.com

http://www.thedailygold.com/newsletter

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.