U.S. Treasury's Drive to Devalue the Dollar, Fed Takes Aim at Chinese Yuan

Currencies / Fiat Currency Oct 12, 2010 - 02:40 PM GMTBy: Gary_Dorsch

Although the United States is still the world’s #1 economy, it’s increasingly feeling the heat of the Chinese dragon, breathing down its neck. At the beginning of the twenty-first century, the US-economy was eight-times larger than China’s - a decade later the figure was down to three-times. China’s $5-trillion economy has eclipsed Japan, Germany, France and Britain, to become the second-biggest, after three decades of blistering growth, and is now within reach of overtaking the US within 10-years. With China’s economic growth rate at 10% and the US-economy struggling at +1.5% growth, - this long-term prediction doesn’t sound that far-fetched.

Although the United States is still the world’s #1 economy, it’s increasingly feeling the heat of the Chinese dragon, breathing down its neck. At the beginning of the twenty-first century, the US-economy was eight-times larger than China’s - a decade later the figure was down to three-times. China’s $5-trillion economy has eclipsed Japan, Germany, France and Britain, to become the second-biggest, after three decades of blistering growth, and is now within reach of overtaking the US within 10-years. With China’s economic growth rate at 10% and the US-economy struggling at +1.5% growth, - this long-term prediction doesn’t sound that far-fetched.

China, with 10-times Japan’s population, has long been expected to catch up with its neighbor. But the global crisis and Japan’s sluggish growth brought that point forward by many years. China has emerged to become the world’s largest exporter, overtaking Germany, which held the title since 2002. Factories employing low-paid workers to assemble iPods, computers, shoes, and toys are leading the boom. China has also passed the US as the world’s largest auto market and producer. Two decades ago, a car industry barely existed in China.

In the midst of the global banking crisis, stimulus-driven Chinese growth helped to propel the world’s economy out of recession. Chinese demand for raw materials and other imports buoyed economies from Australia to Brazil to South Korea. China uses more than half the world’s iron ore and more than 40% of its steel, aluminum, and coal, lifting commodity prices. China is the biggest player in the copper market, buying 35% of the global supply, and is the second biggest importer of crude oil. State-owned Chinese companies are pouring billions of dollars into base metal mines and oil fields from Canada to Latin America to Iraq.

A free trade agreement between China and South East Asian nations came into effect on January 1st, creating the world’s third-largest free trade bloc. The combined population of the trade bloc is 1.9-billion people with a combined GDP of $6-trillion. Already, the ASEAN countries are providing the raw materials and manufacturing parts for assembly hubs operating in China. About 60% of China-ASEAN made goods end up in European, Japanese, and US consumer markets.

China is at the epicenter of the fast growing Asian sphere, with satellites such as South Korea, Hong Kong, Taiwan, India, and Australia, hitching a ride to the Chinese juggernaut. The shift of economic gravity to China didn’t happen by chance. Beijing’s massive intervention transformed its economy into the world’s locomotive. The state-run mouthpiece, the People’s Daily newspaper has hailed China’s economic superiority over Western-style capitalism, boasting about its authoritarian rulers’ ability to make quick decisions and their will to carry them out.

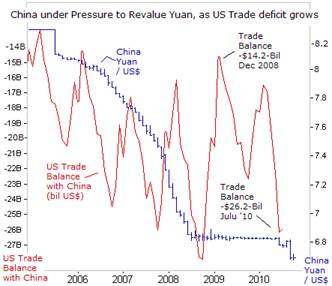

Washington is becoming increasingly alarmed at the rapid rise of China’s economic might, and also worries that Beijing might eventually challenge the US for military superiority in the decades ahead. US Congressional lawmakers have long cited Beijing’s policy of undervaluing its currency, - the yuan, to give its exporters an unfair advantage in world markets, and making China a more affordable place to attract foreign direct investment in new manufacturing plants. In July and August, the US ran a combined trade deficit of about $52-billion with China, with the massive imbalance highlighting the hollowing out of America’s industrial base.

