The Battle Between Fiat Money Versus Gold and Silver

Commodities / Gold and Silver 2010 Oct 12, 2010 - 12:54 PM GMTBy: Steve_Betts

We are bearing witness to one of the most prolific battles in modern times; it's the battle of fiat money versus gold and silver. Another way to express this is the Federal Reserve versus the free market, or evil versus good. You don't need soldiers, planes, battleships or missiles. The forces of evil require two printing presses: one for making fiat currency and one for printing misleading propaganda. The forces of good require an adherence to the concepts of value and the primary trend.

We are bearing witness to one of the most prolific battles in modern times; it's the battle of fiat money versus gold and silver. Another way to express this is the Federal Reserve versus the free market, or evil versus good. You don't need soldiers, planes, battleships or missiles. The forces of evil require two printing presses: one for making fiat currency and one for printing misleading propaganda. The forces of good require an adherence to the concepts of value and the primary trend.

What's at stake is your financial freedom and wealth, or what's left of it. The war started way back before you were born, in 1913 with the creation of the US Federal Reserve and income tax. At that time the United States was the largest creditor nation in the world, with a huge middle class, and the idea was to transfer that wealth from the many to a very select few. Some of the select few weren't even Americans. The justification was that it was necessary in order to protect the country's wealth, but that was a smoke screen. Although you may sense that something has gone awry, you more than likely have no awareness that such a conflict even rages.

Why is gold the enemy? For the simple reason that it is the only real money; a store of wealth that has stood the test of time. Most people fail to comprehend that fiat currencies always, without exception, fail. The central banks eventually succumb to political and financial pressures, they print excessively with the idea of draining liquidity from the system at a later date, and then they never do. The end result is a worthless piece of paper that will serve as cocktail conversation in a decade or two. Right now the US dollar is well down

that well traveled road toward the currency graveyard where you'll find all kinds of Pesos, Sucre's, and Soles along with a lot of failed Asian cousins and the occasional Franc and Pound from way back when. If you go back far enough you'll even find the old predecessor to the greenback, the Continental. The experience was so unpleasant that our Founding Fathers wrote into the US Constitution that gold and silver coin were money and warned against fiat currencies ad nausea. Unfortunately, politicians never let a little thing like the Constitution get in their way.

The problem with gold, from the point of view of the central banks, is that it can't be created out of thin air. Such constraints mean that an ignorant Congress cannot dilute your wealth with a stroke of a pen. If gold reigned supreme they would be forced to go straight to confiscation, and that would be politically unpopular in a so-called democracy. A central bank with a printing press is a powerful force that can tax a population without them ever realizing that they've been duped. The average American has no clue that a 2010 dollar only buys 1.5%, in real terms, of what a 1913 dollar purchased. Before the creation of the Federal Reserve in 1913 the dollar held its purchasing power for more than eighty years!

As you can see in the gold's daily chart, after a period of consolidation the price of the yellow metal has slogged its way higher day after day with little or no interruption. In the process gold has become extremely overbought but it still marches higher. Yesterday the spot gold price gained 6.40 to end the session at 1,353.60 and that is a new all-time closing high. The spot gold price is fast approaching a test of strong resistance at 1,372.80 and this comes only two weeks after breaking through the last level of critical resistance at 1,298.10, so things are heating up. With all of that said, the Fed is expected to come out with another significant stimulus package in November and that will put added downward pressure on the dollar. Inversely gold will be forced higher, overbought or not. In the meantime you can look for volatile one or two day reactions similar to what we saw last Thursday and Friday morning. Yesterday on Monday afternoon we had yet another new all-time closing high!

For those of you who want to look a little further down the road, the Fed is waiting for the mid-term elections to pass before it declares its intentions to ease further. It has mentioned that it may resort to "unconventional tools", but you shouldn't lose sight that any and all "tools" are just some derivative of the printing press. The Fed possesses no assets, and never did, so it can't go out and sell gold, property, or companies. It can only print and lower rates, but rates are at zero already. How much will it ease? The last time around cost Americans US $3 trillion and this time will be as much if not more, although they may initially announce that it will be less.

Since the Bush administration first announce a tax rebate and denied that any problem existed three years ago, each successive bailout has been bigger than its predecessor. This is unfortunate but typical of politicians who avoid reality at all costs. If the Fed would have come out with a US $3 trillion bailout in 2007, we'd be enjoying a nice healthy inflation right now instead of a debilitating deflationary spiral. Gold of course knows this and that's why the smart money continues to buy each and every dip¹. That will continue along with the new policy of central banks to accumulate gold. Of course we have the odd US politician who wants to sell all the gold in Ft. Knox, assuming it hasn't all been leased out, but that's typical of doing the wrong thing at the wrong time. The upward pressure on the gold price will only increase over time and that doesn't include what happens once the general public starts to buy into the gold market.

