China and the Future of Rare Earth Elements

Politics / Metals & Mining Oct 15, 2010 - 03:49 AM GMTBy: STRATFOR

A recent diplomatic spat between China and Japan has heightened territorial tensions and called attention to China’s growing forcefulness with foreign powers. One of the more intriguing aspects of this development was China’s suspension of the export of “rare earth” elements (REE) to Japan. REE comprise 17 metallic elements with a variety of modern industrial and commercial applications ranging from petroleum refining to laptop computers to green energy applications to radar. China produces roughly 95 percent of the global supply of REE and Japan is the largest importer. China’s disruption of REE shipments to Japan has caused alarm among other importer countries, bringing new urgency to the search for new supplies and substitutes.

A recent diplomatic spat between China and Japan has heightened territorial tensions and called attention to China’s growing forcefulness with foreign powers. One of the more intriguing aspects of this development was China’s suspension of the export of “rare earth” elements (REE) to Japan. REE comprise 17 metallic elements with a variety of modern industrial and commercial applications ranging from petroleum refining to laptop computers to green energy applications to radar. China produces roughly 95 percent of the global supply of REE and Japan is the largest importer. China’s disruption of REE shipments to Japan has caused alarm among other importer countries, bringing new urgency to the search for new supplies and substitutes.

The China Factor

Chinese control of the base of the REE supply chain has increasingly made China the go-to location for the intermediate goods made from REE. In time, China hopes to extend production into the final products as well. As new REE supplies cannot be brought online overnight, the Chinese will enjoy a powerful position in the short term. The Chinese Ministry of Commerce reports that China has ratcheted down REE export quotas by an average of 12 percent per year over the past five years, further leveraging this position. Reflecting that and the current China-Japan spat, the average price for REE has tripled in the year to date.

Rare earth elements are not as rare as their name suggests, however. Before the Chinese began a dedicated effort to mass-produce REE in 1979, there were several major suppliers. Pre-China, the United States was the largest producer. Appreciable amounts of REE were also produced in Australia, Brazil, India, Malaysia and Russia. Any sort of real monopoly on REE, therefore, is not sustainable in the long-run. But before one can understand the future of the REE industry, one must first understand the past.

The story of REE is not the story of cheap Chinese labor driving the global textile industry into the ground. Instead, it is a much more familiar story (from STRATFOR’s view) of the Chinese financial system having a global impact.

Unlike Western financial systems, where banks grant loans based on the likelihood that the loans will be repaid, the primary goal of loans in China is promoting social stability through full employment. As such, the REE industry — like many other heavy or extractive industries — was targeted with massive levels of subsidized loans in the mid-1980s. At the same time, local governments obtained more flexibility in encouraging growth. The result was a proliferation of small mining concerns specializing in REE. Production rates increased by an annual average of 40 percent in the 1980s. They doubled in the first half of the 1990s, and then doubled again with a big increase in output just as the world tipped into recession in 2000. Prices predictably plunged, by an average of 95 percent compared to their pre-China averages.

Most of these Chinese firms rarely turned a profit. Some industry analysts maintain that for a good portion of the 2000s, most of them never even recovered their operating costs. At the same time, an illegal REE mining industry ran rampant, earning meager profits by disregarding worker safety and the environment and ruthlessly undercutting competing prices. With an endless supply of below-market loans, it did not matter if the legitimate mining concerns were financially viable. It was in the environment of continued Chinese production despite massive losses that nearly every other REE producer in the world closed down — and that the information technology revolution took root.

In fact, if not for China’s massive overproduction, the technological revolution of the past 15 years would not have looked the same. In all likelihood, it would have been slowed considerably.

Before 1995, the primary uses for REE were in the manufacture of cathode ray tubes (primarily used in television sets before the onset of plasma and LCD screens) and as catalysts in the refining industry and in catalytic converters (a device used in cars to limit exhaust pollution). Their unique properties have since made them the components of choice for wind turbines, hybrid cars, laptop computers, cameras, cellular phones and a host of other items synonymous with modern life. Chinese overproduction in the 2000s — and the price collapses that accompanied that overproduction until just this year — allowed such devices to go mainstream.

With numerous large REE deposits outside China, the long-term sustainability of a monopoly is questionable at best. This does not mean China will not create some destabilizing effects in the medium term as it attempts to leverage the current imbalance to its benefit, however. That its prolific, financially profitless and environmentally destructive production of REE has largely benefited foreign economies is not lost on China, so it is pushing a number of measures to alter this dynamic. On the supply side, China continues to curb output from small, unregulated mining outfits and to consolidate production into large, state-controlled enterprises, all while ratcheting down export quotas. On the demand side, Chinese industry’s gradual movement up the supply chain toward more value-added goods means more demand will be sequestered in the domestic economy. In fact, in the years just before the financial crisis and accompanying recession, global demand outpaced China’s ability (or willingness) to supply the market, resulting in bouts of price volatility. As the economic recovery proceeds, it is no stretch to envision outright gaps in exports from China within two to five years, even without the kinds of political complications the REE market has suffered in recent days.

