Job Creation and Green Energy Sector

Economics / Energy Resources Oct 13, 2010 - 06:48 AM GMTBy: Dian_L_Chu

Even though unemployment claims drop, while job openings rise in September, the U.S. economy still shed 95,000 jobs in September with steep losses in government employment offsetting moderate rise in private sectors, based on the latest Labor Department reports.

Even though unemployment claims drop, while job openings rise in September, the U.S. economy still shed 95,000 jobs in September with steep losses in government employment offsetting moderate rise in private sectors, based on the latest Labor Department reports.

The Math of Jobs

It is clear that the current employment trend does not fit into the harsh math of jobs - To make up for the more than 7 million jobs lost in the past two years, the U.S. would need 200,000 net new jobs each month for the next seven years to get unemployment back to what used to be considered “normal” 5 percent.

Companies just aren't ramping up hiring fast enough to reduce the unemployment rate, now 9.6 percent. And by Gallop’s measure, jobless rate in September is already at 10.1 percent, with an underemployment rate of 18.8 percent.

Green Tech & Manufacturing?

So where will the U.S. find jobs? In addition to aiming to double American export in the next five years, President Obama has long touted green energy jobs as the way to stimulate job growth and lead the economy out of recession. As recent as Saturday, Oct. 2, in his weekly national address, President Obama once again promoted green energy jobs:

"There is perhaps no industry with more potential to create jobs now, and growth in the coming years, than clean energy ….This will mean hundreds of thousands of new American jobs by 2012."

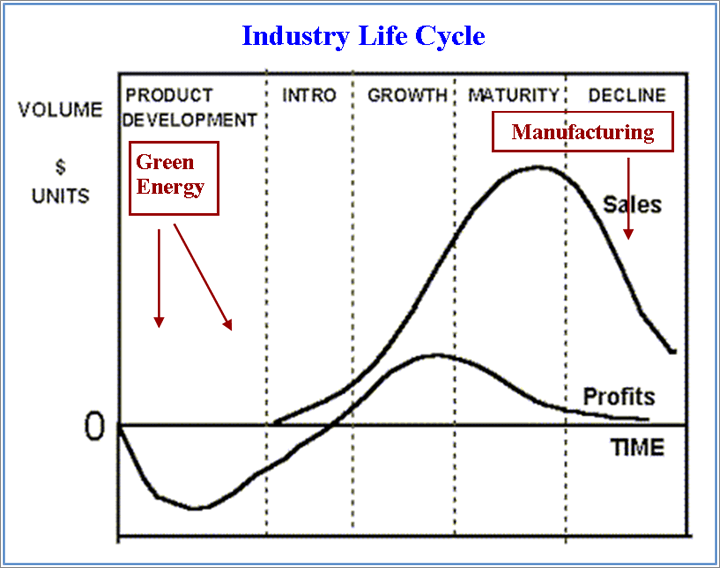

Industry Life Cycle

While most are wrapped up in the excitement of a future in clean energy, and some experts believe the U.S. may devalue its currency to achieve an export advantage, say over China, to bring jobs back to America, people tend to overlook where clean tech and manufacturing are situated in the Industry Life Cycle.

One reason that clean energy is classified as an “emerging technology” is that it is still on the far left side (development phase) of the Industry Life Cycle in terms of market size and maturity.

Meanwhile, the economic structure of the U.S. has been evolving from manufacturing-based into one that’s high tech and services oriented (for example, Info Tech, unconventional oil and gas, digital oilfield, and defense).

This natural evolution has thus rendered the U.S. manufacturing relatively uncompetitive, and sitting on the right (declining) side of the Industry Life Cycle (see chart).

In other words, this type of sectors are simply not big enough or growing enough to make a significant impact on GDP or employment—in the near to medium term--in an economy as big as the United States.

Clean Tech – U.S. Has Little Competitive Advantage

Within the energy sector, the U.S. has a strong presence in the conventional energy supply chain due to the dominance of major oil companies such as Exxon Mobil and Chevron, and the Big Four oilfield services players (Schlumberger, Halliburton, Baker Hughes and Weatherford); however, the supply chain of the alternative energy sector is largely with the European and Asian companies.

