Foreclosure Madness, Securitization Meltdown, U.S. Great Depression Written into Law

Economics / Great Depression II Oct 20, 2010 - 04:38 AM GMTBy: Ty_Andros

The US economy is being SHUTDOWN at a rapid rate by the radical Marxists in the beltway, whom having never met a businessman that they like other than those who pay political tolls -- known as campaign contributions – consider the rest of the WEALTH generating private sector to be the proverbial red headed step child. Ripe for abuse…

The US economy is being SHUTDOWN at a rapid rate by the radical Marxists in the beltway, whom having never met a businessman that they like other than those who pay political tolls -- known as campaign contributions – consider the rest of the WEALTH generating private sector to be the proverbial red headed step child. Ripe for abuse…

As the denizens of the beltway do a Jack-the-RIPPER on the economy to SAVE you, runaway regulation and taxation have now killed wealth creation in the G7.

“The more corrupt the state, the more it legislates.” --Tacitus

With New York Fed president, Bill Dudley, and Chairman Bernanke on record for launching Quantitative Easing II, targeted inflation (financial asset inflation) and GDP, it’s full steam ahead for the PRINTING PRESS. The structural incentives to produce, to create wealth and to reduce micro management through reduction of federal red tape ARE NOT being considered. So their policies and laws guarantee the next leg down in the unfolding DEPRESSION.

“Like some great swelling river, the powers of the federal government have today breached their constitutional levees and spilled into countless areas of life never anticipated by the Founders.”

--Joel Miller, author of “The Portable Patriot”

Just ask the chamber of commerce and the national federation of Independent business: the trade organizations for MILLIONS of small businesses with virtually no voice through K Street (lobbyist row). Somehow advocating for economic growth, small business, end of bailouts and wealth-creation-friendly legislation has become a THREAT to big government, crony capitalists and the social welfare state the G7 has become. So, the big government, progressive, incumbent public servants are in full-throated roar to silence their voices during this election cycle.

“Remember democracy never lasts long. It soon wastes, exhausts and murders itself. There never was a democracy yet that did not commit suicide…” John Adams 1814

Authors note: This is not DOOM and GLOOM; it is the reality of declining EMPIRES throughout history. Look no further than these words from one of the founding fathers of the United States and former president. At no time in history have the opportunities been greater than TODAY. As new realities are priced into markets they will zoom higher or lower as Volatility EXPANDS -- Volatility is opportunity for the prepared investor!

Gold and Silver backed absolute-return alternative investments with the potential to thrive in up down and sideways markets should be part of most portfolios. The rest of your portfolio must be designed with applied Austrian economics in mind, as it will be the difference between success and failure in preserving and building your wealth during a currency and financial-system extinction event… now back to the essay

In the minds of public servants, independent businesses are threats; they are not DEPENDANT on government, which is a crime in the eyes of socialist, progressive public servants currently in charge in the G7. Keep in mind that any economic recovery must come from this group of businessmen.

How obscene that these small businesses, which are the backbone of America (these are the folks who will create a recovery if there is to be one), are now being VILIFIED by the president and portrayed as the evil empire (millionaire and billionaire BOGEY men) and any wealth they have created and accumulated ill gotten. No -- their wealth comes from hard work, saving, successful risk taking and delivering products and services for which people want to pay. Something Ob@ma and his congressional Marxist supporters only punish today, so they will get a lot less of it. No -- the evil empire is inside the beltway in the tradition of George Orwell’s prophetic books 1984 and Animal Farm.

“It is not an endlessly expanding list of rights ---the “right” to an education; the “right” to health care; the “right” to food and housing. That is not freedom. That is dependency. Those are not rights. Those are the rations of slavery – hay and a barn for human cattle.” --Alexis de Tocqueville

Of course the same can be said of businesses, public sector labor unions and entrepreneurs who depend on government for the bulk of their receipts from subsidies and supplying government programs with OVERPRICED goods and services.

