Widening U.S. Trade Deficit Will Trim Q3 Real GDP Growth

Economics / US Economy Oct 15, 2010 - 03:35 AM GMTBy: Asha_Bangalore

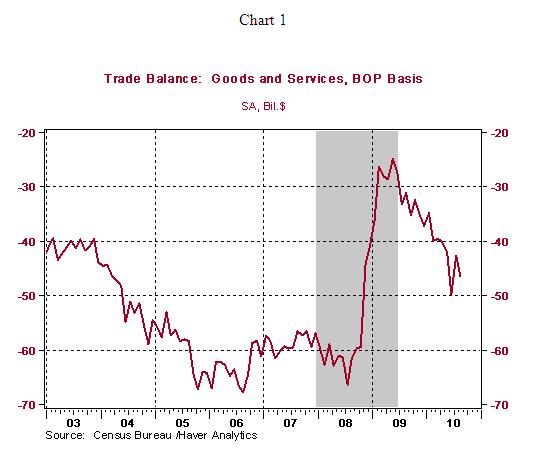

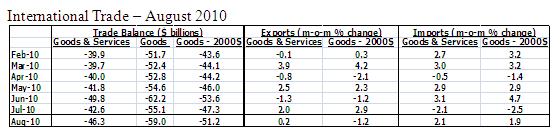

The trade deficit widened to $46.3 billion in August, reflecting a small increase in exports and a large jump of imports. The July-August data suggest that the trade deficit will trim the headline real GDP reading in the third quarter.

The trade deficit widened to $46.3 billion in August, reflecting a small increase in exports and a large jump of imports. The July-August data suggest that the trade deficit will trim the headline real GDP reading in the third quarter.

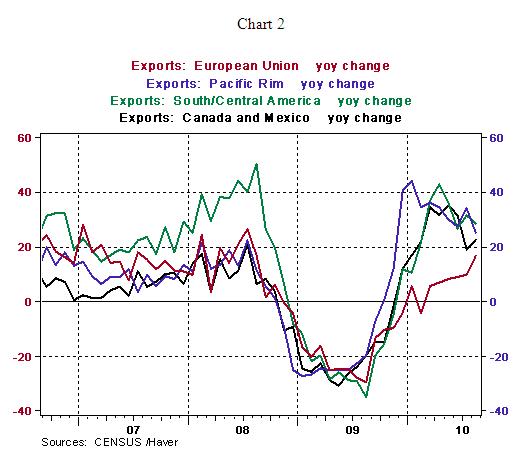

The 0.2% increase in exports of goods and services is projected to change during the rest of the year given the weak trend of the dollar and robust growth of emerging nations. The strength in exports to South/Central America and Pacific Rim is predicted to dominate the export picture in the near term. A large imported oil bill accounted for the 2.1% increase in imports during August. In addition, imports of capital goods excluding autos (+2.2%), autos (+3.1%), and consumer goods excluding autos (+3.4%) made up the bulk of imports in August.

Jobless Claims - Labor Market Conditions Remain Problematic

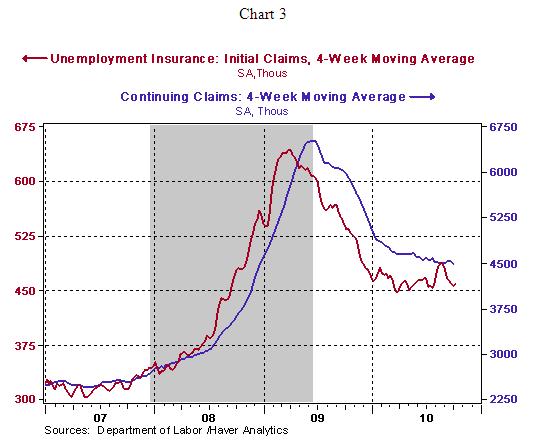

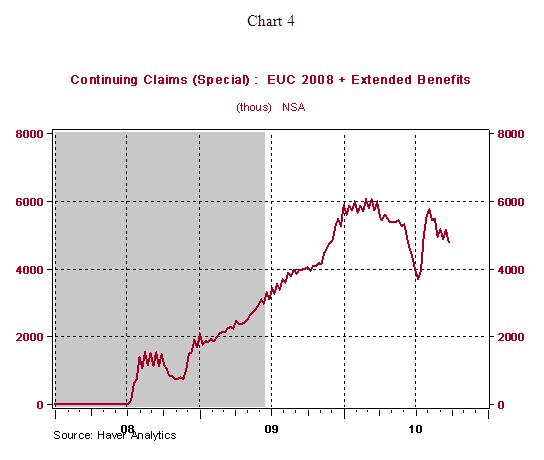

Initial jobless claims increased 13,000 to 462,000 during the week ended October 9. Continuing claims, which lag initial jobless claims by one week, declined to 4.399 million. Claims under special programs, which are published two weeks after initial jobless claims, declined 340,130 to 4.795 million. The reduction of both continuing and special claims reflects a large number of claimants exhausting eligibility for unemployment insurance. Therefore, initial jobless claims are the best indicator, for now, and they have held around 450,000 for the nearly the entire first ten months of the year (see chart 3). The main message is that hiring trends are not robust, as yet, and will continue to appear at the top of the Fed's list of concerns in the near term.

The most important event of the week: Chairman Bernanke's speech on October 15, "Monetary Policy Objectives and Tools in a Low-Inflation Environment."

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.