Many states already have REE-specific facilities in place able to restart mining in response to this year’s price surge.

The premier Australian REE facility at Mount Weld plans to ramp up to 19,000 metric tons of rare earth oxides by the end of 2011. The top American site — Mountain Pass in California — aims to produce a similar amount by the end of 2012. Those two sites will then collectively be producing 25-30 percent of global demand.

Before China burst on the scene, most REE production was not from REE-specific mines. REE are often found co-mingled not simply with each other, but in the ores extracted for the production of aluminum, titanium, uranium and thorium. As China drove prices down, however, most of these facilities ceased extracting the difficult-to-separate REE. There is nothing other than economics stopping these facilities from re-engaging in REE production, although it will take at least a couple of years for such sites to hit their stride. Such locations include sites in Kazakhstan, Russia, Mongolia, India and South Africa as well as promising undeveloped sites in Vietnam, Canada (Thor Lake) and Greenland (Kvanefjeld). And while few have been exploring for new deposits since the 1970s given the lack of an economic incentive, higher prices will spark a burst of exploration.

Getting from here to there is harder than it sounds, however. Capital to fuel development will certainly be available as prices continue to rise, but opening a new mine requires overcoming some significant hurdles. Regardless of jurisdiction, a company needs to secure the lease (usually from the central government) and obtain a considerable variety of permits, not the least of which is for handling and storing the toxic — and in the case of REE, radioactive — waste from the mine. Even if the governments involved want to streamline things, vested interests such as the environmental lobby and indigenous groups appear at every stage of the permit process to fight, lobby and sue to delay work. And depending on the local government, successfully mining a deposit could involve a considerable amount of political uncertainty, bribe paying or harassment. Only after clearing these hurdles can the real work of building infrastructure, sourcing inputs like electricity and water, and actually digging up rocks begin — itself a herculean task.

Another complication is the fact that many of the best prospects are in jurisdictions undergoing significant changes. In the United States, activists are working to reform the federal mining law dating to 1872, which has ensured that U.S. jurisdictions remain among the most attractive mining destinations in the world. Initiatives like the Hardrock Mining and Reclamation Act of 2007 would drastically constrain mineral companies and increase project costs across the board. In Australia, ongoing negotiations over the implementation of a so-called “super tax” has dampened enthusiasm in one of the world’s premier mining jurisdictions and home to Lynas Corporation’s Mount Weld project. The tax, which sought to impose a 40 percent tax on mining profits, has since been watered down, but the debacle has left a discernable mark on the country’s resource extraction industry. And for an industry that is positively allergic to uncertainty, events like the BP oil spill in the Gulf of Mexico and the Chilean mine collapse only portend tighter regulation worldwide.

Re-opening an existing mine is somewhat easier since some infrastructure remains in place, and the local community is accustomed to having a mine. Old equipment may need to be brought up to specifications, and the regulatory questions will still affect how miners and bankers view the project’s profitability, but the figuring margins are simpler when the basic geology and engineering already have been done.

Unfortunately, there is more to building a new REE supply chain than simply obtaining new sources of ore. A complex procedure known as beneficiation must be used to separate the chemically similar rare earth metals from the rest of the ore it was mined with. Beneficiation proceeds through a physical and then chemical route. The latter differs greatly from site to site, as the composition of the ore is deposit-specific and factors into the choice of what must be very precise reaction conditions such as temperature, pH and reagents used. The specificity and complexity of the process make it expensive, while the radioactivity of some ores and the common use of chemicals such as hydrochloric and sulfuric acid invariably leave an environmental footprint. (One reason the Chinese produced so much so fast is that they did not mind a very large environmental footprint.) The chemical similarity among the REE that was useful to this point now becomes a nuisance, as the following purification stage — the details of which we will leave out to avoid a painfully long chemistry lecture — requires the isolation of individual REE. This stage is characterized by extraordinary complexity and cost as well.

At this point, one still does not have the REE metal, but instead an oxide compound. The oxide must now be converted into the REE’s metallic form. Although some pure metals are created in Japan, China dominates this part of the supply chain as well.