Look no further than the GREEN jobs industries (crony capitalists and campaign supporters) subsidized by over 17 billion dollars in the stimulus bills. How many 100’s of BILLIONS of dollars have been WASTED on Ethanol? It pollutes more, costs more to create, is a less efficient energy source and costs more than it produces. The money to pay for them is taken from productive taxpayers and transferred to unproductive use.

If withdrawn, if they LOST their SUBSIDIES, these crony capitalists would FAIL in a HEARTBEAT in the global market place, uneconomic endeavors all. They consume more than they produce. Malinvestment and misallocation of capital of obscene proportion.

If not for monetary cannons blaring….. er, blasting out tens of billions of dollars, the stock and bond markets would be in broad retreat. Competitive devaluation is in full swing with indirect bidders at treasury auctions now over 50%, as central banks recycle the dollars they receive from competitive devaluation or exports to the US into US treasuries. Those doses of fiat currencies ARE NOT money or capital into their economies; they are DEBT/IOU’s and they deepen the insolvencies. Keep in mind, fiat currencies are credit and credit is not money.

These competitive devaluations also have the handy by-product of financing each others budget deficits in a hidden manner. Remember, FIAT currencies are just a check-kiting scheme’; one central banks liability is another’s asset and they are created with a keystroke. This is why global central bank reserves are up 300 to 500% since 2000. They are monetizing each other’s DEFICITS; quantitative easing (printing money out of thin air) actually began back then.

The obscenity of the Fed Open Market Committee saying they want to TARGET inflation and GDP growth; actually purposeful destruction of a FIAT currency and asset inflation disguised as growth, ouch. Look at this excerpt from David Rosenberg in his daily missive (www.Gluskinsheff.com):

“Brian Sack, a senior official at the New York Fed, had this to say about the powers of quantitative easing in a speech he just delivered:

‘Some observers have argued that balance sheet changes, even if they influence longer-term interest rates, will not affect the economy because the transmission mechanism is broken. This point is overstated in my view. It is true that certain aspects of the transmission mechanism are clogged because of the credit constraints facing some households and businesses, and it is true that monetary policy cannot directly target those parties that are the most constrained. Nevertheless, balance sheet policy can still lower longer-term borrowing costs for many households and businesses, and it adds to household wealth by keeping asset prices higher than they otherwise would be. It seems highly unlikely that the economy is completely insensitive to borrowing costs and wealth, or to other changes in broad financial conditions.’

I just love that one comment to the effect that QE “adds to household wealth by keeping asset prices higher than they otherwise would be.” When will these guys ever learn that maybe, just maybe, these Fed policies aimed at targeting asset prices at levels above their intrinsic values is probably not in the best interests of the nation? As our friend Marc Faber likes to say, the “Bernanke put” is cut from the same cloth as the fabled “Greenspan put” — only the strike price is different.

Imagine running a policy aimed at getting people to spend money based on an artificial level of asset values — what an admission. Then again, this is what the Fed has been all about since the LTCM bailout of 1998. We’re still not convinced after reading this sermon that this next “pull-another-rabbit-out-of-the-hat” experiment is going to end with very much success. There is something to be said about paying for our mistakes and to have the Fed try to rekindle an asset-based economy that has only ended up in generating a series of burst bubbles over the last 12 years, not to mention encourage a lifestyle of living beyond our means, is irresponsible at best, dangerous at worst.

I am honestly still trying to grasp the fact that the Fed has admitted to trying to run what is really nothing more than a Ponzi scheme….That is our great American growth strategy. Unbelievable.”

Thank you, David. To those people whose countries are in QE as well, it is a double dose of debasement, one domestic, and one by the reserve currency of the world in which they hold their central bank reserves. Woe to Britain, China, the Euro Zone, and Japan, etc.

Thank you, David. To those people whose countries are in QE as well, it is a double dose of debasement, one domestic, and one by the reserve currency of the world in which they hold their central bank reserves. Woe to Britain, China, the Euro Zone, and Japan, etc.