Furthermore, unlike the infrastructure spending on roads and bridges, the green stimulus funding does not increase the demand side of the market due to the lack of mass delivery system and the still high economic threshold (remember where it is at in the Industry Life Cycle).

With companies scrambling for government funds in tight credit conditions after the global financial crisis, the green funding actually increased demand in the middle supply chain for equipment such as wind turbine, and solar panels which the U.S. does not have the competitive advantage.

Green Jobs So Far?

So, it is of no surprise that even though more than 11 percent - About $92 billion--of President Obama's original $814 billion of stimulus funds were targeted for renewable energy-- at the expense of the tried and true construction infrastructure-- the results have been disappointing so far.

According to The Washington Times, only about $20 billion of the allotted funds have been spent - the slowest disbursement rate for any category of stimulus spending. Private analysts are skeptical of White House estimates that the green funding created 190,700 jobs.

Meanwhile, the Department of Energy estimated that 82,000 jobs have been created, while acknowledging that as much as 80 percent of some green programs went to foreign firms.

Service Sector Competitiveness

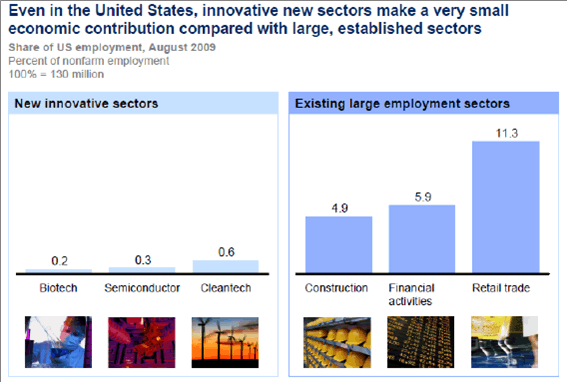

The industry cycle and supply chain analysis discussed here is further supported by a recent McKinsey Global Institute (MGI) research. After examining six industry sectors across eight countries, MGI concludes that to create jobs, service sector competitiveness holds the key and that competitiveness in new innovative sectors is not enough to boost economy-wide employment and growth. (See graph from MGI)

MGI further cited statistics that from 1995 to 2005, service sectors generated all net job growth in high-income economies and 85 percent of net new jobs in emerging economies.

Green Tech – Up to Speed in Ten?

Undeniably, innovation in R&D-intensive sectors including green technology may play an important role in the overall economic picture from a long term and strategic point of view--think ten years down the road. Nevertheless, it is not at the immediate tier (jobs, food, place to live) of people’s Hierarchy of Needs right now – “Nice to Have..In the Future” vs. “Got To Have…Now”.

I have not even begun to discuss the supply security and environmental risks associated with rare earth metals -- of which China controls 97% of the world's supply. These are essential and have no substitution in many alternative and renewable energy sources.

Where Policy Could Have Made a Difference, But....

In order to make a dent in the 10% unemployment rate, it would be more efficient and effective to direct the bulk of government resource towards the large and established sectors in the Growth and Maturity stage, while still supporting sectors in the Development and Intro stage.

That means fostering sectors such as infrastructure (jobless rate in the construction sector, for example, is still riding high at 17.2%), capitalizing on the strong services sectors, while working on some deep-rooted structural and skill mismatch problems in the labor market.

With the world’s top economic minds at its disposal, I’m certain this is nothing new to the Administration. But unfortunately, the policies implemented so far have been doing quite the opposite where the government could have helped and made a difference.

I guess it is just the case as the old saying goes—“You can lead a horse to water, but you can't make him drink”. To that end, President Obama will most likely be greatly disappointed pinning jobs hope on clean tech and trade/currency maneuvers to prop up the declining-for-over-a-decade manufacturing sector.

Dian L. Chu, M.B.A., C.P.M. and Chartered Economist, is a market analyst and financial writer regularly contributing to Seeking Alpha, Zero Hedge, and other major investment websites. Ms. Chu has been syndicated to Reuters, USA Today, NPR, and BusinessWeek. She blogs at Economic Forecasts & Opinions.

© 2010 Copyright Dian L. Chu - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.