Gold and Silver: You Can Trade This Bull Market

Commodities / Gold & Silver Oct 05, 2007 - 09:40 AM GMTBy: Bob_Kirtley

What a difference a month makes! Gold closed at $731 and the HUI hit 400 , which makes the job of writing this update more of a pleasure. We will start with both the chart of the HUI and the chart of gold. Both have moved to higher ground aided by the Federal Reserve who pitched in with a 50 basis points rate cut. The US dollar weakens and gold strengthens as their inverse relationship continues.

What a difference a month makes! Gold closed at $731 and the HUI hit 400 , which makes the job of writing this update more of a pleasure. We will start with both the chart of the HUI and the chart of gold. Both have moved to higher ground aided by the Federal Reserve who pitched in with a 50 basis points rate cut. The US dollar weakens and gold strengthens as their inverse relationship continues.

The first part of this article was taken from postings in our Free Gold Prices Newsletter and Free Silver Prices Newsletter on the 22 nd and 23 rd of September:

As we can see from the HUI, the largely un-hedged gold mining stocks have put on a spurt and added around 100 points to this index lifting this index from 300 to 400. Gold has also performed stupendously with the price hitting over $731/oz.

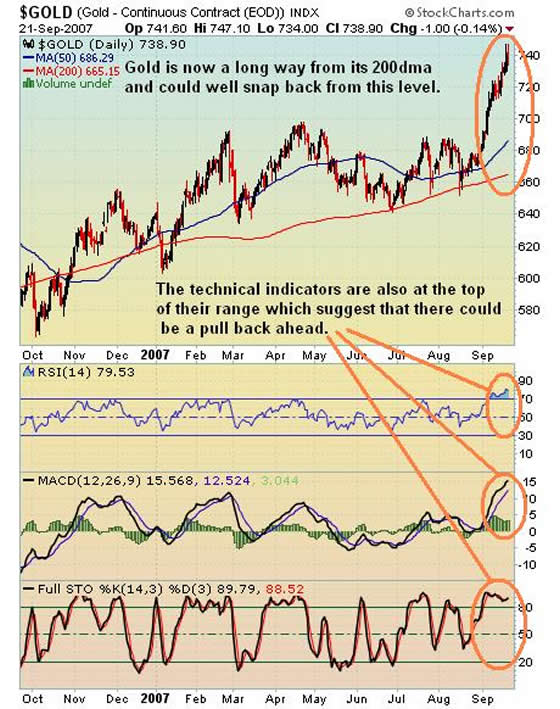

Now please remember that as gold bugs we tend to see the world through gold tinted glasses with nothing but blue-sky scenarios ahead of us. From what we can glean searching the web there are a number of well-respected analysts shouting from the rooftops to buy. However if we take a hard cold look at the charts they are in the sell zone . So as investors we need to assess the possibility of a snap back, if so just how severe will it be and what if anything should we do about it? If you are invested in this sector for the long term then you can sit through the turbulence comfortable in the knowledge that this uptrend remains intact and will continue to rise despite any short-term pull back. If you are a trader and the situation appears to be a little over bought then by all means take some money off the table.

We are not recommending any buying at this point. We will hold the gold stocks that we have and we may take some money off the table in the near term.

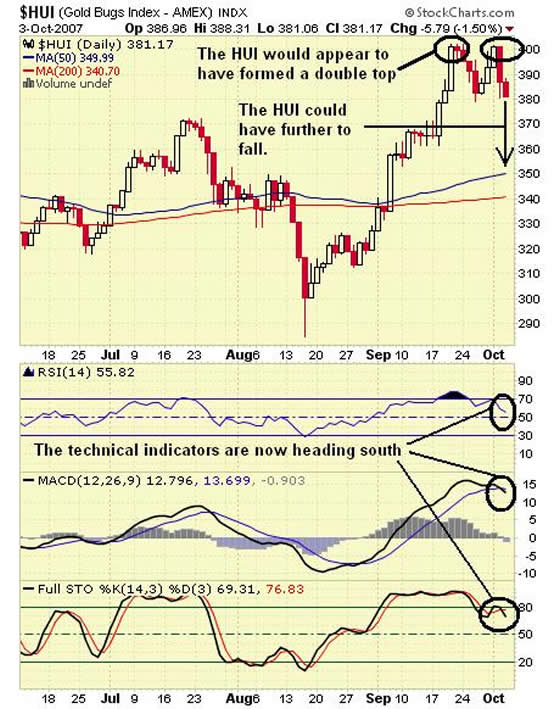

Chart One the HUI:

Chart Two Gold:

Last month we wrote about disappointment as we watched our profits being eroded but made the decision to hang on in there and as our profits are slowly being returned we will allow ourselves a little smile.

Going forward we intend to make the occasional short-term trade as we did with silver and we will be constantly on the look out to accumulate more of what we have and to add new stocks to our portfolio .

Silver has put on a sparkling performance adding around $2/oz to the spot price for a gain of 17.39% lifting silver stocks along the way.