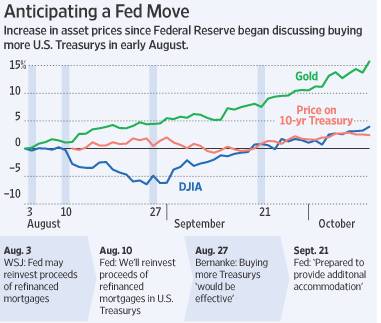

In addition to this debasement, we have Quantitative Easing II front and center with Japan having formally announced it, and the Federal Reserve and Bank of England with their fingers on the trigger. In fact, the Federal Reserve COMMENCED operations in August, as outlined by this illustration:

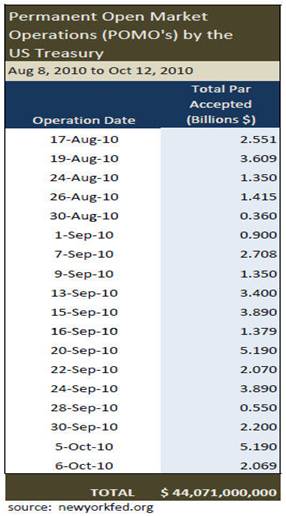

This was not in anticipation of QE II; it was in tandem with its beginning as you can see from the next chart showing the money printing cannons blasting, beginning with the fed preferring to announce it after the November elections. Asset markets began their explosive move higher at that time. Take a look at this chart of POMO, Permanent Open Market Operations, since the August Fed meeting:

This was not in anticipation of QE II; it was in tandem with its beginning as you can see from the next chart showing the money printing cannons blasting, beginning with the fed preferring to announce it after the November elections. Asset markets began their explosive move higher at that time. Take a look at this chart of POMO, Permanent Open Market Operations, since the August Fed meeting:

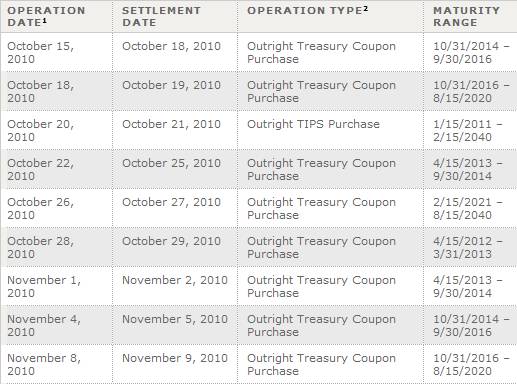

WOW, in two months the fed has PRINTED OUT OF THIN AIR $44 BILLION, that works out to $220 billion a year BEFORE QE II begins after the election. As I am sitting here on Thursday, Oct 14th writing this letter, BOOM BOOM Bernanke is speaking and the Federal Reserve just fired its monetary cannon again to the tune of almost $5 billion (not included above or below), BANG BANG, it’s now Monday, Oct 18th and another $6 billion just hit the streets. With another $32 billion scheduled for the next 3 weeks leading right into the election (is this the quid pro quo for being reappointed fed chairman?):

When these NEW purchases are completed, the Federal Reserve (the fed is only $24 billion away) will surpass CHINA as the world biggest holder of US treasuries. WOW… Then add the 100’s of billions of Dollars, Pounds, Euros and other currencies which have been printed by central banks around the globe as the competitive devaluation raceway unfolds, continues and accelerates, and you can see the impetus for the rallies in asset markets. Now we know where the cash has come from to FUEL the GIGANTIC rallies in everything that began in early AUGUST.

When these NEW purchases are completed, the Federal Reserve (the fed is only $24 billion away) will surpass CHINA as the world biggest holder of US treasuries. WOW… Then add the 100’s of billions of Dollars, Pounds, Euros and other currencies which have been printed by central banks around the globe as the competitive devaluation raceway unfolds, continues and accelerates, and you can see the impetus for the rallies in asset markets. Now we know where the cash has come from to FUEL the GIGANTIC rallies in everything that began in early AUGUST.

Those financial assets are just REPRICING to reflect the lost purchasing power of the currency in which they are denominated. GOLD is not going up, SILVER is not going up, stocks are not going up, commodities are not going up: they are just repricing to reflect the loss of purchasing power of the currency in which they are denominated. The US dollar is losing purchasing power equal to the advances and past monetization in which are finally being priced.

