Chinese Interest Rate Hike Spooks Stock Markets

Stock-Markets / Stock Markets 2010 Oct 19, 2010 - 11:01 AM GMTBy: PaddyPowerTrader

U.S. stocks rose Monday to a five-month high, led by financial shares, after Citigroup.’s earnings topped estimates and an unexpected drop in industrial production was taken as a further sign that the Federal Reserve will help fuel the recovery with another bout of QE. Citigroup rallied 5.4%. Hasbro., the second-largest toymaker, advanced 3.8% after reporting higher-than- estimated earnings. But Halliburton, the second-biggest oilfield-services provider, slumped 4.8% as profit missed analysts’ estimates.

U.S. stocks rose Monday to a five-month high, led by financial shares, after Citigroup.’s earnings topped estimates and an unexpected drop in industrial production was taken as a further sign that the Federal Reserve will help fuel the recovery with another bout of QE. Citigroup rallied 5.4%. Hasbro., the second-largest toymaker, advanced 3.8% after reporting higher-than- estimated earnings. But Halliburton, the second-biggest oilfield-services provider, slumped 4.8% as profit missed analysts’ estimates.

Datawise US housing starts & building permits have both surprised to the upside Tuesday helping to take some of the red ink off the big board

European equities have opened broadly flat this morning as disappointing guidance from both IBM and Apple after the bell last night and weaker economic data has been offset by increased expectations that the Fed will implement a second round of quantitative easing at its next policy meeting in November. US industrial output shrank for the first time in more than a year in September, falling by 0.2%. This was compared with economists’ forecasts of 0.2% growth and reinforced the market’s expectations that the Fed will soon unleash a second round of unconventional monetary policy measures. US unemployment remains stubbornly high at 9.6% and with the recovery beginning to lose steam and political barriers preventing another round of fiscal stimulus, the Fed feels the need to act. This was echoed by the Atlanta Fed President Dennis Lockhart who indicated yesterday that he was leaning in favour of further quantitative easing. See below for the full story.

Market Moving Stories Today

Breaking News: PBOC (Chinese central bank) RAISES BENCHMARK DEPOSIT LENDING RATE BY 25 BPS RTRS-PBOC RAISES 1-YEAR LENDING RATE BY 25 BPS

A surprise move ahead of the G20 summit and may elicit a negative knee jerk reaction i.e. stronger $, sell commodities, lower equities (particularly miners & basic resources stocks) & weaker emerging markets FX. The rationale behind this is that very easy Chinese monetary conditions have been one of the primary drivers for global asset demand (including commodities) and that this start to the rate hiking cycle will tighten monetary conditions thus reducing demand from China at the margin.

The move comes on a day when the World Bank said in a report that said China could help stem the rising inflation it is likely to face in the short term by guiding the yuan higher. Further asset price increases would pose a key risk to the rapidly growing Chinese economy. But “a gradual rise” in the Chinese currency’s nominal exchange rate could “help stem price pressures,” the Washington-based international financial institution said.

The World Bank also lowered its outlook for growth next year in China and across East Asia, urging officials in the region to curb inflation and ward off asset bubbles to avoid a repeat of the Asian financial crisis. Developing East Asia, which excludes Japan, Hong Kong, Taiwan, South Korea, Singapore and India, will expand 7.8 percent next year, slower than an April estimate of 8 percent, the Washington-based lender said a semi annual report today.

Can A Currency War Be Prevented?

Currency markets will probably continue trading in response to the likelihood of a G-20 agreement. The chance of an agreement has increased as the IMF uses its influence to convince G-20 participants that an agreement is a must to avoid the Great Recession drifting via a trade war into depression. Brazil and South Korea have either imposed or discussed the introduction of measures to control hot money inflows, illustrating to all parties involved how the world would look if a currency war cannot be prevented. Once capital flows are prevented from moving freely it would not be a big step to impose trade barriers, which will be the ultimate killer for risk appetite eventually moving economies into a liquidity trap.

