Is Android The Next Gold Mine For Google?

Companies / Google Oct 11, 2010 - 07:27 AM GMTBy: Dian_L_Chu

After years of searching, developing, acquiring, plus a few flops along the way, Google seems to have finally found the next big revenue stream--in addition to its web search. Eric Schmidt, Google CEO, claims that Android is making money and that android-based phones already generate enough new advertising revenue already covered the cost of its development. And according to Newsweek:

After years of searching, developing, acquiring, plus a few flops along the way, Google seems to have finally found the next big revenue stream--in addition to its web search. Eric Schmidt, Google CEO, claims that Android is making money and that android-based phones already generate enough new advertising revenue already covered the cost of its development. And according to Newsweek:

“Schmidt envisions a day when there are 1 billion Android phones in the world and notes that if Google could get just $10 from each user per year, it would be a $10 billion business.”

“Schmidt envisions a day when there are 1 billion Android phones in the world and notes that if Google could get just $10 from each user per year, it would be a $10 billion business.”

Google’s Android is currently trailing behind RIM and Apple in the global smart phone platform market share. But according to research firm IDC, Android will have 25 percent world market share in smart phones, more than double Apple’s 11 percent share, while Piper Jaffray and Gartner also issue similarly bullish projections on Android’s eventual world domination. A CNNMoney article even concluded that “….with Android, it looks like Google is sitting on a gold mine.”

It is true that free open-source model gives Google an advantage enabling handset makers like Motorola and Samsung to develop rival units to iPhone, RIM and Nokia’s Symbian, and Google is rumored to have been cutting in Android carriers, manufacturers on ad revenue. All this, of course, has helped boost the number of Android handsets.

However, despite the impressive Android number, keep in mind that the free open source means zero revenue for Google. So in order to evaluate if Android will be the next big revenue stream for Google, one needs to get past the initial excitement arising out of the handsets growth projection.

According to Schmidt’s vision, Google will make money with ads displayed on Android handsets, and possibly with Android Market (Google’s answer to Apple’s online store). However, his one billion users and $10 billion market remark sounds overly “optimistic”, if not somewhat arrogant.

First of all, the number of Android handsets/users worldwide is currently estimated at around 8.5 million. So, to reach one billion users, we are talking about a compounded annual growth rate (CAGR) of 61.09% for the next ten years, or a CAGR of 37.42% for the next fifteen years. Both numbers seem lofty (although Schimdt might disagree) considering the fierce competition (name brands as well as “gray market”) in the handset market.

As for the mobile ad and search revenue, it is certainly an incremental income for Google, but I’m not quite sure about the “gold mine” status due to the small screen space and possible cannibalization from desktop, which is also dwindling.

As for the mobile ad and search revenue, it is certainly an incremental income for Google, but I’m not quite sure about the “gold mine” status due to the small screen space and possible cannibalization from desktop, which is also dwindling.

Ok, let’s say Schimidt’s statement is just a figurative speech to highlight the rapid growth and adaptation of Android. But I’d imagine China has to be factored into Schimidt’s equation… somewhere, somehow, despite Google’s de facto exit of China. After all, China was the world’s second largest smart phone market in Q2 2010 for the sixth consecutive quarter, according to Canalys, and In-Stat projects Smartphone shipments in China is to triple by 2013.

Some (I suspect Google as well) might think Android would provide a “back door” into China, as Android is the “behind the scene” operating system on many different handset brands ranging from HTC, Motorola to China Mobile, just to name a few examples. And China did say Google's Android operating system will not be blocked if it follows local regulations.

Well, unfortunately there’s new confirmation that access to the Android Market has been blocked, and many Google mobile services--including GTalk and Gmail—are also unavailable to China consumers. This most likely will greatly diminish the ad revenue potential despite Android’s growing market share, unless Google and Beijing somehow manage to kiss and make up (Well, let’s just say it will be a long and winding road for Google).

Contrasting with Google’s predicament in China, Apple seems to be at a much better place. iPhone 4 has been selling like hot cakes after the Sept. 25 release in China. More than 200,000 phones have been snapped up within just a few days, and AFP reported that iphone 4 now has a waiting list until the end of October.

And according to Shanghaiist, this is not the first time Apple has changed its products to please Beijing, and the company has also done similar modifications to phones sold in Egypt and the United Arab Emirates to fit in with each government’s restrictions.

This not only highlights the contrasting styles of the two companies when it comes to “Doing Business in China”, but also Google will increasingly feel China’s wrath far beyond just the web search portal. I think Google’s little spat with Beijing would prove to be a lot more costly than expected, even if just temporary (a big if), setting the company back considerably against its rivals.

For now, my suspicion is that for Schmidt to make such a big splash about Android, Google most likely does not have other good prospect in the pipeline. On that note, Google could be on its way moving from “Growth” into the “Mature” phase of its business cycle—i.e., a stagnant Microsoft in the making--whereas Apple might be able to stretch out its Growth phase just a bit longer.

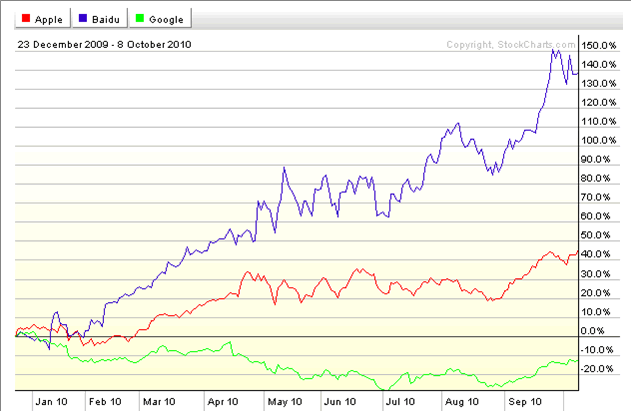

And the stock price comparison chart of Google (GOOG), Apple (AAPL) and Baidu (BIDU) seems to tell a similar story as well.

Disclosure: No Positions

Dian L. Chu, M.B.A., C.P.M. and Chartered Economist, is a market analyst and financial writer regularly contributing to Seeking Alpha, Zero Hedge, and other major investment websites. Ms. Chu has been syndicated to Reuters, USA Today, NPR, and BusinessWeek. She blogs at Economic Forecasts & Opinions.

© 2010 Copyright Dian L. Chu - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.