GOLD, SILVER and COMMODITIES are HOLDING their value as they have throughout HISTORY. Not only is this wealth creation an ILLUSION, the illusionary GAINS are TAXABLE by government. It has been this way since 1971 when this whole monetary charade began at Breton Woods II. This is how the fraud of FIAT currencies works. Your nominal balances rise or stay the same, but your purchasing power shrinks in your paper assets by the same amount or more.

This is an obscene theft of purchasing power from anyone who stores wealth in the financial assets offered by the big banks and financial institutions and those that earn, save or are paid in dollars. It appears to be a gain, but in REAL terms it is a LOSS. Expect it to continue. No wonder the dollar is declining and markets have been on a tear (money for nothing racing off the sideline to preserve purchasing power as more rolls off the presses behind them), it’s becoming more abundant than TOILET paper. Of course, QE II is fait accompli as failure to do so would collapse expectations and markets. The FINANCIAL markets will collapse to their true values in any event because they are HOPELESSLY overvalued by any measure over the last CENTURY.

"Unless investors believe that bubble valuations can be maintained indefinitely, they can expect little but abysmal returns over the coming 5-7 year period." -- Dr John Hussman www.hussmanfunds.com

Take a look at this article by John Hussman outlining the extreme OVERVALUATIONS in traditional asset markets: http://www.hussmanfunds.com/wmc/wmc101011.htm . What’s the conclusion of this article? Historically, when yields on stocks and bonds are at this level you have NO EXPECTATION of gains over the next 7 years. The bottom line to me is that there are BOATLOADS of FIAT currency being created, which are constantly losing value from the day they are born and which have to land somewhere with a potential to rise nominally (nobody tells you the real loss in purchasing power because it is HIDEOUSLY negative). How many of you have investments which can make money in down or sideway market action? Or use stops? Most markets are highly correlated, so wide diversification does not work anymore…

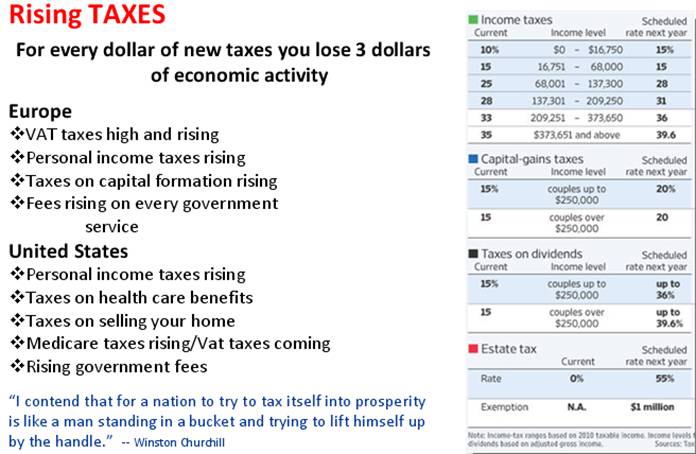

The corrupt congress adjourned without extending the current tax rates (planned from the beginning), thereby implementing the greatest TAX INCREASE in history. They pretended it was just an issue of raising taxes on the job-creating small businesses (millionaires and billionaires as they call them), which the current administration and congress support.

"In politics, nothing happens by accident. If it happens, you can bet it was planned that way.” ‐Franklin D. Roosevelt

NO, they wanted the whole enchilada of $4 trillion of new taxes SUCKED out of the private sector to fund bloated government, crony capitalists, too-big-to-fail banks and companies (AIG, Fannie Mae, Freddie Mac, Government Motors, etc) and their something-for-nothing constituents. Here is what’s coming your way on January 1st:

What can you say about this? The private sector is about to be BURIED again, what little income they have left will be confiscated AGAIN; do you think this will DRIVE the economy into recovery or slam it with a new BODY blow? The answer is obvious. The wealth transferred to the government sector will be misallocated in traditional fashion from production and wealth creation to consumption.

