Nothing Like Uncertainty to Boost Gold Prices

Commodities / Gold and Silver 2010 Oct 14, 2010 - 06:18 AM GMTBy: Bob_Kirtley

A snap shot of the year as captured by the above chart, shows that we have in first place silver, followed by gold, which is closely followed by the gold producers and in fourth spot, heading the wrong way, the US Dollar. Despite the stated strong dollar policy, the reality is that the United States Dollar is in free fall.

A snap shot of the year as captured by the above chart, shows that we have in first place silver, followed by gold, which is closely followed by the gold producers and in fourth spot, heading the wrong way, the US Dollar. Despite the stated strong dollar policy, the reality is that the United States Dollar is in free fall.

As things stand we have the sequel to Quantitative Easing about to darken our doorway in early November when the Federal Reserve will announce their intentions, which they have already trailed, so all we need to know is just how much will be allocated for this purpose. Then we have the Obama administration losing its popularity and facing the mid term elections also in early November. The results of which may well throw up a few new faces who just might have something to say about how things are being run and the wisdom of printing more money. We wont know until the results come in and we get some indication of where the power lies and just how vocal and influential these people will be.

We also have the unfolding sub prime mess which throws into question home ownership and puts a question mark above property investment, placing both buyers and sellers into the doldrums as the situation stagnates while ownership issues are resolved. Housing is not only an important part of the economy it weighs heavily on the minds of home owners who are now wondering if they do actually have the correct paperwork in place and can clearly demonstrate that the roof over them is in fact theirs. The only certainty we can see here is that the lawyers will very busy. Enough said.

Looking at the external forces that come into play the biggest by far is the stance that foreign governments are taking by disparately trying to maintain parity will dollar in order not to lose their competitive edge. And so the race to bottom continues with the competitive advantage being won and lost on a momentary basis as the other countries try to fall into line by making similar devaluations.

Over on Wall Street the ‘DD’ phrase is being played down, however we do have the possibility that we could experience a Double Dip recession as the recovery, in the western world at least, remains fragile with robustness still a long way off.

So just where are the winners? The answer is to look no further than the precious metals sector where both silver and gold prices have been on a tear and look set to become turbo charged. Its also true that the other commodities have also sprung into life, but that’s a discussion for another day.

Please read what we have to say with a pinch of salt as we are not in the 5% to 15% of our portfolio allocated to the gold and silver group, apart from a little cash, we are fully loaded with physical gold and silver, their associated stocks and tranches of Options Contracts. These opportunities do not come along everyday and we are hitting it as hard as we can, a strategy that is not for the majority of investors.

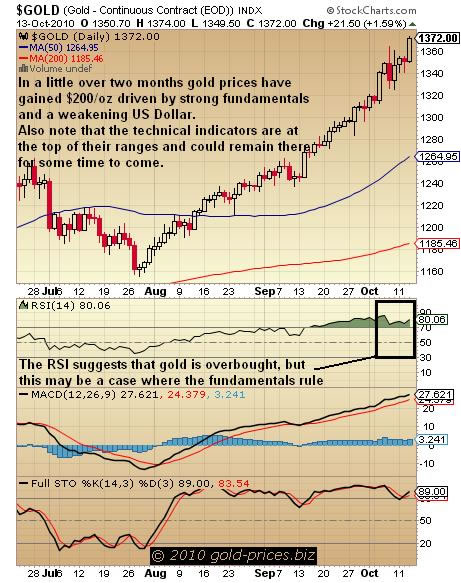

Below we have the chart for gold prices where we can see a stupendous rally which started a little over two months ago adding $200/oz, driven by strong fundamentals and a weakening US Dollar. Also note that the technical indicators are at the top of their ranges, in particular the RSI, which could remain there for some time to come, as in this instance we expect the fundamentals to overcome the technical analysis and drive gold prices ever higher.

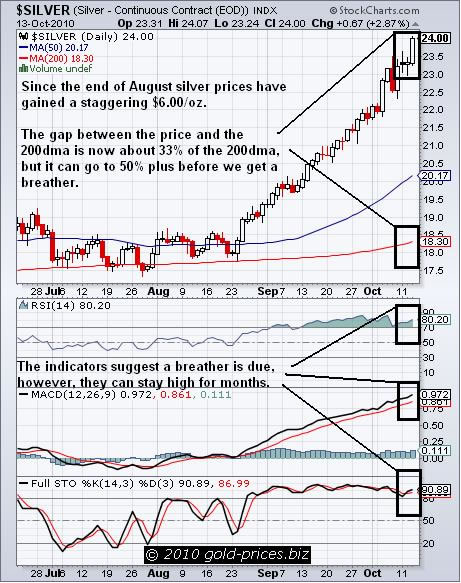

Taking a quick look at silver and we can see that over recent times silver prices are outperforming gold prices which adds a little spice to the world of precious metals. Since the end of August silver prices have gained a staggering $6.00/oz, which should come as no surprise as the gold/silver ratio has been out of kilter for some time. However, there is now a yawning gap opening up between the price and the 200dma which is now about 33% above that of the 200dma, but it can go to 50% plus before we get a breather. Although the indicators suggest a breather is due, as with gold we expect them to remain on the side for some time yet. With the occasional shallow pull back we expect silver prices to climb all the way to the end of the year.

Finally we have the US Dollar, which as we write has just fallen through the ‘77′ level on the US Dollar Index, next stop could be as low as ‘72′ where it will need to find a few friends in order to stop the rot.

Stay on your toes and have a good one.

Got a comment then please add it to this article, all opinions are welcome and very much appreciated by both our readership and the team here.

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. (Winners of the GoldDrivers Stock Picking Competition 2007)

For those readers who are also interested in the silver bull market that is currently unfolding, you may want to subscribe to our Free Silver Prices Newsletter.

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit. Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.