Every bull market has three defined stages. In the first stage the smart money accumulates the item in question, in the second stage institutions buy into the market and in the third stage the general public piles in. Gold is still in the second stage! The third stage is the most profitable stage for speculators who are willing to ride it out as prices often double! I have maintained that the price of gold would reach 1,372.80 on this leg up and eventually run as high as US $3,000.00 before we see an end to this bull market. That was before. Now I see this leg up running to a minimum of 1,447.50 and the bull market will reach CHF 4,000.00! Notice I've changed the target to a price in Swiss Francs because I think the US dollar as we know it may not be around by then. With respect to the here and now, my updated price target of $1,447.50 may be low, at least if the Point & Figure chart is any indication!

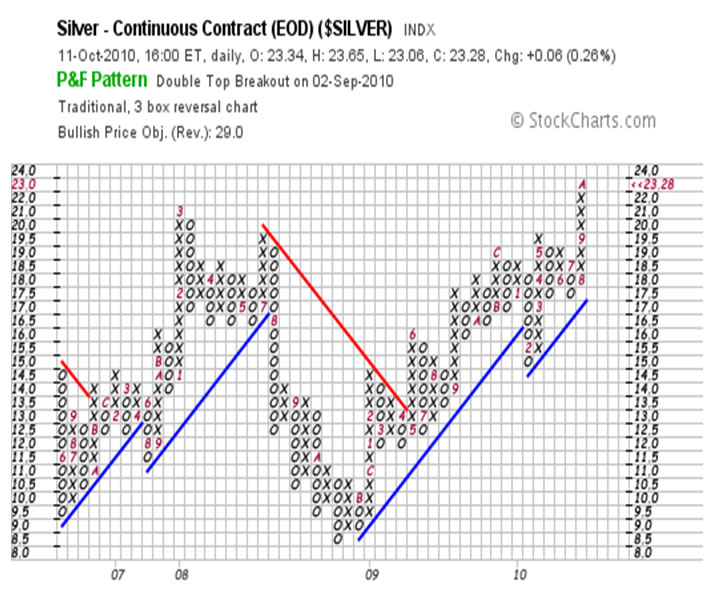

The same logical analysis applies to silver although gold's poor cousin will follow a more volatile path. As you can see in its respective Point

& Figure chart, it has a bullish price target of 29.00 and I would not be surprised to see that reached on this leg up. My price target remains at 26.45 for the moment, but I will more than likely modify that in another week or so.

In the US you have a serious financial crisis breaking out as a result of the foreclosure fraud, in Europe there is civil unrest on a daily bases as we saw in Greece and Spain last week and in France today, and China keeps on taking preventive measures in order to protect its own interests. Furthermore the dollar cannot hold a rally as we've seen time and again, this morning is an example as all the gains disappeared by 11:45 am EST. In the US everyone is waiting for the elections as if it's some sort of panacea, but the elections will solve nothing. All that will happen is that the Republicans will gain control of one or both houses and Obama will refuse to sign any bills they produce. Neither of the parties has any real solution, and neither party is willing to admit that a problem exists. No one wants to tackle the issue of debt, or worse yet live within their means, so the market will intervene as the great equalizer and it will be brutal. As a result gold may not get the correction everyone keeps on calling for, and those selling at what they think may be a top, will be in for a nasty surprise!

1 The same holds true for the Swiss Franc which continues to rally even when the US dollar is higher. It's a real flight for safety! Today it is up .0036 at 1.0413 and that would be a new multi-decade closing high.

[You can contact us at our new e-mails, info@stockmarketbarometer.net (general inquiries regarding services), team@stockmarketbarometer.net (administrative issues) or analyst@stockmarketbarometer.net (any market related observations).] By Steve Betts

E-mail: analyst@stockmarketbarometer.net

Web site: www.stockmarketbarometer.net

The Stock Market Barometer: Properly Applied Information Is Power

Through the utilization of our service you'll begin to grasp that the market is a forward looking instrument. You'll cease to be a prisoner of the past and you'll stop looking to the financial news networks for answers that aren't there. The end result is an improvement in your trading account. Subscribers will enjoy forward looking Daily Reports that are not fixated on yesterday's news, complete with daily, weekly, and monthly charts. In addition, you'll have a password that allows access to historical information that is updated daily. Read a sample of our work, subscribe, and your service will begin the very next day

© 2010 Copyright The Stock Market Barometer- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.