Meanwhile, Japan’s Finance Minister suggested that it did not intend to single out Korea and China when previously talking about currency under valuation. Indeed, Japan is trying to de-escalate tensions ahead of the G-20, helping to create a constructive negotiation atmosphere. US Treasury Sec Geithner suggesting that the US will not engage in dollar devaluation is an attempt to win back confidence in the USD. However, currency policy is in the hands of the US Treasury and it seems to be undisputed that the USD decline has been due to the Fed printing money as the Treasury has run out of funds to promote fiscal and hence USD support. I assume that the Fed and the Treasury will coordinate its views before going to Seoul. Hence, the relationship between the size of upcoming QE and the US willingness to reach a compromise with China in Seoul is clear. Therefore, the outcome of the 4th November Fed announcement will tell us a lot about the motivation of the US side to reach out to China to avoid a currency war.

Tim Geither Talks up the USD

And the EUR/USD cross falls 50 pips. As we haven’t heard him try to support the USD since Feb, so the FX impact was significant but temporary (since Feb, we’ve had to rely on the ECB’s JC Trichet to remind us that the US operates a strong dollar policy!). It’s also significant given the overall backdrop of lawmakers/policymakers talking down their currencies (not to mention lingering suspicions that Fed is engaging to QE to weaken USD). Geither said neither the US nor any other country can “devalue its way to prosperity, to competitiveness”. “It is not a viable, feasible strategy and we will not engage in it.” He said the U.S. will “work very hard to make sure that we preserve confidence in a strong dollar.” He also, predicted USD will remain the supreme global reserve currency in our lifetimes. Music to the ears of dollar bulls, but Fed speakers have a greater influence these days and I methinks Tim has his fingers crossed behind his back

The Fed’s Lockhart leaning towards QE

Atlanta Fed governor Lockhart is an FOMC voter in 2012. He sees more QE as insurance against the current disinflation (a slowing rate of positive inflation) turning into deflation (and actual negative CPI print). The overwhelming majority of voting FOMC members (and non-voting hangers-on) now seem in favour of QE2. There a cacophony of Fed speakers today: Lockhart (again), Dudley, Fisher, Kocherlakota, Bernanke (very briefly). But the key will be Duke. A governor we haven’t heard from in months. She last mentioned economy/monetary policy in early July and has tended to avoid the subject completely in recent speeches

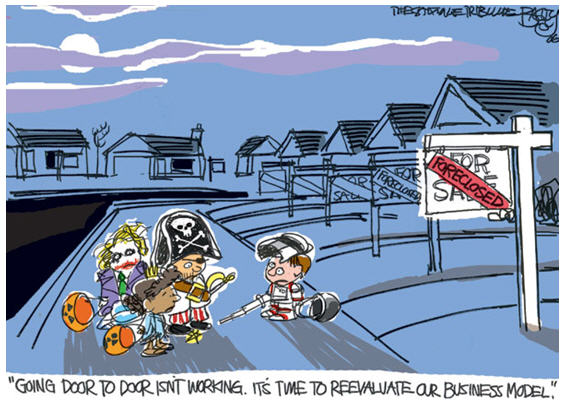

US Mortgage Foreclosures

Bank of America, the largest U.S. bank by assets, said it will start resubmitting foreclosure affidavits next week in 102,000 cases in which judgment is pending. Shares of the company gained as much as 3.3% . “As was the case for our judicial state review, our initial assessment findings show the basis for our foreclosure decisions is accurate,” spokesman Dan Frahm said in an e-mailed statement today. Bank of America shares declined 9.1 percent last week, reaching their lowest level in more than a year, amid scrutiny of foreclosure practices and speculation that investors may force lenders to buy back faulty loans.

Forced repurchases of soured U.S. mortgages may be the “biggest issue facing banks” even as errors in the foreclosure process draw attention to other industry risks, according to JP Morgan analysts. Future losses from repurchases of home loans whose quality failed to meet sellers’ promises will likely total $55 billion to $120 billion, or potentially $10 billion to $25 billion for the next five years, the New York-based mortgage-bond analysts led by John Sim and Ed Reardon wrote in a Oct. 15 report.