What can you say about this? The private sector is about to be BURIED again, what little income they have left will be confiscated AGAIN; do you think this will DRIVE the economy into recovery or slam it with a new BODY blow? The answer is obvious. The wealth transferred to the government sector will be misallocated in traditional fashion from production and wealth creation to consumption.

Christina Romer, currently Chairman of the Council of Economic Advisers in the White House, and her husband, David, when they were at Stanford conducted exhaustive research which concludes that tax increases are highly contractionary. Their estimates imply that the tax increases will shrink economic output by more than three dollars for every dollar in new taxes.

The sun setting of the Bush tax cuts and new healthcare taxes beginning in 2011 will generate a projected 300 billion dollars a year in new taxes. Using the Romer Multiplier implies a 900 billion dollar decline in economic activity next year.

It’s too late for the withholding tables to be changed so families making $50,000 to 100,000 a year will suffer an immediate reduction in pay of $225 to $327 dollars a month or $2,720 to $3,920 per year in reduced take-home pay. In addition, their take-home pay will be reduced by the taxes due on the value of their healthcare benefits which are now taxable. So add a hefty $150 to $300 a month to the above figures for plans costing $10,000 to $20,000 per year.

A crushing blow; I weep when I think of the damage to the middle class and their children when I realize this was done for political and ideological purposes. They need to be destroyed so government can SAVE them. This will do it…

The healthcare reform was not reform, it was a federal takeover and tax bill in disguise, as I reported when it was passed. This will further bankrupt the middle class. Just think of a family of four desperately holding on as jobs disappear, LOSING $375 to $627 a month in take-home pay to FUND the beltway and their special-interest supporters, as they LOOT America…. er, I mean build socialist progressive Amerika.

Who do you think will spend that money more productively? The middle class as they struggle to make ends meet for their families or the government elites? The answer is obvious; this is an OBSCENE theft from those who are most vulnerable to a depression, transferred to those who are the best connected in Washington. This is the purposeful destruction of the middle class by the administration and their socialist, progressive congressional supporters.

Impoverishment and increased government dependence as written into the laws passed in the last two years. This is how socialists build the something-for-nothing constituents, by making them desperate for relief. These bills are not to save them; they are to enslave them as dependants of new political MASTERS in the beltway. It is a recipe for economic disaster.

Impoverishment and increased government dependence as written into the laws passed in the last two years. This is how socialists build the something-for-nothing constituents, by making them desperate for relief. These bills are not to save them; they are to enslave them as dependants of new political MASTERS in the beltway. It is a recipe for economic disaster.

Look at how many people are falling onto the government dole since radical progressives took congress in 2006:

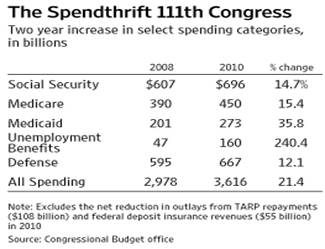

Wow, the policies they have and continue to implement are throwing millions onto the dole and out of a job, as profitability is removed from the private sector by radical Marxists in the beltway. A 37% increase since radical progressives took the congress in 2006. Do you think this means their helping or hurting the middle class with their expansion of government to SAVE them? To see what percentage the government has grown since the chosen one and his supermajority took congress, look no further than this recent post in the Wall Street Journal (www.wsj.com ):

Wow, the policies they have and continue to implement are throwing millions onto the dole and out of a job, as profitability is removed from the private sector by radical Marxists in the beltway. A 37% increase since radical progressives took the congress in 2006. Do you think this means their helping or hurting the middle class with their expansion of government to SAVE them? To see what percentage the government has grown since the chosen one and his supermajority took congress, look no further than this recent post in the Wall Street Journal (www.wsj.com ):

Wow, a 21.4% increase in just two years, and now it is in the baseline and set in stone, another rock around the necks of the private sector. Government as a percentage of the economy has grown from 20 to 25% IN TWO SHORT YEARS. The United States now borrows $.41 cents of every dollar it spends as business creation and incomes collapse under their progressive policies, and public servants blame the evil rich, who happen to be the small businessmen that employ them.