Washington is becoming increasingly alarmed at the rapid rise of China’s economic might, and also worries that Beijing might eventually challenge the US for military superiority in the decades ahead. US Congressional lawmakers have long cited Beijing’s policy of undervaluing its currency, - the yuan, to give its exporters an unfair advantage in world markets, and making China a more affordable place to attract foreign direct investment in new manufacturing plants. In July and August, the US ran a combined trade deficit of about $52-billion with China, with the massive imbalance highlighting the hollowing out of America’s industrial base.

After holding the yuan steady against the US-dollar through the financial crisis, Beijing signaled on July 19th, that it would begin to allow for the yuan to drift higher, but at a gradual pace. Since then, the yuan has gained about +2.2%, - far short of what US lawmakers want. US Treasury chief Timothy Geithner told Congress on Sept 16th, “the pace of appreciation has been too slow and the extent of the yuan’s appreciation too limited. We are examining the important question of what mix of tools, those available to the United States and multilateral approaches, might help encourage the Chinese authorities to move more quickly,” he warned. IMF economists estimate the yuan is 5-27% undervalued.

As the US-economy continues to stagnate, lifting the all inclusive U-6 jobless rate to 17.1% of the workforce, the Obama administration and Congress are starting to wage an increasingly hostile war against China, demanding that Beijing allow the yuan to rise significantly, and at a faster rate. The US House of Representatives passed a bill on Sept 29th, with huge support of 348-79, that treats China’s exchange rate as an unfair subsidy, and allows US companies to request a countervailing tariff to offset China’s price advantage. Such legislation, if passed by the Senate, and signed by the President could ignite a full fledged protectionist trade war.

The US-Treasury and the Federal Reserve (“Plunge Protection Team”) are seeking to corral central bankers and finance ministers from other G-20 nations, to join Obama’s campaign to strong-arm Beijing into raising the value of the yuan more quickly. The US-Treasury is preparing an all-out “currency war,” which has already started to inflate commodity and stock market bubbles, by instructing the Federal Reserve to send signals about a resumption of “quantitative easing” (QE-2) or the printing of dollars to purchase US Treasuries notes, in the months ahead.

The US-Treasury and the Federal Reserve (“Plunge Protection Team”) are seeking to corral central bankers and finance ministers from other G-20 nations, to join Obama’s campaign to strong-arm Beijing into raising the value of the yuan more quickly. The US-Treasury is preparing an all-out “currency war,” which has already started to inflate commodity and stock market bubbles, by instructing the Federal Reserve to send signals about a resumption of “quantitative easing” (QE-2) or the printing of dollars to purchase US Treasuries notes, in the months ahead.

The Fed is expected to pump vast quantities of freshly printed dollars into the money markets, in a bid to lower long-term Treasury yields lower. The markets have already discounted the probability of at least $500-billion of QE-2 injections. On the surface, the Fed’s propaganda artists say they aim to prevent a deflationary collapse and stave off a “double-dip” recession. However, clandestinely, the Fed is monetizing the federal government’s debt, and is prepared to buy the Treasury notes that Beijing decides to dump, should a full scale Chinese-US trade war erupt.

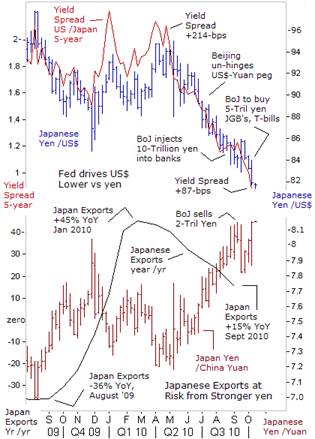

Discounting the probability of QE-2, the US-Treasury’s bond yield advantage over comparable Japanese bonds, has narrowed sharply, thus weakening the US-dollar to a 15-year low of 81.75-yen. Tokyo has tried to offset the Fed’s QE-2 gambit, saying it plans to launch its own version of QE-3, - a 5-trillion yen ($60-bil) scheme, designed to purchase Japanese government bonds (JGB’s) and other securities.