Sterling Weakens On CBI Data

Sterling has been hit hard today and will remain under selling pressure after the release of disturbingly weak CBI data. The report showed total orders declining to -28, the weakest reading since April and the volume of output has been only held up due to an increase in the index of finished goods. The Treasury plans cutting fiscal support worth 2.4% of GDP. The UK will be heading towards a tight fiscal / loose monetary policy approach which will weaken Sterling.

The Bank of England risks stoking inflation with little benefit to economic growth if it expands its so-called quantitative easing program of stimulus, former policy maker Kate Barker said. “If rising inflation expectations have followed the use of QE, there is a risk that relying on monetary policy to ride to the rescue of faltering growth might be misplaced,” Barker said yesterday at an event held by Queen Mary College in London. More stimulus could “have more of an impact on inflation than on growth if it feeds through into higher inflation expectations.”

German Sentiment Index Declined

The German forward-looking ZEW index of economic sentiment among investors and analysts declined for the sixth consecutive month to a 12 month low, while the spread with the current situation index widened further. The ZEW index of consumer sentiment, gauging expectation on the German economy among investors and analysts for the six months ahead dropped from -4.3 in September to -7.2 in October, the lowest level since January 2009, while the index of current conditions jumped to a three year high of 72.6. The greater negative value in the expectations index means that now an even greater proportion of those surveyed expect conditions to deteriorate rather than improve. This is a sign that the global slowdown and the appreciation of the Euro is taking a toll on sentiment. Such large and widening spread levels between the current situation and sentiment indexes have generally anticipated significant slowdowns in actual activity indicators.

Company / Equity News

•Apple’s. forecasted profit for the current quarter will rise less than analysts predicted as supply constraints hamper sales of the iPad computer. The stock fell in extended trading. Profit will be about $4.80 a share in the current period, which includes the yearend holiday shopping season. Analysts surveyed by Bloomberg had predicted profit of $5.03. Profit and sales in the fourth quarter, which ended in September, exceeded analysts’ projections. Net income rose to $4.31 billion, or $4.64 a share, compared with $2.53 billion, or $2.77, a year earlier, Apple said today in a statement. Sales rose to $20.3 billion. Analysts surveyed by Bloomberg had estimated profit of $4.10 a share and sales of $18.9 billion. Apple slumped as much as 7.9 percent to $292.75 in extended trading. It had climbed $3.26 to $318, a record, at 4 p.m. in Nasdaq Stock Market trading. The shares, up 51 percent this year, surpassed $300 for the first time last week.

•IBM declined as much as 4% in late U.S. trading yesterday after a drop in new contracts overshadowed an improved financial forecast. Services signings fell 7 percent to $11 billion in the third quarter, IBM said yesterday in a statement, the third straight quarterly drop in new contracts. While companies increased spending on IBM’s software and hardware, such as storage computers, they’re holding back on large outsourcing projects in the aftermath of the recession.

•Microsoft has announced that its Chief Software Architect Ray Ozzie is to step down. The departure while not totally unexpected, the timing is a surprise. Ozzie’s departure follows recent resignations including entertainment chief Robbie Bach and head of its Office division Stephen Elop.

•Bloomberg reports that Ireland’s government plans to name Irish Life & Permanent Plc and an investor group led by Cardinal Asset Management as the two preferred bidders for EBS Building Society, the lender rescued in May, two people familiar with the talks said. An announcement may be made as soon as today, said the people, who declined to be identified before an announcement.

•PSA Peugeot Citroen: France’s largest carmaker and Munich-based BMW said they plan to expand their partnership on hybrid vehicles.

•Xstrata, the mining giant, said Tuesday in a management report and update that the third quarter reflected “strong momentum” in coal, copper and nickel volumes. And the company laid out expected production volumes for certain key projects. At Las Bambas in Peru, for example, the company initially expects to produce 400,000 tons a year of copper concentrate, with “significant gold, silver and molybdenum byproducts.”

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.© 2010 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.