Now comes the mortgage foreclosure crisis which is political football and demagoging at its finest; it will EXPLODE in public servants’ FACES. No one despises the predatory nature of the US and G7 banking system more than I do. Unfortunately, the buzzards in the beltway allowed and encouraged millions of predatory and unviable loans under the authorship of Rep. Barney Fr@nk, Sen. Chris D0dd, and Sen. B@rack 0b@ma who lead the charge of Fannie and Freddie into sub-prime and reckless lending, and defending Fannie and Freddie right up to the day of collapse, to preserve their campaign donations and power over the mortgage markets. Now the mess has to be CLEANED UP, the housing market MUST BE allowed to clear, (decline to values where buyers emerge) and inventories must decline to levels where values can rise again -- from wherever the bottom may be.

These same public servants have tried everything they can to stop nature from taking its course and they have worsened the crisis through regulatory forbearance, extend and pretend for the banks and nonsense such as HAMP (a program that guarantees that homeowners remain underwater, thus financial drowning is assured). Imagine a program that takes an underwater homeowner and makes sure they remain there? This is what the president and congress has done to SAVE them. Why did public servants design these programs? To save the reckless lenders (banksters) and further victimize the hapless homeowner who should never been given the loan in the first place.

Regardless of the previous crimes committed by pet-rock legislators, regulators and their bankster masters, this market HAS TO BE liquidated, the owners cannot pay, the houses are worth less than is owed on them, and most owners have not made a payment in 18 months. Are we now a nation of SQUATTERS? Of course not, since they no longer teach the meaning of the word. No amount of state attorneys general or Washington theatrics can change these SIMPLE facts. Of course the banksters kept sloppy records, cut corners on overdue foreclosures and in general skirted the laws.

What’s new about that? NOTHING. The banksters have owned the regulators since the Federal Reserve was created in 1913 in the dead of night. A privately-owned monopoly on the banking and currency system of the United States operated for the benefit of its shareholders, also known as the too-big –to-fail banks and brokerages. Who among you have heard of a monopoly run for the benefit of its customers?

What is the next shoe to drop in this regulatory and congressional failure known as Fannie Mae, Freddie Mac and mortgage-backed securities? If they don’t have the mortgage to foreclose, then they don’t have the mortgage for the investors who bought them in the CDO’S and Mortgage-backed securities, and the buyer of the mortgages bought a security with no IDENTIFIABLE collateral.

Furthermore, it has also been reported that many of the securities had mortgages equal to only 95% of the face value, which will become apparent during discovery as the civil lawsuits unfold. In addition to this, the banksters provided warrantees to Fannie Mae, Freddie Mac and the purchasers of the securities that the mortgages were of a verifiable quality, which it now appears many of them were not. So the banks that wrote the mortgages and sold them will have to buy them back. It is projected to be hundreds of billions of dollars. Can you say TARP part II? Waterloo?

It will be interesting to see how the banksters, regulators and Washington devise the methods to wiggle out of this one and stick the bill to the public for their poor fiduciary performance. It’s what they have done since the inception of the global financial crisis; stick the bill to the public… This time will be no different.

Now it is clear that Cap and Tax will be IMPOSED by regulatory fiat under the Clean Air Act from the early 1970’s. Unable to pass through the Congress, the EPA, under radical environmentalist and socialist Lisa Jackson, will implement it under instructions from the chosen one in the Whitehouse. Look no further than the lifting of the moratorium on oil drilling in the Gulf for political purposes before the election. New rules will shut oil production down in any event. Energy security just got a lot further away. Not one person on the Oil Crisis Commission is from the industry. The new director is a litigation lawyer with NO EXPERIENCE, and the other board members are recognized radical environmentalists. What will be the result? Significantly higher energy prices to heat your homes, fuel your cars and power your businesses. This IS NOT a way to build economic growth; it is how you DESTROY IT, courtesy of your ELECTED representatives in the BELTWAY.