In any other industry, this refining/purification process would be a concern that investors and researchers would constantly be tackling, but there has been no need, as Chinese overproduction removed all economic incentive from REE production research for the past 20 years (and concentrated all of the pollution in remote parts of China). So any new producer/refiner beginning operations today is in essence using technology that has not experienced the degree of technological advances that other commodities industries have in the past 25-30 years. It is this refining/purification process rather than the mining itself that is likely to be the biggest single bottleneck in re-establishing the global REE supply chain. It is also the one step in the process where the Chinese hold a very clear competitive advantage. Since the final tooling for intermediate parts has such a high value added, and since most intermediate components must be custom-made for the final product, whoever controls the actual purification of the metals themselves forms the base of that particular chain of production. Should the Chinese choose to hold that knowledge as part of a means of capturing a larger portion of the global supply chain, they certainly have the power to do so. And this means that short of some significant breakthroughs, the Chinese will certainly hold the core of the REE industry for at least the next two to three — and probably four to five — years.

Luckily, at this point the picture brightens somewhat for those in need of rare earths. Once the REE have been separated from the ore and from each other and refined into metallic form, they still need to be fashioned into components and incorporated into intermediate products. Here, global industry is far more independent. Such fashioning industries require the most skill and capital, so as one might expect, these facilities were the last stage of the REE supply chain to feel competitive pressure from China. While some have closed or relocated with their talent to China, many component fabrication facilities still exist, most in Japan, many in the United States, and others scattered around Europe.

All told, a complete regeneration of the non-Chinese REE system will probably take the better part of the decade. And because most REE are found co-mingled, there is not much industry can do to fast-track any particular mineral that might be needed in higher volumes. And this means many industries are in a race against time to see if alternative REE supplies can be established before too much economic damage occurs.

Affected Industries

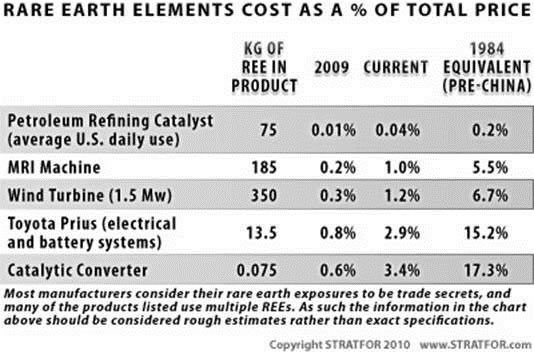

Everyone who uses REE — which is to say, pretty much everyone — is going to feel a pinch as REE rapidly rise in value back toward their pre-Chinese prices. But some industries are bound to feel less a pinch than a death grip. REE applications broadly fall into six different categories, with the first being the least impacted by price increases and the sixth being the most impacted.

The first category consists of cerium users. Cerium is the most common REE and the most critical for refining and catalytic converters. As the average global crude oil gets heavier, cerium is needed more and more to “crack” the oil to make usable products. As clean air requirements tighten globally, automobile manufacturers need more cerium to ensure cars run as cleanly as possible. Cerium thus remains in high demand.

Luckily for cerium users, the steady phasing-out of cathode ray tubes means that supplies rapidly are being freed up for other applications. Between the sudden demand drop and ongoing REE production in China, there are actually substantial cerium stockpiles globally. This means that cerium users are not likely to face serious price increases even though their REE has the most inelastic demand. Petroleum and automotive companies use the most cerium, which also is used for polishing agents for glass and semiconductor chips, ultraviolet ray-proof glass, self-cleaning ovens, and some steel alloys.

The second category comprises non-cerium goods with inelastic demand. This includes items that will be built regardless of cost, either because they are irreplaceable or because they are luxury items. This list includes satellites, which use yttrium in their communications systems; europium, used in LED screens in TVs; lanthanum, used for fish-eye lenses in iPhones; scandium, used for lighting systems in movie studios; and neodymium and gadolinium, indispensable for MRIs. These are all items that people — in particular Americans — would not stop purchasing without a large increase in prices. Luckily, while REE are critical to these devices, they make up a rather small proportion of their total cost. So while the world will certainly see REE price increases, those price increases are unlikely to affect the luxury market.

The third category comprises defense goods. Somewhat similar to luxury goods in terms of how REE demand and prices will affect them, demand for defense goods is extremely unlikely to shift due to something as minor as a simple price increase. Military technology that uses REE — ranging from the samarium in the guidance module in joint-direct attack munition kits to the yttrium used in the “magic lantern” that locates subsea mines — is going to be in demand regardless of price. Demand for urgently needed military technology is quite inelastic regardless of price in the short run, and militaries — in particular the American military — have robust budgets that dwarf the additional costs of components whose contribution to the final cost is negligible. The only reason STRATFOR places defense uses as likely to suffer a greater impact than luxury goods is that China itself is aiming to be a producer of luxury goods, so such products will most likely have a Chinese supply chain. By contrast, few militaries in the world with the high-end capabilities likely to be impacted by REE prices are interested in purchasing military technologies from China, so there will be a large constituency pushing for alternative production of REE as well as a large market for alternative products. This could turn out to be a boon for the American industry: Anyone seeking to increase REE production is going to find a friend in the Pentagon, and no one can lobby Congress quite like the military.