On September 15th, Tokyo acted unilaterally, dumping some 2.1-trillion yen into the foreign currency market, for the first time in six-years, and purchasing of $25-biilion, while trying to defend the US-dollar at 83-yen. However, two-weeks later, the impact of the BoJ’s “shock and awe,” intervention scheme had worn-off, with the US-dollar sinking to new lows. Japan’s counterattacks have failed to reverse the US-dollar’s slide against the yen, because the size of the Fed’s QE-2 printing spree is expected to be at least ten-times greater magnitude than Tokyo’s QE-3.

And because Beijing essentially pegs the yuan to the US-dollar, Japan’s exporters are getting slapped with a double whammy, a rising yen versus the US-dollar, and a rising yen versus the Chinese yuan. Since early May, the yen has risen +10% to around 8.2-yuan, making Japanese goods more expensive in China, and also in neighboring Hong Kong, where the central bank pegs the US$ at around HK$7.78.

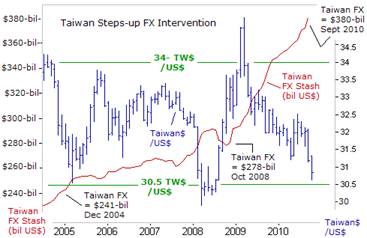

Tokyo’s financial warlords are very worried about the yen’s strength, since the growth rate of Japan’s exports have already slowed by two-thirds, from +45% at the start of this year, to +15% in August. Japan’s exports are also becoming less competitive than those from Asian tiger - Taiwan, where the central bank enforces a “dirty float,” by restricting the US-dollar to a narrow 10% trading band versus the Taiwan dollar. If left unchecked, the yen’s upward spiral against rigged Asian currencies, and the US$, could push Japan’s export growth into negative territory by next year.

Tokyo’s financial warlords are very worried about the yen’s strength, since the growth rate of Japan’s exports have already slowed by two-thirds, from +45% at the start of this year, to +15% in August. Japan’s exports are also becoming less competitive than those from Asian tiger - Taiwan, where the central bank enforces a “dirty float,” by restricting the US-dollar to a narrow 10% trading band versus the Taiwan dollar. If left unchecked, the yen’s upward spiral against rigged Asian currencies, and the US$, could push Japan’s export growth into negative territory by next year.

Taiwan’s exports account for roughly 70% of its economic output, and trade data for September showed the growth rate for its exports slowing to +17.5%, down from +26.6% in August. A slowdown in the growth of shipments to the Chinese mainland, where many goods are processed and re-exported, fell from +18.1% in August to +11% in September. All of this suggests Taiwan’s authorities will not back down from its efforts to slow the US-dollar’s fall, against the Taiwan dollar.

Taiwan’s foreign currency reserves jumped $8.4-billion in September, a monthly record, and by about $21-billion in the past 3-½-months. In the first 10-days of October, the Taiwanese central bank bought US$3-billion to prevent it from falling below its red-line in the sand at 30.5-Taiwan dollars, the bottom of a decade long trading range. Through its stealth intervention over the past few years, Taiwan has amassed a huge stash of $380-billion in foreign currency reserves. Yet shockingly, only 4.3% of Taiwan’s FX stash is invested in the king of currencies – Gold.

The US Treasury and the Obama team have allowed currency intervention culprits, such as Hong Kong’s Monetary Authority (HKMA) and Taiwan, to slip under the radar, and instead, have chosen to focus more exclusively on Beijing’s rigging of the yuan. However, the smaller Asian culprits might be next in-line. In any event, Washington is trying to gain the firm backing of the world’s second most powerful trading bloc, the Euro-zone, which is also the biggest buyer of Chinese exports, in order to prod Beijing to allow the yuan to rise more rapidly.

The US Treasury and the Obama team have allowed currency intervention culprits, such as Hong Kong’s Monetary Authority (HKMA) and Taiwan, to slip under the radar, and instead, have chosen to focus more exclusively on Beijing’s rigging of the yuan. However, the smaller Asian culprits might be next in-line. In any event, Washington is trying to gain the firm backing of the world’s second most powerful trading bloc, the Euro-zone, which is also the biggest buyer of Chinese exports, in order to prod Beijing to allow the yuan to rise more rapidly.

