Stock Market Mid-Week Market Report

Stock-Markets / Stock Markets 2010 Oct 14, 2010 - 05:04 AM GMTBy: Chris_Vermeulen

Its been an interesting week with stocks, commodities and currencies having a knee jerk reaction to the FOMC minutes released Tuesday afternoon. In short the Fed clearly said there must be more quantitative easing before things will get better. It was this news which triggered a rally in both stocks and commodities.

Quantitative easing is a fast way to devalue the dollar and the Fed is doing a great job at that. As long as the dollar continues to decline the stock market will keep rising.

This week kicked off earning season with INTC and JPM beating analyst estimates. We usually see the market trade up the first week of earnings and then start to sell off by the end of earnings season. Both INTC and JPM sold off on strong volume today despite the good earnings and today’s broad market rally. This just goes to show the market has not forgot about buy on rumor sell on news… The big/smart money sold into the morning gaps exiting at a premium price. Is this foreshadowing for what is to come?

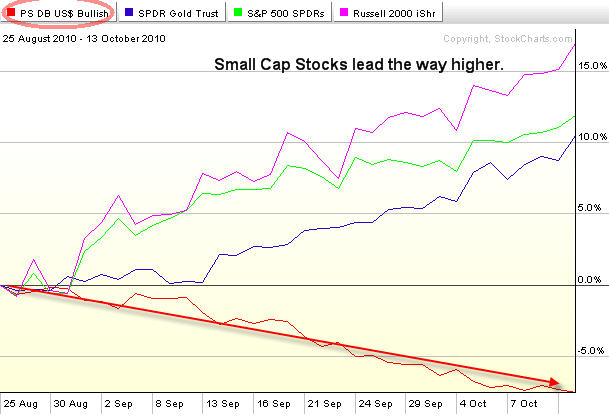

Take a look at the chart below which shows the falling dollar and how its helping to boost stocks and commodities.

While earnings season is trying to steal the spot light in the market, the fact is everything for the past 2 months has been about the US Dollar. If you put a chart of the dollar and the SP500 together they trade almost tick for tick in reverse directions. The amount of money getting pumped into the market cannot last and it will lead to a huge volume reversal day in due time. Until this happens the market will trade higher.

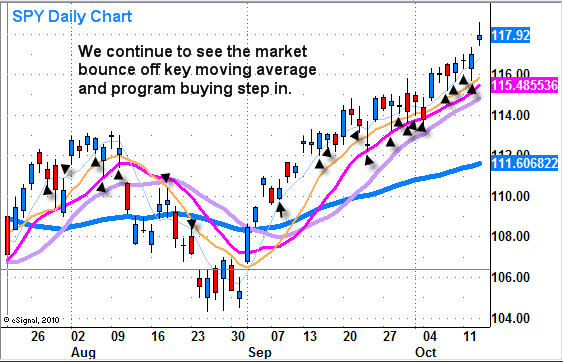

Taking a look at the SPY daily chart the 5, 10, and 14 simple moving averages tend to act as buy zones. The market was choppy from April until about 2 months ago. Now we are seeing the market smooth out and traders are switching to more of a trend trading strategy and not so much looking for extreme sentiment levels which typically signal short term tops and bottoms. Focusing on buying at these moving averages has been providing good support thus far. Stops should be set on a closing basis, meaning if the market is to close below the moving average then exiting the position is a safe play. It’s always best to layer your stops (scale out) in trending market. So stops below the 5, 10, 14 and even the 20ma will provide you with enough wiggle room to riding a trend.

Mid-Week Trading Conclusion:

In short, we are in a strong uptrend and until we get a major reversal day, buying the market is the way to go. The market as we all know is way over bought so if you decide to take a position on your own, be sure to keep it small. I would also like to note that financial stocks were the worst performing on the day so that could be telling us there could be some profit taking in the next day or two.

I’d like you to have my ETF Trade Alerts for Low Risk Setups! Get them here: http://www.thegoldandoilguy.com/specialoffer/signup.html

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.