What Happened To The Stocks On Cloud 9, Bearish First Thrust Down Patterns

Companies / Company Chart Analysis Oct 11, 2010 - 07:52 AM GMTBy: David_Grandey

Last week we saw a lot of damage done in this space, namely the most over loved and over owned names in the cloud nine computing space.

Last week we saw a lot of damage done in this space, namely the most over loved and over owned names in the cloud nine computing space.

These names have for the most part all staged bearish First Thrust Down patterns by breaking major uptrends.

Odds favor these issues at the least go through an intermediate term correction from here on out. This means 3-6 months as all new basing patterns need time to be built. Before all is said and done some of those names will test the 200 day averages and over time carve out bottom of cup patterns before they can reassert their leadership capabilities. Below are a few good examples are names from the past who used to be leadership.

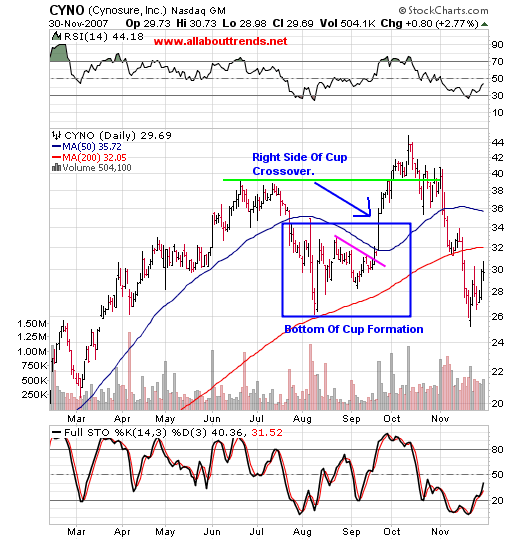

CYNO

Broke its uptrend and 50 day then carved out a bottom of a cup pattern above the 200 day for a few months.

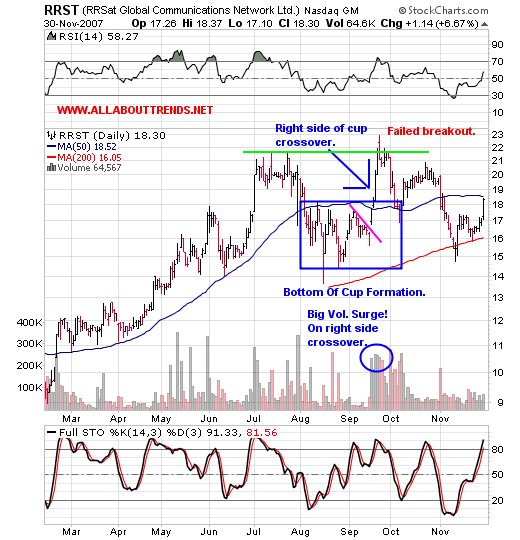

RRST

Broke its uptrend and 50 day then carved out a bottom of a cup pattern above the 200 day for a few months.

In both of the above notice that once they carved out the bottom of the cup pattern they staged right side of cup crossovers then broke into new highs and TOPPED?

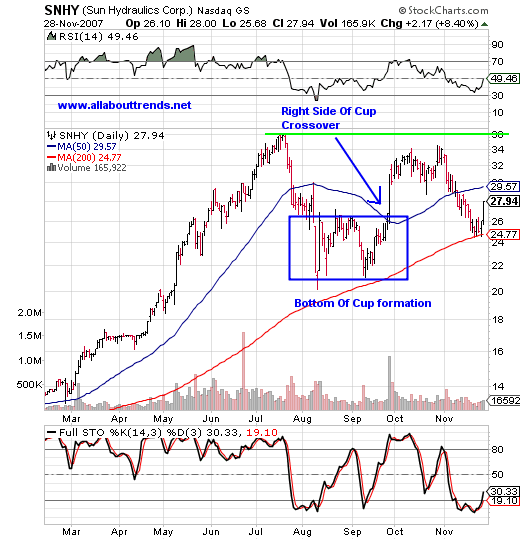

SNHY below did the same thing only that issue could not complete a cup and failed.

SNHY

These are also a good examples of what a “Coming Up The Right Side” of a cup pattern looks like when an issue emerges out of its correction and when happens when they fail.

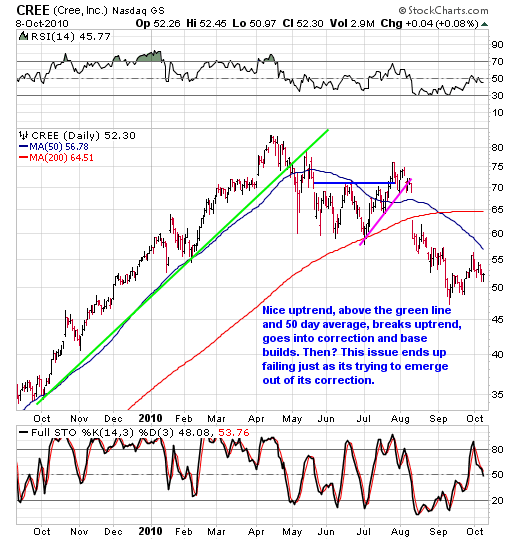

Speaking of failure check out the chart below of CREE:

What remains to be seen is whether the recent cloud nine stocks have topped or are just staging a normal consolidation to relieve their over extension.