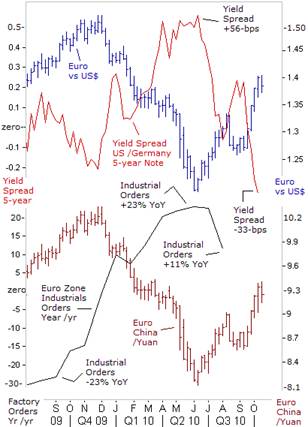

In some ways, the Greek debt crisis was a blessing in disguise for the Euro-zone’s economy. The Euro’s slide to a four-year low of $1.200, and a nine-year low against the Japanese yen, helped to boost new orders for industrial goods made in the Euro-zone to +23% higher in May than a year earlier. Germany in particular thrived on a weaker Euro, with surging exports and growth in consumer spending, powering the German economy to a record expansion in the second quarter. German exports were bolstered by demand from China and other emerging economies.

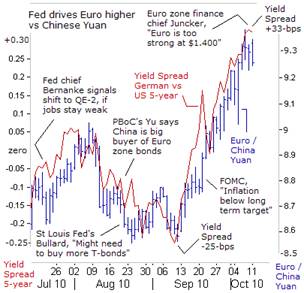

The Euro was plunging in a downward spiral in late April and early May, amid fears that the European Central Bank would unleash its own version of QE, by purchasing large quantities of Greek, Irish, and Portuguese bonds that Euro-zone banks were desperately looking to unload. So far however, the ECB has limited its purchases of distressed sovereign bonds to 60-billion Euros, and these purchases were largely sterilized, thus helping the Euro to rebound to $1.400 last week.

Also helping the Euro to rebound sharply versus the US$, was the frequent drumbeat of implied threats by the Fed to unleash QE-2, and public calls of support for the Euro by China’s premier Wen Jiaboa. “I have repeatedly expressed China’s support for a stable Euro and said that we will not reduce the amount of European bonds that we hold. We have stood by the EU’s efforts to overcome its difficulties and achieve recovery,” Wen said on Oct 3rd, seeking to curry favor with Euro-zone politicians. Wen also promised that Beijing would buy Greek bonds next year.

However, because Beijing pegs the yuan to the US-dollar, the Euro has climbed about 10% against the Chinese yuan over the past four months, and partly as a result, new orders for Euro-zone industrial goods quickly tapered-off. New orders for industrial goods fell -2.4% in July, slumping to a +11.2% year-on-year rise. Orders for capital goods, which are used in investment, fell -5.1% on the month and demand for durable consumer goods dropped -3.2-percent. Euro-zone exports were +18% higher in July than in the same period of 2009, and while still impressive, were down sharply from June’s annual growth rate of Ūpercent.

However, because Beijing pegs the yuan to the US-dollar, the Euro has climbed about 10% against the Chinese yuan over the past four months, and partly as a result, new orders for Euro-zone industrial goods quickly tapered-off. New orders for industrial goods fell -2.4% in July, slumping to a +11.2% year-on-year rise. Orders for capital goods, which are used in investment, fell -5.1% on the month and demand for durable consumer goods dropped -3.2-percent. Euro-zone exports were +18% higher in July than in the same period of 2009, and while still impressive, were down sharply from June’s annual growth rate of Ūpercent.

A further rise in the Euro’s value against the Chinese yuan and the US-dollar could further undermine global demand for the Euro-zone’s industrial exports, which prompted the Euro-zone’s finance chief Jean-Claude Juncker to warn on October 8th, “The Euro is too strong today,” as it crossed $1.400, and just a few hours ahead of a meeting of finance ministers and central bankers of the G-7 clique. “I don’t think the US-dollar is in line with underlying fundamentals,” Juncker said.

At a meeting with Chinese Prime Minister Wen Jiabao, ECB chief Jean “Tricky” Trichet, Jean-Claude Juncker, and the EU’s Monetary Affairs chief Olli Rehn, called for “a significant and broad-based appreciation” of the Chinese yuan, to at least match the Euro’s rebound against the US-dollar. Yet at the same time, the Euro-zone leaders praised China’s commitment to purchase debt issued by troubled Greece, a measure that would boost the Euro vs the yuan.