In Conclusion: The depression is intensifying due to these pieces of legislation and regulation, reflected in the unbelievable drop in interest rates as they price in the depression-era laws BEFORE and while they are being implemented. The continuing collapse in interest rates is testament to this.

"I think this group does not understand what it takes to create jobs. And I think they're flummoxed by their experiment in Keynesian economics not working."… "Every business in America has a list of more variables than I've ever seen in my career." If variables like capital gains taxes and the R&D tax credit are resolved correctly, jobs will stay here, but if politicians make decisions ‘the wrong way’, people will not invest in the United States. They'll invest elsewhere." - Paul Otellini, CEO Intel

Of course they will invest somewhere else, count on it. Capital flight is in full bloom, both in the United States (over $200 billion out since the first of the year) and in the European Union. The bubbles in Asian asset markets are evidence of this. The baby boomers are retiring and want income, so stocks are on the offer and bonds are bid, deflating the last bubble and inflating the current one.

Only 8% of the current corrupt, socialist, progressive crew in Washington has worked in the private sector. The purposeful final destruction of the middle class and the capitalist economy by socialist progressives is at hand. This is called the Cloward-Piven strategy, look it up on the internet. Their goal is to make the majority of US citizens DEPENDANT on government, rather than independent of them, by collapsing the economy.

At no time in memory have the investing challenges and potential opportunities been as enormous as today. As the effects of money printing, deficit spending and Marxist legislation unfold in the developed world, all markets (stocks, bonds, currencies, commodities, natural resources, etc.) are set to zoom up and down to price in the mayhem being implemented by public serpents, banksters, elites and crony capitalists. BUY and HOLD is dead. Actively managed, GOLD BACKED absolute-return alternative investments -- which SHORT CIRCUIT monetary debasement and have the potential to make money in up, down and sideways markets -- are essential diversification. This is what I do…. ( www.traderview.com/consult/ )

Unemployment is about to SKYROCKET as small businesses decide to close due to government-caused DISTRESS and the next group decides not to open their enterprises. By early next year you can expect monthly employment figures to reflect the bloodbath we saw in early 2009 of approximately 700,000 job losses a month, as small businesses flee the vipers in the beltway, close down, say enough is enough and REFUSE to be their slaves.

Capitalism is now dead in the lands of its birth because there are NO REWARDS for saving, investing, starting a business, hiring an employee, taking a risk or working your ass off to get ahead.

The rewards for doing so now go to GOVERNMENT, public serpents and their supporters for redistribution to themselves and to the desperate, useful idiots who support them (because they do not have the education required to know not to). As the something-for-nothings in society turn to government to save them, more torture lays ahead for the private sector.

This is a currency and financial system extinction event and we know the destination; it is the zigs and zags to that destination that we seek to understand and profit from. The developed-world government and financial systems’ MORAL and FISCAL insolvency is inescapable and inextinguishable, but the illusions of safety still persist. The moral and fiscal insolvency of public serpents, elites, banksters and crony capitalists are on full display. Only the inevitable collapse will allow the developed world to return to its roots as capitalist, industrialized societies which produce wealth, rising incomes and middle classes rather than consume them. Gold-backed, absolute return alternative investments with the potential to thrive in up, down and sideways markets are part of the solution. Volatility has been and is set to SOAR. As the unfolding depression is priced into markets, stocks, bonds, currencies and commodities will ZOOM up and down to REFLECT the insanity of our socialist progressive leader’s policies. Buy-and-hold is dead; an actively managed investment by professionals is essential to meet the challenges of today’s markets. This is what I do.

I will be doing a webinar on gold-backed, absolute return investments in the next several weeks, watch for links to register to attend in upcoming editions. Tedbits is also about to release a video book entitled: “When HOPE turns to FEAR” which will ONLY be for available to registered subscribers of Tedbits. Subscriptions are free at www.TraderView.com/subscribe/ . Don’t miss the next edition of Tedbits: Depression written into law series…

By Ty Andros

TraderView

Copyright © 2010 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.