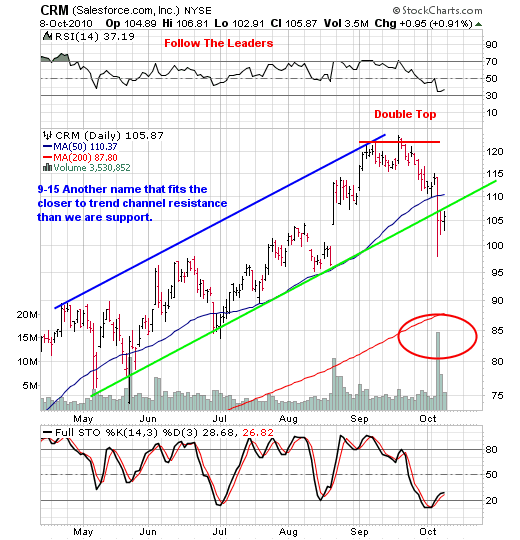

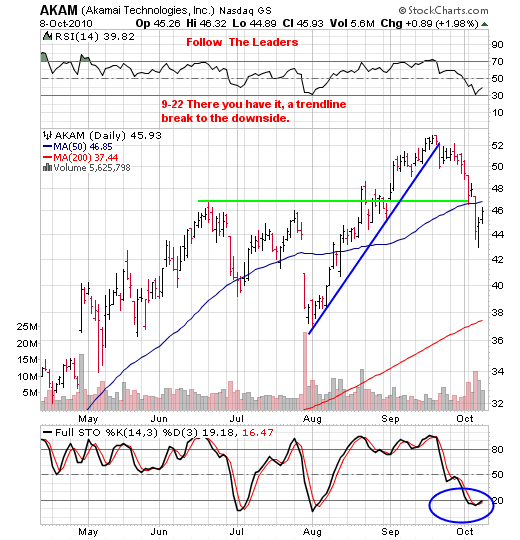

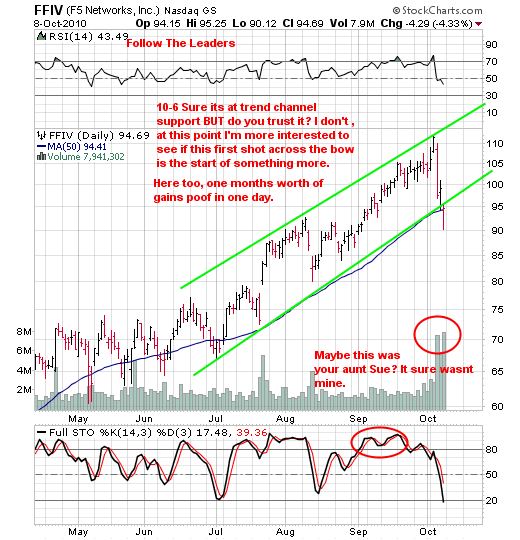

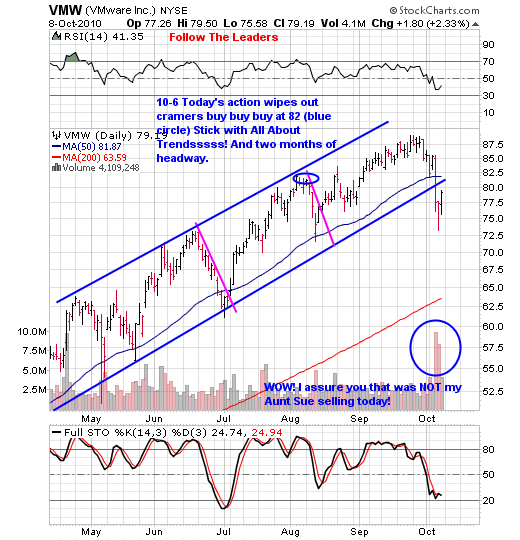

So what does this all say about all the cloud nine charts below?

CRM

AKAM

FFIV

VMW

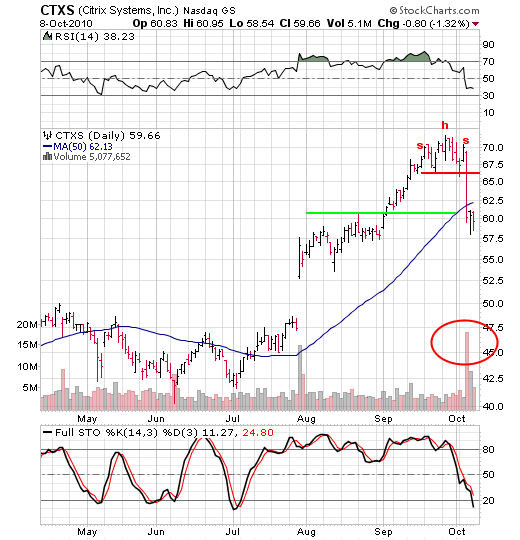

CTXS

As you can see for the most part with all of the above IF they are going to follow the script of the examples at the beginning of this section then history says these issues have a lot of work to do before we would even consider going long any of them. It also says they are not done going down yet and may ultimately work their way to the 200 day average before all said and done. For longer term investors these names may end up being dead money for months.

By David Grandey

www.allabouttrends.net

To learn more, sign up for our free newsletter and receive our free report -- "How To Outperform 90% Of Wall Street With Just $500 A Week."

David Grandey is the founder of All About Trends, an email newsletter service revealing stocks in ideal set-ups offering potential significant short-term gains. A successful canslim-based stock market investor for the past 10 years, he has worked for Meriwest Credit Union Silicon Valley Bank, helping to establish brand awareness and credibility through feature editorial coverage in leading national and local news media.

© 2010 Copyright David Grandey- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.