The Gold Contrarian Call

Commodities / Gold and Silver 2010 Oct 14, 2010 - 04:59 AM GMTBy: Jordan_Roy_Byrne

Numerous recent busts (technology, banks, internet, oil, stocks, etc) have given rise to the principle of contrarian investing. Contrarians seek to buy when sentiment is bearish or when a market is completely ignored. They seek to sell when a market is overpriced or overvalued. The problem nowadays is that everyone has bubble fatigue. The herd seems to think that whatever rises is a bubble and will automatically go bust.

Numerous recent busts (technology, banks, internet, oil, stocks, etc) have given rise to the principle of contrarian investing. Contrarians seek to buy when sentiment is bearish or when a market is completely ignored. They seek to sell when a market is overpriced or overvalued. The problem nowadays is that everyone has bubble fatigue. The herd seems to think that whatever rises is a bubble and will automatically go bust.

However, there is much more to contrarian investing than simply going against the herd or prevailing trend. First, the herd is actually right most of the time. As a bull market develops, more and more people come on board. Sentiment will inevitably become more bullish as time goes on. Furthermore, an investor should also consider technicals, fundamentals and value in their contrarian approach.

Fake, fraudulent and imposter contrarians (who neglect true contrarian analysis) think Gold is a bubble and will soon decline. They see this simply because Gold has gone up too far and too fast. Meanwhile, others see Gold in a bull market but continue to be worried about a 2008-style setback.

As contrarians, we have to evaluate sentiment, technicals and fundamentals. The fundamentals here are certainly obvious. Sentiment, as we stated, is long-term bullish but not hyper-bullish at the present time. Most investors don’t own Gold nor precious metals shares. This fact, along with the technical picture lead us to believe Gold is getting ready to accelerate into 2011 and this will catch most by surprise.

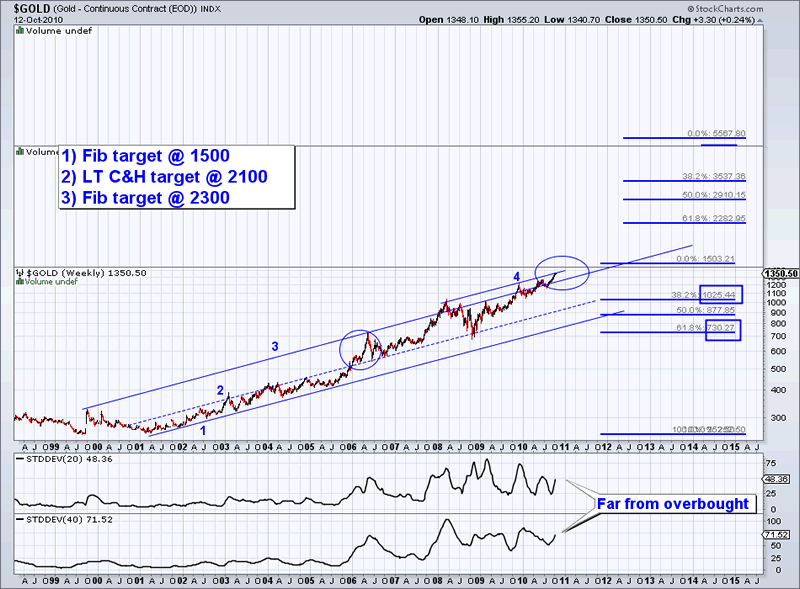

Please see the chart below.

From 2001 to 2005, Gold stayed within channel lines 1 and 2. After bumping up against 2 several times from 2003 to 2005, Gold accelerated above 2 in late 2005. Similar action occurred from 2008 to 2010. The market, after several tries, has broken above 3 while 4 is only slight resistance.

In addition to the channel line, we note in the lower rows the 20 and 40-week standard deviations. This is how far the market is from those levels. These show that the market is not even close to overbought on a long-term basis. Thus, this means the market has even more room to rise over the next few quarters. Going forward we have strong targets at $1,500, $2,100 and $2,300.

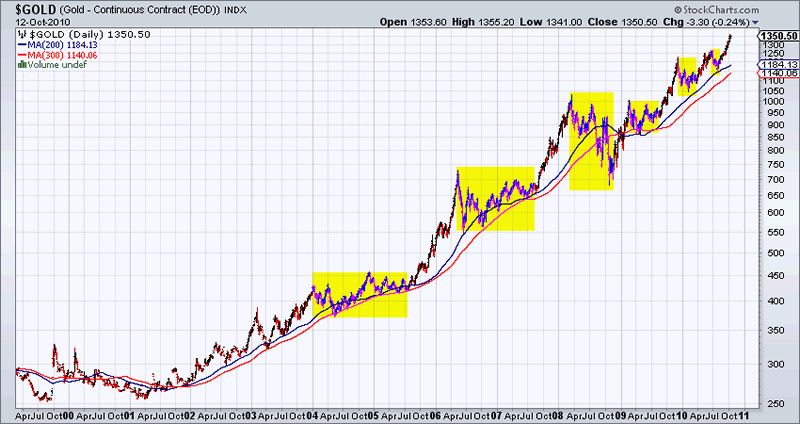

What is another way to tell if a market is nearing acceleration? Check the length of recent corrections and consolidations, which is more important than the depth. A market that is gaining strength will experience shorter and shorter and corrections. Notice how the duration of each correction has become smaller and smaller? Gold has yet to surge as it did in late 2005 and late 2007 but has continued to rise steadily since late 2008 while actually gaining strength.

We are ten years into this bull market, so naturally we should be seeing more and more people pile on board, creating acceleration and bigger gains. The current technical and sentiment picture are in position for this to happen over the next 12-18 months. Yet, most aren’t thinking about this. Certainly there can be small corrections along the way and perhaps one last big correction several years down the road before a final blowoff.

Yet, for the time being traders and investors need to be prepared both mentally and financially for an accelerating market. We see this possibility and are coaching our subscribers as to how to position to take advantage while at the same time managing your risk. If you’d like professional guidance to help you navigate this potentially rewarding bull market, then we invite you to consider a free 14-day trial to our service.

Good luck ahead!

Jordan Roy-Byrne, CMT

Jordan@thedailygold.com

http://www.thedailygold.com/newsletter

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.