Before we get carried away with blue-sky scenarios we will take a look at the chart of silver's progress and try and ascertain where next for our elusive star .

The first thing that we can see is that silver has had a dramatic climb over a short time period. The technical indicators, RSI, MACD and the Stockastics are all in the sell zone. They are telling us to beware. Now taking these indicators into consideration we have decided to remove all BUY signals from silver stocks. This stance may very well be short lived as we expect any correction to be over with quite quickly.

We are still silver bulls and remain confident that by the end of the year the price of silver will be a lot higher than it is now. In the midst of the prevailing euphoria we are preparing ourselves for a correction, which actually would be a healthy move for silver, so don't dwell it too much when it comes.

For the more hyper active traders amongst us we predicted a 50 cent rise in the price of silver on the 1st July and by the 11th July it was up 62 cents so we hope that your short term trade worked out for you.

On 20th August 2007 we signalled another Trading Opportunity in Silver: BUY as we anticipated silver to rally and gain around $1.00 going forward. This trade has been closed showing a gain of 100% in 30 days .

Going forward we intend to identify other such short-term moves that may just add a little extra spice to this investment account, so keep an eye or you could miss out. However do not go mad on this sort of trade and only put small amounts of your cash at risk. We did this via a spread bet based on a silver futures contract. The spread bet provides limited risk as the most we can lose is the stake and it is also tax free in the UK .

Please read recent articles before buying any particular silver stock as we are trying to post updates on a regular basis and the stock that you are intending to invest in may have entered overbought territory.

We do believe that this portfolio of silver stocks is heading to higher ground, so when you look back these prices will look really cheap lessening the importance of whether you bought at the very bottom or not.

The summer is now behind us and we now expect a good rally in silver prices with much higher silver quotes by the year-end. However the progress made will not be in a straight line so be prepared for snap backs coming from nowhere just to play havoc with your digestive system.

Then today, the 4 th October 2007 , we wrote the following to our subscribers:

Silver has experienced a terrific run up from $11.50 to $14.00 so a pull back of some sort was to be expected. As we write silver is at $13.15, which is pretty close to its 200dma unlike gold, which is trading much higher .

Taking a quick look at the chart we can see that the technical indicators are turning negative which suggest that silver will continue to retreat. However as silver is more or less sitting on its 200dma the downside could well be limited. The danger is that silvers big brother gold continues to be sold off and the selling spills over into the silver sector. Again this would present us with another buying opportunity if that were to happen. Having taken some profits in our gold investment account we decided to hold our position in silver.

We regarded silver as being a little ahead of itself but that it was not as overbought as gold . The question remains when do we re-commence buying stocks? The answer appears to be when gold exhausts its current selling pressure, which has so far seen it drop around $20.00.

The next ten days or so should give us some clues as to when silver will get back into the saddle and head north, for the winter! So no buying for us just yet but it is vitally important to closely observe the individual performance of silver stocks and try and decide which stocks will outperform this market.

USD chart:

The US Dollar has managed three up days to produce a small rally, which in turn has a negative effect on gold. The RSI, MACD and the Stockastics were well and truly in the oversold range however they have turned up and are heading for the neutral zone. It remains to be seen if this embattled currency can produce a significant rally. We do not have any faith in the strength of US Dollar but it must be remembered that nothing goes down in a straight line and a rally will put a cap on gold's progress.

HUI chart:

The HUI would appear to have formed a double top, which suggests that the recent surge upwards is over for now. The RSI, MACD and the Stockastics have just started heading south.

We recently sold approximately 50% of our holdings in gold stocks which are documented on our gold and silver websites and the accompanying free newsletters.

The other 50% of these gold mining stocks remain in our investment account and form part of our core holdings along with the other gold stocks listed in our portfolio.

In conclusion, the USD is heading north for the moment and gold is behaving inversely to it. The charts suggest to us that gold and gold stocks remain under downward pressure. We anticipate that gold will retreat to $700 possibly during the next ten days. Towards the end of October we should see the end of this pull back and gold begin a major rally through until January. As soon as we think that the re-entry point has arrived we will tell you and start buying stocks again. Until then we will watch the action and try and identify which stocks offer the possibility of greater profits.

For ideas on which gold stocks to invest in, subscribe to the Gold Prices newsletter at Gold-Prices.biz completely free of charge.

By Bob Kirtley

www.gold-prices.biz

Bob Kirtley spent many years working on Oil projects including some in Alberta, such as the tar sands installations in Fort McMurray. He lived and worked in many different countries, as that is the nature of the construction business. Planning and cost control are key to a projects success and he tries to apply those disciplines on a daily basis when dealing with investments. His training in such areas as SWOT and Risk analysis can be applied from time to time. His qualifications include being chartered in the United Kingdom, which is similar to that of a Professional Engineer in Canada, along with a Masters Degree in Project Management from South Bank University, London, England.

He has been working for a number of years on a full time basis representing a group of investors in England.

DISCLAIMER : Silver Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.

Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.