The Unconventional Natural Gas Red Zone

Commodities / Natural Gas Oct 21, 2010 - 03:16 AM GMTBy: OilPrice_Com

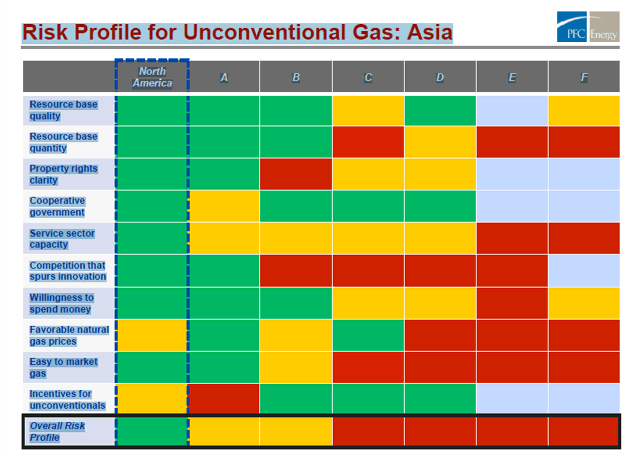

Great chart from PFC Energy. Presented at an Institute of Energy Economics, Japan seminar last month.

Great chart from PFC Energy. Presented at an Institute of Energy Economics, Japan seminar last month.

The piece shows the "red zones" in global unconventional gas (shale, tight gas, coal bed methane). Comparing the unconventional sector in North America to six unnamed Asian nations (lettered A to F, so as not to hurt any feelings), across ten categories related to the gas business in each country. Green is good, yellow okay, red poor.

The sticking points are clear.

Service sector capacity is a big issue. Few countries outside North America can provide the quality services needed for unconventional completions.

And price is an even bigger factor. Most of the studied nations rank poorly in terms of competition. And competition is key for pricing. In America, it was relentless battling between service suppliers that drove down service prices to the point where tinkering with unconventional gas made economic sense for producers.

Note that governments are trying. Most nations rank well for government cooperation and incentives for unconventionals.

But the private sector needs to be involved if services costs are going to be optimized in order to make unconventionals work in new locales.

This is going to be the biggest factor in determining where unconventional gas soars and where it floors.

Source: http://oilprice.com/Energy/Natural-Gas/The-Unconventional-Gas-Red-Zone.html

Dave Forest

By Dave Forest for OilPrice.com who focus on Fossil Fuels, Alternative Energy, Metals, Crude Oil Prices and Geopolitics To find out more visit their website at: http://www.oilprice.com

© 2010 Copyright OilPrice.com- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.