Behind the scenes, the Fed engineered the Euro’s recovery by submerging the yield on the US-Treasury’s 5-year note below Germany’s 5-year bund yields. So far, the ECB has refused to intervene to halt the Euro’s rally. The ECB is skeptical in principle of interventions, - buying and selling currencies to affect exchange rates. However, if the Fed signals a larger than expected blast of QE-2 in November, the Euro could climb higher, and complaints from Euro-zone industrialists would follow. At that point, the ECB might cast aside its principles, and begin printing Euros and start buying bonds denominated in foreign currencies.

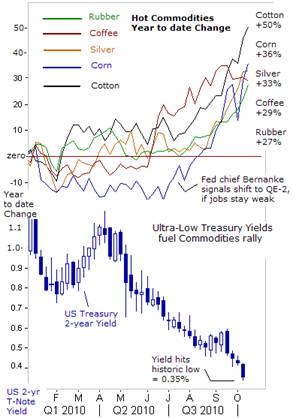

QE-2 fuels Commodities Rally, Since July 21st, Fed chief Ben “Bubbles” Bernanke has floated trial balloons about the unveiling of QE-2, and engineered a sharp fall in the US-dollar against the Euro, Japanese yen, Swiss franc, and emerging currencies. The weaker dollar has fueled “hot money” flows into emerging stock markets, lifted gold to record heights at $1,365 /oz, fueled silver’s parabolic rally to 30-year highs, and global commodity indexes have climbed to two year highs.

QE-2 fuels Commodities Rally, Since July 21st, Fed chief Ben “Bubbles” Bernanke has floated trial balloons about the unveiling of QE-2, and engineered a sharp fall in the US-dollar against the Euro, Japanese yen, Swiss franc, and emerging currencies. The weaker dollar has fueled “hot money” flows into emerging stock markets, lifted gold to record heights at $1,365 /oz, fueled silver’s parabolic rally to 30-year highs, and global commodity indexes have climbed to two year highs.

On Sept 21st, the Fed made it clear that given the US-labor markets’ weakness, it’s determined to prevent a deflationary spiral. That’s a widespread drop in wages, prices of goods and services, stock portfolios, and the value of homes. Under a cloak of deceit and deception, the Fed is reviving the animal spirits among speculators, and whetting the appetite for risk taking, by driving interest rates to historic lows and crushing the value of the US-dollar. The Fed’s gambit is succeeding! Traders are now bidding-up commodities, shares of commodity producers, and precious metals, before the next tidal wave of QE-2 floods world money markets.

Soybeans jumped to $11.78 /bushel in Chicago, up +7% this month. Corn prices saw their biggest two-day rise since 1973, up 12.7% to $5.75 /bushel, as expectations of a drastic shortfall in crop production raised fears of a repeat of the global food crisis of 2007-2008. Already there’s talk of the necessity rationing corn next year. Coffee and cotton have surged to their highest levels in 15-years, and in Shanghai, rubber futures rallied by their daily limit to their highest in four-years.

London copper rallied to around $8,400 /ton, its highest since July 2008, and aluminum extended a rally to touch $2,438,/ton. Shanghai zinc soared 5% to its upside limit of 18,875 yuan /ton, and US light crude oil topped $83 /barrel, as the US-dollar weakened against the Euro. So while Americans are losing their jobs and their homes, the Fed is making matters worse, by inflating the cost of the basic staples of life. Another key driver behind the resurgence of the “Commodity Super Cycle” is the slide in the US Treasury’s 2-year yield to historic lows of 0.35% this week, essentially ruling out any hike in the fed funds rate until 2012.