The fourth category comprises goods in which REE are a critical component and a significant price impact but that are made by industries with a long habit of adapting to adverse price shifts. A case in point is the Japanese auto industry. There is a long list of vehicle systems that the Japanese have adapted over the years as the price of various inputs has skyrocketed. In 2000, the Russian government banded together the country’s disparate platinum group metals (such as palladium and platinum, critical in the manufacture of catalytic converters) exports into a single government-controlled cartel. Platinum group metal prices subsequently skyrocketed. By March 2001, Honda had announced a new advance that reduced the need for palladium by roughly half. Platinum group metal prices subsequently plummeted.

In anticipation of this type of disruption, the Japanese have been developing substitutes to REE. Presently, the Toyota Prius uses roughly one kilogram of neodymium. At pre-2010 spike prices, that neodymium used in one Prius cost $20, a marginal impact on the Prius’ sticker price. Should prices rebound to pre-China levels, however, the average Prius buyer would notice a roughly $450-price hike due to magnetic components alone. One week into the China-Japan REE spat, government-funded researchers announced a magnet system design that can completely replace the neodymium used in the Prius.

This hardly solves the problem overnight; it will take months or years to retool Toyota’s factories for the new technology. Still, consumers of REE are going to find ways of lessening their use of REE. The information technology revolution has proceeded unabated since 2000 in part because REE have been one-tenth to one-twentieth of their previous prices. Absent any serious price pressures, industries have had no need to invest in finding means of cutting inputs or finding substitutes. (REE are so abundant that in China they are used in fertilizers and road-building materials.)

The shift in prices could well give a much-needed boost to non-REE dependent technologies hampered by relatively inexpensive REEs. For example, the REE lanthanum is a leading component in the Prius’ nickel metal-hydride battery system. (The Prius uses ten kilograms of lanthanum). Toyota has been edging toward replacing the nickel-hydride system with REE-free lithium-ion batteries, but has demurred due to the low price of lanthanum. Increase that cost by a factor of 20, or even the factor of three seen in recent months — and add in the threat of a full cutoff — and Toyota’s board is likely to come to a different conclusion.

Computer hard drives may fall into a similar category. A major cause of the increased demand for REE has been the demand for neodymium in particular and a specific intermediate product made from it, the neodymium-iron-boron magnet (which also uses some dysprosium). The magnets are a critical component in hard drives, particularly for laptops. But like lithium-ion batteries, a new technology is gaining market share: solid-state hard drives. Currently, the consumer’s cost difference between the two is a factor of four, but sustained price hikes in the cost of neodymium and NdFeB magnets could cause demand to plummet.

The fifth category comprises goods where the laws of supply and demand are likely to reshape the industries in question. These are goods where price is most certainly an issue, and where consumers will simply balk should the bottom line change too much. Compact fluorescent light bulbs that use phosphors heavy in terbium, LED display screens that use europium and various medical techniques that use erbium lasers all fall into this category. None of these industries will disappear, but they are extremely likely to see far lower sales as none of these products are economically indispensable and all have various product substitutes.

The sixth category comprises goods for which there are very low ore and metal stockpiles with demand that is both high and rising rapidly, and for which it will take the longest to set up an alternate supply chain. The vast majority of these industries depend on the same type of neodymium magnets used in hard drives, but do not have an obvious replacement technology. These magnets are a critical component in the miniaturization (and convergence) of electronic devices such as cellular phones, MP3 players, computers and cameras. They are also central to the power exchange relays for electricity-generating wind turbines used in today’s wind farms.

But even within this category, not all products will be impacted similarly. Many of the miniaturized electronic consumer goods manufacturers will face growing pains as they find their supply chain increasingly concentrated in China. But cheaper production costs could offset rising materials costs, and technological innovation will also help lessen the impact. Alternative energy is not likely to be as lucky. Neodymium magnets are critical to windmill turbines, one of the specific areas the Chinese hope to dominate. Each 1-megawatt windmill uses roughly a metric ton of NdFeB magnets.

For green energy enthusiasts, this is a double bind. First, green power must compete economically with fossil fuels — meaning rather small cost increases in capital outlays could be a deal breaker. Second, the only way to get around the price problem is to advocate greater neodymium production. And that means either tolerating the high-pollution techniques used in China, or encouraging the development of a not-particularly-green mining industry in the West.

Read more: China and the Future of Rare Earth Elements

By George Friedman

This analysis was just a fraction of what our Members enjoy, Click Here to start your Free Membership Trial Today! "This report is republished with permission of STRATFOR"

© Copyright 2010 Stratfor. All rights reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis.

STRATFOR Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.