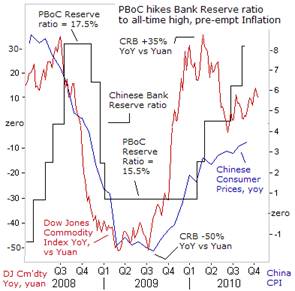

Food and energy account for about half of the budgetary outlays for the population in China and India that live on less than $2 /day. Thus, the central banks in the world’s top-2 fastest growing economies are more willing to tighten monetary policy in order to combat inflationary pressures from higher commodity prices. According to Beijing’s apparatchiks, China’s consumer price index (CPI) was creeping +3.4% higher in August from a year ago. But China’s CPI could be galloping ahead at a +5% clip or more, if global commodity markets continue to soar.

Food and energy account for about half of the budgetary outlays for the population in China and India that live on less than $2 /day. Thus, the central banks in the world’s top-2 fastest growing economies are more willing to tighten monetary policy in order to combat inflationary pressures from higher commodity prices. According to Beijing’s apparatchiks, China’s consumer price index (CPI) was creeping +3.4% higher in August from a year ago. But China’s CPI could be galloping ahead at a +5% clip or more, if global commodity markets continue to soar.

On October 11th, the People’s Bank of China (PBoC) tried trying to deflate a powerful bubble in global commodity prices, and asset price inflation, by mopping-up excess yuan in the Shanghai money markets. The PBoC hiked reserve requirements for China’s six largest banks, by a half-point to 17.5%, tying the highest level in history. Earlier this year, in January, global commodity and stock markets fell sharply after China surprised the traders by hiking reserve requirements a half-point to 16-percent. But on this latest occasion, traders simply yawned.

This time around, the PBoC’s tightening moves have been neutralized by the Fed’s plan to unleash $500-billion or more of QE-2. The Fed and the US Treasury are threatening to take the inflationary effects of super-easy money to the extreme limit, even though QE-2 won’t bring down the US-jobless rate. Instead, the impact of QE-2 could be felt more acutely in China and India with sharply higher commodity prices, and perhaps, followed by tighter monetary policies. At some point, Beijing might see the logic of allowing the yuan to rise faster against the dollar, utilized as a tool to help keep the imported price of commodities under control.

This time around, the PBoC’s tightening moves have been neutralized by the Fed’s plan to unleash $500-billion or more of QE-2. The Fed and the US Treasury are threatening to take the inflationary effects of super-easy money to the extreme limit, even though QE-2 won’t bring down the US-jobless rate. Instead, the impact of QE-2 could be felt more acutely in China and India with sharply higher commodity prices, and perhaps, followed by tighter monetary policies. At some point, Beijing might see the logic of allowing the yuan to rise faster against the dollar, utilized as a tool to help keep the imported price of commodities under control.

In both Japan and the United States, short-term interest rates are so close to zero-percent that their central banks have resorted to nuclear QE in a bid to drive down long-term bond yields. But these radical measures have failed to boost economic growth. With fiscal stimulus packages being pared down, in order to rein-in bloated budget deficits, and zero-percent interest rates failing to produce jobs, politicians are seeking to expand exports, by reducing the value of their currencies, as the sole remaining measure available to provide an economic boost.

In both Japan and the United States, short-term interest rates are so close to zero-percent that their central banks have resorted to nuclear QE in a bid to drive down long-term bond yields. But these radical measures have failed to boost economic growth. With fiscal stimulus packages being pared down, in order to rein-in bloated budget deficits, and zero-percent interest rates failing to produce jobs, politicians are seeking to expand exports, by reducing the value of their currencies, as the sole remaining measure available to provide an economic boost.

Warning of the danger of currency wars, IMF Managing Director Dominique Strauss-Kahn told finance chiefs of the G-7 industrial powers and the emerging economies of Asia and Latin America, “There is clearly the idea beginning to circulate that currencies can be used as a policy weapon. Translated into action, such an idea would represent a very serious risk to the global recovery.” Yet the global currency system itself, and the entire network of economic relations built upon foreign trade, - is already breaking down under the weight of QE- in England, Japan, and the US, and the daily rigging of currencies in the emerging world.

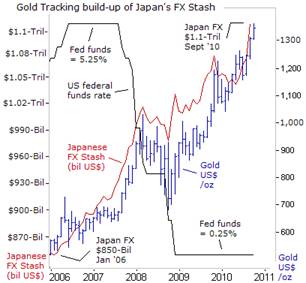

Through stealth intervention in the foreign exchange market, Japan’s central bank has accumulated the world’s second largest stash of FX reserves, reaching $1.1-trilion in September. The size of Japan’s FX has also swelled reflecting the inflated value of its holdings of European and US-Treasury bonds. Last moth, the BoJ held 765-tons of gold in its vaults, equal to only 2.7% of its FX reserves. Gold dealers have long recognized that at some point, Tokyo would eventually end its folly of accumulating paper currencies, and instead, would see the logic of switching more of its bloated FX stash into hard assets, such as gold or silver.

In an interesting move last week, Japan’s ruling Democratic Party proposed taking advantage of a strong yen to invest part of Japan’s $1.1-trillion stash into securing natural resources in overseas markets, thus raising the stakes in a global battle with Beijing for strategic assets. Thus, the global “currency wars,” revolving around the Chinese yuan, can resurrect the “Commodity Super Cycle,” and establish Gold as the key medium of exchange that can guarantee banks’ promises to pay depositors, promises to redeem note holders, or to secure faith in a currency.

This article is just the Tip of the Iceberg of what’s available in the Global Money Trends newsletter. Subscribe to the Global Money Trends newsletter, for insightful analysis and predictions of (1) top stock markets around the world, (2) Commodities such as crude oil, copper, gold, silver, and grains, (3) Foreign currencies (4) Libor interest rates and global bond markets (5) Central banker "Jawboning" and Intervention techniques that move markets.

By Gary Dorsch,

Editor, Global Money Trends newsletter

http://www.sirchartsalot.com

GMT filters important news and information into (1) bullet-point, easy to understand analysis, (2) featuring "Inter-Market Technical Analysis" that visually displays the dynamic inter-relationships between foreign currencies, commodities, interest rates and the stock markets from a dozen key countries around the world. Also included are (3) charts of key economic statistics of foreign countries that move markets.

Subscribers can also listen to bi-weekly Audio Broadcasts, with the latest news on global markets, and view our updated model portfolio 2008. To order a subscription to Global Money Trends, click on the hyperlink below, http://www.sirchartsalot.com/newsletters.php or call toll free to order, Sunday thru Thursday, 8 am to 9 pm EST, and on Friday 8 am to 5 pm, at 866-553-1007. Outside the call 561-367-1007.

Mr Dorsch worked on the trading floor of the Chicago Mercantile Exchange for nine years as the chief Financial Futures Analyst for three clearing firms, Oppenheimer Rouse Futures Inc, GH Miller and Company, and a commodity fund at the LNS Financial Group.

As a transactional broker for Charles Schwab's Global Investment Services department, Mr Dorsch handled thousands of customer trades in 45 stock exchanges around the world, including Australia, Canada, Japan, Hong Kong, the Euro zone, London, Toronto, South Africa, Mexico, and New Zealand, and Canadian oil trusts, ADR's and Exchange Traded Funds.

He wrote a weekly newsletter from 2000 thru September 2005 called, "Foreign Currency Trends" for Charles Schwab's Global Investment department, featuring inter-market technical analysis, to understand the dynamic inter-relationships between the foreign exchange, global bond and stock markets, and key industrial commodities.

Copyright © 2005-2010 SirChartsAlot, Inc. All rights reserved.

Disclaimer: SirChartsAlot.com's analysis and insights are based upon data gathered by it from various sources believed to be reliable, complete and accurate. However, no guarantee is made by SirChartsAlot.com as to the reliability, completeness and accuracy of the data so analyzed. SirChartsAlot.com is in the business of gathering information, analyzing it and disseminating the analysis for informational and educational purposes only. SirChartsAlot.com attempts to analyze trends, not make recommendations. All statements and expressions are the opinion of SirChartsAlot.com and are not meant to be investment advice or solicitation or recommendation to establish market positions. Our opinions are subject to change without notice. SirChartsAlot.com strongly advises readers to conduct thorough research relevant to decisions and verify facts from various independent sources.

Gary Dorsch Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.